July 21, 2023 | China Property Market Struggles with Debt Bubble

China began a new stage in its multi-year struggle with insolvency among property developers. One of the biggest, China Evergrande, reported losses of US$81 billion this week.

Will massive debts of US$207 billion dollars in the property sector drag China down?

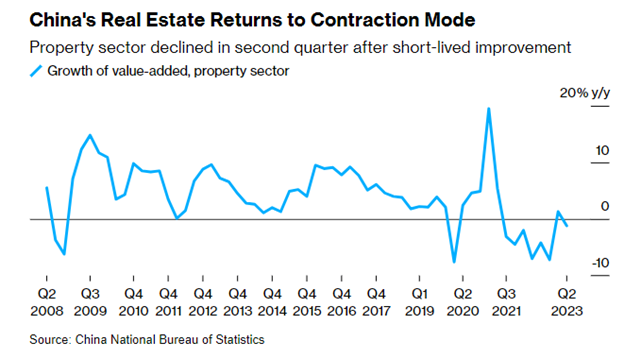

The property sector started to contract in 2021, after a brief post-COVID surge. Recent reports from companies are revealing deeper troubles.

A leading property developer that encountered trouble early was China Evergrande, described in a July 2021 post.

Evergrande, one of the largest property companies in the world, owed a substantial amount of money to domestic and foreign investors. Other large developers, like Country Garden Holdings, also owed billions but were considered to be in good shape at that time. Domestic debts owed by these companies were even larger, but easier to handle as the Chinese government had control over the repayment of those amounts in local currency.

In December 2021 Evergrande defaulted on its US-dollar debts. Now, many other Chinese developers are delinquent on their payments.

With property sales slumping by 28 percent from last year there is little help coming from sales of new properties that could have generated cash for developers to pay off debts.

Evergrande losses reported this week were for the years 2021 and 2022 as those results had been delayed.

The optimism that came from expectations of a government bailout in late 2022 has now evaporated as a growing list of developers are unable to pay their debts. Government help has been too small to make a difference, so far. While China Evergrande owed about $20 billion to foreigners, and more than $300 billion in total, the sector had total foreign debts of an estimated $207 billion, and that amount could be understated. There is little chance of repaying those debts now that the property bubble is bursting. About 18 developers have defaulted on their debts so far.

Greenland Holdings, a government-backed developer, defaulted on a payment this week. Dalian Wanda warned of funding shortfalls. A Bloomberg economist, Eric Zhu, indicated that “an extension of funding support for developers goes in the right direction but probably isn’t enough.”

US-dollar junk bonds in China continued their slide:

Source: Bloomberg

It’s not only property developers that are hurting. Chinese households hold much of their savings in residential property, often buying new apartments as a store of wealth. They are angry with the government for allowing property prices to slide. This means that further price declines would be a political problem. Chinese citizens believed that the government would always support their real estate investments. But It now appears that the government is trying to deflate a bubble, without triggering a crash.

This property debt crisis will be a key issue for the Chinese Communist Party leadership if citizens experience even larger losses.

And since China is the second largest economy in the world with many interconnections to financial markets in the US and elsewhere, this debt crisis will not be contained in China.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth July 21st, 2023

Posted In: Hilliard's Weekend Notebook