March 18, 2023 | Trading Desk Notes For March 18, 2023

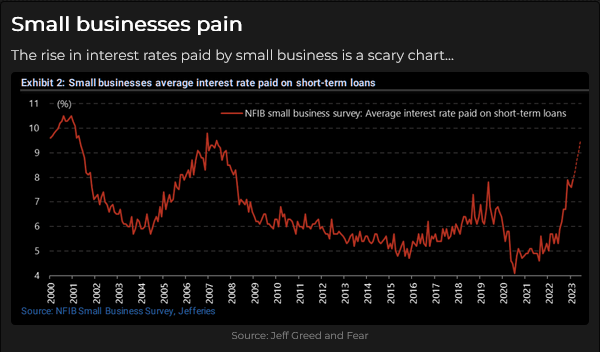

Things break when interest rates have been near zero for more than a decade and then rise ~5% in less than a year!

Today’s blog will focus on price action across markets; I’ll avoid commenting on “what’s wrong with banks;” thousands of new social media experts have already exhausted that subject.

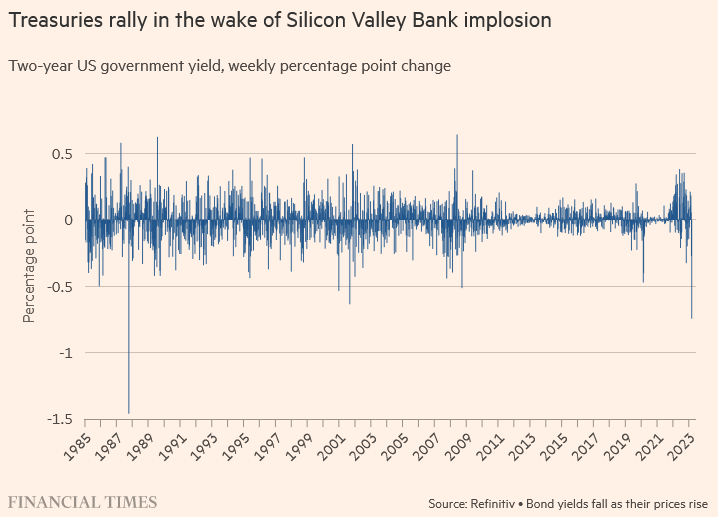

Interest rates declined in volatile trading

Fed Chair Jay Powell testified before Congress on Tuesday and Wednesday of last week that interest rates were likely to go higher and stay higher for longer. Two-year Treasury yields reached a 16-year high of ~5.1% following his congressional appearance and then fell to ~3.82% by this Friday’s close, the steepest decline since October 1987.

Prices of the 2-year futures hit a recent high on February 2 (the date I’ve previously called a Key Turn Date) and then fell to the March 8 lows following Powell’s remarks. A close look at this chart will reveal this week’s “wild” day-to-day swings.

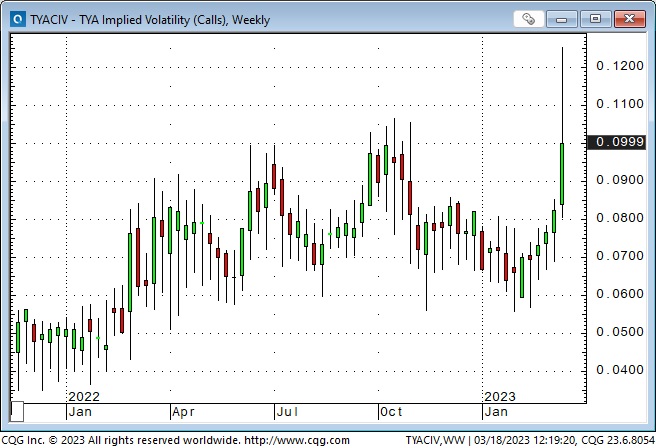

This implied volatility chart of the 2-year futures puts the surge in perspective.

SOFR futures were pricing s/t interest rates ~5.5% come December on March 8 after Powell’s testimony; a week later, they were pricing s/t rates as low as ~3.4%.

The long bond futures contract had an inflection point on the February 2 KTD, but prices bottomed and turned higher on March 2, ahead of the turn higher in short-term interest rate futures on March 8, causing the yield curve to become more deeply inverted. The week following Powell’s comments, 2-year note futures rallied harder than longer-term bond futures, causing the yield curve inversion to reverse. The 2-year/10-year inversion fell from ~1.07% to ~0.41%. Some folks say that reversing the yield curve inversion is the true signal of an imminent recession.

