June 17, 2023 | Trading Desk Notes For June 17, 2023

Central banks are determined to get inflation down

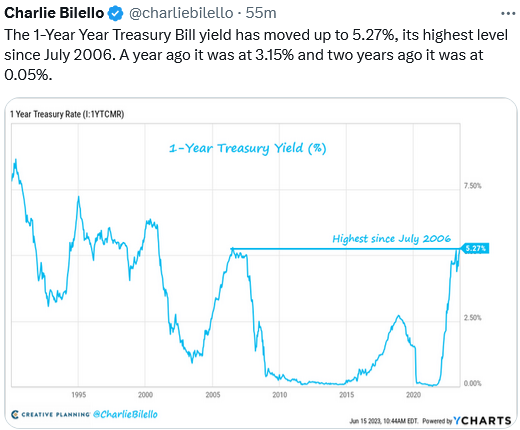

The Fed and the ECB reminded markets again this week that they are determined to slow inflation, echoing recent statements from the BoE, the BoC and the RBA. The “explicit” message is that rates will stay higher for longer. The underlying rationale for current central bank policies is that rising inflation expectations present a more significant economic risk than a recession.

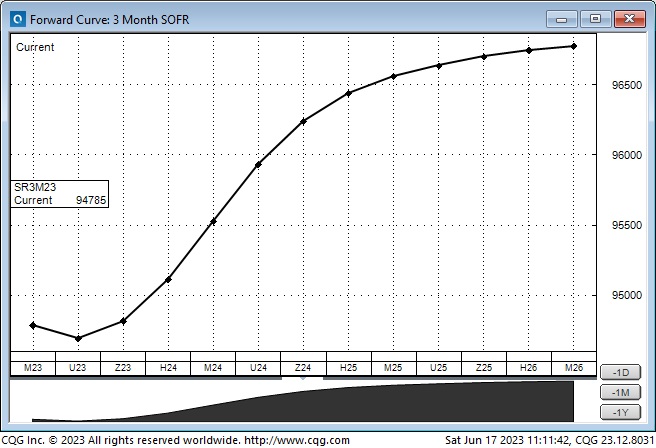

Short-term interest rate markets see the Fed near the end of its tightening cycle, with rates falling ~75bps by June 2024 and ~150bps by December 2024. Please note: the forward market has been (wrongly) pricing the Fed to be near the end of its tightening cycle for most of this year despite warnings of “higher for longer” from Powell. “Fighting the Fed” has been a losing proposition!

Stock indices accelerated higher this week

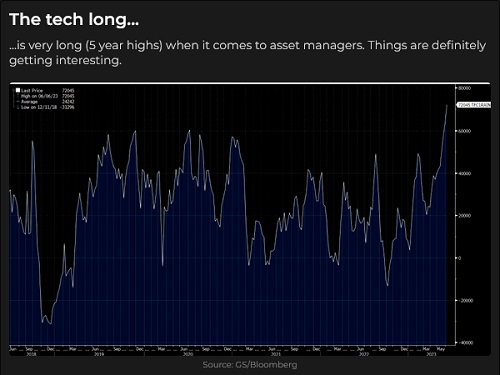

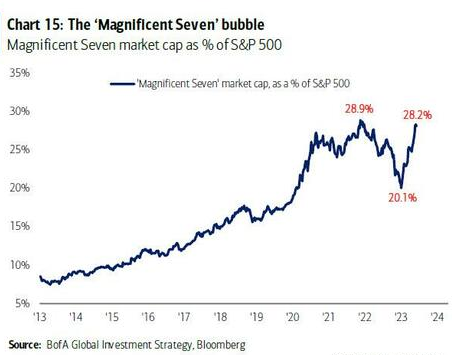

The S&P surged to a 14-month high this week, up ~27% from the October lows. The Nasdaq 100 hit a 16-month high, up ~46% from the October lows. The DJIA is up ~20% from the October lows but only ~3.5% YTD compared to the NAZ YTD gain of ~42%.

AAPL and MSFT made new All-Time Highs as Megacap tech continued to lead the market higher. TSLA is up ~70% in eight weeks, up ~160% YTD.

