February 11, 2023 | Assumptions Have Consequences

Remember National Lampoon’s Vacation? It was a 1983 comedy film in which suburban dad Clark Griswold (Chevy Chase) takes his family on a cross-country road trip to the fabled Walley World amusement park.

Clark made one critical mistake, though. He assumed Walley World would be open and waiting for them. This was to be the family’s reward for a long, stressful journey. His assumption was… incorrect.

Many have noted the word’s first three letters hint at how assumption can make an ass out of u and me. Yet we must assume some things or life becomes impossible.

Assumptions can be wise or unwise. They can be unduly optimistic or excessively pessimistic. Slightly different assumptions can produce giant changes in predicted outcomes. Assumptions are necessary but we shouldn’t make them lightly, nor forget we are making them.

This is important because assumptions abound in our assessments of the economy and markets. They tend to sort of fade into the background while we explore everything else. Today I want to bring some of them back into the light, and talk about how we use them.

Automatically Wrong

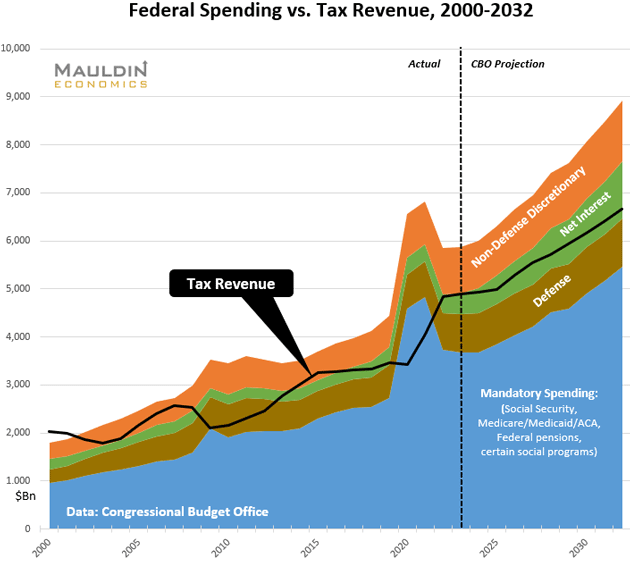

Let’s start with federal budget assumptions. Here’s a chart I’ve shown several times. We updated it last June with the most recent Congressional Budget Office data. CBO releases new projections next week, so we’ll have another update soon.

I wish you could see the spreadsheets that go into making this. Each spending and revenue category has several subcomponents, which if we tried to show separately would be an indecipherable mess. It’s a balance between illustrating the point and obscuring the point.

The point, as a possible debt ceiling showdown nears, is that even completely eliminating that “non-defense discretionary” spending slice would still leave Washington without enough income to cover interest, defense, and mandatory spending growth. Those have to be on the table if you want to balance the budget. And they aren’t, at least not to the degree necessary, so the debt will only continue growing.

Odds Congress won’t change anything in the next decade are approximately 0%. That makes CBO projections automatically wrong the second they are published. Policies will change. Maybe the changes will help, maybe they’ll hurt, but some will certainly happen.

That said, whatever Congress changes might not matter in the big picture because the largest expense category, the blue “mandatory spending” area, really is on autopilot. Programs like Social Security and Medicare don’t require annual authorization. If you meet certain qualifications defined by law (age, sufficient tax payments, etc.), the government pays you certain amounts, also defined by law.

Predicting those amounts requires assumptions. Some are fairly straightforward like life expectancies. They change, but slowly. Others like healthcare costs are more difficult. Worse, assumptions can interact with other assumptions. The amount of Medicare money you consume depends in part on how long you live.

More assumptions go into interest expense (what interest rates will be) and tax revenue (how much income we will earn). None of these are knowable years in advance, especially 5 to 10 years out. So is the chart useless? No, not at all. It’s useful in the same way a weather forecast is useful.

I’ve told the story before about future Nobel Laureate economist Kenneth Arrow, who in World War II was on a team tasked with predicting the Normandy weather 30 days out from the D-Day landing. Arrow noted any such forecast would likely be wrong. He was told the generals knew this, but still needed a forecast “for planning purposes.”

“Missed By Miles”

Thinking about this brought to mind a joke I told back in a 2013 letter similar to this one (see Assume a Perfect World).

A businessman interviews a mathematician, an accountant, and an economist for a job. He asks them, “What is 2 + 2?” The mathematician answers, “Exactly 4.” The accountant replies, “Depending on what your interest, depreciation, and taxes are, approximately 2.”

The economist walks over to the door, shuts and locks it, closes the blinds on the window, and leans over and softly asks, “What do you want it to be?”

Politicians can find economists who share their biases and beliefs to provide models saying what they want to hear. Or they simply cherry-pick the data to produce the desired media “spin.”

