June 16, 2023 | The Fed Remains Committed To Fighting Inflation

The Federal Reserve delivered a “hawkish pause” this week. The Fed funds rate was held steady, as the Fed continued to tighten monetary policy and suggested that further rate hikes are inevitable.

Will the Fed stay the course until inflation is at its 2 percent target?

The official statement says that the Fed is committed to a 2 percent target for inflation. The US CPI declined to about 4 percent year-over-year for May 2023:

Source: Bloomberg

CPI is trending lower which gives the Fed enough room to take a pause, unlike Canada and Australia who both hiked rates recently.

The Canadian hike followed an April pause, as the BOC had to return to a more hawkish stance.

The Fed wanted to pause but made it clear that more hikes are coming. As a result, forecasts by market participants were changed dramatically.

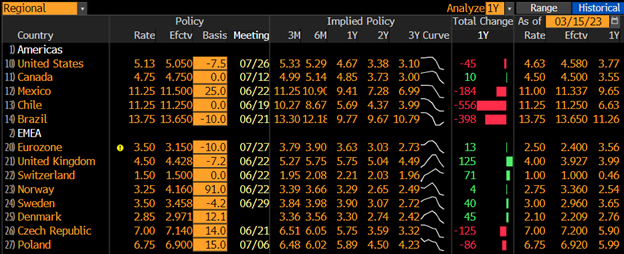

Markets had been pricing in rate cuts as early as this autumn. Now rate cuts are expected much later, with higher rates priced in for the end of this year. The six month policy rate shows higher in most countries including the US, Canada and the Eurozone:

Source: Bloomberg

The 6m (six months) column shows higher rates. In the US the rate is listed as 5.13 percent now, and 5.29 percent in six months. Similar increases are shown for Canada, up to 5.14 percent and the Eurozone 3.90 percent. This means that the market sees one or two more rate hikes this year, starting in July for the US Federal Reserve.

The impact of rate hikes, which have numbered 10 since March 2022, has started to be felt as regional banks in the US failed and mortgage volumes are slipping in Canada. There are no recessions seen yet in North America, but economic growth forecasts are very small, and a recession could have already started given the notorious lag in reporting economic numbers and the frequency of revisions to those numbers. Leading indicators of recession, such as inverted yield curves, are screaming recession, but those indicators are being ignored now, partly because they have been flashing “recession” for a very long time.

In the press conference following Wednesday’s news release Chair Powell said that “rate cuts are a couple of years out.” This is a significant statement given that market expectations were committed to rate cuts by the end of this year.

Powell said, “It will be appropriate to cut rates at such time as inflation is coming down really significantly…Not a single person on the committee wrote down a rate cut this year, nor do I think it is at all likely to be appropriate.”

The Fed seems to believe that inflation will not be brought back to its 2 percent target without a lengthy period of monetary policy restriction. This is in line with experience in the 1970s and 1980s when it took several years and two recessions to impact inflation decisively.

The Fed and its chair, Jerome Powell, are determined to get inflation under control.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth June 16th, 2023

Posted In: Hilliard's Weekend Notebook

Next: Espionage Act & Abuse of Power »