December 19, 2022 | Better Balance

Bank of Canada Governor, Tiff Macklem, delivered some final comments this week at a keynote speech in BC. He didn’t mince words following the fastest rate hiking cycle in recent history.

“There’s no question that if you bought a house near the peak, you took a variable rate mortgage with a high loan to income ratio you’re really feeling the squeeze of higher interest rates.”

No doubt. Here’s our real life example to refresh your memory.

1. $500,000 mortgage, 25 year amortization, 1.5% mortgage rate = $2000/month

$500,0000 mortgage, 25 year amortization, 5.5% mortgage rate = $3052/ month

2. $1,000,000 mortgage, 25 year amortization, 1.5% mortgage rate = $3997/ month

$1,000,0000 mortgage, 25 year amortization, 5.5% mortgage rate = $6104/ month

“Look, the housing market was unsustainably hot for the last couple of years, part of getting the economy into better balance is getting the housing market in better balance.” Macklem concluded.

Have no fear, the housing market is definitely in better balance, at least if you’re a buyer. National housing figures released last week paint a rather drastic turn of events in the nations housing market. Home sales fell 39% year-over-year in November. The 30,135 sales reported across the entire MLS system are the lowest for the month of November in over a decade. You’d have to go all the way back to November 2008 during the depths of the financial crisis for lower sales volumes.

It’s no wonder the Bank of Canada is finally talking about a pause, having shifted to a wait and see approach on future rate hikes. Regardless, even a pause does not prevent further downwards pressure on housing.