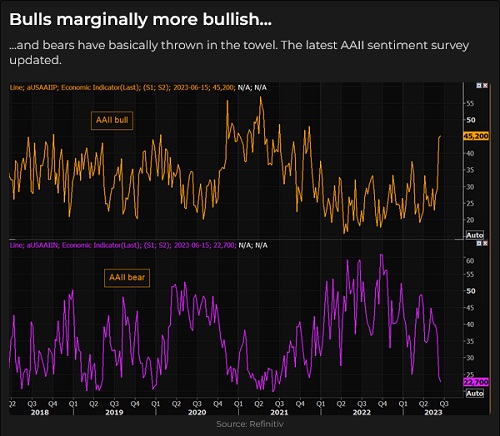

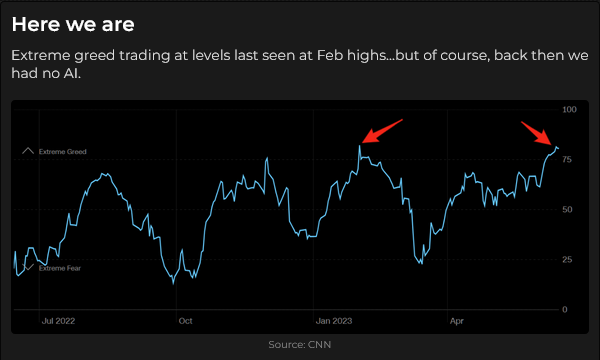

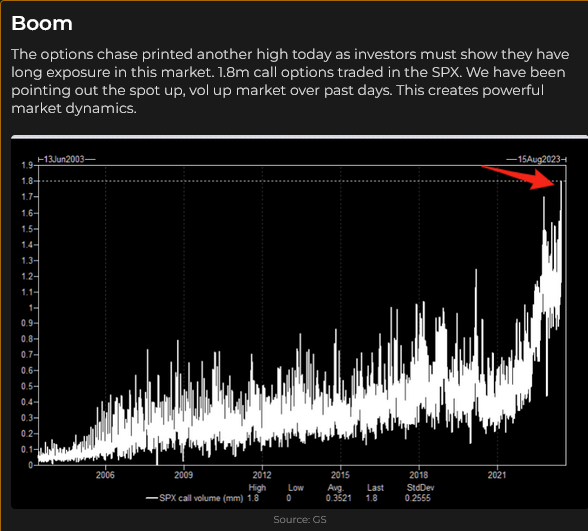

The FOMO chase is making the market look “overbought” in many ways.

The Japanese Nikkei index hit a 33-year high, up ~33% YTD.

Currencies

The US Dollar Index weakened in June, with stock markets in a “risk-on” mood and the Fed apparently (?) near the end of its tightening cycle.

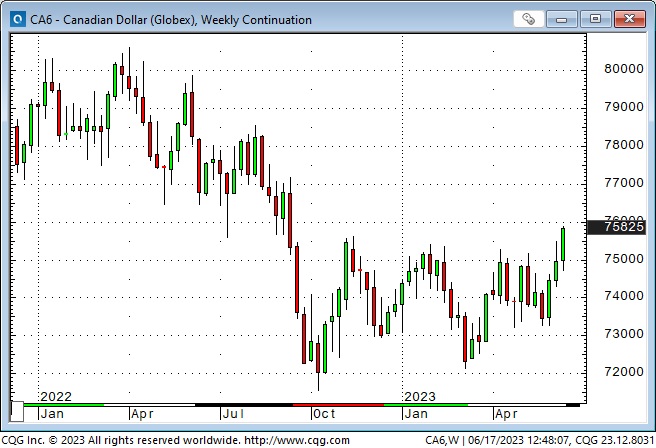

The Canadian Dollar traded to a 9-month high this week, getting a lift from “risk-on” sentiment, a weaker USD and thoughts that the BoC may be more aggressive than the Fed in the coming months.

The Japanese Yen hit a 15-year low against the Euro this week after the BoJ made no change to monetary policy. In the currency futures market, the net short speculative Yen position is bigger than when the Yen hit a 33-year low against the USD last October. Nobody likes the Yen!

Gold

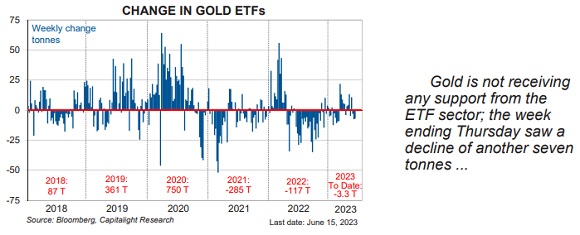

Gold fell to a 3-month low on Thursday but bounced back ~$45 at Friday’s high. With interest rates rising and inflation falling, real interest rates are rising, which is not good for gold, even though the USD has trended lower this month. Note that open interest is down ~17% from the mid-May highs as speculators who bought the highs in the March-to-May rally liquidated their positions. The gold ETF market has also seen net liquidation in the past few weeks.

How to earn “income” in the gold market

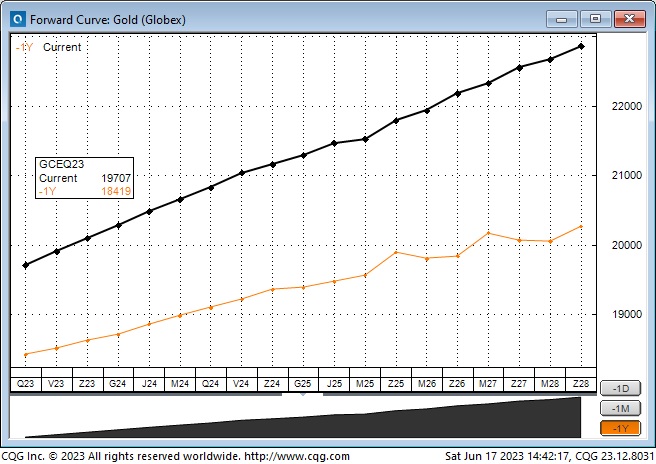

I know that gold miners think that most of their shareholders don’t want them to hedge the gold price but look at the math. Rising interest rates mean that the gold contango has been steepening. One year ago (the gold line on this chart), the premium of Dec 23 over Aug 23 was ~$20. It is now ~$38 (black line.) The 1-year forward contango has risen from ~$68 to ~$112.

