June 3, 2023 | Trading Desk Notes For June 3, 2023

Up, up and away?

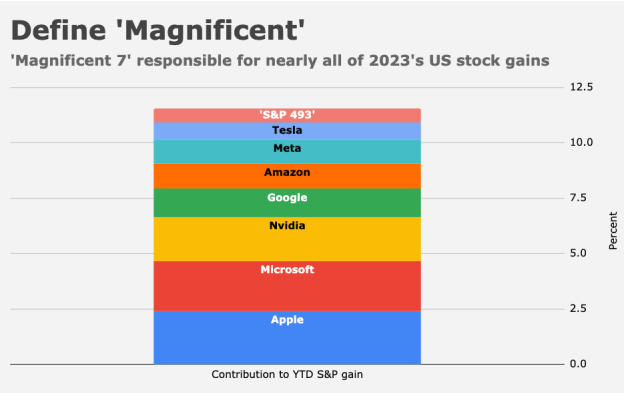

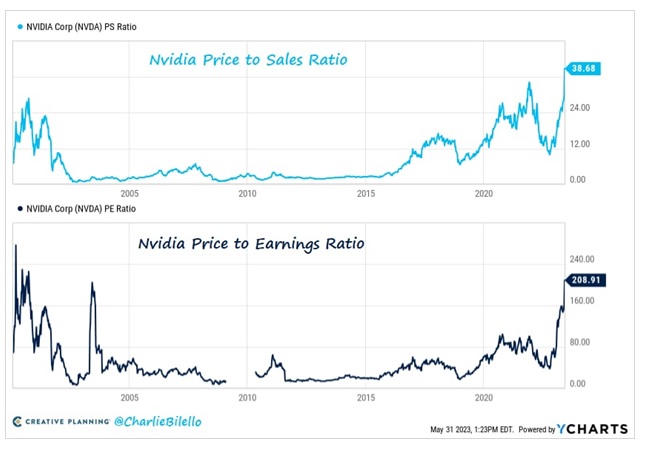

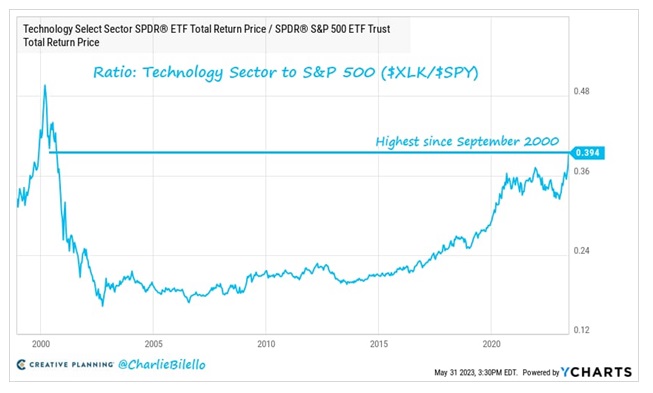

The Nasdaq 100 futures had their highest weekly close this week since March 2022, up ~32% YTD; the S&P 500 index had its highest weekly close since April 2022, up ~11% YTD, while the DJIA had its highest weekly close since…last month, and is up ~2% YTD (imagine what the DJIA would look like if it didn’t hold AAPL and MSFT!)

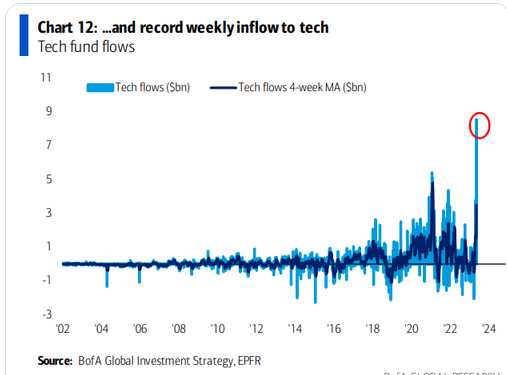

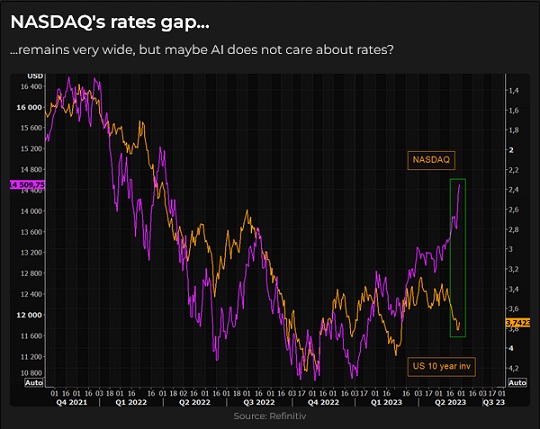

Everybody knows it’s ALL about Megacap tech lately, but the question is, would you buy the market here? That depends on who “you” are. If you’re an “active” money manager and you’ve been “defensively” positioned YTD because 1) you had a bad year last year with both stocks and bonds down, 2) you’ve been underweight tech because it was the worst performing sector last year, with the Nasdaq down ~33%, 3) you believe there will be “consequences” resulting from Central Banks raising interest rates so sharply after more than a decade of ultra-low interest rates, 4) and those “consequences” could include a banking or credit crisis or a recession, 5) you’re overweight cash, and 6) you’ve been buying puts to hedge downside risk. If that is who “you” are, you’re probably experiencing FOMO. Actually, it looks like a LOT of people are experiencing FOMO!

