The past year has seen the most aggressive Fed tightening cycle in at least 30 years (see the chart below as of March 30, 2023, courtesy of Isabelnet.com). Base effects matter a lot; coming off a decade of constant QE and near-zero interest rates, the “normalizing” of monetary conditions this cycle is particularly acute at a time when the world owes record amounts of debt.

US total household debt is at $16.5 trillion, including auto loans of $1.6 trillion, credit card debt at $986 billion, and student loans at $1.6 trillion (recall that interest on student loans has been suspended since 2020, but it is set to resume this year).

Auto loan and credit card interest rates just hit new record highs, with average interest rates of 24.5% on credit cards, 14% on used cars, and 9% on new vehicles (Kobeissi Letter data).

Auto loan and credit card interest rates just hit new record highs, with average interest rates of 24.5% on credit cards, 14% on used cars, and 9% on new vehicles (Kobeissi Letter data).

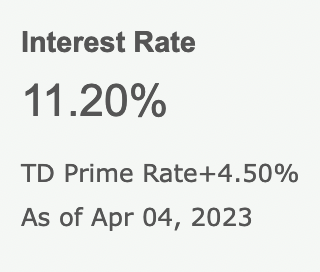

With prime rates at 6.7%, prime plus lines of credit are above 11% (nearly double from one year ago).

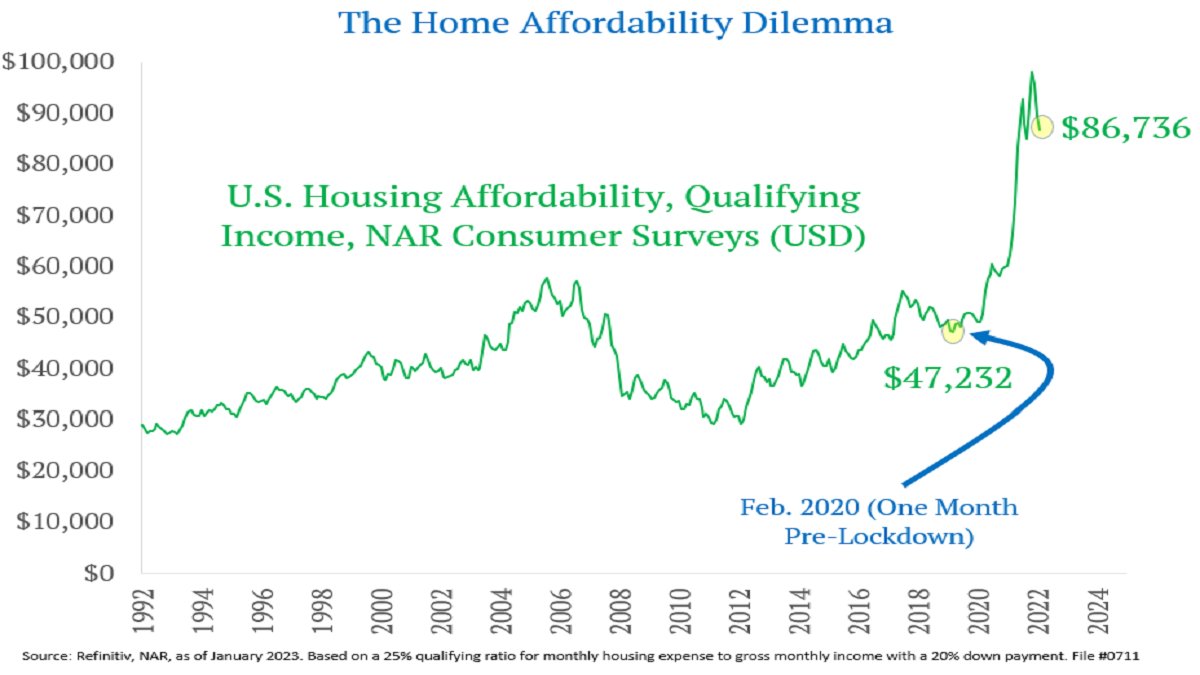

At current mortgage rates, US households need an income of $86,736 to qualify for the median-priced home, compared with $47,232 in February 2020. Affordability numbers are even worse in Canada.

And then there are the knock-out effects on levered investors/speculators who ballooned during the 2010-2022 easy money era, now in the take-back phase. Prices tumble as distressed sellers rise; see Housing is turning out to be a lousy shelter for investors:

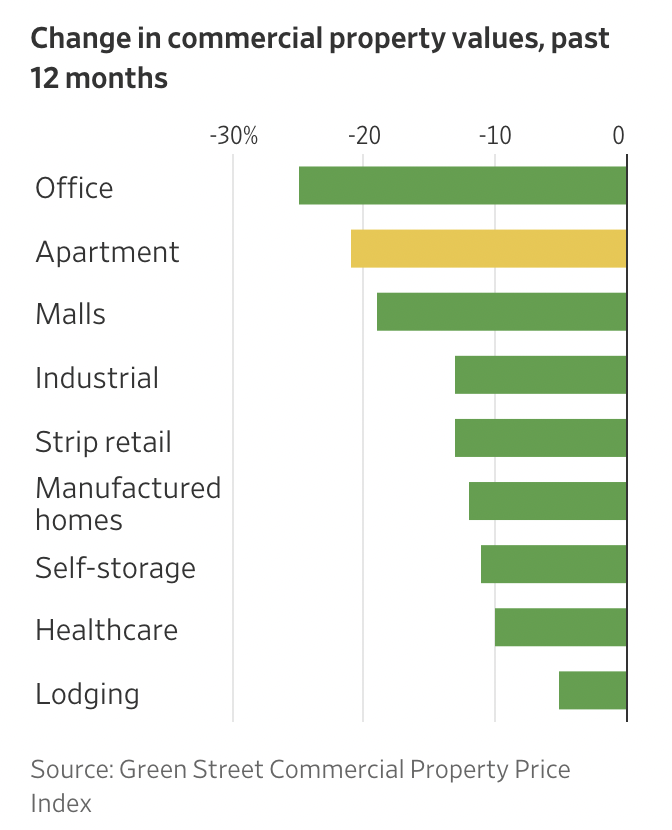

Investors that snapped up apartment blocks with short-term, floating-rate debt are in especially hot water now. Research provider Green Street pointed out that privately held Houston real-estate investor Nitya Capital wants to sell 38% of its portfolio as it grapples with higher debt payments. Most of Nitya’s assets were bought at peak prices in 2021, when interest rates were at rock-bottom. Costlier debt wiped out cash flows on some of the landlord’s assets.

Commercial property prices are heading south in all sectors. As stress spreads among the lenders, see Shadow Banks Could Yet Cause Trouble:

As stress spreads among the lenders, see Shadow Banks Could Yet Cause Trouble:

As a recent TS Lombard note laid out, the level of real estate debt maturities in 2023 is expected to be high. This means asset managers may be forced to go to investors for more capital (which will be a tough negotiation at the moment) or sell property out of their portfolio to cover loans.

..It is possible that concerns about commercial real estate will start to expose other vulnerabilities — or at the very least asymmetries — in the financial system and shadow banks in particular.

Consider, for example, how rich non-bank asset managers such as Blackstone, Apollo, Carlyle and others became on both residential and commercial real estate in the wake of 2008. This was partly because they were able to make deals that more regulated banks couldn’t…But it’s safe to say that the combination of falling values, higher rates and a credit crunch is going to mean we’ll probably see some high-profile defaults.