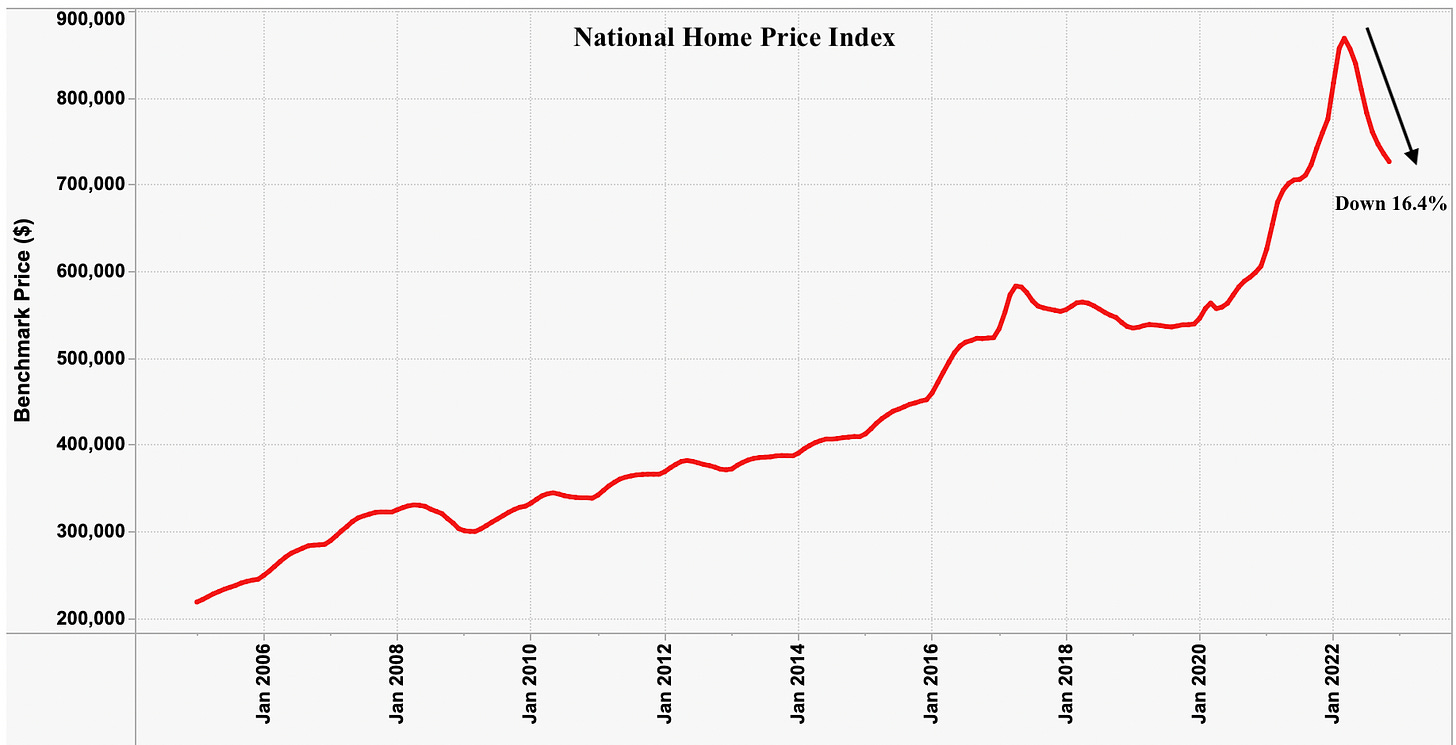

The MLS home price index dropped another 1.4% month over month in November, bringing the total decline to 16.4% since peaking in March. This is the sharpest correction since the index was created in 2005.

What’s even more interesting is that this 16% drawdown has happened at a time when new listings remain low. With the one exception of 2019, November 2022 saw the fewest new listings in 17 years!! There is still only 4.2 months of inventory on a national basis, we are only now back to pre-pandemic levels.

This is undoubtedly supporting further price declines in the market, at least for now. The next test comes in the spring when, seasonally, new listings increase.

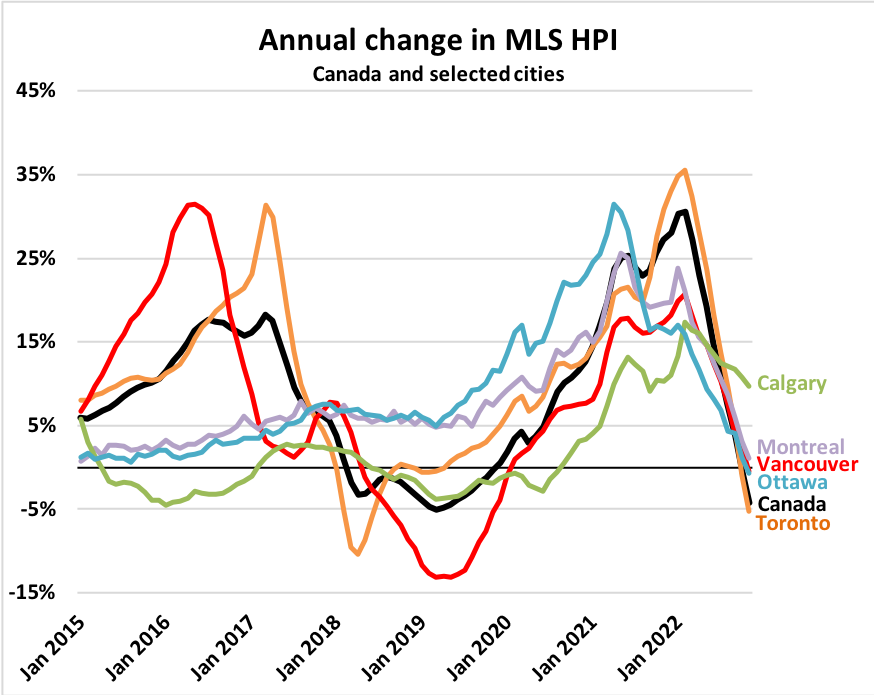

It’s worth noting that while national house prices are down 16% from the peak, and 4% on a year-over-year basis, the declines vary by city.

- Calgary +9.7%

- Montreal +1.1%

- Vancouver -0.5%

- Ottawa -0.7%

- Toronto -5.3%

In other news, OSFI confirmed what we suspected last week. At their annual December 15 meeting, the banking regulator confirmed the mortgage stress test is here to stay, at least until they can conduct a further review of mortgage underwriting standards.

In January, OSFI says it will launch a consultation to review its B-20 mortgage underwriting guidelines. This could “take months, not weeks,” it said on a media call.

“This review will include the MQR (minimum qualifying rate), which forms part of B-20, but will also progressively include other mortgage underwriting standards,” the regulator noted. “We expect to leave the MQR at its current rate pending the outcome of the review, although the economic environment could result in a more immediate change.”