With stocks so aggressively bid on Friday (even the DJIA was up >1,100 points from Thursday’s low), it stands to reason that volatility metrics would be hitting 2+ year lows – or was VOL down because hedgers were liquidating their puts?

If “you” are an open-minded trader and you believe that the 493 stocks in the S&P that are not part of the “Magnificent Seven” may have been correctly pricing in “trouble ahead,” then you’ll watch to see how far this FOMO rally goes before it runs out of steam and then you’ll fade it.

“Trouble ahead” could include a “liquidity drain” as the Treasury issues a ton of paper now that the debt ceiling issue has been “resolved.” It could also include reduced consumer spending come September when a LOT of people will have to resume student loan payments. It could also come from tighter central bank monetary policies.

If “you” are an open-minded trader, you will also consider the possibility that stock markets worldwide made a “major” low last fall, and a new bull market is underway.

Interest rates

Interest rates across the curve fell in mid-March as the “banking crisis” became front-page news, with the forward market pricing in ~250 bps of Fed easing by December 2023.

As the “banking crisis” faded and as the much-anticipated recession was pushed further and further into the future by stronger-than-expected economic data, especially employment data, the forward markets began to price in another 25 bps bump from the Fed in June or July with short rates steady to only slightly lower by December.

In Canada, with immigration policies (apparently) helping to drive vigorous economic activity, the forward markets have “come around” to believing BoC head Tiff Macklem when he says the central bank will not be cutting rates in 2023. The banker’s acceptance futures market is now pricing another 25 bps bump from the BoC in June or July, with rates steady to higher through yearend.

Currencies

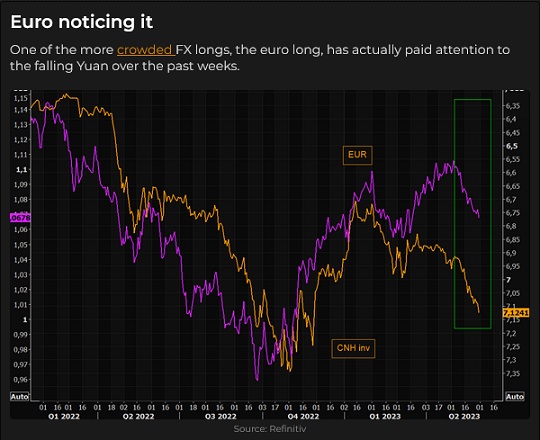

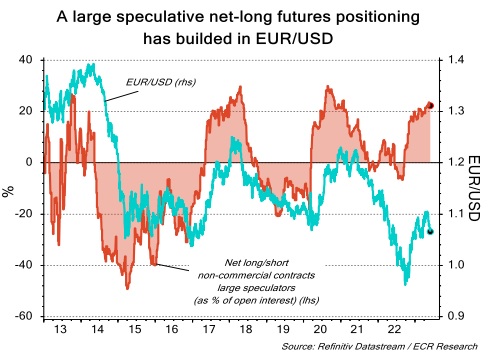

The US Dollar Index made its high for the week on Wednesday, May 31. (Perhaps there was some month-end rebalancing following the ~3% rally from early May lows.) COT data as of May 30 showed a modest reduction in net speculative long Euro positions and a modest increase in net speculative short Yen positions.

German and French inflation levels declined a bit this week, with some analysts thinking that might cause the ECB to slow their tightening program, but Lagarde said, “No.” Weak Chinese economic data continues to weigh on the Euro as China is the Eurozone’s largest export market.

The RMB continues to decline, reflecting China’s tepid “re-opening.” Many analysts now expect the Chinese authorities to try to stimulate the economy with fiscal and monetary policies. (I’ve inverted this chart to demonstrate the RMB’s decline.)

The Canadian Dollar had a good week as 1) the USD was soft, 2) Canadian GDP data was stronger than expected, and 3) the market now expects the BoC to increase interest rates by 25 bps in either June or July and to keep rates steady to higher through yearend.

