March 28, 2023 | Battle for Deposits: Tired of Getting Screwed by Banks, People Yank their Cash Out, Forcing Banks to Pay Higher Interest Rates. Treasury Yields Are a Mess Though

People – and I mean massive numbers of people – have finally figured out that they’ve been getting screwed by near-0% interest rates on their bank deposits, and they’re moving huge sums of money around, as deposits have suddenly turned into hot money, forcing banks to respond by offering better deals. And the land is now awash with banks offering 5%-plus on CDs, and people are moving huge sums from some banks into other banks, from money-market accounts to CDs, from checking and savings accounts to CDs, money market accounts, etc., and they’re massively piling into Treasury securities. The goal is low-risk 4% to 5%-plus.

And the amounts and flows are huge between deposits ($17 trillion), regular money market funds, Treasury money market funds, Treasury bills ($4.1 trillion of 1-year or shorter maturities), and Treasury securities with a relatively short remaining maturity.

Banks have been offering high-interest rate CDs through brokers (“brokered CDs”) to get additional cash to make up for the cash they lost from their regular customers.

Now it’s also a battle to keep deposits.

What’s the new thingy now is that they’re offering their existing clients 4% or higher CDs to encourage them to keep their money in their accounts instead of yanking out to put it into a money market fund or someone else’s CDs.

This fight for deposits is something we haven’t seen in many years, not to that extent, but that’s how it should be. People should force banks to compete for their deposits. And the way people force banks to offer higher rates is by yanking their money out that’s earning 0.1% in large enough numbers.

Banks can always borrow from the Fed’s Discount Window, currently at 5% and they have to post collateral. So paying folks 4% or even 5% and not having to post collateral is a much better deal. This is how the Fed’s rate hikes wash into the economy.

There was a little bit of that back in 2018.

Back then, the Fed raised rates timidly, and it timidly trimmed down its balance sheet, even while inflation was at or below the Fed’s target range. At the time, the Fed just wanted to “normalize” its policy rates, and so it eased them up, and it eased its balance sheet down, and yields of money market funds and Treasury bills rose above 2%. I mean, WOW! After 10 years of Fed-imposed near-0% saver-confiscation policy!

And so in early 2018, banks started losing deposits to money market funds and Treasury bills, and so they fought back, well, in kind of a quaint way by today’s standards, offering just over 2% on some CDs and high-yield savings accounts, but nearly all of it was to attract new money.

We talked about this back then a couple of times in April and May 2018. But then President Trump started keelhauling Fed Chair Powell – Trump’s man at the Fed – on a daily basis about these timid rate hikes and QE, and that was the beginning of the end for savers and Treasury bill investors and money-market investors, and they got re-crushed and soon they were back to near 0% yields.

Now it’s different. It’s massive, and it’s costly for the banks.

These higher deposit rates mean the banks’ costs of funding are rising, and their margins are getting squeezed.

But it’s finally some relief from 14 years of financial repression for savers and Treasury bill investors and money-market investors.

The discussions of how to get those 5% yields are now everywhere, even on NPR, which is my thermometer for when a financial concept has become totally mainstream and everyone is doing it.

And that’s how it should have been all along. But the Fed killed the free market for deposits with its interest rate repression.

The average rates across all deposits are still minuscule, just 0.4% in March on average across savings accounts. But more and more banks are now paying much higher rates. CD rates on average are still low, with the average 12-month CD in March of just 1.5%, according to FDIC data, but that’s up from 0.15% a year ago, and the increase is driven by the 5% CDs that are starting to flood the market looking for buyers.

My broker today offered CDs up to five years with the top rates for all maturities at 5%-plus, from all kinds of banks, small and large. The top rate offered was an 18 months CD paying 5.4%. Those are efforts by banks to get new deposits.

One of my banks increased its “high-yield” savings account rate to 3.75%. That’s an effort to keep its deposits.

One of my other banks, a TBTF bank, is offering me 4.25% CDs just to keep my money there – it did so while I was logged in, putting a promo right in front of me to dissuade me from transferring my money to a money market fund that pays 4.6% or to my broker to buy those 5%+ CDs. That’s an effort to keep deposits. I don’t even have any savings products at this bank, just my personal and business operating funds and some just-in-case funds. But it sure wants me to keep those funds there.

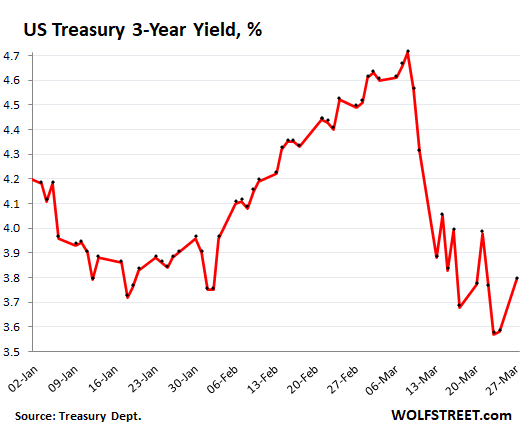

Treasury yields go haywire in the fear trade.

This battle for deposits occurs even as Treasury bills have been on a majestic roller-coaster over the past two weeks, with rates plunging on the fear-trade, particularly late in the week as folks want to trim down their uninsured deposits, just in case their bank does a bellyflop over the weekend.

Then on Monday, including last Monday and today, as fear settled down and interest in Treasuries waned, prices fell and yields spiked, but they remain a lot lower than they were.

Today, was another crazy day in the Treasury market:

- 3-month yield: +17 basis points (to 4.91%)

- 1-year yield: +19 basis points (to 4.51%)

- 2-year yield: +18 basis points (to 3.94%)

- 3-year yield: +21 basis points (to 3.79%)

- 10-year yield: +15 basis points (to 3.53%)

These huge moves, up and down, occur because of money sloshing around the financial system looking for higher yields one day and getting spooked and looking for safety the next day. I mean, look at this mess:

But this interest income stimulates consumer spending.

So banks are paying more, their profit margins are getting squeezed, and they’re hating it, and a couple have collapsed because they got caught ignoring the rising rates.

But for consumers with trillions of dollars in savings, money-market accounts, and Treasury bills: they’re now seeing a real cash flow for the first time in 14 years. And even though it still doesn’t keep up with inflation, it’s still a cash flow, and some of it is getting spent and is getting recycled in the economy. This is particularly the case for retirees that are often spending every dime in income they get, and this additional income is turning into additional spending.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Wolf Richter March 28th, 2023

Posted In: Wolf Street