July 12, 2023 | Corporate Bankruptcy Wave Just Started

Unlike government bonds that typically rise while stock prices fathom bear market lows, higher-risk corporate bonds tend to fall with risk appetite and equity prices. That trend has held over the past 15 months as most corporate securities have lost value.

As US junk bond prices have tumbled, their yields have risen to around 8.75% from sub-4% in 2021, when desperate and undisciplined funds were eschewing risk management for “there is no alternative” madness.

The rapid doubling in yields is an encouraging trend for value-conscious investors. But it’s early days yet. A ton of low-rate debt is not yet up for renewal. A growing default, reorganization and bankruptcy wave suggest that firesale prices (and hence higher yields) are yet to come. See, The corporate bankruptcy wave will get even uglier:

Business bankruptcies are surging around the world, in some countries reaching volumes not seen since the aftermath of the 2008 financial crisis. It’s likely just the start of a wave of corporate defaults: A decade of cheap money instilled a false sense of invincibility in business executives and private equity managers who forgot that bust normally follows boom. Now, a combination of weakening demand, surging inflation, over-indebted balance sheets and much higher borrowing costs will prove too much for weaker borrowers.

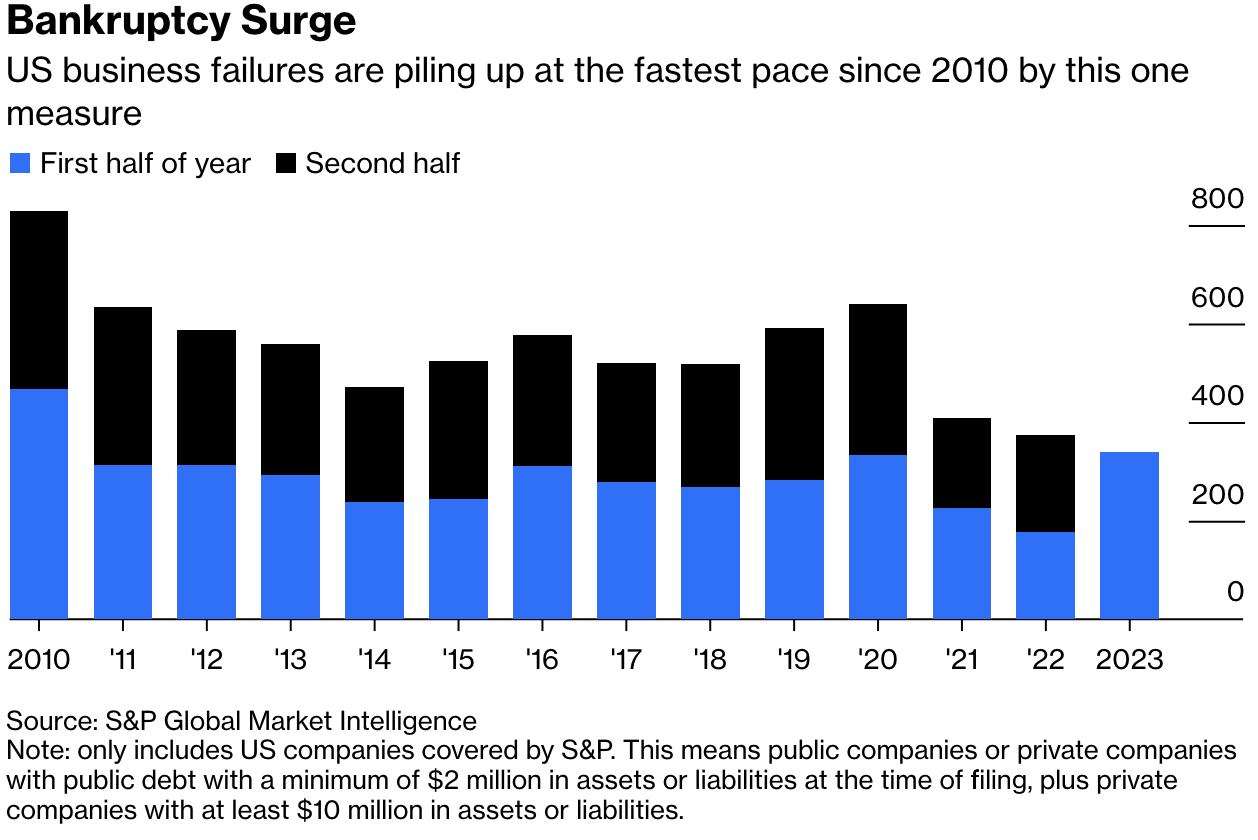

US bankruptcies in the first six months of 2023 were the highest since 2010 among the companies covered by S&P Global Market Intelligence. In England and Wales, corporate insolvencies are near a 14-year high. Swedish bankruptcies are the highest in a decade, while in Germany bankruptcies jumped almost 50% year-on-year in June to the highest level since 2016. In Japan, bankruptcies are at their the highest in five years.

US business failures in the first half of 2023 were already the highest since 2010 (blue bar below). Insolvency pressures are set to intensify in the second half.

Rapid Ratings CEO James Gellert reviews corporate refinance troubles for upcoming debt maturities. Here is a direct video link.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park July 12th, 2023

Posted In: Juggling Dynamite