President Biden said this week in his State of the Union speech he had cut the deficit by $1.7 trillion. If you look hard enough, you can find that statistic. But the last four months calculated by the CBO showed a deficit of $459 billion, on the way to the almost $2 trillion we projected last year. (Don’t forget off-budget spending, possibly $200 billion or more, which adds to the overall US debt. Sadly, in an unspoken conspiracy, no party talks about off-budget deficits.)

But both are technically true. It is just the spin in how you present it. The deficit fell significantly once the COVID-related emergency spending was mostly finished. Now it’s rising again.

Projecting tax revenue is a prime example. The CBO assumes current tax policies won’t change, but other things do. The government derives most of its revenue from income and payroll taxes. The tax rate is only part of the equation; you also need to assume how many people are working, how much money they are making and will make over the next 10 years, what inflation will be, and how much occurs within each rate bracket.

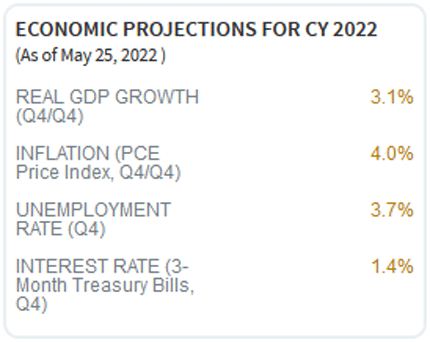

These economic questions are even more error-prone than the policy mysteries. That’s true even in forecasting the next year, much less 5‒10 years out. Here is what the CBO expected for 2022 when we updated that chart last year:

Source: CBO

With the calendar year over and the first GDP estimate in, we can now see how close these projections were:

- Real GDP growth from Q4 2021 to Q4 2022 was 1%, not 3.1%.

- PCE inflation was 5%, not 4%.

- The unemployment rate (Q4 average) was 3.6%, not 3.7%.

- The 3-month Treasury yield in Q4 averaged 4%, not 1.4%.

The CBO was very close on unemployment and not far off on inflation. Its GDP and interest rate projections missed by miles.

To be fair, this was a particularly difficult time to make predictions with the Fed having recently started tightening as inflation surged. But even in May, T-bill rates were approaching 1% and the Fed was clearly headed higher.

The CBO seems to have assumed inflation would climb but real interest rates stay deeply negative. That would have been quite beneficial to the federal budget; below-inflation interest rates mean the Treasury is essentially being paid to borrow money. Again, I have no evidence this was political bias. But if there were going to be bias, this is what it would look like.

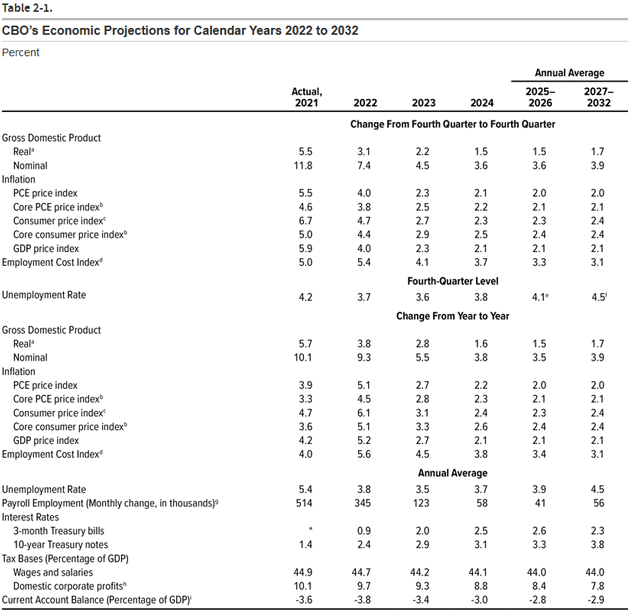

Here are the CBO’s longer-term economic assumptions, again as of May 2022. We will revisit this table as the CBO updates it. My associate Patrick Watson and I have been paying attention to CBO projections for a long time. To a lesser or greater extent, each 10-year budget projection shows the total debt after 10 years to be higher. There’s never much cost cutting.

Source: CBO

(If the above table is fuzzy, go here and scroll down to Table 2-1.)

(Wonky point: Note how they show the first set of data points two different ways: “Change from Fourth Quarter to Fourth Quarter” and “Change from Year to Year.” What does that mean? It mirrors the way the Commerce Department reports GDP. What they call “year to year” is a comparison not of one year to the next, but of each year’s hypothetical average quarter. That’s not how we measure other things, so I think it is better to look at the Q4 to Q4 numbers.)

