July 29, 2023 | Trading Desk Notes For July 29, 2023

It was Central Bank Week

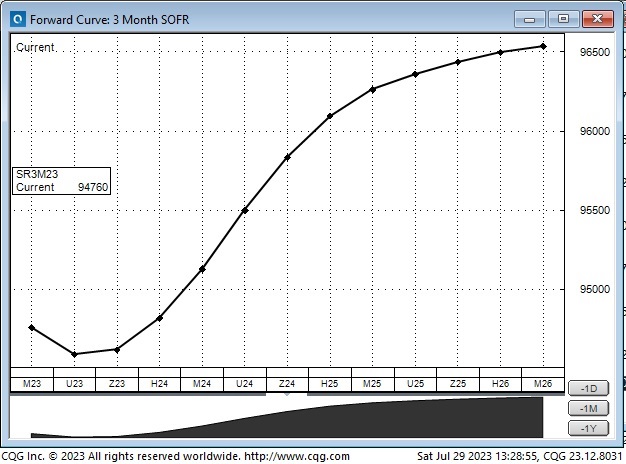

The FOMC met on Wednesday and raised 25 bps as expected, with markets now pricing a ~30% chance of another 25 bps at their September 19/20 meeting. Financial markets were essentially unchanged on the news.

The ECB met on Thursday and raised 25 bps as expected but surprised markets by NOT forecasting another increase at their September 14 meeting. EURUSD fell sharply, leading to losses in other currencies and gold. (Part of the bid for EURUSD over the past few months was the idea that the ECB would be more aggressive than the Fed.) Eurozone stock indices rallied.

The BoJ met on Friday and “tweaked” monetary policy (no change to short rates; bond buying range widened, but BoJ will resolutely buy all bonds at a 1% yield ceiling.) The Yen was wildly volatile for an hour (it traded in a 200+ point range in one minute after the BoJ announced its policy change), then drifted lower against other currencies. JPYUSD closed the week near its lows.

Japanese bond yields surged higher, but other country bond yields were little changed (some analysts feared that global bond yields might soar if BoJ’s actions caused Japanese institutions to sell overseas and buy domestic bonds.)

Key American stock indices continue higher; key Eurozone indices hit All-Time Highs

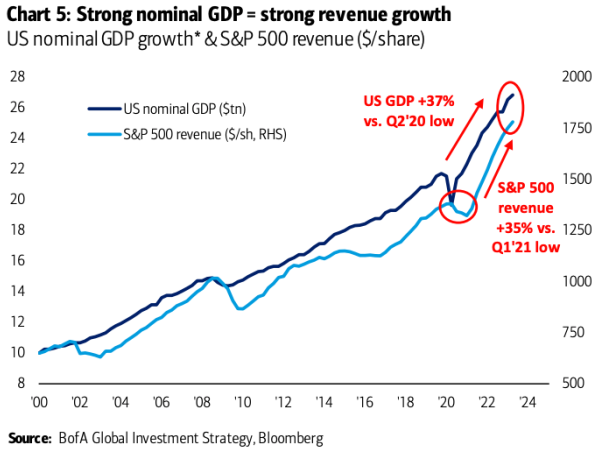

The S&P had its highest weekly close since January 2022, is up ~28% from last October’s lows, and is ~5% below the January 2022 All-Time Highs.

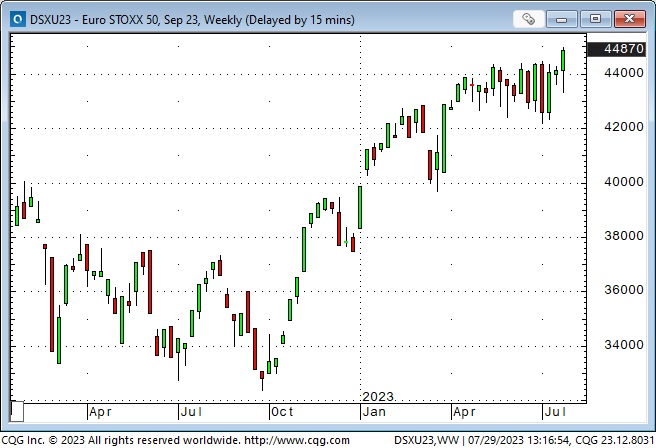

The Euro STOXX 50 Index hit All-Time Highs this week, up ~34% from last October’s lows.

The rally in American stock indices has been a low VOL melt-up, similar to 2017. Ben Bowler, a BoA analyst, notes that S&P puts to hedge against a drawdown in the S&P over the next 12 months are the cheapest they have been since early 2008.

