May 27, 2023 | Trading Desk Notes For May 27, 2023

Nvidia

Following a quarterly report described by one analyst as “The greatest beat of all time,” Nvidia’s market cap soared by >$200 Billion on Thursday, the largest one-day value increase of any company in American equity market history. The company’s market cap at the beginning of this year was ~$350B; at Friday’s close, it was ~$960B. The share price at $389 is nearly 4X since the October lows, up ~10,500% in the past ten years! (It traded below $3 in early 2013.)

Other “AI-involved” companies’ share prices also jumped this week.

The Nasdaq 100 futures contract had its highest weekly close in 13 months, courtesy of the enormous gains posted by AI-involved companies.

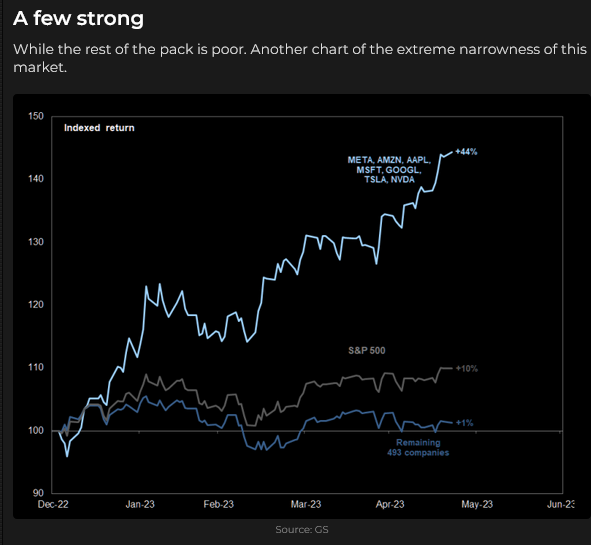

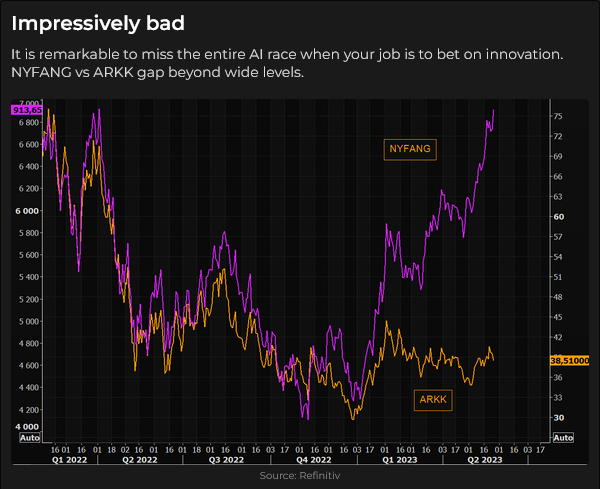

The greatest “pain trade,” as noted here last week, is suffered by portfolio managers who are underweight Megacap tech, which is soaring relative to other market sectors.

A “new era” for tech stocks – or not?

Is the FOMO frenzy over AI a function of “late-cycle” flight-to-quality driving a powerful rally in the tech sector (last year’s weakest sector) while overall market breadth deteriorates – or is this 1999 all over again?

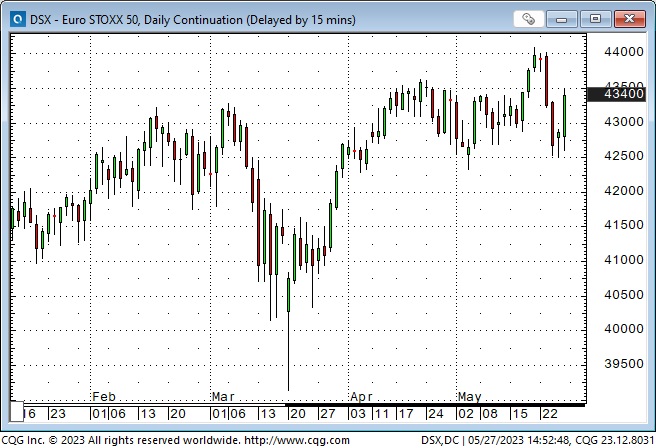

The Euro Stoxx 50 Index of leading European stocks broke out of its narrow range to touch its 2021 All-Time Highs last week. It tumbled early this week but rallied back on Friday.

Interest rates

Interest rates are rising across the curve as the much-anticipated recession fails to materialize, labour markets remain tight, consumers keep spending, too-high inflation is sustained, and the market braces for Central Banks to stay higher for longer.

Markets recently priced the FOMC to pause in June and cut in July and/or September. Now markets are pricing better than a 50/50 chance of a raise in June (assuming the debt ceiling is resolved) and only one 25bps cut by December.