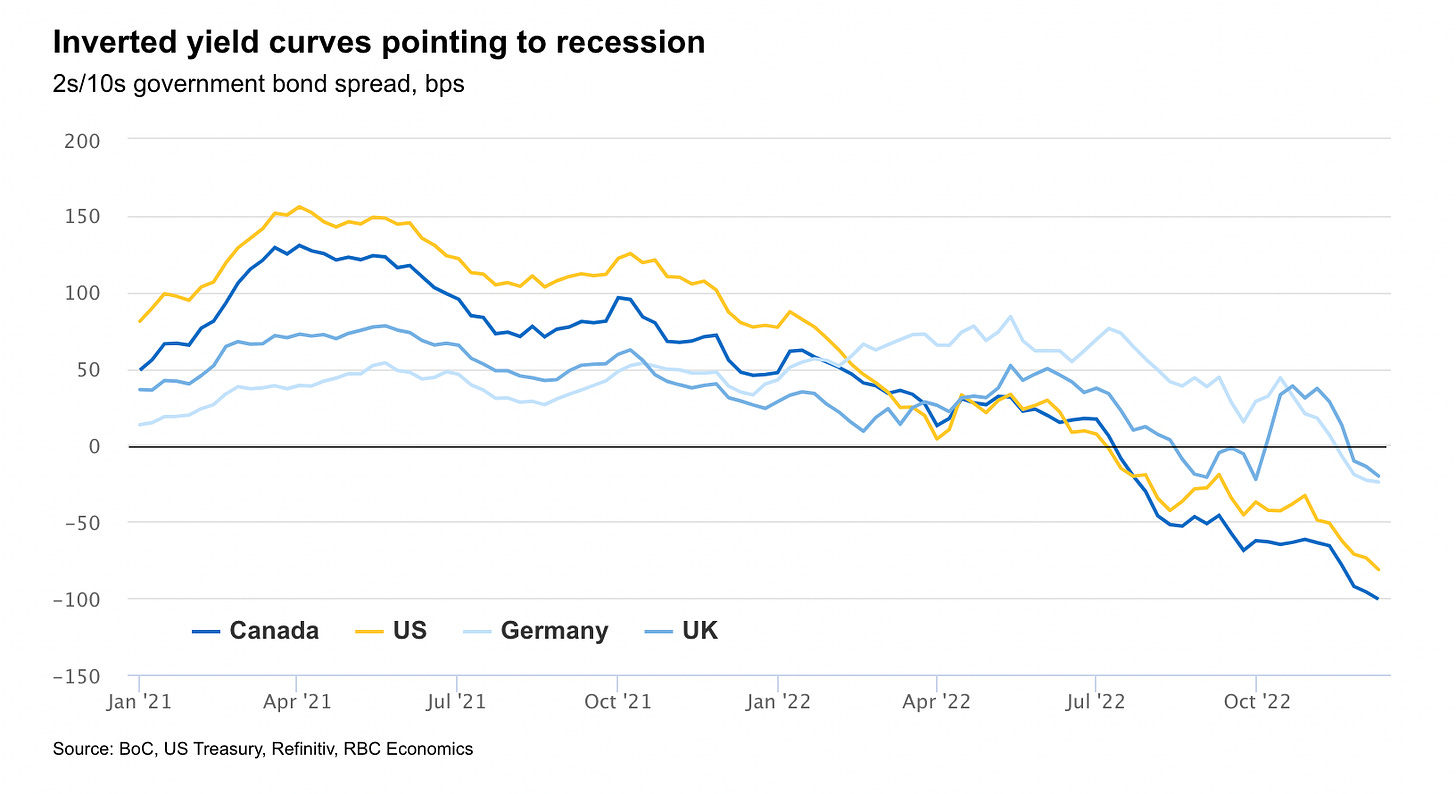

The economic environment they’re referring to is a continued deterioration in the housing market, which the bond market is certainly signalling with the 100bps yield curve inversion.

The Canada 5 year bond yield, which has historically tracked the 5 year fixed rate mortgage continues to fall, now hovering around 2.9%. This brings us back to levels last seen in early May when the 5 year fixed mortgage was hovering in the low 4’s. Perhaps a sign of things to come. We shall see.

Lots more to discuss in the New Year. This will be the last edition of the year, see you all in 2022. Happy Holidays!

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky December 19th, 2022

Posted In: Steve Saretsky Blog