December 12, 2022 | Inflationary Pressures Moving Lower with Demand and Prices

Demand destruction is weighing on prices globally as financial conditions tighten.

It’s not just interest rate increases three times faster than historical norms, an estimated $750 billion is running off of global central bank balance sheets monthly as the massive 2020-22 QE injections now reverse.

Notwithstanding new sanctions on Russian oil and continued production cuts from OPEC+, 0il (WTI) has been flirting with $70 a barrel for the first time since December 2021–some 43% below the inflationary peak in June 2022.

US oil and gas consumption is running at the second lowest annual level in the past 20 years, second only to the pandemic recession in 2020. Consumer volume spending on energy to October contracted for five months running and was 2% below the pre-COVID-19 level (Rosenberg Research).

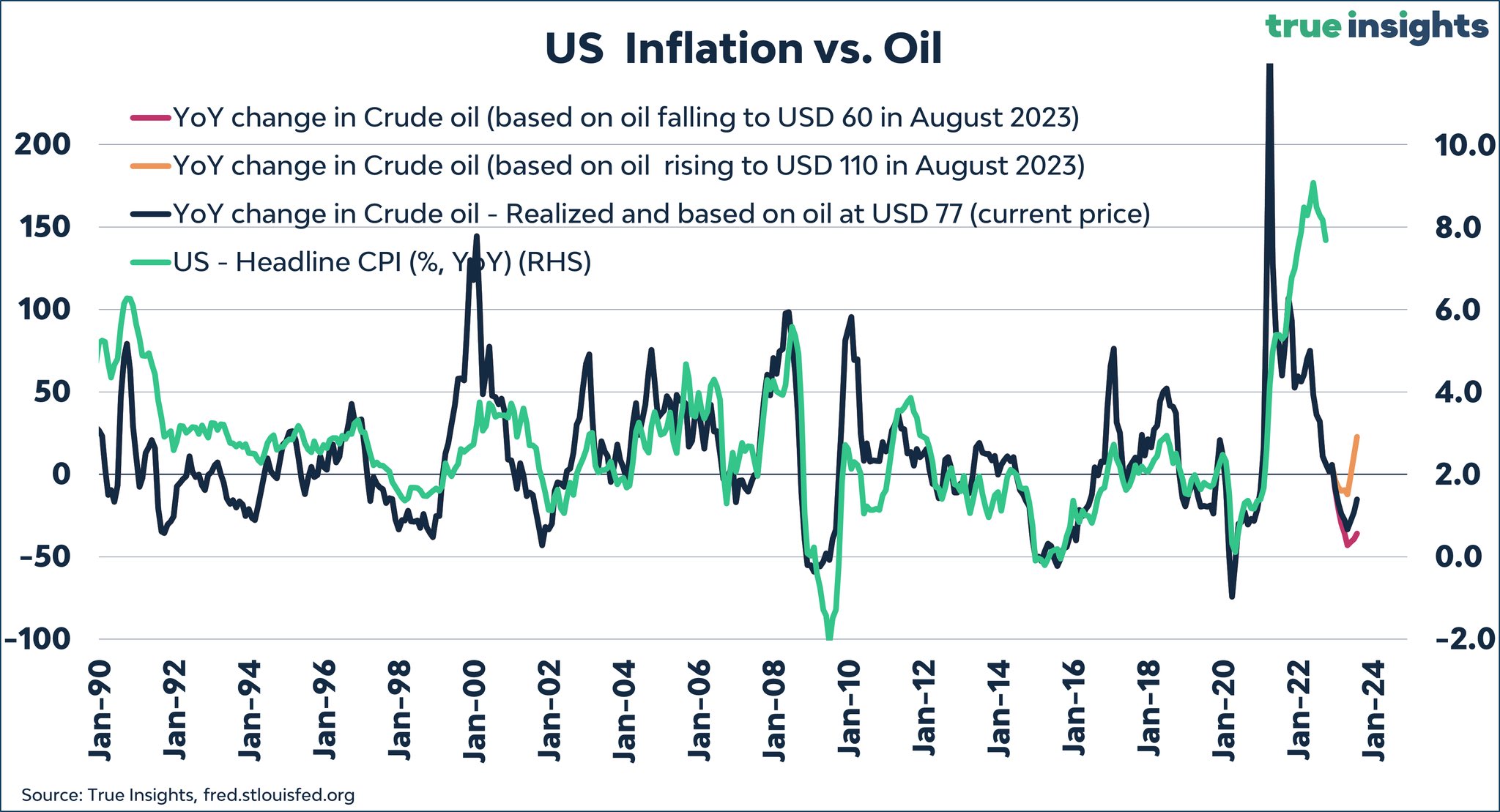

The good news (as shown below since 1990) is that headline CPI (in green courtesy of True Insights) is set to follow crude (in black) lower in 2023.

Another major deflationary impulse comes from housing costs that comprise 30% of the consumer price index (40% of the core). With sharply higher interest rates, prices and rents, demand is slumping as housing starts, units under construction and completions are all skyrocketing. Home prices and rents nationally are now falling at the same pace as during the 2008 Lehman collapse.

