August 11, 2023 | Deflation Risk in China is Real

The risk of deflation in China is real. A moderating pace of growth, large private sector debts and a slowdown in the crucial property sector suggest lower income, prices and deflation.

Is China entering a debt deflation spiral?

China has enjoyed a longer-than-four-decades income and wealth expansion that has rarely happened in the thousands of years since humans became economic units.

That era started with the rise to power of Deng Xiaoping in 1977. Deng implemented reforms in all aspects of China’s political, economic and social life. Deng is considered to be the guiding hand that led to China’s modern economy and its amazing growth. Some have called that more than 40-year era the “China economic miracle.”

Now China faces a test. One of the most indebted nations, China’s private sector owes 297.2 percent of GDP. For comparison, the US is only 152 percent while Canada is slightly above China at 305 percent at year-end 2022. China’s government sector debt is better at 78 percent GDP compared to Canada at 94 percent and the US at 111 percent.

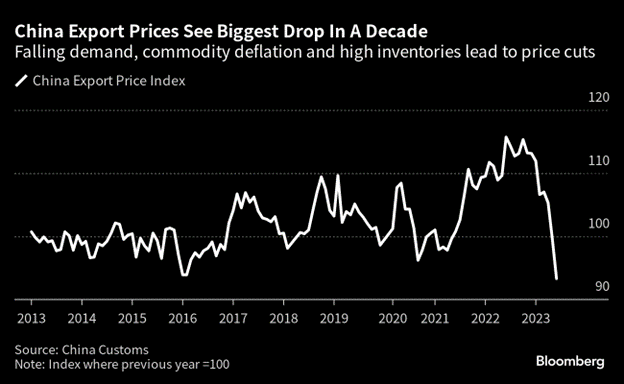

China’s ability to support those private debts is closely linked to export sales, as those exports create US dollars that can be used anywhere. Recently, China’s exports are weak, and prices are being cut.

Domestic growth in China is based on investment, especially property and infrastructure construction, and consumer spending. As property prices have declined consumers have become more cautious. New construction of housing is slowing.

When growth slows private sector debts become more difficult to pay back. A rapid growth rate covers up many problems, and a slowing growth rate forces those problems to become visible. As Warren Buffett says, “You only see who is swimming naked when the tide goes out.”

A debt deflation spiral was described by Irving Fisher in the 1930s (The Debt-Deflation Theory of Great Depressions) and by Minsky in the 1970s as a major risk to any developed economy that has enjoyed a long period of expansion. When that growth ends, as happened in the 1930s, lenders become reluctant to extend new credit. Previously, heavily indebted borrowers relied on new credit to service their old debts. In a deflationary period, many borrowers are suddenly insolvent. So, in order to repay debts, assets used as collateral must be sold at a discount, leading to asset price declines. The probability of a debt deflation spiral becomes very high, unless the government provides new loans to borrowers without regard to their ability to pay or provide collateral.

If China enters a debt deflation spiral, that deflationary force would spread to other developed countries, as China is the largest or second largest economy in the world. China’s massive amounts of stimulus during previous downturns have acted as a welcome stabilizer for others, like the U.S.

China’s government must decide quickly if it will stimulate or allow debt deflation. Most large, developed countries have suffered through that, but China has not yet experienced one in the current era.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth August 11th, 2023

Posted In: Hilliard's Weekend Notebook

Next: London Riots »