Let’s start with that 2023 column. As of last May, CBO projected real GDP to grow 2.2% this year, following what we now know was only 1.0% real growth in 2022. It expected inflation, as measured by the PCE price index, would fall to 2.3% from what we now know was 5.0% in 2022. It expected unemployment would stay about where it is at 3.6%. And it expected real interest rates to stay negative at the short end (2.0% for 3-month T-bills vs. 2.3% inflation) but slightly positive at the long end with 2.9% 10-year Treasury yields.

In January 2023, the 3-month yield averaged about 4.5% and the 10-year yield fluctuated around 3.6%. That’s just the first month, of course, but it’s nowhere near what CBO projected. Maybe the new estimates coming next week will be closer to the mark. But again, if you can’t get close to the mark until you are near enough to see it, what good are projections in the first place? (See the D-Day note in my personal section.)

Looking out further, we see that from 2024-2032 CBO projects real GDP will range from 1.5%‒1.7%, inflation around 2%, unemployment rising only gradually, and interest rates no higher than 2.6% at the short end and 3.8% at the long end. That would mean the Treasury’s real (inflation-adjusted) interest rate will stay below 2% for the next 10 years.

That being said, assuming 3-month rates to be 2% when the Fed is at 4.5‒4.75% and says it will go higher for longer just builds in error at the beginning on your model which will impact the outlying years of total debt significantly.

Even after a year-plus of sometimes painful inflation, real (again, inflation-adjusted) rates have stayed below zero. Jerome Powell has said he wants them positive across the yield curve, and CBO projects it will happen. But a change in real rates from -2% to 2% is a pretty big swing—big enough to sharply raise the Treasury’s borrowing costs—which will already be rising if spending increases faster than tax revenue.

But spending and tax revenue are assumptions, too. See how maddening this is? Intuitively, past experience tells us higher government spending and higher taxes are both good bets, but we can’t know specifically what a future Congress and president might change.

Personally, I find it very hard to expect “only” 2% inflation over the next decade. I think inflation will fall considerably from what we saw in early 2022, but then I think it will stay over 2% and approach 3%. Anything lower than that will require lower energy prices than I think are possible. In time, yes, we’ll get disinflationary new technologies like nuclear fusion, but not by 2032. That means the Fed will keep short-term rates above 3%‒4% for longer than cheap (free?) money borrowers would like.

To paraphrase Bill Clinton, “The era of cheap money is over.” And that is a very good thing.

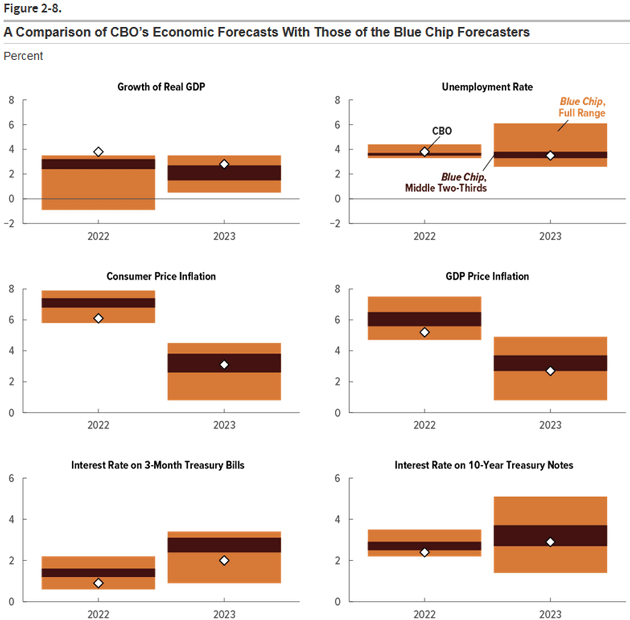

To its credit, the CBO is quite transparent about its assumptions. The outlook report even includes a section with the CBO comparing itself against other forecasts. In this chart the diamond is the CBO’s May 2022 forecast vs. the private-sector Blue Chip Forecasters range. The dark bars are the middle two-thirds of the Blue Chip economist estimates.

Source: CBO

Here is the CBO’s own comment:

“CBO’s economic projections for 2022 and 2023 can be usefully compared with the consensus (that is, the average) of the forecasts of about 50 private-sector economists published in the May 2022 Blue Chip Economic Indicators (see Figure 2-8).19 The agency’s projections of real GDP growth for those years are higher than most of the Blue Chip forecasts. CBO’s projections of inflation, both in GDP prices (as measured by the GDP price index) and in consumer prices (as measured by the CPI-U), are lower than the consensus of Blue Chip forecasts in 2022 and are within the middle two-thirds of those forecasts for 2023. The agency’s projections of interest rates on 3-month Treasury bills for those two years are lower than the consensus of Blue Chip forecasts, and its projections of rates on 10-year Treasury notes are near the bottom of the middle two-thirds of the ranges of Blue Chip forecasts.”