Short-term rental supply, up 23% year over year, is set to exert more downward pressure on prices and rents as vacation bookings contract and negative carry prompt a surge in long-term rental and sale offerings.

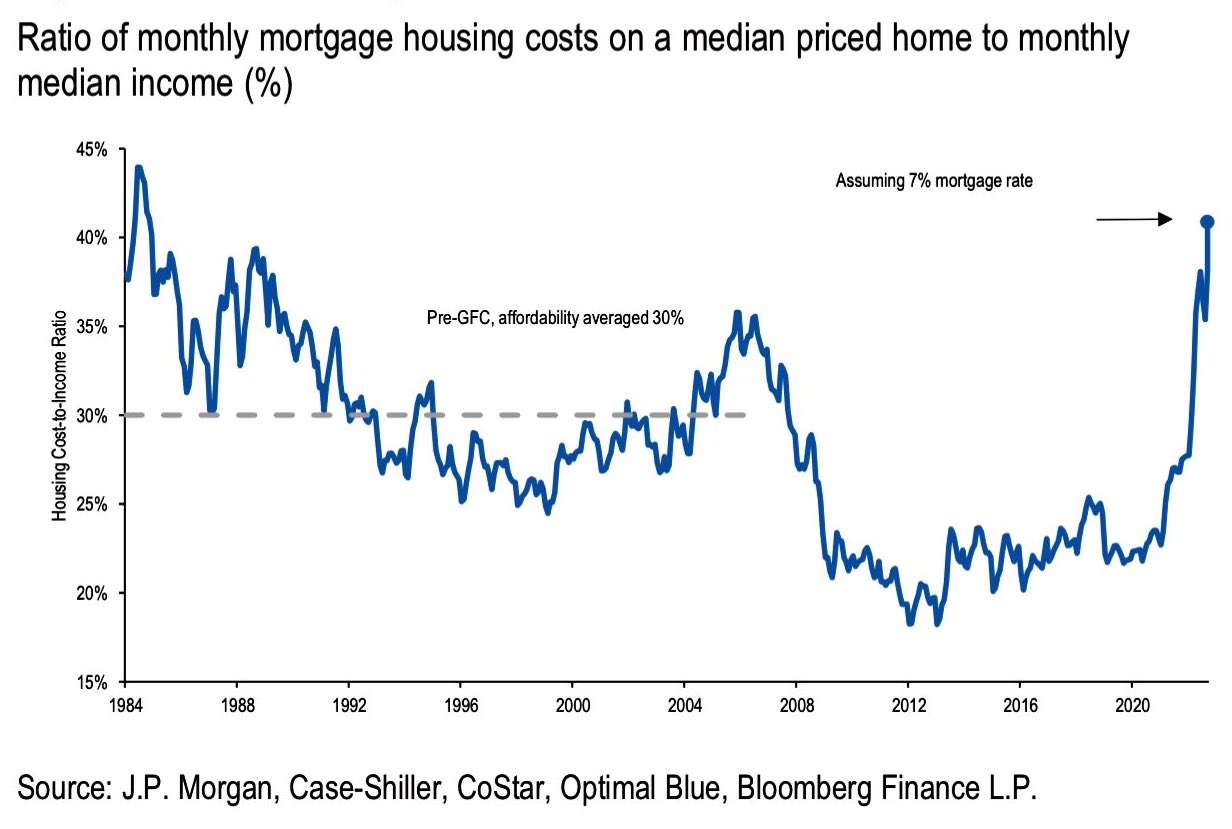

As shown below, since 1984, restoring the long-term mean in the median housing cost to median income ratio typically takes several years (via lower prices, lower interest rates and higher incomes). US mortgage applications are presently running at 25-year lows. In the third quarter, credit card and auto loan payments 30 days past due (+5.25% and +6.21%, respectively) were the highest since Q3 of 2020. Both lead the credit default cycle. This has broader implications because a ton of consumer credit was packaged into securitized loan products bought by yield-desperate, risk-blind investors in the past few years.

In the third quarter, credit card and auto loan payments 30 days past due (+5.25% and +6.21%, respectively) were the highest since Q3 of 2020. Both lead the credit default cycle. This has broader implications because a ton of consumer credit was packaged into securitized loan products bought by yield-desperate, risk-blind investors in the past few years.

Retail capitulation has been missing in 2022. However, over the past three weeks, global equity funds saw the largest net redemptions in five months, while 60% of bond ETF inflows since November have gone into Treasury bonds. Both trends are likely to continue in the first quarter of 2023.

This Wednesday, any dovish nods out of the FOMC could spark a year-end relief rally in risk markets.

But history reminds us that it’s not the pause nor first rate cuts that historically mark cycle bottoms for equities and Treasury yields. Those bottoms come an average of 16 months after the Fed pause and 70% of the way through recessions when the yield curve has re-steepened such that short interest rates are lower than long. That’s likely to be a 2023/24 story. Today, the US 10-year yield remains a whopping 77 bps lower than the 3-month and 81 bps lower than the 2-year.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park December 12th, 2022

Posted In: Juggling Dynamite

Next: A Pause, But Not a Pivot »