Gold

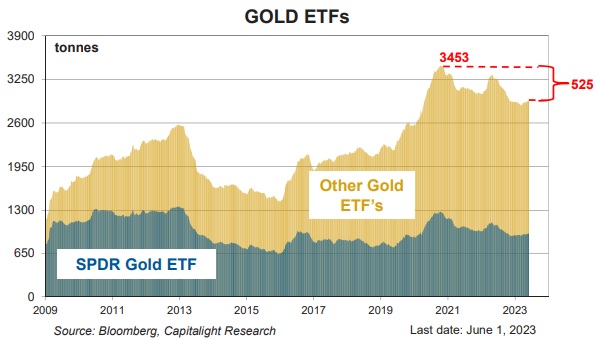

Gold dipped to a >2-month low (~$1950) early in the week, rallied back to ~$2,000 by Thursday but fell again Friday when the strong US employment report caused interest rates and the USD to rise. Open interest rose sharply early in May (speculative buying) but has declined since mid-month (speculative liquidation.)

Total ETF gold holdings reached a record high in mid-2020 when gold prices hit a record high and interest rates hit a record low but have trended modestly lower since then, even though gold prices have made new highs.

The gold miners’ ETF made a high in mid-2020 as bullion prices hit a record high, but the GDX was well below its 2011 All-Time High. As I’ve noted previously, the GDX under-performed gold as the industry got a reputation for “burning cash” and making ill-conceived acquisitions following the 2011 high. My friend, Martin Murenbeeld, a veteran gold analyst, thinks that the rise of the gold ETF market may have siphoned off some buying that might otherwise have gone into gold shares. Martin is now increasing the weight of gold shares in the gold portion of his overall investment portfolio.

Energy

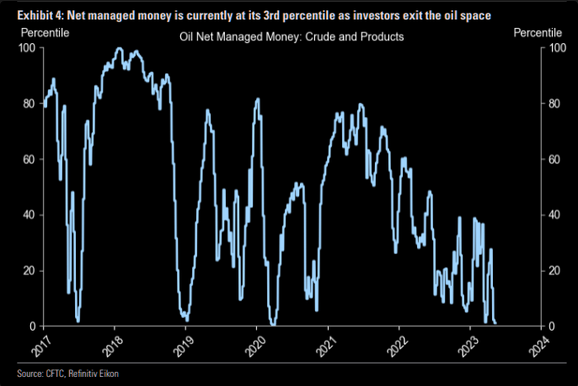

WTI crude oil has traded mostly between $70 and $80 since November 2022. The market gapped ~$5 higher in early April following a surprise production cut from OPEC+ but rolled over and made new lows within a few weeks of that cut. This week, the market rose ~$5 Thursday/Friday ahead of the scheduled OPEC+ meeting this weekend, perhaps anticipating another production cut.

Nymex natural gas prices hit 14-year highs in 2022 following the Russian invasion of Ukraine but have tumbled to 3-year lows recently.

Commodities

The energy-heavy Goldman Sachs commodity index dropped to an 18-month low early this week, but the Thursday/Friday bounce in WTI caused the index to close slightly higher on the week.

The significant decline in fossil fuel prices from last year’s highs has weighed on the index, but grain prices, especially wheat (down more than 50% from last year’s highs) and base metal prices have also been under pressure.

Futures markets for live cattle and orange juice have soared to All-Time Highs, while lumber has had a spectacular “round-trip!”

Quote of the week

“If you are biased against equity rallies built on hype, greed, mania, and other manifestations of human psychology run amock, I have some potentially distressing news: All market rallies are, to a greater or lesser extent, a function of humanity’s penchant for irrationality. The same is true of selloffs, by the way.” The Heisenberg Report, June 2023

My comment: First of all, let me recommend the Heisenberg Report. I’ve been a subscriber for a few years, and I’m astonished at the volume and quality of his work – and the very modest subscription fee. You can go to the website and look around for free.

I agree 100% with his comment. I’m frequently baffled by what appears to be irrational price action in various markets, and I’ll ask myself, “What the hell are we trading here?” And then I remember, oh yes, we’re trading psychology! I’ve thought for years that studying and, to some extent, understanding mass psychology (God bless Jimmy Dines – I have an autographed copy of his book) is much better training than studying accounting or finance if you want to become a successful trader.

My short-term trading

I started this week short the Euro and gold – positions I re-established last week after being stopped out of both last week with good profits. (I’ve been trading gold and the Euro from the short side throughout May and June.)

Gold dropped to 2+ month lows at the beginning of the week, and I lowered my stop. The market rallied Wednesday/Thursday, and I was stopped for a slight loss. I reacted slowly to the gold’s tumble on Friday and missed re-shorting it.

The Euro dove to a 2+ month low on Wednesday (month-end rebalancing?) I considered taking profits with the market down ~80 points on the day. I thought about writing OTM puts against my position (I wish I had done one of those things!), but I reminded myself that I’m trying to “lengthen” my trading time horizon and hold winning trades longer – so I lowered my stop to lock in some profits. I was stopped with decent gains when the market rallied Thursday.