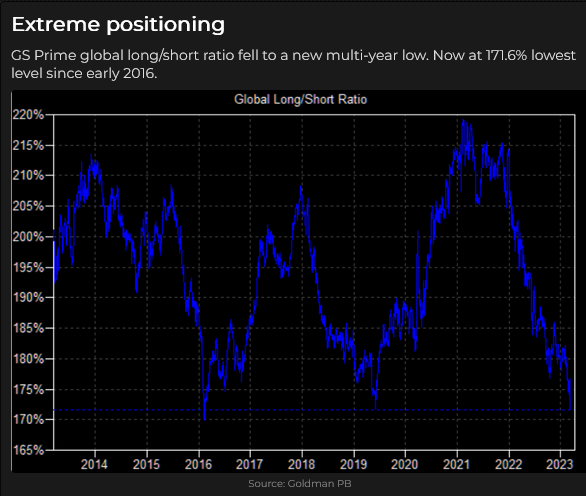

Bonds had a scorching rally on 1) a flight-to-safety bid, 2) increasing prospects of a recession, and 3) massive short covering. (Hedge funds made a fortune short bonds in 2022; as noted here last week, they had maintained a HUGE short position this year.)

Stock indices bounced back from Monday’s lows

The S+P hit a 6-month high on the February 2 KTD, then fell ~9% to Monday’s lows but rebounded this week.

The DJIA hit a 5-month low this week but didn’t bounce much.

The Nasdaq led this week’s bounce with interest-rate-sensitive SuperCap tech (MSFT, AAPL etc.) leading the Nasdaq. MSFT hit a 7-month high.

It’s interesting to see Big Tech getting bid ahead of a looming recession, as though they were consumer staples, while industrials like CAT make new lows.

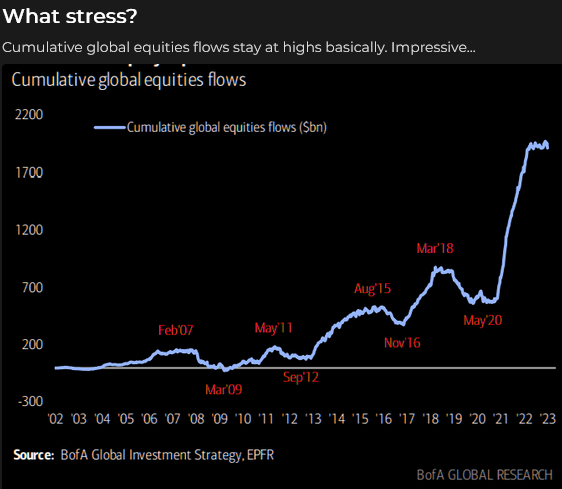

Despite all the hand-wringing about stress in the banking sector, capital continues to flow into global equity markets. Maybe some folks think having their money in stocks rather than banks is better. (Money market funds hit another record high over $5 trillion this week, with fresh inflows of ~$120 billion!)

Currencies

The US Dollar Index rallied ~28% from mid-2021 to a 20-year high on September 2022, then fell ~12% to a 10-month low on the February 2 KTD. It rallied ~5% from early February to the highs made following Powell’s congressional remarks last week and has weakened a bit since. (The ECB raised rates by 50 bps on Thursday.)

The Canadian Dollar fell ~4% from the February 2 KTD to last week’s lows as 1) the USD was strong against most currencies, 2) BoC monetary policy was perceived to be easier than the Fed’s, 3) stock market sentiment was generally risk-off, and, 4) commodity prices were trending lower. CAD bounced back this week as the USD weakened and stock market sentiment improved.

Following Powell’s testimony, the Japanese Yen has been the strongest of the major currencies against the USD, gaining ~5%.

