January 23, 2023 | A Healthy Cleansing

Happy Monday Morning!

We got more encouraging news on the inflation front. Consumer prices in Canada fell on a seasonally adjusted basis, dropping -0.1% month over month, the first drop since July 2020. Yes, annual inflation still looks very high at 6.3%, but that only tells us what happened a year ago. We discussed these big fat, laggy indexes last week so no need to beat a dead horse. Let’s try to filter through the noise here.

As my good friend Ben Rabidoux points out, Consumer prices have been nearly flat over the past 6 months. Remember, prices don’t have to drop, they just have to stop going up a lot.

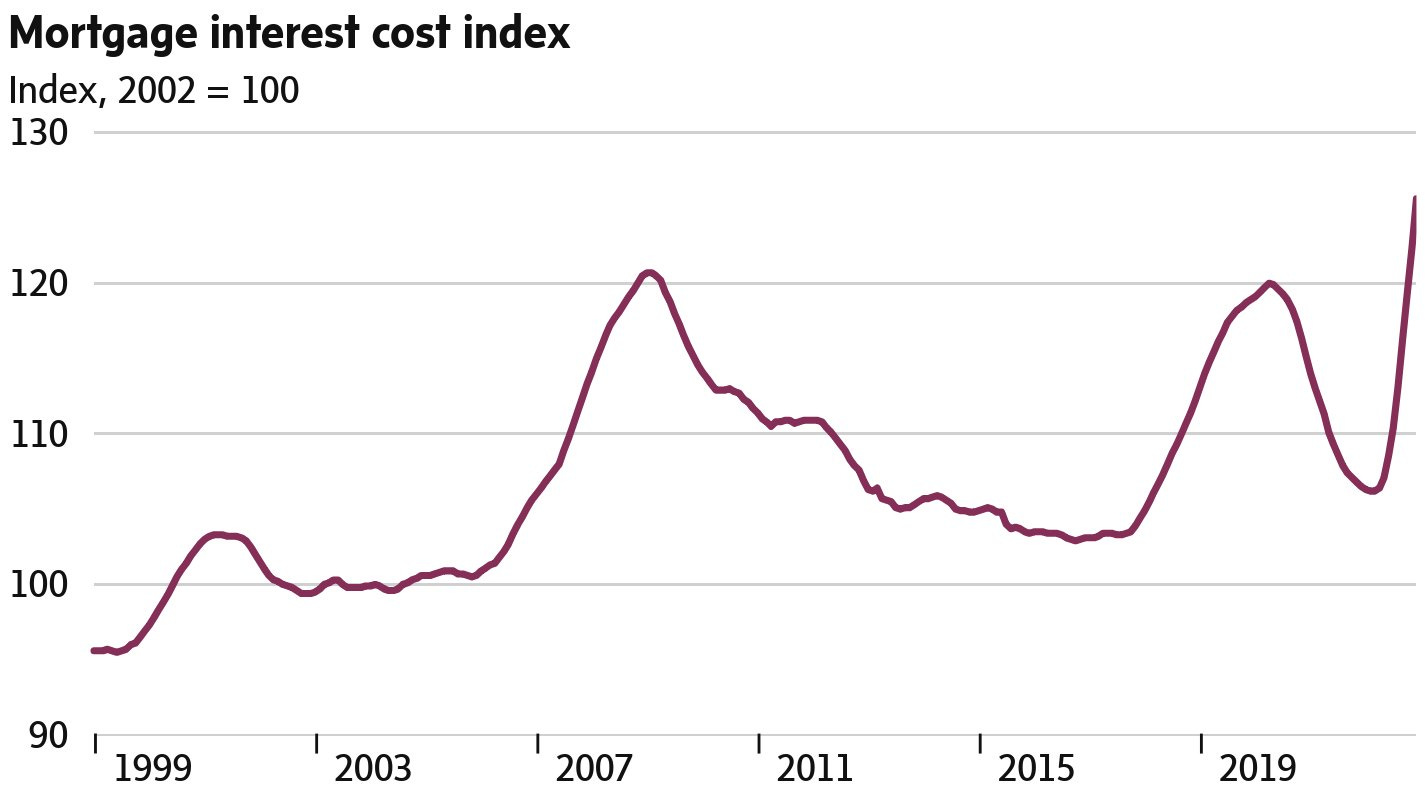

Shelter inflation remains stubbornly high, despite house prices cratering. Ironically, the largest contributor to annual inflation in Canada right now is now mortgage interest costs. A whopping 400bps of tightening on a highly levered household sector will do that.