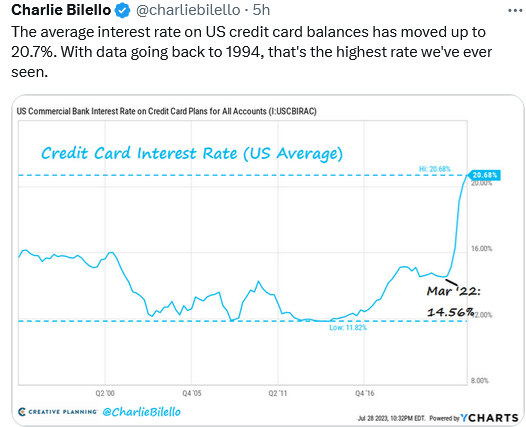

Interest rates

CME Secured Overnight Financing Rate (SOFR) futures are pricing the Fed essentially done raising rates with minor cuts beginning in Q1/24. The market sees additional cuts accelerating throughout 2024, with rates ~120 bps lower YOY by December 2024.

Currencies

The US Dollar index touched a 15-month low in mid-July (as the Euro rallied to a 17-month high) but has rebounded ~2% since.

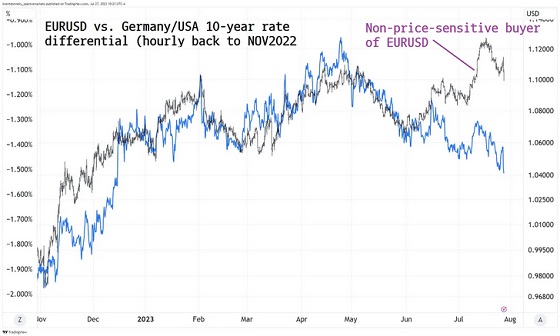

I’ve been puzzled by the Euro’s June/July rally, especially with Germany in recession as their exports to China fell, but I discovered a rationale for the Euro’s strength in a note written by Brent Donnelly. (I’m a subscriber.) He believes the PBOC was “re-balancing” (a non-price sensitive move) their FX reserves in July, buying Euro/selling USD.

That “makes sense” to me because I didn’t think the EURUSD “deserved” to be above 1.10!

Brent’s chart shows how the EURUSD (black line) tracks the German/USA 10-year rate differential but broke down in June/July.

Regular readers may remember that I’ve recently been looking for an opportunity to short the Euro (the On My Radar section). Last week, I was moaning about having missed an excellent opportunity to short the Euro! (Missing a trade often bugs me more than losing money on a trade.)

The Canadian Dollar has traded in a 4-cent range between 72 and 76 cents since last September but has looked toppy above 76 cents.

Gold

As my good friend Martin Murenbeeld notes in this week’s Gold Monitor, gold was the “flip side” of the USD and the US 10-year yield this week (strong negative correlation.) The USD and bond yields were up – gold was down.

I did a 30-minute interview with Jim Goddard this morning. Jim noted that gold briefly traded above $2,000 three different times (August 2020, March 2022 and May 2023) but could not stay above that level. He asked me what it would take for gold to rally above $2,000 and STAY above that level.

My first answer was if we had a severe geopolitical event – for instance if China moved against Taiwan. I pointed out that gold had jumped above $2,000 when Russia invaded Ukraine, but China moving against Taiwan would be a “much bigger deal.”

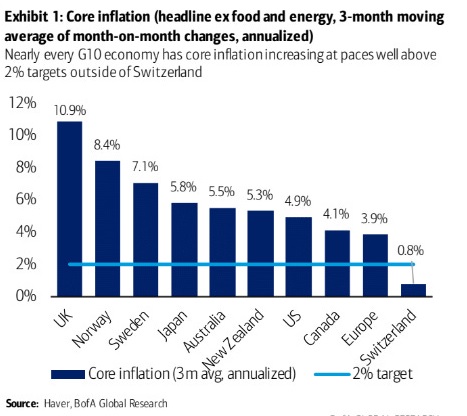

My second answer was that I thought it was inevitable that gold would rally through $2,000 and stay above $2,000 as people realized the purchasing power of their currencies (dollars or euros, or Yen or pounds etc.) kept shrinking as governments continued debt-funded fiscal policies.

Energy

Front-month NYMEX WTI crude oil closed above $80 this week for the first time since early April. It had traded below $70 just four weeks ago. Front-month RBOB gasoline had its highest weekly close since last August.

My short-term trading

I started this week short the Nasdaq and the Canadian dollar – positions I had established last week. I covered both positions on Monday (I made a decent profit on the NAZ and a tiny profit on the CAD) when both markets passed up an excellent opportunity to fall.