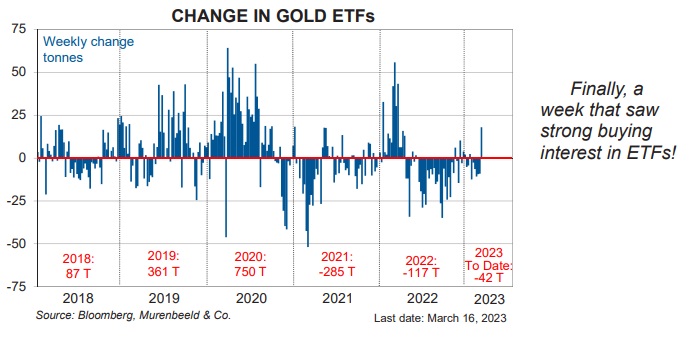

Gold is having its day in the sun

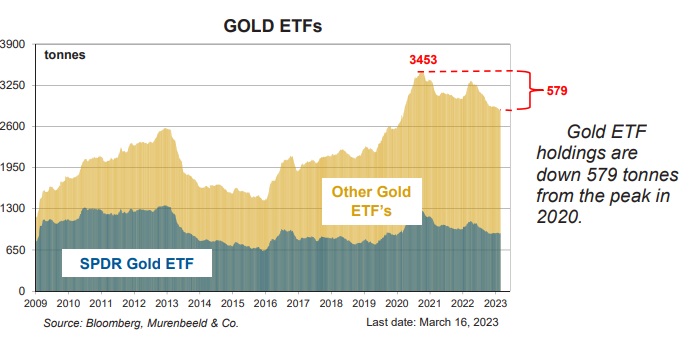

Gold has rallied ~10% following Powell’s remarks, as the USD and interest rates went lower. The possibility of the Fed “going soft” on inflation is music to the gold bugs’ ears! Reports that the Bank of China bought more gold is also good news. The gold ETF market has perked up. Gold was bid very aggressively into Friday’s close; perhaps “somebody knows something,” or somebody had to cover a significant short position.

The gold ETF charts are courtesy of my good friend, Martin Murenbeeld, who has been writing the Gold Monitor for 40 years. His subscribers include prominent institutional money managers and major gold producers. If you are seriously interested in the gold market, I recommend you check out his website – sign up for a free trial, and see why he has been successful for so long.

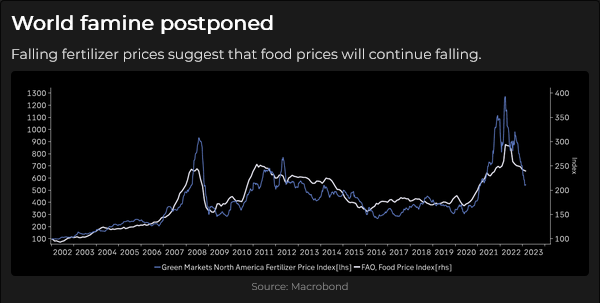

Commodities are weaker

The energy-heavy Goldman Sachs commodity index made a 14-year high on the Russian invasion in March 2022, made a lower high three months later, and has been trending lower ever since. It appeared to be basing around the 565 level for the last few months but cracked that support and fell to a 15-month low this week.

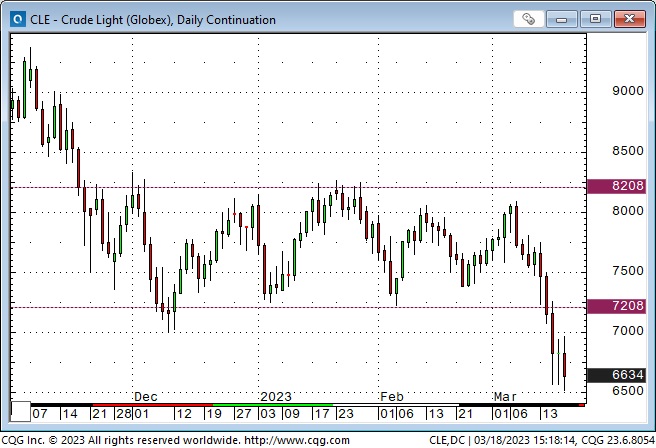

Energy

WTI crude oil has traded chiefly inside a $72 to $82 range for the past four months but broke down to 15-month lows this week. Bulls will argue that the supply/demand picture is bullish, but a lot of babies (in a lot of different markets) got thrown out with the bathwater this week.

The FOMC meets Tuesday/Wednesday – what will they do?

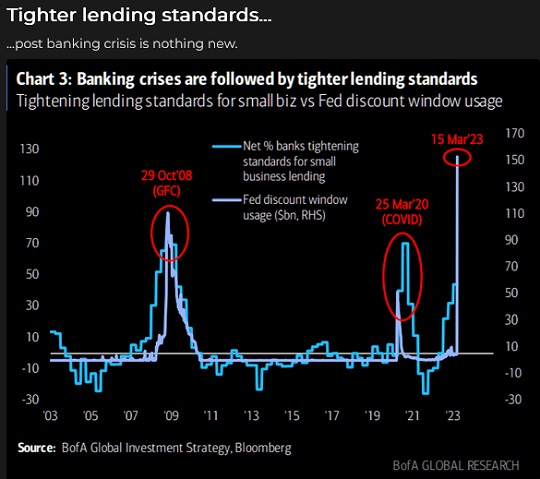

Eleven days ago, markets were pricing a good chance that the FOMC would raise rates by 50 bps this coming week as the next step in the higher-for-longer scenario – now it looks like a coin toss between a 25 bps bump and leaving rates unchanged.

