The median new US home in April sold for $420,800 -15% lower than the peak last October. Less spending is evident in home improvement spending too. Yesterday, Lowe’s joined Home Depot in announcing a year-over-year decline in same-store sales (the first since 2009) with a marked fall-off in big-ticket purchases. Higher interest rates and falling home prices are undermining the ability and desire to spend on housing just as inflated prices make it more affordable to rent than buy in most cities in North America. The EPB Macro segment below reviews key numbers and historical context.

The US housing market is in its 6th major downturn since the late 1960s. Home prices are declining in 75% of major cities, with many areas posting declines for six or seven consecutive months. In this article, we’ll look at the distribution of home price declines and show where home prices have fallen the most and where home prices have held up the best. We’ll also compare the depth and duration of this home price downturn to past declines to see how it stacks up. Here is a direct video link.

As shown below, the present math is significantly more favourable to rent versus buy in all but four major US cities.

Math is also less favourable to buy versus rent in most Canadian cities. A typical example: our daughter rents a one-bedroom condo with her partner in downtown Toronto where they pay $2200 a month, including parking and hydro. The same model condo is on offer to buy for just over $519,800, down 8.6% from the $569,000 it sold for in March 2021 (and -13% from the $600,000 ask for similar units at the market peak in February 2022).

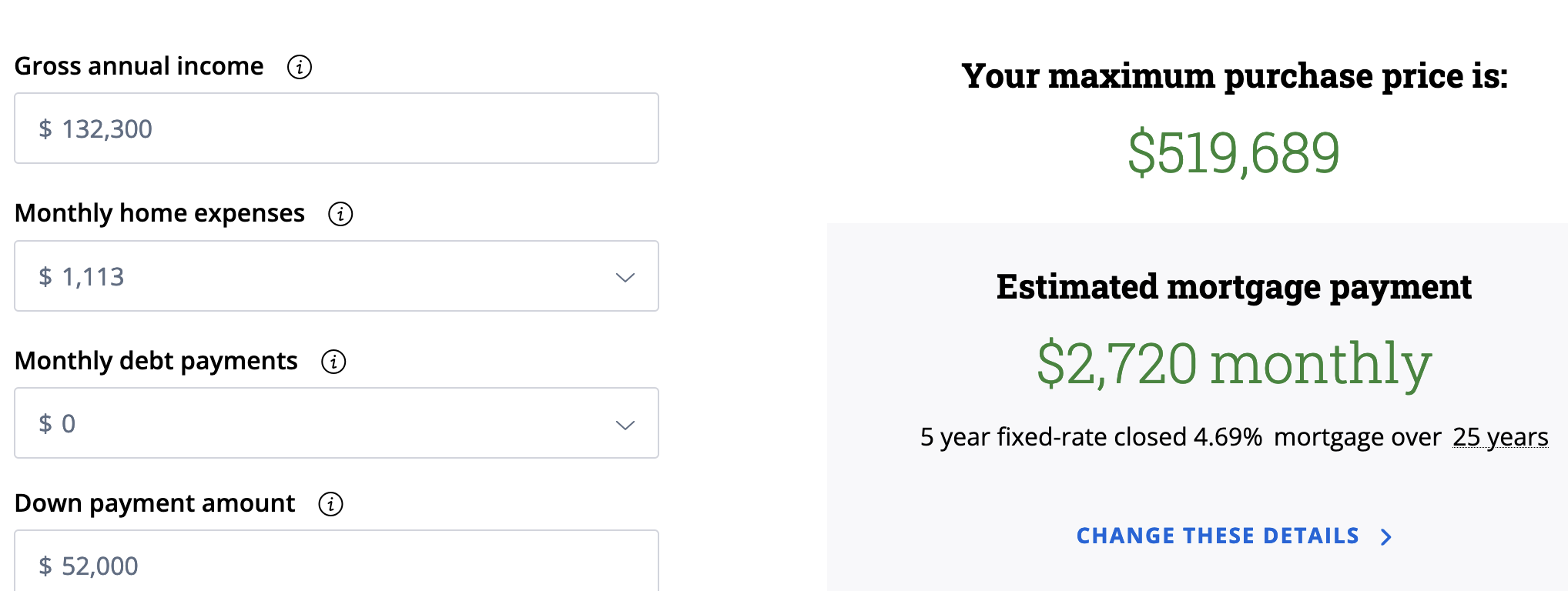

To pay $519k with a 10% downpayment (52K), the monthly payment on a $468,000, 5-year fixed term (4.69%), 25-year amortization mortgage is $2720 plus $793 in condo fees, $170 in taxes, and $150 in hydro–a total monthly outlay of $3833 plus any property maintenance costs for the unit. In other words, not counting any maintenance costs, renting is $1633 cheaper per month than owning the same condo. Landlords who bought over the past couple of years are facing falling prices and some $20k in negative annual cash flow on their “investment.” How long will present owners hold properties off the market as unemployment increases and rising supply lowers rents and property prices?

As shown below, at current prices and interest rates, one requires $132,300 of household income and zero other debt payments to qualify for the mortgage to purchase an “entry-level” Canadian home at $519k. The average home sale price in Canada for April was $716,000 (-4% yoy). The average condo apartment sale price in Toronto was $724k, down 8.3% year-over-year.

People may want to buy rather than rent for emotional, psychological and situational reasons. Patience may be hard to come by. But it’s not true that renting is always a waste of money. Financially, renting and banking monthly savings make more sense in most places today. And this will build savings for future downpayments as property prices decline. Historically, the average housing downturn has taken 4 to 6 years to bottom and has always led to the worst economic contractions. This housing downturn started 14 months ago in Canada and six months ago in the US—some food for thought.