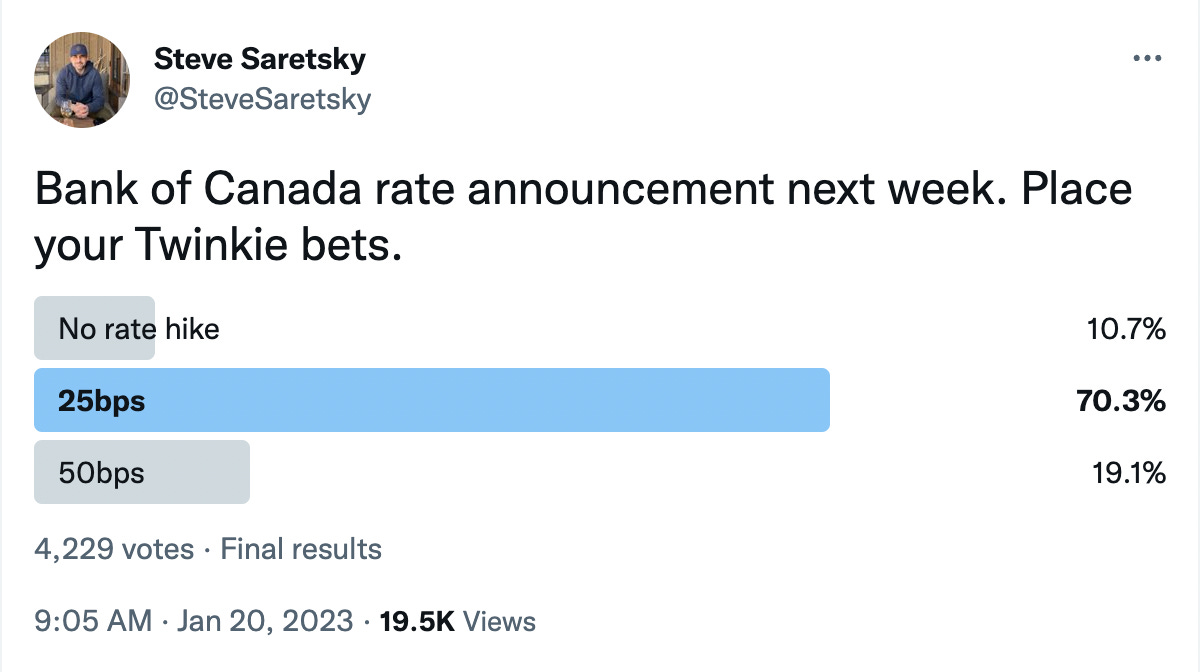

And we might not be done yet. The Bank of Canada will provide an important update this Wednesday. Markets are still expecting the BoC to squeeze in another 25bps before pausing. Twitter seems to agree.

