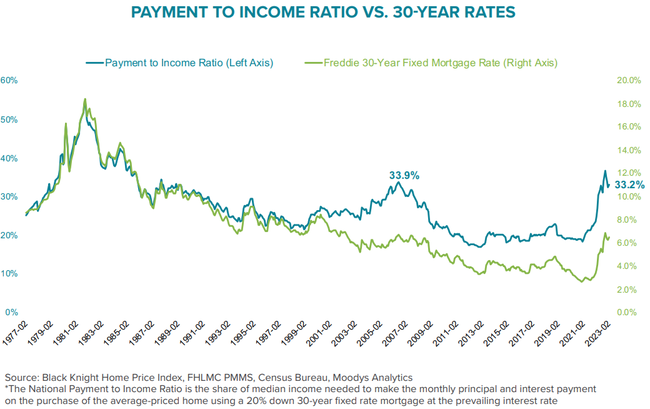

As mentioned in the segment below, in America, more than 90% of mortgages are fixed for terms greater than ten years, and 95% of existing mortgages are at rates less than presently on offer. And yet, as shown below, since 1977, US mortgage payments to income are already at unaffordability levels seen in the last US housing bubble peak in 2006. Unaffordability impedes new buyers from entering the housing market and existing homeowners from moving up or refinancing.

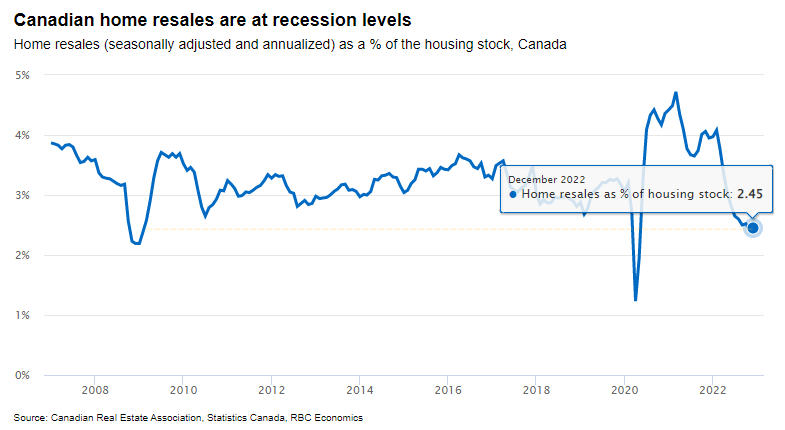

In Europe, the UK and Canada, most mortgages are floating rate or coming up for renewal over the next couple of years. So, sharply higher rates are hurting home affordability even faster. As shown below, since 2007 (from RBC), Canadian home resales as a percentage of the housing stock were already at recessionary levels in December 2022; and have fallen further since.

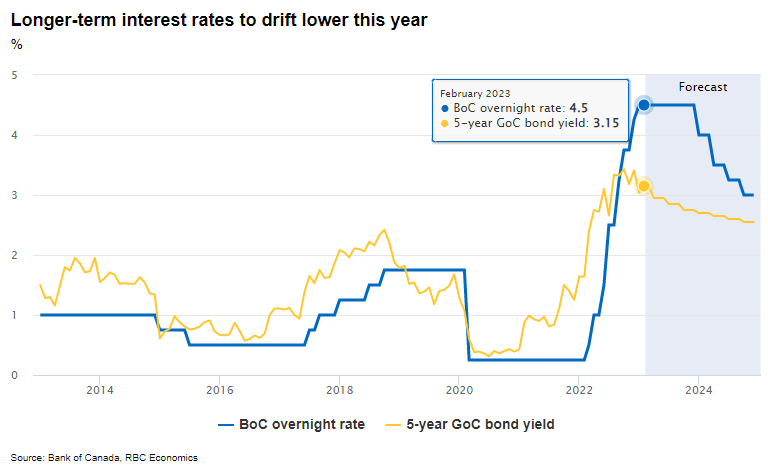

The Bank of Canada (BOC) saw the housing downturn underway when it paused its rate hiking cycle in December at 4.5% (from .25% last March). As shown below, since 2013 (in blue), the BOC is expected to hold its base rate in the banking system at 4.5% through year-end, followed by 150 basis points of cuts in 2024. Meanwhile, the five-year treasury bond price (on which Canadian fixed-rate mortgages are priced) bottomed in October 2022 (yellow line below). As Treasury bonds rise/yields fall, fixed mortgage rates should retreat into 2024. But for highly levered markets and asset owners today, lower interest rates over the next year will likely be too little, too late.

Alf does an excellent job explaining the bond market dynamics and impacts on the housing market and the global economy.

Alfonso (“Alf”) Peccatiello, founder of The Macro Compass and host of The Macro Trading Floor, returns to Forward Guidance to argue why he is starting to like bonds at this point in the business cycle. Alf and Jack discuss inflation, the labor market, the Fed hiking cycle, “higher for longer,” the housing market, the earnings cycle, and how all of these factors affect the future performance of longer-duration Treasury bonds. Here is a direct video link.