August 18, 2023 | Inflation Moderates But Still Could Bite Hard

The headline measure was recorded as 3.2 percent from a year ago, while the closely watched core CPI was a more troublesome 4.7 percent.

Is inflation beaten yet?

In the mid-1970s a concentrated advertising campaign was orchestrated by the U. S. government to demonstrate a willingness to beat inflation at all costs. President Ford named the campaign Whip Inflation Now.

Source: U.S. Library of Congress

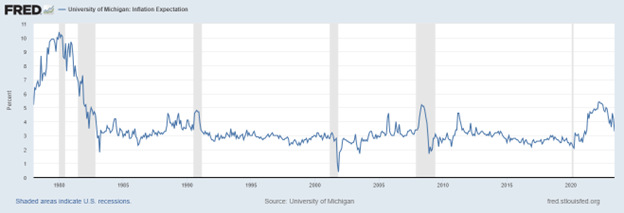

President Carter was elected in 1980 and watched with horror as inflation soared to double digits, based on an old formula for calculating CPI (CPI would be higher today if that formula were still in use). Two years of inflation above 10 percent resulted in interest rates rising to 19 percent. Beginning in 1982 inflation started to decline, and that trend continued until recently, when a new outburst took inflation to a peak of 9 percent in mid-2022. The Fed continued to hike rates long after inflation started to fade.

Many pundits argue that since inflation has dropped to a range of 3-5 percent the battle is over. The pressure on the Fed to amend its policy of hiking rates is growing and some are calling for rate cuts soon, to avoid a recession that is overdue (There’s always another recession coming).

But based on the experience of the 1970s and early 1980s the declaration of victory over inflation seems premature and naively optimistic. After all, there is still a high risk that inflation expectations could become embedded with consumers, although consumer surveys show expectations are still modest and have been falling with the CPI rate.

The gains in house prices over the last two decades were never recorded in the low CPI numbers that were reported. If those gains had been included, CPI would have been much higher and perhaps the Fed would not have kept interest rates at near zero for more than a decade. And today’s inflationary impulse would not have happened. We will never know.

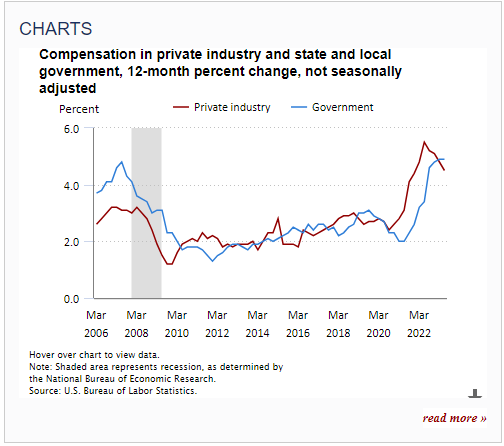

But the reality is that shelter is expensive, and wages have not kept up to the growth in house prices. While house prices in Canada quadrupled during that period from 2000 to 2020 wages did not even double. Now in the last couple of years we have seen a further increase in the cost of living, led by shelter but also food and transportation so wage earners must be pretty unhappy.

Demands for higher wages are inevitable after a period of only modest gains. Businesses have been earning record profits, due to an ability to pass on higher prices for goods and services in excess of inflation. But what good are higher prices if the average wage earner cannot afford food or shelter or an automobile?

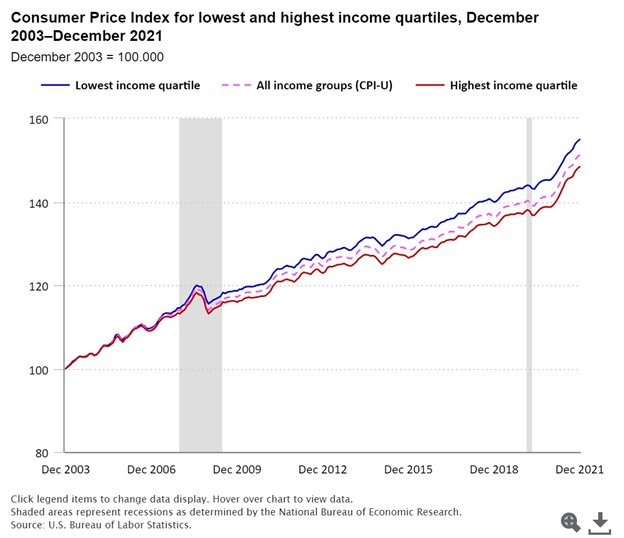

Inflation is cumulative unless we get deflation, so two decades of inflation have taken the cost of living higher by more than 50 percent since 2003.

The pressure for wage hikes from workers, especially among low-income earners, is just getting started.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth August 18th, 2023

Posted In: Hilliard's Weekend Notebook