March 26, 2023 | Recession Odds Rising

Recently I saw someone share a clip from their weather app. It said, “Rain expected at 3 pm,” right above a little graphic showing a 30% chance of rain at 3 pm. What’s wrong with that picture?

Well, if the calculated odds of rain were only 30%, then “expected” wasn’t the right word. The odds were actually against rain by 70%. Expecting it would likely prove wrong.

Predicting recession is a lot harder than predicting weather. Clouds don’t care what you think; they go wherever the wind pushes them. The economy, on the other hand, responds to human action. Our actions and attitudes can actually change it.

Many of us economy-watchers have been expecting recession, though with significant differences on the odds and timing. Whatever the numbers, recent banking developments—the kind of human actions the weather blithely ignores—just made recession more likely and may have accelerated its onset. Today we’ll talk about why. But first…

Source: John Mauldin

38 Days to SIC

This year’s Strategic Investment Conference is shaping up to be the best ever. We’ve secured Stephen Roach who has a storied history on Wall Street and is now a senior fellow at Yale University, teaching courses on “The Next China” and “The Lessons of Japan.” Before moving into academia, Roach spent 30 years at Morgan Stanley, including working as the firm’s chief economist. From 2007 to 2010, he was the chairman of Morgan Stanley Asia.

He also has a fascinating new book called Accidental Conflict: America, China, and the Clash of False Narratives. I would argue few people are better positioned to understand China in all its complexities than Stephen.

My old friend, Danielle DiMartino Booth, will be joining us again this year for several sessions. She has become one of the leading lights on the intersection of macroeconomics and Fed policy. The next FOMC meeting (May 2‒3) is in the middle of our conference, which is May 1, 3, 5, 8, and 10.

This year’s SIC theme is “Thinking the Unthinkable.” We chose this theme because it’s now abundantly clear that investment success depends on geographic, intellectual, and tactical flexibility. If we’re staring down the barrel of a Lost Decade (or worse) for US equities, we must challenge ourselves NOW to “Think the Unthinkable,” map out scenarios, weigh risks, and identify possible opportunities. I believe more major world-shaping events will confront us, economically, politically, and technologically in the next few years than in the past 20 years combined.

Conferences are my art form. I bring together a faculty that will give us insight into not only what is right in front of us but also what we will be facing as we navigate the curves ahead. There simply is not another conference with the wealth and breadth of information that the SIC has. You want to be here. You can watch it live, at your convenience, listen to it as a podcast while you walk, or read the transcripts. Click here now to learn more and register now.

Loan Margins

The latest bank issues have shed new light on Fed policy, which just weeks ago looked like more tightening as Powell and crew sought to stamp out inflation. Many had said the rate hikes and QT would continue until something broke. Bank failures would seem to qualify.

But remember, we’re talking about a complex system here. All these actions by different parties combine and interact in unpredictable ways. As it’s turning out, the bank failures could lead to more tightening, not less. But the channel isn’t necessarily obvious.

First, think about how monetary policy works. Faced with price inflation (in this case largely its own fault, but set that aside for now), the Fed responds (usually late) by raising the price of money and restricting credit, which theoretically reduces demand for goods and services bought with borrowed money. Producers then cut prices, reduce hiring, lay off workers, and do other deflationary things. It generally works but takes a long time.

Lenders have different constraints and incentives. For them, the interest rate level is less important than the spread between their cost of funds (what they pay depositors) and the rate they get from borrowers.

When this “net interest margin” is wider, banks have more profit potential and can take risk on less qualified borrowers. That’s been the case since 2020 as the Fed’s ZIRP policy kept deposit rates near zero. Flush with cash in checking and savings accounts, banks could loan at attractive rates and still make good interest revenue.

They could also use deposits to buy government and agency securities, which became a more attractive choice in the last year as the Fed hiked rates and ended quantitative tightening. This carried no credit risk but did produce the kind of interest rate risk that contributed to Silicon Valley Bank’s downfall.

However, this was attractive only with low deposit rates. Bank deposit rates are always relatively low because those balances are “sticky.” Households and businesses typically keep base amounts in their bank accounts to cover normal expenses. At some point, however, non-bank rates rise enough to entice some of that money away. That point appears to have arrived.

Meanwhile, higher rates are starting to have the Fed’s desired demand reduction effect in leveraged sectors like housing. This reduces loan volume, which means less bank revenue no matter where interest rates land.

Now combine that with some high-profile bank failures and fears of more. In that scenario, banks are motivated to get more liquid, which means less money available for lending. At the macro level, that amounts to additional tightening on top of whatever the Fed does. The Fed knows it, too.