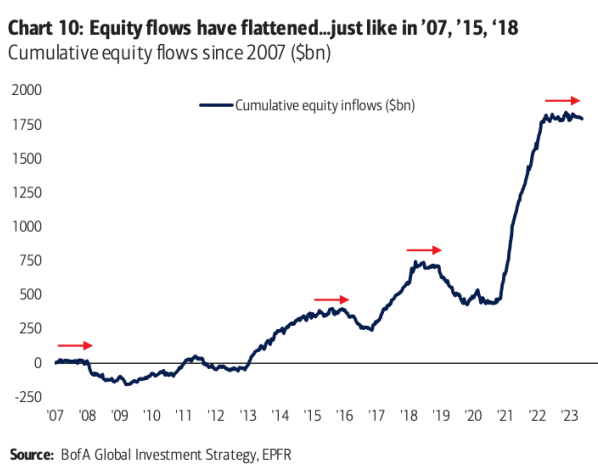

Markets may also be anticipating a substantial bill issuance once the debt ceiling has been raised. That issuance may drain liquidity and act as a headwind for risk assets.

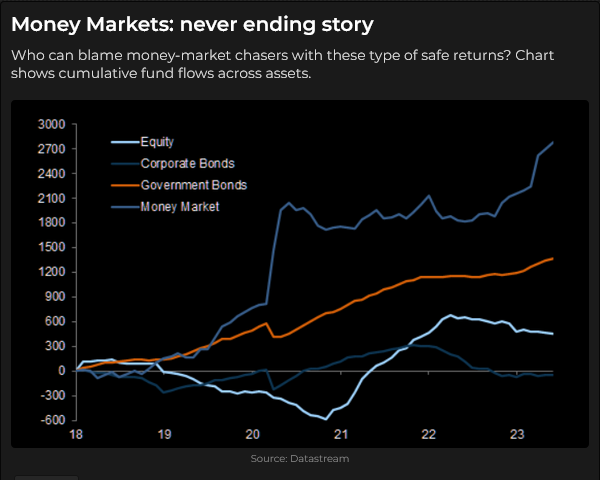

Money market funds

Money market funds took in another ~$50 Billion this week, taking total assets to ~$5.4 Trillion. Since October, MMF increased by ~$800 Billion while bank deposits declined by ~$650 Billion.

Currencies

The US Dollar Index (USDX) has closed higher for three consecutive weeks and is up ~3% from early May lows. The low around May 4, circled in this chart, correlates with the highs circled in the T-Note and SOFR charts above. The rise in the USDX over the past three weeks has been linked to rising American interest rates.

The USDX has trended higher for the last 15 years after making All-Time Lows in 2008. Interestingly, a number of the countries that have been involved in “de-dollarization” talks recently (Brazil, India, South Africa, Iran) have seen their currencies trend lower against the USD over the past 15 years.

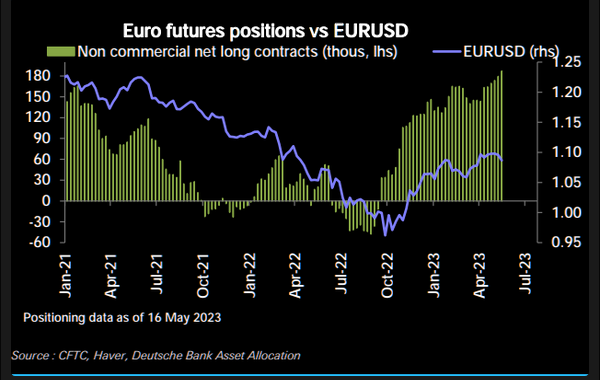

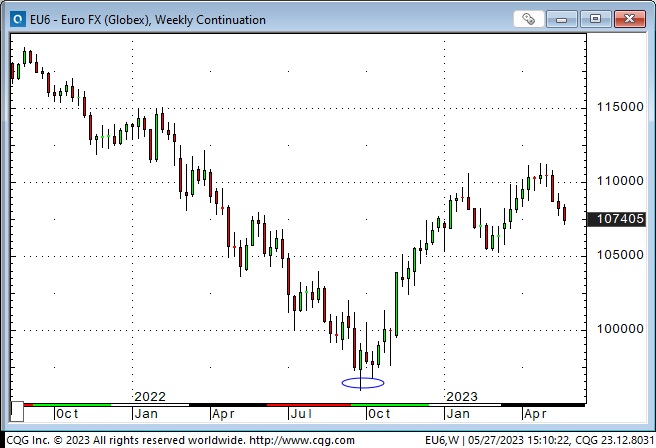

Non-commercial positioning in currency futures as of May 23 saw a slight reduction in net short USD positions (net short Yen positioning grew a bit, and net long Euro positioning shrank a bit). Still, the net long Euro positioning remains substantial at ~$23.5 Billion even though the Euro has fallen from ~1.11 to ~ 1.075 in May. If the Euro continues to weaken, some speculators may start to liquidate their positions, adding to downside pressure. (I can’t help but wonder if capital won’t “return to America” if the American exceptionalism on display in Megacap tech is sustained.)

