The Bank of Canada raised policy rates another 50bps today, taking base rates in the banking system to 4.25% from .25% at the start of the year. As we look into 2023, it bears remembering that monetary changes move through the economy with lags of up to two years. The Bank of Canada explains on their website as follows:

When we adjust our policy interest rate at the Bank, we don’t expect immediate results. It usually takes 18 to 24 months to see the full effects. Interest rate changes affect the economy through four main channels:

- commercial interest rates—what you pay on mortgages and loans and what you receive on deposits

- the Canadian dollar exchange rate

- people’s expectations for inflation

- the prices of assets such as houses, stocks and bonds

In other words, the massive increase in Canadian base interest rates over the past nine months has barely begun its demand destruction effects on the economy.

Some 20% of Canada’s $2 trillion in mortgage debt was borrowed when rates were 1.5% compared with more than 5% today (BMO data). Variable mortgage rates have already tripled year to date, and some 35% of fixed terms are up for renewal in 2023. So it’s not surprising that home sales have collapsed, and prices are falling nationally, down 9.9% year over year in October (CREA).

Mortgages are not the only credit that’s inflicting stress, of course. Vehicle and education financing, commercial loans, lines of credit and credit cards have all helped push household interest costs to a record 10% of Canadian household income in 2022.

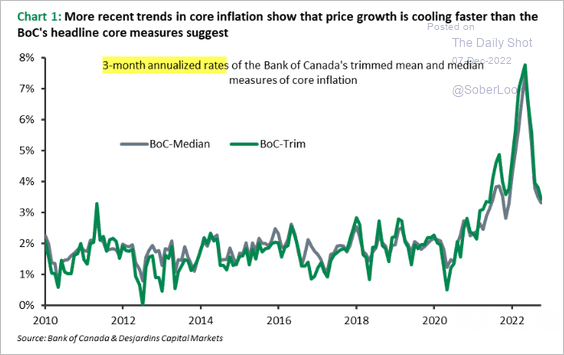

As demand weakens for goods and services, the 3-month annualized core inflation rate has been falling faster than projected (shown below since 2010 courtesy of The Daily Shot).

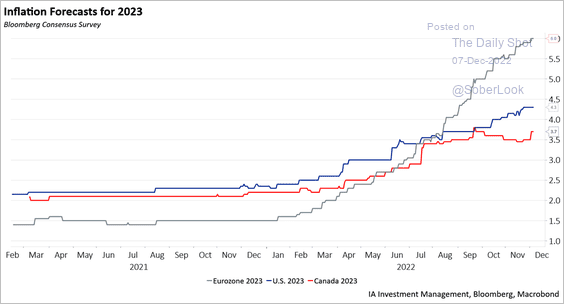

With Canadians some of the most debt-laden and cash-strapped of major economies and our economic growth and net worth more concentrated in real estate than most, inflation forecasts for Canada have fallen since June (below in red since 2020) compared with the Eurozone (in black), and America (in blue).

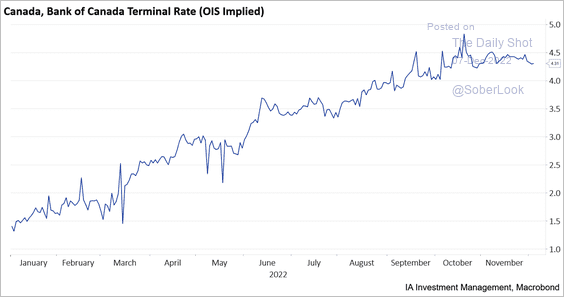

All of this suggests that today could end the Bank of Canada’s hiking this cycle. The options market predicts a terminal funds rate of less than 4.5% (as shown below).

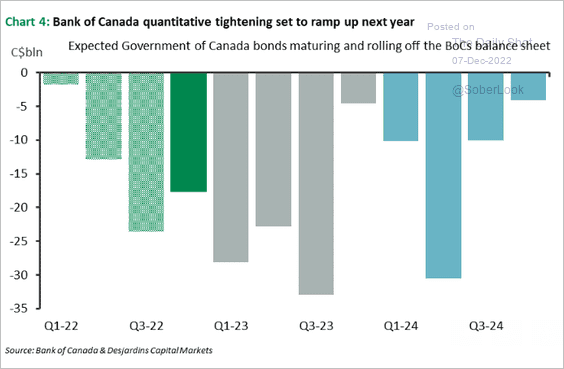

Even without more hikes, billions in Government of Canada bonds set to mature and roll off the Bank of Canada’s balance sheet in 2023-24 (QT) will further tighten financial conditions.

Even without more hikes, billions in Government of Canada bonds set to mature and roll off the Bank of Canada’s balance sheet in 2023-24 (QT) will further tighten financial conditions.

The treasury curve sees the forest for the trees. Yields have plunged over the past month (government bond prices have risen), and the spread between Canada’s 30-year and 3-month Treasury yield has inverted to a jaw-dropping -1.376. This is a bet from the math-focused bond market that the Bank of Canada will cut short rates again in 2023.

But back to those multi-quarter policy lags. To try and maintain respect for their process, central banks like to leave many months between their last hike and their first cut; otherwise, the whole “measured response” mantra looks circumspect. Once they start cutting, it will also take many months for that to alleviate credit strain. 2023 is going to feel like tough love for many.