February 3, 2023 | EPB Macro: Housing Leading The Economy Lower

This segment reviews US data, but the trends are similar in Canada.

The EPB Housing Deep Dive report is focused on the residential construction cycle (the leading sector of the economy). Here is a direct video link.

This report is a preview of content exclusive to members of the EPB Research Gold Tier. If you would like access to frequent reports on economic growth and the economy, click this link.

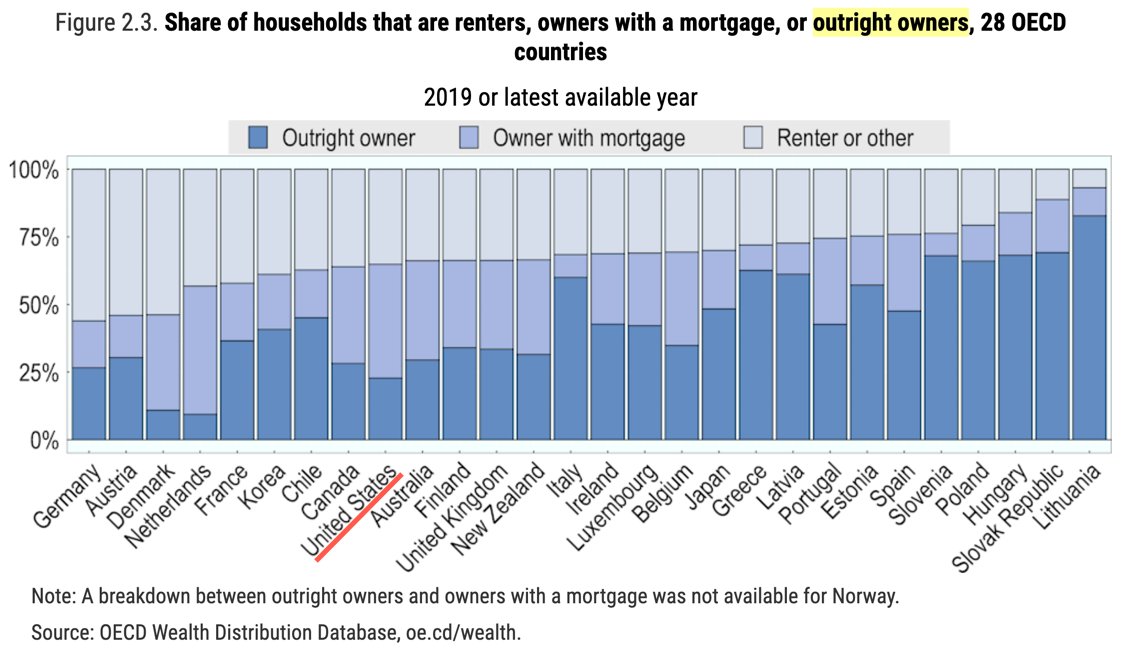

The chart below from the OECD shows the latest available data on the percentage of homes in each country which are rented, owned with a mortgage, and owned outright without a mortgage (dark blue). Here we can see that Canada and America have two of the most leveraged housing markets in the world, with just 25% of Canadian homes owned free and clear. Moreover, unlike in America, where 30-year fixed-term mortgages are common, some 40% of Canadian mortgages were floating rate coming into the rapid hikes of 2022. Those with fixed loans typically have terms of 1 to 5 years.

A recent Yahoo/Maru poll found 35%+ of Canadian homeowners surveyed estimate they will be forced to sell their properties within the next year:

Thirty-five per cent of Canadian homeowners say they can handle the Bank of Canada’s current benchmark interest rate of 4.5 per cent for an average of less than 10 months before they would be forced to sell or vacate their homes. That’s according to a Yahoo/Maru Public Opinion survey of 1,920 Canadian homeowners released on Thursday.

The survey found that how long Canadian homeowners can sustain today’s interest rates varies, depending on the type of mortgage or financing method on their home.

According to the survey, 45 per cent of Canadians with variable rate mortgages would be able to ride out today’s interest rate levels for 8.3 months before having to sell or vacate their home. Of those with a line of credit on their home, 45 per cent said they would be able to sustain today’s interest rate levels for 8.3 month

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park February 3rd, 2023

Posted In: Juggling Dynamite