With Aug 2023 gold at ~$1970, a miner (or someone who owns gold) could sell 1-year forward $100 out-of-the-money calls ($2070 strike price) and receive ~$135 per ounce. If the gold price is less than $2070 in August 2024, the seller keeps the $135 premium. If the gold price is above $2070, the seller (effectively) delivers gold and receives $235 (~12%) over and above the current price.

If you want to learn more about this, email me: [email protected].

My short-term trading

I started this week short CAD, EUR and the S&P. In last week’s notes, I commented, “I have tight stops on all of these “top-picking” trades, and I’m trading small sizes, respecting the up-trend and the correlation between the positions.”

I was stopped out of the EUR and the S&P on Monday, and on Tuesday, I was stopped out of the CAD. I took slight losses in all three positions.

This was a classic case of why I use stops. I had an opinion about these markets that turned out to be 100% wrong. The good news was that I got out early and avoided taking bigger losses.

I shorted gold on Tuesday after the CPI report and remained short into the weekend.

I reshorted the CAD and the S&P on Friday (at much higher levels than where I had previously been stopped out) and remained short into the weekend.

I’m trading small sizes, and I have tight stops.

On my radar

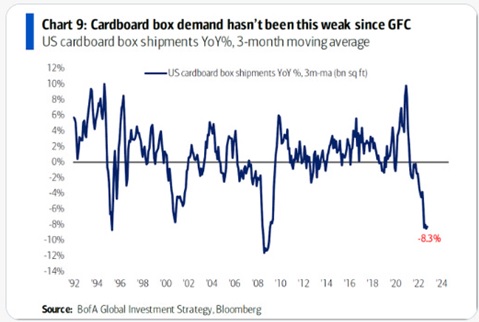

Is this as good as it gets? A FOMO rush is happening, and I’m willing to (cautiously) take the other side of that trade.

The market expects the Fed to stop tightening while the ECB continues tightening after raising short rates this week to 22-year highs. This has given the EUR a lift from around 1.07 to 1.10. The net long EUR speculative position is enormous; I’ll look for a setup to short the EUR.

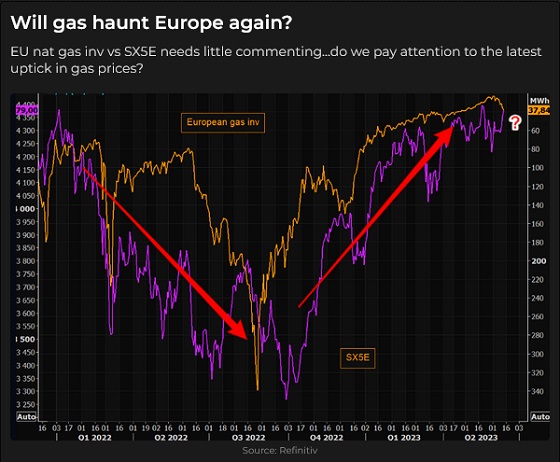

The Euro hit 20-year lows last September when people thought the Eurozone might suffer from sky-high Natgas prices. Natgas prices tumbled, and the Euro (and European stocks) rallied. Will Natgas be cheap and readily available this coming winter?

Bond prices have been trending lower for six weeks, while stock indices have been trending higher, a classic risk-on move. If the market goes risk-off, bonds may be bid. If the market starts thinking of “recession,” bonds may be bid. The net-short bond position is huge.

“Everybody” hates the Yen, and the net-short position is huge. What would it take for the Yen to bounce?

The Barney report

Barney and I walked part of the golf course between 5 and 6 am this morning when no golfers were around. Barney found two dozen golf balls without hardly trying. We walk near the edge of the fairway; he smells a golf ball in the long grass, dives in, gets it, and gets rewarded with a treat. He loves finding balls. I clean them up and put them in our “free golf balls” bucket on the wall between our house and the 17th fairway.

Here’s Barney offering to shake a paw.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Listen to Victor talk about markets

I did an 8-minute interview with Mike Campbell on his top-rated Moneytalks podcast on June 17. We talked about the FOMO rush driving the stock indices higher, how the market thinks the Fed is nearly done with its tightening program, the Canadian Dollar rallying to 9-month highs and how higher real interest rates are a weight on the gold market. You can listen to the podcast here. My interview with Mike starts around the 49-minute mark.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys, and talk with him.

Headsupguys has had over five million hits on its website, and over a half million men have taken the self-check. Most men who click on the website do so after midnight their local time. Headsupguys save lives.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair June 17th, 2023

Posted In: Victor Adair Blog

Next: A Skip, Not a Stop »