August 21, 2023 | Historic Opportunity Now in the Making

As the riskiest asset prices rebounded into July, most strategists and investment advisers proclaimed the all-clear (as usual), and bullish sentiment roared back near levels seen at the cycle top in early 2021 (shown below courtesy of The Daily Shot).

This is typical behaviour: market sentiment moves in lockstep with price. As stocks have tumbled over the past three weeks again, bullish sentiment has started an abrupt reversal once more (green highlight above).

Meanwhile, monetary policy moves through the economy at multi-month lags, and the bulk of the rapid tightening since March 2022, just starting to bite, will crimp global GDP growth over the next 18 months (green bars shown below).

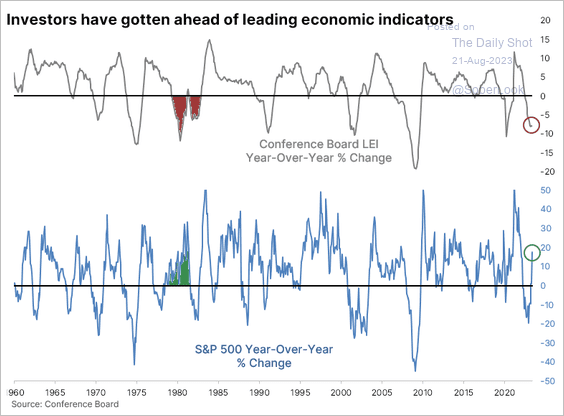

The Conference Board of US Leading Indicators signals the trend; falling for the past 16 months, the LEI is at levels seen during past recessions (grey line below since 1960) and flies in the face of the S&P’s hope-filled rebound into July (lower blue line).

The relative over-valuation in stocks versus government bonds is today more extreme than at any time in at least 35 years (theWilshire 5000 vs. bond prices is shown below since 1990 courtesy of Real Investment Advice)–and suggests an epic mean-reversion is due where stock prices fall, and government bond prices leap.

Sometime within the next 12 months, central banks will blink at rising unemployment and deflating asset prices and start to ease monetary conditions once more.

It bears remembering that government bond prices have consistently risen during Fed-cutting cycles while the stock market has always bottomed 13 to 33 months after the Fed’s last hike and after the S&P 500 has fallen 24 to 55%, respectively.

There’s a historic financial opportunity here in the making. But to benefit, one has to be prepared in advance, patient and positioned counter to the masses.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park August 21st, 2023

Posted In: Juggling Dynamite