One side of the coin represents the Fed’s concern about stress in the banking system; the other side represents the Fed’s determination not to be seen as giving up on the fight against inflation.

The ECB raised rates by 50 bps despite Credit Swisse’s stress (maybe they assumed/knew SNB/UBS would act), and that may point to business-as-usual for the Fed and a 25 bps bump. Powell may believe that last week’s Fed/Treasury actions ring-fenced contagion risks and that there will be inevitable “collateral damage” as the Fed fights inflation.

That “collateral damage” may help get inflation down. For instance, commercial banks will probably be less likely to lend, slowing things down. Inflation, ex CPI services, has been falling, retail sales have been falling even as consumer debt and debt service costs have risen, industrial output is weakening, and the leading indicators continue to fall. Powell may believe he is “this close” to “turning the tide” on inflation expectations and won’t want to show any weakening of resolve.

My short-term trading

By Friday of last week, my bias was that “fear” was overdone. I went into the weekend with a small long position in the S&P. The market rallied nearly 70 points from my entry price Sunday night and Monday morning and then tumbled below Friday’s lows. I stayed with my position as the market rallied, looking for a breakout above Friday’s highs, but it didn’t happen, and I closed the trade for a slight loss.

On Tuesday and Wednesday, I bought the S&P four times. I lost money on three trades, made money on one and had tiny net losses.

On Thursday, I bought the Mexican Peso, WTI and shorted gold. I took small losses on the gold and WTI but held the Peso with a small unrealized gain into the weekend.

I bought small positions in the S&P Friday but was stopped for quick small losses. I rebought WTI on Friday and held it into the weekend.

I lost a little money this week, even though the S&P (as I expected!) closed higher on the week. Three times I had 50+ point unrealized gains on the S&P but took small losses on two of those trades. It was a whippy, choppy week, but I’ll be back looking for profits Sunday afternoon.

On my radar

I firmly believe that “Anything Can Happen,” so my best “edge” is rigorous risk management. It’s disappointing to see a nice unrealized gain evaporate, but if I start taking small profits, I’ll never have any big ones, and I will likely keep taking smaller and smaller profits until I’m chasing my tail.

I trade liquid markets; I don’t use much, if any, leverage and I’m always wary of concentration. Even though I know “Anything Can Happen,” I’m willing to bet on what I see, what my intuition tells me, so if I want to be long a market, I’m eager to buy it on weakness – although in the back of my mind I can hear Denis Gartman telling me that when a market is going down, you have no idea how far down, down is – which is why I use tight stops when I’m buying weakness, or selling strength.

There was a big Opex on Friday, so the stock market may be less choppy early next week. Prices may “square up” ahead of Fed Wednesday and then react to the FOMC decision. I can imagine markets rallying or tumbling, but my bias is that “fear” and volatility will subside.

The Barney report

My wife was in Vancouver for three days this week, so “the boys” spent a lot of time together, and we had some great off-leash runs on the forest trails. That puppy loves to run, and he gallops just like a horse, and when he’s running flat out toward me, he’s grinning from ear to ear!

Barney can hop onto a four-foot-high log – and run back and forth on it with the grace of a squirrel.

The Archive

Readers can access weekly Trading Desk Notes going back five years by clicking the Good Old Stuff-Archive button on the right side of this page.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. You can listen to us talk about markets on March 18 on the Moneytalks podcast.

I recorded a 30-minute interview with Jim Goddard on March 11 for This Week in Money. I discussed what happened in different macro markets this week and how I blended fundamental and technical analysis in my trading. You can listen to it here.

Headsupguys

At the World Outlook Financial Conference, I had the opportunity to tell the audience about Headsupguys and why I support their work.

I support this project because I’ve had friends who took their own lives. Headsupguys helps men deal with depression. Headsupguys has had over five million hits on its website, and over a half million men have taken the self-check. Most men who click on the website do so after midnight their local time. Headsupguys save lives.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair March 18th, 2023

Posted In: Victor Adair Blog

Next: On The Edge »