April 12, 2023 | Check Out Gold’s Quiet Bull Market

Gold just set a couple of records, but you’d never know it from the relatively modest level of investor enthusiasm.

The metal’s March 31 price of $2,008/oz was its highest-ever monthly and quarterly close. That’s admittedly a ways below the all-time daily close of $2,069. But still, record highs of any kind deserve a certain amount of respect.

Why the lack of enthusiasm?

There are two simple reasons for the tepid response. First, gold and silver have been in a trading range since 2010 and the recent record, though sort of a break-out, is not sufficiently decisive to capture the imagination of momentum investors (or any other flavor of non gold bug). People don’t change their minds easily, and what’s happening now hasn’t met that threshold.

Second, the economy is slowing and a growing number of investors are expecting a recession, with all that that implies for financial asset prices. See here, here, and here. Tanking stocks traditionally take precious metals down for the ride, which means the economy trumps gold’s recent price action in the minds of many.

But let’s take the opposite side of that argument, just for fun

The long-term reasons to love precious metals are compelling and becoming more so with every new trillion tacked onto global leverage. But a case can also be made that we’re already off to the races. The major points:

The recent bank run sparked a rush to safety. Gold bugs have been screaming “Don’t trust the banks!” for decades, without changing many minds. But the recent implosion of Silicon Valley Bank made people realize that even their sleepy local lender is at risk, and that should such a contagion spread, the required government bailout will cost trillions and might impact the dollar itself. So now you can’t trust your bank or your currency. Meanwhile, the next test of the banking system is barreling down the tracks, in the form of a commercial real estate bust that will disproportionately hurt those same local and regional banks. Suddenly, a box of gold or silver coins hidden in a safe place looks dramatically safer than a bank account. And a softening economy will only amplify that flight to safety.

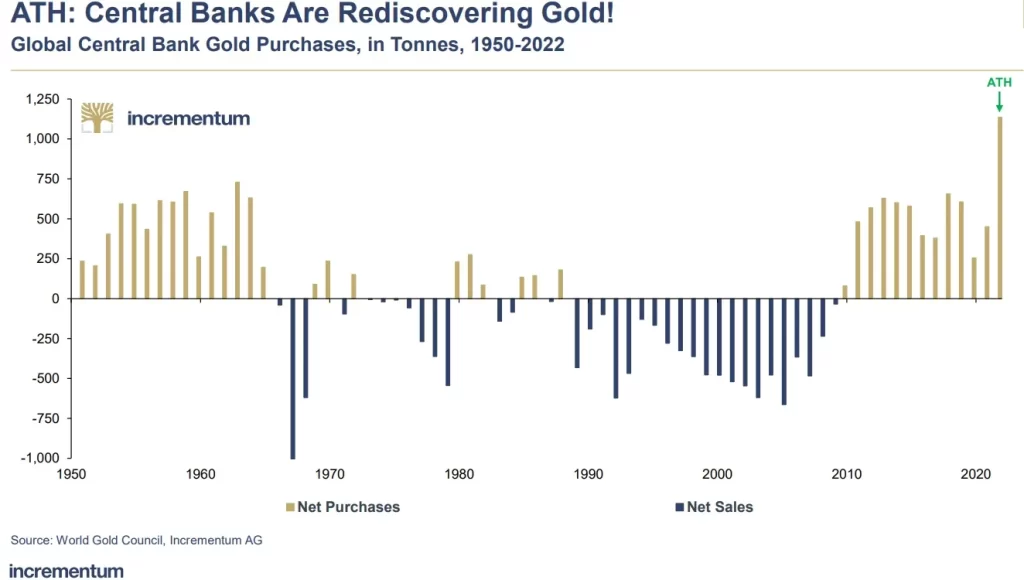

Central banks are now both net gold buyers and “strong hands.” The rest of the world is sick of US bullying and is looking for ways around dollar hegemony. One way is to shift central bank reserves out of Treasury bonds and into other currencies and gold. So central banks have stopped selling gold and started buying it. And once bought, gold that resides in these banks’ vaults won’t be dumped just because the metal’s price goes up a bit. Put another way, the gold market now has a bunch of whales with printing presses on the buy side, and they’re apparently not going away, recession or no. See De-Dollarization Just Got Real.

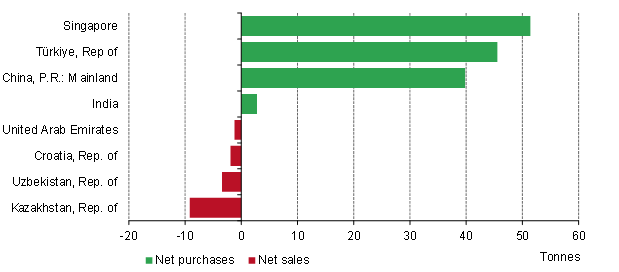

Year-to-date, purchases have heavily outweighed sales*

Investor enthusiasm, though still muted, is coming around. True, there’s not yet a lot of breathless Buy! Buy! Buy! commentary out there. But money is flowing into precious metals at an accelerating rate. In March, gold ETFs saw net inflows of US$1.9bn (+32 tonnes), their first positive reading in ten months. And mining stocks are at long last catching a bid. GDX, which owns the major gold miners, has been rising steadily since early March.

20% in a month won’t light many fires, but it does put a stock on momentum screens, especially when everything else is languishing. Another month like this and trend followers will be all over this sector.

I’ll leave you with a video of Michael Oliver, a technical analyst with an unusual amount of credibility, giving his strongest-ever gold/silver buy recommendation.

The required caveat: It’s fun to contemplate a huge precious metals bull market, but no one really knows the future. So even if you love what you’ve just read, you’re better off sticking with a strategy of gradually adding to positions. Slow and steady wins the race.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino April 12th, 2023

Posted In: John Rubino Substack