. Although it’s typical for companies to “beat” lowered earning estimates, the earnings trend is recessionary, with a second sequential quarter of negative growth in 10 of 11 sectors. See Factset, Canada Earnings Season Preview Q1 2023:

Analysts lowered their earnings estimates more than average for the first quarter for companies in the S&P/TSX Composite. On a per-share basis, estimated earnings for the first quarter decreased by 8.9% from December 31 to March 31. This decline was larger than the 5-year average (-1.6%), the 10-year average (-3.1%), the 15-year average (-4.6%), and the 20-year average (-3.6%) for a quarter. The first quarter also marked the largest decline in the quarterly EPS estimate since Q2 2020 (-36.7%). At the sector level, 10 of the 11 sectors recorded a decline in estimated earnings during the quarter, led by the Energy (-20.9%), Materials (-17.6%), and Consumer Discretionary (-16.2%) sectors.

Because of the net downward revisions to earnings estimates, the estimated (year-over-year) earnings decline for Q1 2023 is larger now relative to the start of the first quarter. As of today, the S&P/TSX Composite is expected to report a (year-over-year) earnings decline of -16.4%, compared to the estimated (year-over-year) earnings decline of -11.7% on March 31 and the estimated (year-over-year) earnings decline of -4.0% on December 31.

If -16.4% is the actual decline for the quarter it will mark the largest earnings decline reported by the index since Q3 2020. It will also mark the second straight quarter in which the index has reported a year-over-year decline in earnings. Three of the eleven sectors are projected to report year-over-year earnings growth, led by the Industrials sector. On the other hand, seven sectors are predicted to report a year-over-year decline in earnings, led by the Materials and Energy sectors. A growth rate is not being calculated for the Health Care sector due to the loss reported by the sector in Q1 2022.

The second and third quarters aren’t looking better, with EPS forecasts of -10.2% and -2.9%, respectively. Assuming a rebound in Q4 2023, full-year TSX earnings are forecast to decline by 5.3%.

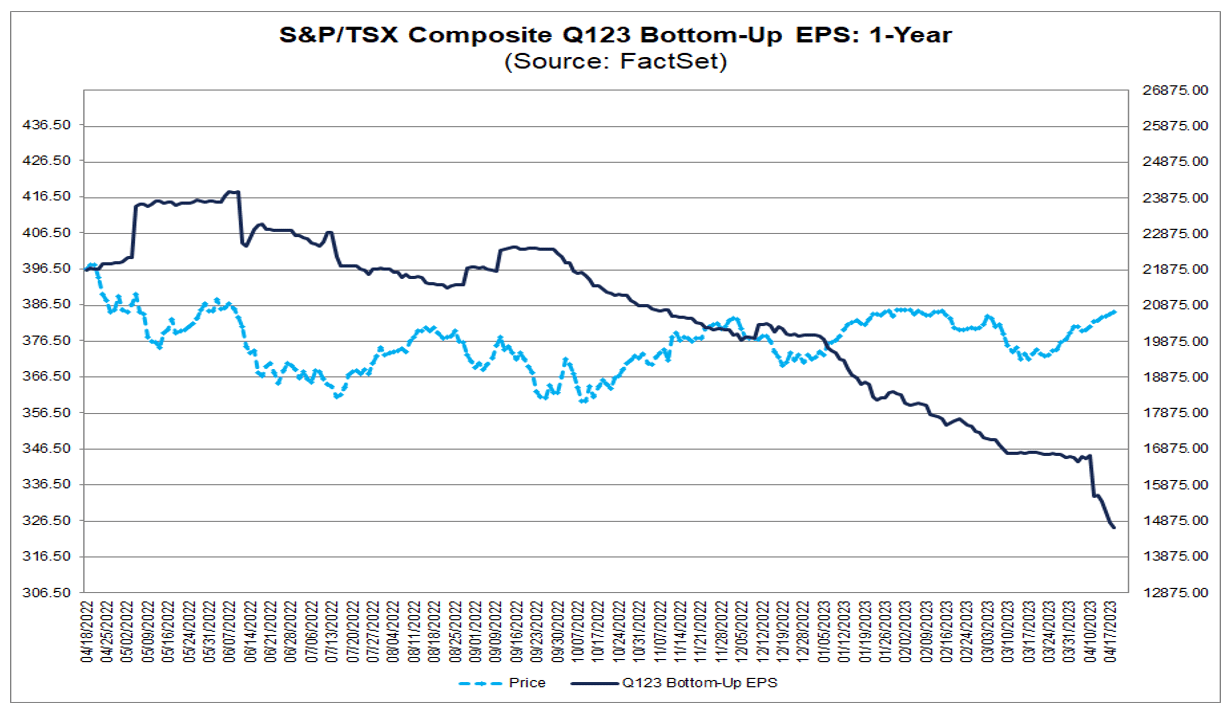

After rebounding (again) on central bank pivot dreams the past month, the TSX basket of stocks (which most Canadian funds and portfolios track–blue line below) is where it was 19 months ago in September 2021. Buyers have been paying up for negative earnings (black line below). A significant price correction is needed to restore attractive investment opportunities for the Canadian equity market. That’s overdue and coming.