I re-shorted the Euro on Friday, a couple of hours after the American employment report and remained short into the weekend with an unrealized gain of ~40 points.

I shorted the S&P on Tuesday after it broke above the recent highs and then fell back through the overnight lows. The stock market had been buzzing with FOMO over gains in Megacap tech stocks, and I was willing to bet (with a tight stop!) against what I thought could be “irrational exuberance!”

The market traded lower on Wednesday, and I was about 50 points ahead at the day’s lows of ~4175. 4175 was a breakout level last week and acted as support on Wednesday; when the market couldn’t break below 4175 and started to rally back, I covered my short for a gain of ~ 25 points.

The “bad news” – making a little money on the short side left me psychologically “wrong-footed,” and I could not buy into the 100+ point Thursday/Friday rally!

On my radar

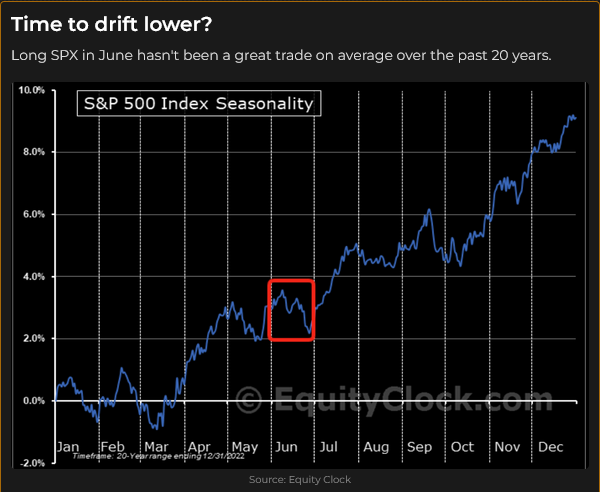

I can imagine the stock market ripping higher from here as “people” get a bad case of FOMO and decide they have to jump in – and not miss the new New Thing – the New Tech Epoch.

I can also imagine “people” buying the highs (like they did recently in gold) and then having the market reverse lower.

I’ll watch and see which way the wind blows.

I believe inflation will stay higher for longer, and interest rates will do the same. I think the USD will go higher.

My core trading belief, however, is that I make money by managing risks, not by having a great crystal ball. As my friend Denis Gartman used to say, “I have strong opinions, weakly held!”

I may not write the Trading Desk Notes next week – and if I do, they will be shorter than usual. Next Saturday is the local Special Olympics fund-raising golf tournament, which will be my priority! Click this link to play or donate to a worthy cause. Thank you!

Thoughts on trading

Years ago, I had an idea to set up a trading program where entering a market, either long or short, would be determined by a coin toss. I believed that risk management of an existing position was much more critical to trading success than the initial trade selection, and perhaps such a trading program could “prove the point.”

I never set up that program, and over time I realized that selecting a good entry point was just another aspect of risk management.

I had a German client in 1984 -85 who was astonished at how the US Dollar was soaring against (his beloved) Deutsche Mark. He kept buying the DMark as it fell in late 1984 – early 1985 until he lost ALL of the money in his account. The DMark bottomed in late February (as the USD topped) and soared for the next few years (as the USD fell.)

What is the “risk management” lesson from this story? Never fall in love with a trade! Never trade what you think “should” happen – trade what you think will happen! (h/t to the Macrotourist, Kevin Muir.)

The Barney report

One of Barney’s favourite spots is a chair in one of the upstairs guest bedrooms where he can look out the window and “keep an eye” on the neighbourhood. He barks a warning if he sees somebody he doesn’t know or anybody with a dog.

Hey Papa, I’ve got a tea towel if you need help with the dishes.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Listen to Victor talk about markets

I did a five-minute interview with Mike Campbell on his top-rated Moneytalks podcast on June 3. We discussed how Megacap stocks are soaring and pulling the whole market higher; why money managers who have had good reason to be defensive now have to chase the market. You can listen to the podcast on this link.

I did a 30-minute interview with Jim Goddard on This Week In Money on June 3. We discussed my macro market views and what I think about several individual markets – especially the stock, currency, interest rate and gold markets. You can listen to the podcast here.

Oceanside Special Olympics Charity Golf Tournament at Pheasant Glen golf course June 10, 2023

This event is the annual fund-raiser for the 50 special needs kids in the Oceanside area of Vancouver Island. If you’d like to play in this event (my team in the photo) or donate money to a worthy cause, click this link.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys, and talk with him.

Headsupguys has had over five million hits on its website, and over a half million men have taken the self-check. Most men who click on the website do so after midnight their local time. Headsupguys save lives.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair June 3rd, 2023

Posted In: Victor Adair Blog