Weighted Activity

Last week, as many others talked about the Fed pausing, I said they would hike rates again while expressing their vigilance over banks. The FOMC statement included this new language:

“The US banking system is sound and resilient. Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation. The extent of these effects is uncertain. The Committee remains highly attentive to inflation risks.”

Let’s break that down.

“The US banking system is sound and resilient.” Of course, the Fed would never say anything else. And I think it’s correct; the banking system is sound, though some banks clearly aren’t. The Fed’s new lending facility gives banks more liquidity than they had two weeks ago. This will be important going forward as low-interest loans reset and borrowers face additional stress.

“Recent developments are likely to result in tighter credit conditions for households and businesses.” This is a little odd, if you think about it, since tighter credit conditions are exactly what the Fed has been producing. While it would be très gauche to celebrate the help they are getting from the banks, I’ll bet there are more than a few tight-lipped smiles. Tighter margins combined with higher liquidity requirements mean less incentive to lend.

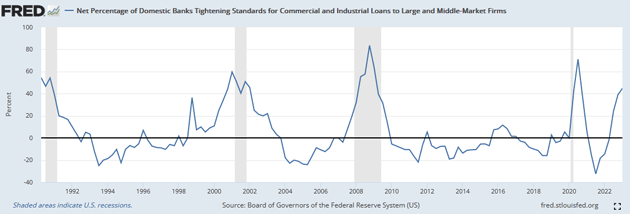

Note in the graph below that the percentage of banks tightening loan standards is back to levels associated with recessions. This is from a survey taken before the latest bank events, too.

Source: FRED

In the Fed’s view, this is actually helpful. The rest of that sentence in their statement explains why. Tighter credit conditions will “weigh on economic activity, hiring, and inflation.” Those are exactly what Federal Reserve policy has been trying to produce. They are goals, not regrettable side effects. Or as the techies say, “feature, not bug.” Jerome Powell wants to reduce economic activity because that’s how he will reduce inflation.

In that sense, the banking industry’s challenges actually help the Fed. They are bringing its desired slowdown closer without the Fed having to lift a finger. That may be why the new FOMC economic projections still forecast a 5.1% peak rate this year, implying we should expect only one more quarter-point hike, then a pause.

That doesn’t mean the Fed is finished tightening. It means the tightening will now come from an additional source as banks reduce credit availability. The effect isn’t small, either. I’ve seen estimates it will be equivalent to the Fed hiking an additional 150 basis points.

So, if you thought 5% short-term rates were going to push us into recession, what would 6% to 7% do? That was on no one’s radar a month ago. Now it seems highly possible, if not probable.

“Highly Attentive to Inflation Risks”

Frankly, I don’t see how we avoid recession now, but there are mitigating factors. For one, the post-2008 reforms helped make the private economy somewhat less leveraged. Combined with all the pandemic relief money, it may also be why the Fed’s rate hikes haven’t seemed to reduce demand as much as many expected. The economy is simply less rate-sensitive now.

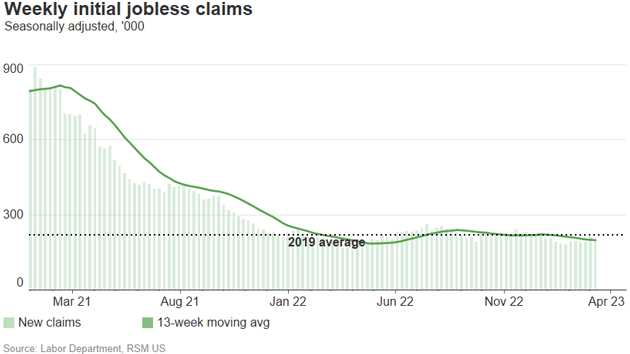

We also have a different demographic situation. The percentage of retirees is rising and working-age population growth isn’t meeting the demand for labor. At some point recession would “solve” this problem by reducing employment and wages. Recent technology sector layoffs might be an early sign but the weekly unemployment claims are still holding steady near the pre-pandemic level.

Source: RSM

Of course, no one wants mass unemployment. We all hope for a “soft landing” with inflation subsiding while everyone keeps their jobs. And up to this point, that’s kind of been happening. Inflation is still high but not like last summer. Job growth is weakening only gradually. Consumer spending is still strong. All good news.

The question now is whether, between higher rates, continued QT and tighter credit will be enough to change these trends. Note that FOMC paragraph I quoted above: “The extent of these effects is uncertain. The Committee remains highly attentive to inflation risks.”