I was predisposed to get flat ahead of the looming risk of policy changes from the Fed, ECB and BoJ and also because my son was arriving Tuesday night, and we were planning to play golf for a couple of days and stay away from the markets!

I bought the Yen on Tuesday and was over 100 ticks ahead on the trade before the BoJ’s Friday announcement. I almost always use stops, and my stop on the Yen was hit when “the machines” gunned the market up and down moments after the BoJ announced their policy “tweak.”

Immediately before and for a few moments after scheduled risk events, dealers pull their bids and offers from the screens and “the machines” have a field day gunning the markets up and down – hitting stops. Check out the 30-minute chart of the Yen above. I’ve seen this happen many times in many different markets, but the +200 point range in the Yen (in less than one minute) after the BOJ announcement was extra wild. The alternative to taking the risk of stops being hit when dealers back away is to have no position, use wider stops, or cancel stops.

I shorted the NAZ on Thursday (following the stronger-than-expected GDP, durable goods and employment data and the surprise from the ECB that got the Euro tumbling.) I’d shorted the YTD high day last Wednesday, and the chart looked like a possible “lower high” could develop.

The market tumbled after trading through the opening (floor session) range, and I stayed in the position overnight. However, the market rallied during the o/n session, and I covered for a slight profit before the day session began.

I went into the weekend flat.

On my radar

The stock indices look like they want to make new All-Time Highs. I wonder if the “hard trade” is to buy them here. In a world where currencies keep losing their purchasing power, stocks (and real estate and commodities) will keep getting bid higher.

For my short-term trading, I’ll be looking for signs that the rally is starting to fade.

I will look for opportunities to short the Euro and the British Pound. Short the Euro/Yen at 15-year highs looks interesting.

Thoughts on Trading – what is your edge?

For over forty years, I’ve heard people talk or write about “having an edge,” for most of that time, I’ve thought that having an edge meant that a trader had an “advantage” over other traders.

For instance, a trader with access to inside information or got the “first call” from a broker/dealer had an edge over other traders. A trader who was a “commercial” had an advantage. For instance, if a trader had been in the cattle business for several years, through good times and bad, he had an edge over traders (who had never actually seen a real live cow) when it came to trading cattle!

If a trader specialized in trading only one market, he probably had an edge in his market over a macro tourist who wandered from market to market.

I was concerned about having an edge (and wondered if I had one) because if I didn’t, the “odds” of winning were stacked against me if I was betting against someone with an edge.

I’ve frequently noted that I’ve met a few successful traders (and read about many more), and I noticed that they were as different from one another as chalk is from cheese, but the “thing” they had in common was that they had found a way to participate in markets that “suited them.”

I think that is a great definition of having an “edge.”

I think traders develop an edge after years of trial and error as they discover what works for them, what markets they like, what time frame, and what risk tolerance works for them.

In high school, I played drums in a rock and roll band. I quickly discovered that the other guys in the band had a “gift” for music, and I didn’t. I didn’t feel bad about that because that’s how life is; some people are naturally better at some things than others.

We’ve all seen some athletes who are better than other athletes, and I think we can readily agree that some traders are better than others, but you don’t have to be the best trader in the world to be successful at trading.

I remember reading Victor Sperandeo’s book, “Methods Of A Wall Street Master,” years ago, and he said (paraphrasing from memory) that if he had been a baseball player instead of a trader, he would have played in the major leagues for a couple of decades, made a hell of a good living. Still, nobody would have ever heard of him.

The Barney report

We’ve been having an endless summer of great weather here on the Island, and Barney has been having a great time running the forest trails and swimming in the ocean. But he got a rash on his nose – we took him to the vet, who said it was not unusual, but we had to put a special cream on his nose twice a day for a week, and he had to wear “the cone” for a few days.

He didn’t like the cone. Not even a little bit! So we took it off after a couple of days, and his life returned to normal despite having his nose creamed twice a day!

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Listen to Victor talk about markets

I did an 8-minute interview with Mike Campbell on July 29 on his popular Moneytalks podcast. We talked about “central bank week” and the different central banks’ impact on the markets this week. We talked about the continuing stock market rally and commodities and particularly about how rising energy prices will likely sustain higher inflation. You can listen here. My interview starts around the 1.10-minute mark.

This morning, I did a 30-minute interview with Jim Goddard on the This Week In Money show. We talked about Central banks, stocks, currencies, gold, and the energy markets and some of my thoughts about a trader’s “edge.” You can listen here – my interview starts around the 13.24 mark.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys, and talk with him.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair July 29th, 2023

Posted In: Victor Adair Blog

Next: Turning Time »