The Euro hit a 20-year low against the USD in late September last year and rallied ~15% to its recent highs.

The Euro Stoxx 50 Index also made a significant low in September (as the Euro made a 20-year low) and rallied over the next several months as the Euro rallied. Some analysts explained that American stocks had outperformed the Rest Of The World for more than a decade, and capital would flow to “bargains” in developed and emerging markets. Over the past six months, there may have been more than a simple correlation between the Euro and European stocks.

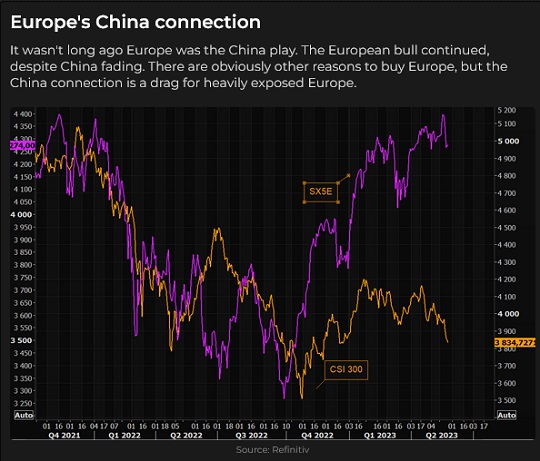

I have previously noted that the weak Chinese “re-opening” is not good news for the Euro – China is Europe’s biggest export market. Given the correlation between the Euro and the Euro Stoxx 50, the weak Chinese “re-opening” may also not be good news for European stocks.

The Canadian Dollar has fallen ~1.5 cents from ~75 cents (the high end of its range over the past eight months) as the USD has rallied against virtually all currencies for the past three weeks.

From a longer-term perspective, the CAD has traded mostly between 72 and 80 cents for the past eight years.

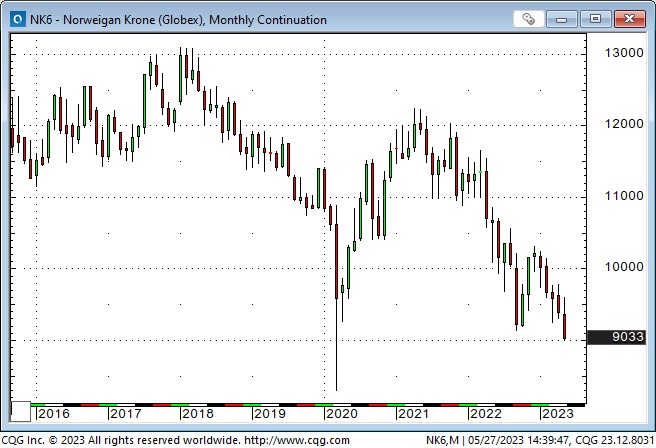

The Scandinavian currencies have trended lower over the last 24 months, with the Norweigan Krone near a 20-year low against the USD (save a brief spike down in March 2020 during the covid crisis.)

Gold

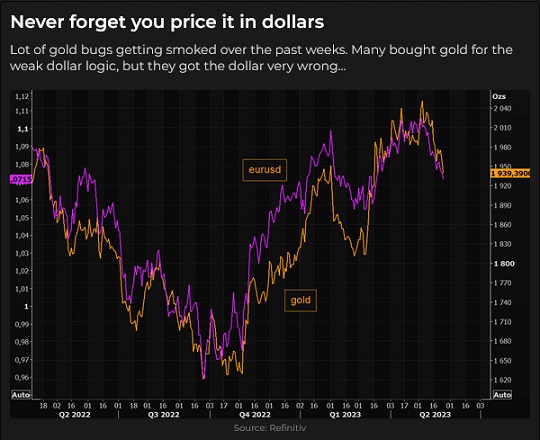

Comex gold futures briefly (two minutes) traded to an All-Time High on May 4 (the same day the USDX made a low and US interest rates turned higher) and has fallen ~$150 over the last three weeks as the USD and US interest rates rose.

I have previously written about net speculative gold positions increasing aggressively in early May, leaving the market vulnerable to a correction. Open interest grew as speculators bought the highs (and bought more as prices backed off a bit) but then declined sharply once prices broke decisively below $2000, and speculators liquidated some of their positions. Net speculative long positions as of May 23 were valued at ~$32 Billion, down ~$4 Billion on the week.