The Fed is not letting down its guard. Reducing inflation remains its top priority. The strategy is changing a bit now that banks are being drafted into the fight, but that doesn’t mean Fed officials are folding. They are not.

For now, the dot plots say they expect core PCE inflation will drop below 3% next year. If that starts to look unlikely, I expect to see new measures. Rate hikes could resume or maybe they’ll try something else.

The bank situation remains problematic, too. As I’ve said, inflation has cumulative effects, and so do higher interest rates. Many banks are highly exposed to commercial real estate, having made loans for office buildings and shopping centers which are now struggling against post-COVID changes. The work-from-home change appears to be sticking and that may mean a lot of unrented office space for a while. Bad news for both developers and their lenders.

On balance, I think the latest events raise recession odds. I suspect Powell and the other FOMC members made their peace with that possibility months ago. They hope to avoid recession, but they know continued inflation would be even worse. And now we’re entering a phase with additional dynamics outside their control.

All this is iterative. What we’re seeing now is the inevitable result of decisions in the past, which were the result of decisions further in the past and so on. Each decision to defer pain into the future simply makes the pain bigger. At some point it becomes undeferrable. That point is getting closer.

What’s an FOMC to Do?

Many in the market are screaming for the Fed to stop hiking rates and pause and cut soon. Obviously, it is hurting their businesses. I understand. Inflation is a problem for everyone, but mostly for the bottom 80%. That is why the Fed is finally focused on inflation.

Let me paint a different scenario. Come the May 2‒3 meeting, what will the Fed be looking at?

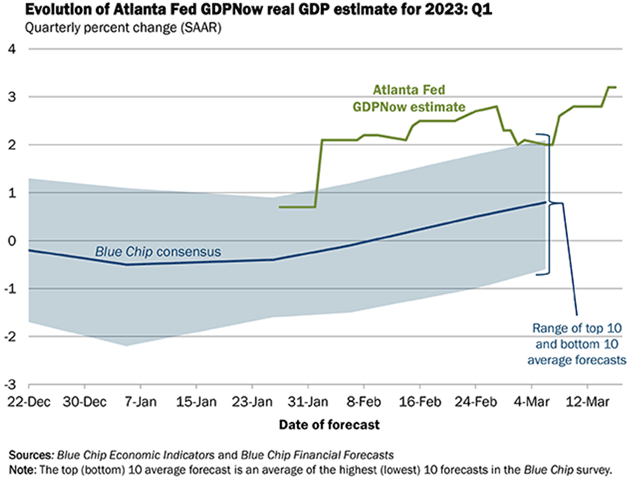

Atlanta Fed GDPNow is uncharacteristically more optimistic about the first quarter than the Blue Chip Economist consensus. The Atlanta Fed is nowcasting a GDP number for the first quarter of 2023 at 3%+. The Blue Chip Economists center on about 1%, with some calling for recession.

Source: Atlanta Fed

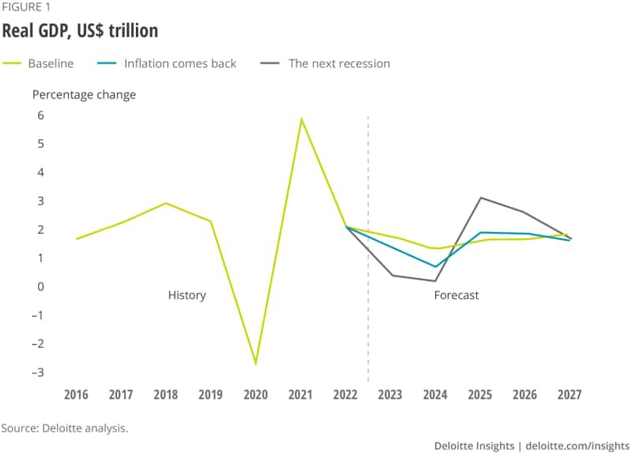

Deloitte echoes the Blue Chip forecast, except more optimistic as their baseline is for 2%. It is easy to find forecasts but it seems most say recession is in “the future,” whenever that is.

