June 19, 2023 | Easy Money Makes You Stupid, Europe Edition

The eurozone is like a big Rube Goldberg machine sitting on a slab of bedrock called Germany. As long as the German economy — and the European Central Bank that Germany controls — are okay, then the currency union is viable.

But recently several things have happened:

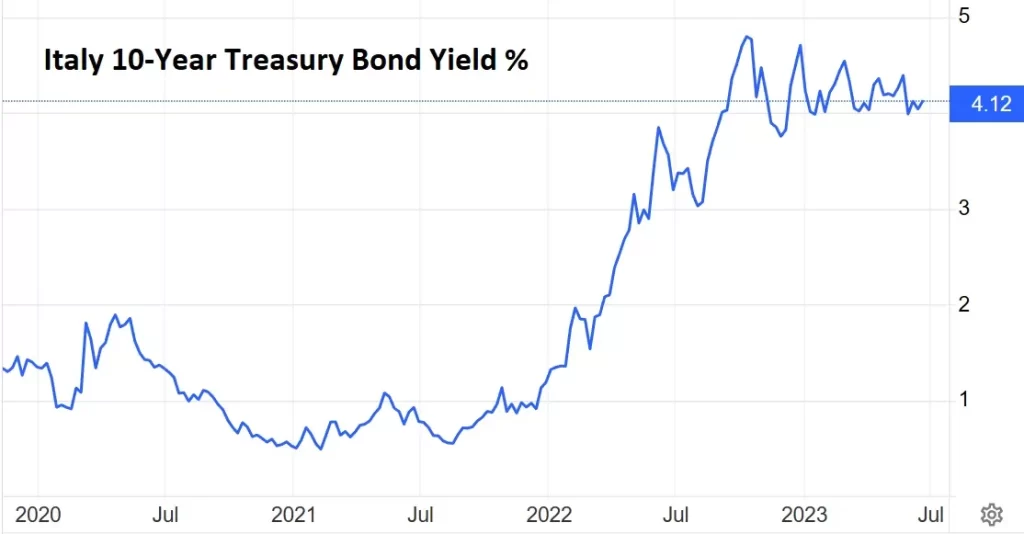

- Interest rates have spiked across the eurozone in response to the double-digit inflation of the past year. The ECB has raised its version of the Fed Funds rate from -0.50% to 3.50%, spiking 10-year bond yields to 4% in Italy and 3.76% in Greece. The weaker eurozone economies are, as a result, seeing the interest on their government debt rise far beyond their ability to pay. Which is a complicated way of saying they’re going bankrupt. And with eurozone consumer price inflation still above 6%, the ECB is in no position to ease the pressure by forcing interest rates back down.

- The eurozone recently tipped into recession, as the past two quarters registered negative growth. In recessions workers lose their jobs and government income tax receipts fall, while those unemployed workers collect benefits, causing government spending to surge. Combine this dynamic with today’s high interest rates, and the result is a feedback loop where rising interest costs beget higher deficits which in turn beget even higher interest costs and so on, until something (most likely the currency) breaks.

Classic wake-up call

This sudden bout of stagflation is a classic wake-up call, to which a rational society would respond by getting its financial house in order. That is, it would stop adding to its debilitating debt and devote itself to the pursuit of efficiency and productivity. Instead, Europe has done the following:

It has embarked on its version of a Green New Deal that calls for a rapid shift towards electric vehicles and an equally rapid closure of farms, dairies, and ranches — with no apparent concern for where the required batteries and food will come from. Germany shut down its nuclear power sector (cutting that electricity source from 25% of the national total to zero), while at the same time making itself dependent on cheap Russian natural gas. This has failed spectacularly, leading to what economists now call the “deindustrialization” of Germany.

The EU waded into the Russia-Ukraine war, sending the latter $79 billion of military aid, with another $79 billion in the pipeline, all of it borrowed.

These policy blunders all have one thing in common: They assume uninterrupted access to cheap credit and energy for as far as the eye can see. Put another way, several decades of a fiat currency printing press running full blast have convinced Europe’s decision-makers that it will always be thus.

And now it’s all coming to an end.

Germany has no more money for EU – finance minister

Germany cannot afford to pay more money into the EU budget, Finance Minister Christian Lindner told the newspaper Die Welt on Friday. Although Germany is the bloc’s largest contributor, it has been forced to make cutbacks as its economy contracts.

“In view of the necessary cuts in our national budget, we are currently unable to make any additional contributions to the budget of the European Union,” Linder told reporters in Brussels, adding that other member states have come to the same realization.

Why the EU’s economic engine is breaking down

Germany is the EU’s largest net contributor, giving €21.4 billion ($23.4 billion) to the bloc’s budget in 2021. Once regarded as Europe’s industrial powerhouse and the EU’s most resilient economy, Germany is currently experiencing deindustrialization as a consequence of its decision to cut itself off from cheap Russian gas and transition to more expensive green energy. The German economy fell into recession in the first three months of this year, and Chancellor Olaf Scholz’s government is planning to reveal around €20 billion ($21.8 billion) in budget cuts later this month.

However, a vote on the budget may be delayed, as Scholz and Lindner’s coalition partners in the Green party argue for tax hikes instead of spending cuts.

So what happens when Germany cuts the rest of the eurozone loose, forcing those overindebted countries to pay their own way? One of two things: Either Italy, Greece, and several other eurozone countries go functionally bankrupt, defaulting on their debts, laying off millions of workers, and possibly leaving the currency union. Or the euro itself is devalued dramatically to make the bankrupt countries’ debts manageable. And (best case scenario) today’s European leaders are replaced by less stupid ones. This is how easy money experiments end, always and everywhere.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino June 19th, 2023

Posted In: John Rubino Substack