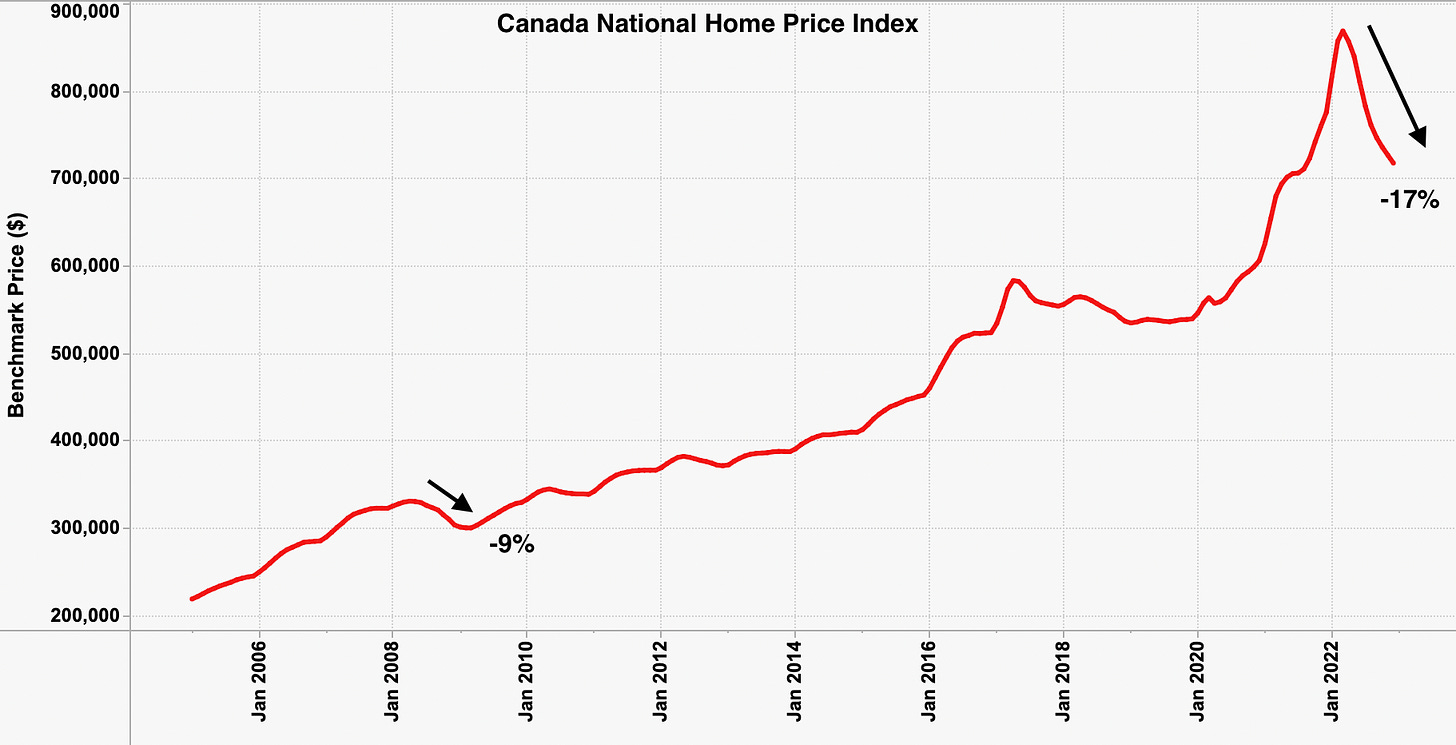

The Bank of Canada has been pretty unpredictable over the past year. My bet is on 25bps but there are plenty of arguments that support a pause. The obvious one is housing, which has been taken to the woodshed over the past ten months. Since peaking in March 2022, the National Home Price index is now down a whopping 17%, the largest decline on record by a country mile.

To be fair this was definitely a healthy cleansing. Housing speculation had run rampant after years of reckless government policy. There will be more bodies floating to the surface assuming the Bank of Canada has the courage to hold rates for the rest of the year.