Source: Deloitte

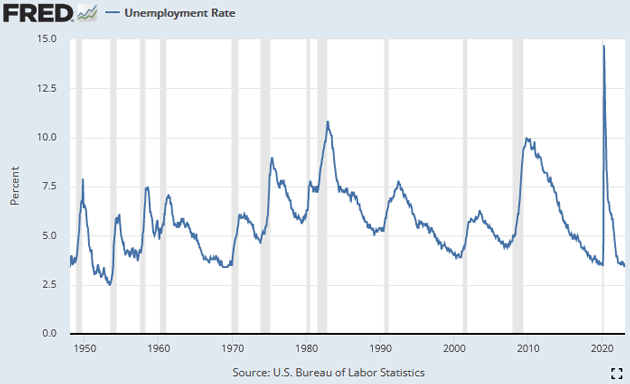

The headline unemployment rate is close to all-time lows at 3.6%. The overall labor market appears to be getting tighter.

Source: FRED

We will know the first estimate for Q1 GDP by the May FOMC meeting. They will go into the meeting with annualized GDP at 2‒3% and unemployment very low. Inflation will still be well above 4%. A strong economy, a tight labor market, and high inflation? I’m not saying what I think the Fed should do. I am simply saying that under those conditions they are going to raise rates again.

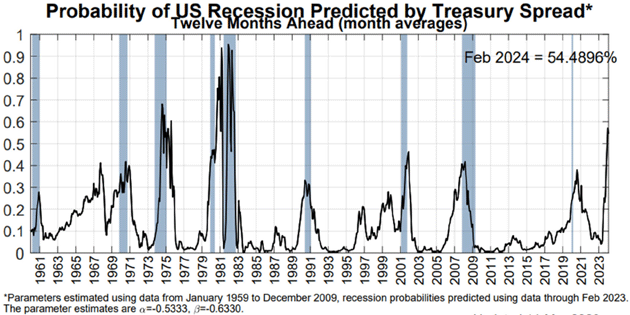

Yes, there are multiple signs of impending recession. By definition, a recession is deflationary and will help the Fed achieve its goal. The New York Fed’s yield curve recession probability is the highest since 1980.

Source: New York Fed

Note that 1982 was the last “intentional” recession and also one of the deepest. Volker purposely threw the US economy into recession to break inflation. While 2023 isn’t the same, it does rhyme. The Fed cannot say this, Powell cannot say this, and they all hope that it won’t come to this, but they’re willing to intentionally put the US into recession if necessary to once again stop inflation. No, they don’t want to, but they recognize it’s a significant risk.

Thinking the unthinkable? What happens if the economy remains relatively strong (1‒2%), unemployment is benign, and inflation is still above 4% going into the June and August FOMC meetings. Could we see more rate hikes? Absolutely! If the economy rolls over and inflation is still above 4%, then we could see that fabled pause. But as Powell said, he doesn’t think a rate cut is likely this year.

Source: John Mauldin

The Art of Artificial Intelligence and Pronouns

My travel plans are the same. I WANT to travel, just nothing is firm.

I assume you noticed the picture of Powell at the beginning of this letter. I had a friend over doing some videos and he showed me his pre-beta version of an artificial intelligence art program. After getting excited about what I was seeing, he asked me to describe a picture I wanted. I asked him to give me a Salvadore Dali-style picture “of Jerome Powell when he realizes he had raised rates too much.” In less than 60 seconds I had four examples.

Note that as the “creator” I own the rights to these pics. What you can create is limited only by your imagination. I can’t draw a straight line, but I do have a hell of an imagination. This looks like fun yet the implications are both staggeringly awesome and possibly bad. Deepfakes move mainstream.

I should note that Powell looked kinder and gentler when I asked for Monet style. You can also edit these to your heart’s content. Powell in hero mode? YOU in hero mode? This is going to change the world of graphic design. They will soon be adding motion. Are movies that far out?

Which is why we will have several SIC sessions on technology (and specifically AI) as OpenAI and others will really change how we interact. This year’s SIC will cover a wider range of topics than ever. You really want to be there. Quantum computing? Robots? So much. So much.

On a humorous endnote, I am part of an active and large email group of fairly connected individuals. Someone made fun of the Signature Bank CEO holding a one-hour seminar on pronouns suggesting that the company use Ze and Hir as gender neutral. Nero fiddling and all. Someone said that the new pronouns are was/were, but I thought the best was the suggestion that it should be has/been. Made me laugh, anyway.

Believe it or not, Shane and I are going to a birthday party at Peter Schiff’s house. The theme is the ’60s. Think Austin Powers. There are probably a few of you who think that both Peter and I are still stuck in the ’60s. Not true. I’ve moved on.

Time to hit the send button. You have a great week!

Your future budding artist analyst,

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Mauldin March 26th, 2023

Posted In: Thoughts from the Front Line

Next: Has the US Gone to DEFCON 3? »