The CBO projects higher growth, lower inflation, and lower interest rates than the private-sector economists (who are themselves far from infallible, by the way). If you are a senator or representative from either party, this is a pretty helpful combination.

Gaps of Uncertainty

I’ve been hard on politicians and bureaucrats, but the private sector makes assumptions, too. Companies borrow billions of dollars to build factories or design new software, assuming this investment will produce enough revenue to repay the debt and then spin off profits. On the other side of those transactions are bankers and bond buyers who assume the company knows what it is doing.

As an example, an LNG terminal being built in Texas (Driftwood) was started in the Trump years and is scheduled to open in 2026. Cost estimates were $13‒$16 billion, but inflation will raise those numbers. Private equity and bank loans are the financing. More and more cheap US gas will eventually find its way to Europe/Japan, and the world. Will it be profitable? That’s an assumption.

I think private parties do tend to be more careful about their assumptions than the government, simply out of self-interest. We pay more attention when our own capital and/or income is on the line. But we are also humans with human frailties: greed, fear, simple mistakes. Our thinking isn’t always as rigorous as we imagine it to be. Global Crossing (international fiber optic cables) comes to mind. They believed their own models and investors lost nearly everything, in the process giving the world a “gift” of cheap internet bandwidth. Every late 19th-century US railroad went bankrupt (bad models) except for the one private line. The others were government sponsored. Easier to be rosy-eyed on someone else’s dime. Not unlike current politicians everywhere.

But there’s another side to this. We make assumptions to fill the gaps of uncertainty. The future is never truly certain. None of us should be certain we will wake up tomorrow, much less be certain our stocks will keep going up. Or that the stocks we’re waiting to buy will keep going down.

Faulty assumptions have put entire companies and their investors out of business. Back in the 1990s, Long-Term Capital Management had an all-star cast of Nobel Prize winners and former Salomon Brothers traders who attracted billions literally selling the assumption various markets would continue their historic correlations. It worked really well until it didn’t. The same happened again with different companies in 2008.

True Confessions

Mea culpa. I live in a world of models and assumptions. I have made more than my share and while I think my track record is fairly good, some have missed by more than a few miles. But it has made me treat models with caution. You must dig into the details.

Whether economic forecasts, return projections on portfolios, climate change, or business estimates, they all require assumptions. Sometimes you need to know the biases of those making AND interpreting the models.

Garbage models and assumptions can create bad forecasts and thus bad policies or investments. Recognizing the problems in models not only will lead to better forecasts but also better opportunities.

If, hypothetically, we could know exactly what was coming, we wouldn’t have to make assumptions. But we also wouldn’t make any gains because positive returns are the reward for risk, and we wouldn’t be taking any. Assumptions create risk, and risk is what leads to profit.

All of which is to say: Assumptions can be good or bad, depending on how you use them. Use them wisely.

Tiffani, Valentine’s, and the Super Bowl

My eldest daughter Tiffani arrives very late tonight. We will spend the next three days working on a book we started some 15 years ago called “Eavesdropping on Millionaires.” She has a fascinating amount of data and anecdotal stories we believe will be intriguing. I have to admit she has been the driver and visionary for this.

Sunday will interrupt our writing schedule, as there are numerous Super Bowl parties that afternoon and evening. I’m not sure whether we will be social butterflies and visit several or just stay at one. But it’s a great time to catch up with friends and meet new people. One of the great things about the Dorado Beach community is the frequent events where you can meet your neighbors. There is actually an infrastructure built up to assist hosts in everything from food to wait staff, music, and so on. You get to know the wait staff and they know your favorites. Quite idyllic.

Tuesday is Valentine’s Day, and Shane and I have a standing reservation on Valentine’s for the Ritz Carlton restaurant Positivo, celebrating our fifth Valentine’s together here in Dorado Beach sitting at the same table on the beach watching the sunset.

D-Day sidebar: The forecast Kenneth Arrow’s team made was for a D-Day on June 5, but the weather was clearly going to be impossible. The Germans also thought any landing would be impossible for weeks, so they relaxed. Many generals, including Rommel, went home for a brief period. But Irish weather stations showed a brief break coming on June 6 and Eisenhower called a go. Waiting any later would have been a disaster as the weather turned nasty. Talk about having a model but then waiting until the last minute to actually make the decision…

And with that, I will hit the send button. I will make one final prediction: I see guacamole and chips, great food, and friends with the background of a football game going on in my life. Given past performance, I can guess that over half of you will have the same forecast for this Sunday. I don’t have a dog in this hunt, as the Cowboys dropped out early, but I have many friends in Philadelphia, so I will be supporting them in their hopes for a championship. You have a great week! And don’t forget to follow me on Twitter.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Mauldin February 11th, 2023

Posted In: Thoughts from the Front Line