December 9, 2022 | The Central Bankers Resort To Wishful Thinking

The Bank of Canada resorted to wishful thinking this week while raising interest rates again and hinting that this increase might be the last one.

The Bank of Canada (BOC) raised rates this week by 50 basis points. The prime rate at Canada’s banks almost immediately jumped by the same amount to 6.45 percent.

In the statement the BOC hinted that they might be done:

“Looking ahead, Governing Council will be considering whether the policy interest rate needs to rise further to bring supply and demand back into balance and return inflation to target.”

This is the latest in a series of abrupt shifts in policy. For example, just 30 months ago BOC Tiff Macklem said:

“If you’ve got a mortgage or if you’re considering making a major purchase, or you’re a business and you’re considering making an investment, you can be confident rates will be low for a long time,” Macklem said at a 2020 news conference while announcing rates would remain unchanged at 0.25 per cent.

Canadians took that statement to heart and proceeded to borrow as much money as they could to buy real estate and spend. Lenders accommodated those loans, experiencing a surge in business.

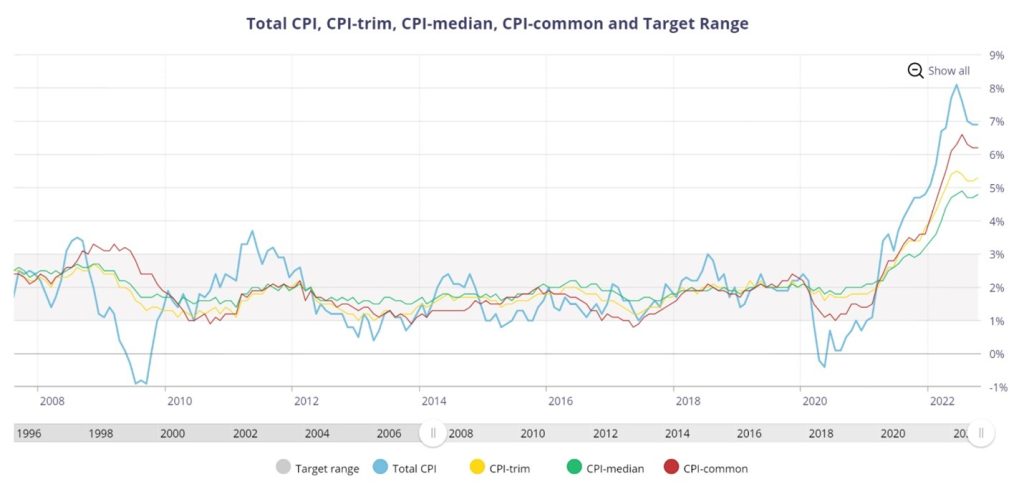

And then inflation jumped to much higher levels. Total inflation:

Source: Bank of Canada

At first the BOC went into denial and the words, “transitory, temporary and transient” were heard repeatedly.

Central bankers had assured us that if inflation ever rose above the target range of 2 percent the gods of monetary policy would have the tools to control inflation.

Central bankers in the US also promised to control inflation but didn’t find it necessary to raise rates, at first. Federal Reserve chair Powell on March 17, 2021:

“I would note that a transitory rise in inflation above 2%, as seems likely to occur this year, would not meet this standard,” Powell said on March 17 when discussing whether the coming wave of inflation would be sufficient to meet the central bank’s three-part test for an eventual increase in interest rates.”

Unfortunately for central bankers those initial attempts to downplay inflation did not work. And so far, those powerful tools that we were told would contain inflation are not working either.

Now Canadian central bankers are relying on wishful thinking, hoping for an end to inflation without the economy going into a deep and nasty recession.

There is no historical record of that ever happening. The only comparable period to today’s inflation is the period from the late 1970s to the mid-1980s. It took two recessions, one of them (1982) which was very severe, and much higher interest rates to break the back of inflation. And even then, it took years for CPI to decline to 2 percent. And comparable debt loads then were much lighter than today.

To be fair, it’s important to note that central bankers have an impossible task. Dual goals of avoiding recession and preventing inflation are too much for their blunt tools to handle.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth December 9th, 2022

Posted In: Hilliard's Weekend Notebook