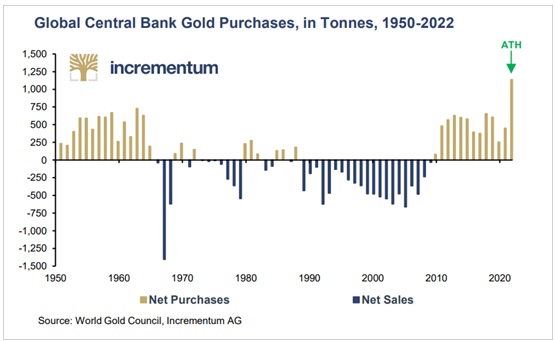

Reports of Central Banks buying record amounts of gold must have encouraged some speculative buying, as did the falling USD and rising inflation.

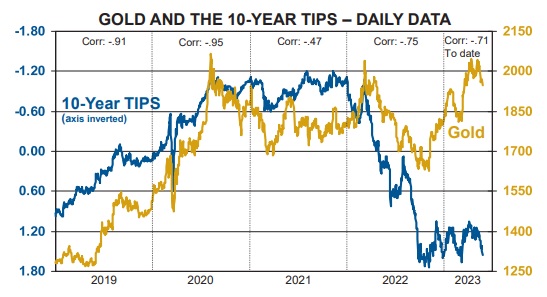

There has been a high correlation between real interest rates and gold for much of the past five years, but recently gold has risen while real interest rates have also increased. (In this chart, courtesy of Martin Murenbeeld, the 10-year TIPS axis is inverted.) The breakdown in the correlation may indicate that “other things” (geopolitical stress, rising debts and deficits, inflation etc.) may be having a more significant impact on the gold price, but if real interest rates were to increase further, that might hurt the gold price.

My short-term trading

I started this week with no positions after getting stopped out (with good profits) of my short Euro and gold positions last week.

I re-established short positions in the Euro and gold this week and have held those positions into the long weekend.

I shorted the S&P as it broke down on Tuesday and was ~60 points onside at Wednesday’s lows, but I was stopped out for a tiny loss when the market rallied on Thursday (I had lowered my stop from its original level when the market moved in my favour on Wednesday.)

On my radar

With the strong rally on Friday, it seems “nobody” wanted to be short stocks going into the 3-day weekend. I don’t know if AI will “change the world,” but I’m not chasing it higher.

I’m happy to try to make money in other markets rather than trying to guess which way the stock market is going!

I continue to have a bullish bias on the USD.

My bias is that central banks will stay “higher for longer” unless there is a crisis, but the markets have been priced for the Fed to pause and then cut, so I’ve been looking for opportunities to be short interest rate futures. I may have missed that trade – it would be hard to get short now.

Thoughts on trading

A subscriber emailed me a question following my interview on last week’s Moneytalks podcast with Greg Weldon. His question was, essentially, how do I define my methodology for risk management? Here is part of my email reply to him (which didn’t reach him because of an address error.)

Greg Weldon told us that Van Tharp said that methodology was 10% of trading, risk management was 20%, and psychology was 70%.

Risk management answers, “What will you do when you’re wrong?” If I’m trading to make money rather than prove I’m right, I must control my risk of loss/ruin.

Risk management defines the “process” it is not an “afterthought.”

For instance, if my bias (my intuition after all the “research” I’ve done) is that the Euro will fall, I will look for an opportunity (the right time, the proper setup) to short the Euro. Why not just short it now? Why wait and maybe miss making a profit?

Finding a good “spot” (time, price, set up) to enter a market is part of RM. Ideally, I want to short the Euro when it appears to be more likely to fall than rally (on whatever time frame I’m using) and as close to my stop-out price as possible (risk a little to make a lot.)

Once I have a position that goes my way, I want to 1) stay with it as long as it goes my way and 2) not let it reverse too much against me. So I will have a trailing stop, knowing that I will leave some “money on the table” if it reverses and I get stopped, but also knowing that leaving “money on the table” is part of trading. I measure my P+L on closed-out trades, not open trades.

The Barney report

This is Barney in the living room, looking at me eating dinner in the kitchen. He is just about to join me in the kitchen to engage in his new “I’ll have what you’re having” diet plan.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Listen to Victor talk about markets

I hosted Mike Campbell’s extremely popular Moneytalks show again this week while Mike was on vacation. I interviewed our regular commentators, Michael Levy and Ozzy Jurock, and I had a terrific 40-minute interview with our feature guest Kevin Muir, The Macrotourist. You can listen to the podcast here – My interview with Kevin starts around the 13.45-minute mark.

Oceanside Special Olympics Charity Golf Tournament at Pheasant Glen golf course June 10, 2023

This event is the annual fund-raiser for the 50 special needs kids in the Oceanside area of Vancouver Island. If you’d like to play in this event (my team in the photo) or donate money to a worthy cause, click this link.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys, and talk with him.

Headsupguys has had over five million hits on its website, and over a half million men have taken the self-check. Most men who click on the website do so after midnight their local time. Headsupguys save lives.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair May 27th, 2023

Posted In: Victor Adair Blog