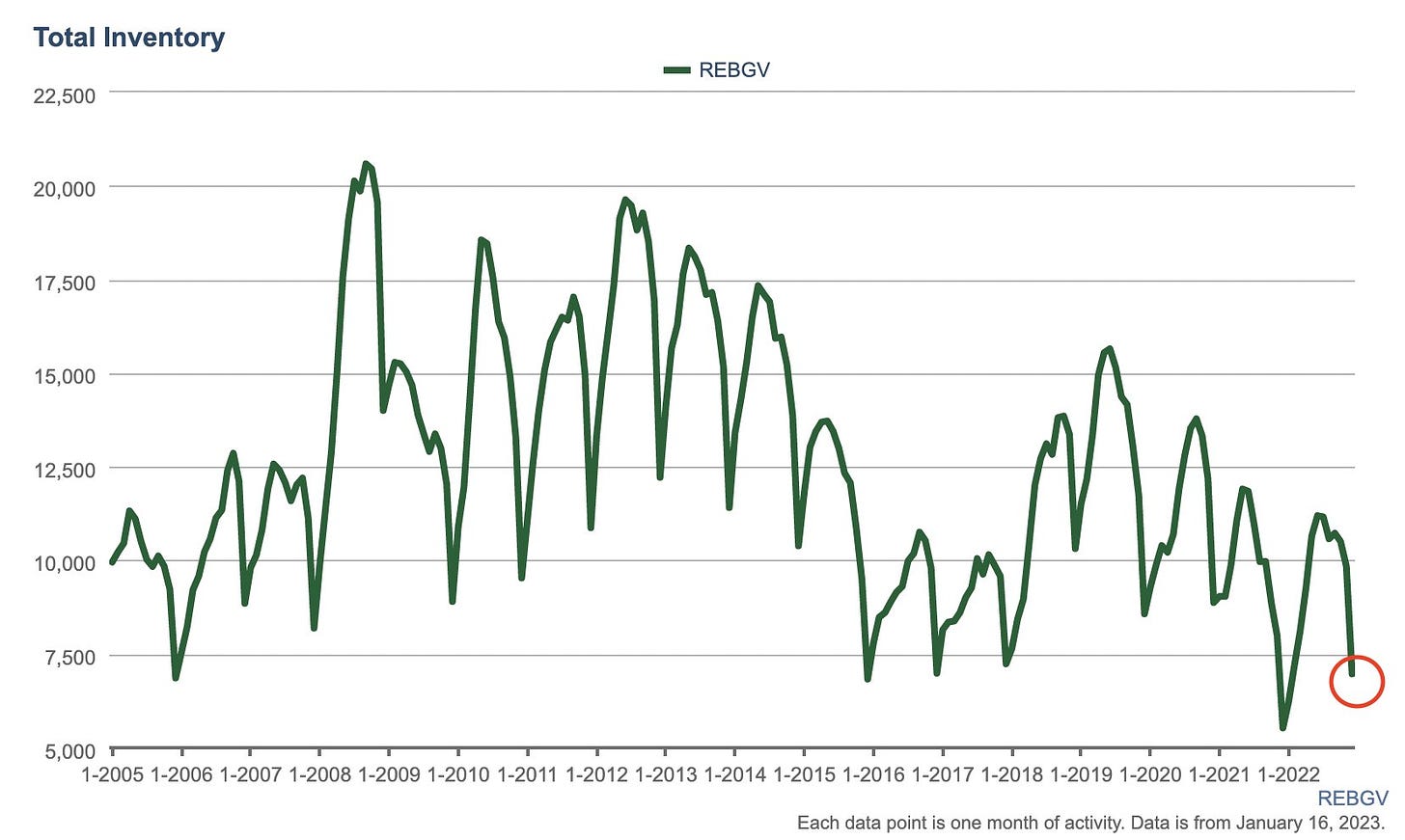

Housing bears will be tested though. Inventory for sale remains stubbornly low. The anecdotal stories of stale listings suddenly going into multiple offers are true. It’s hard to believe it but it’s definitely happening. You have a bunch of buyers who have delayed their purchases throughout 2022 suddenly frustrated over the lack of available inventory. There was a lot of hype about distressed sellers flooding the market but that has not materialized, at least not yet.

Here’s a quick chart of total inventory for sale across all of Greater Vancouver.

Hard to convince sellers to drop their price when there’s no competition. As i’ve said before, the next real test for the housing market will come in March/April when we get our usual uptick in new listings. Just keep in mind inventory levels are starting from a very low base so it will take time for inventory to build to levels that force more price cutting.

It’s also worth watching fixed rates. The Canada 5 year bond yield is now back at levels that would normally put your 5 year fixed rate mortgage in the mid 4’s. Most big banks are now back under 5% if you ask politely and there should be more room to go if yields hold here. Let’s watch.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky January 23rd, 2023

Posted In: Steve Saretsky Blog