October 30, 2022 | Turning Bullish on Energy

I literally grew up in the oil patch: Wise County, Texas, 60 or 70 miles northwest of Fort Worth in a little town called Bridgeport. The two first-generation Greek immigrant brothers who became Mitchell Energy talked old man Christie into funding Christie, Mitchell and Mitchell and they drilled (hundreds?) of natural gas wells which they eventually sold to an Illinois utility. This was in the 1950s and ‘60s.

So, I was introduced early on to the boom-bust cycle of oil and gas. When it was a bust, my friends’ fathers didn’t have jobs. More immediate to me was that they didn’t subscribe to newspapers which was how I made my money—delivering papers.

Today’s letter is the first of what will be a series on energy. My research and observations lead me to believe that there is the potential for traditional energy to break out of its boom-bust cycle, at least for an investable period of time. Today’s letter will hit the highlights and we will get into details in later papers. Let’s jump right in…

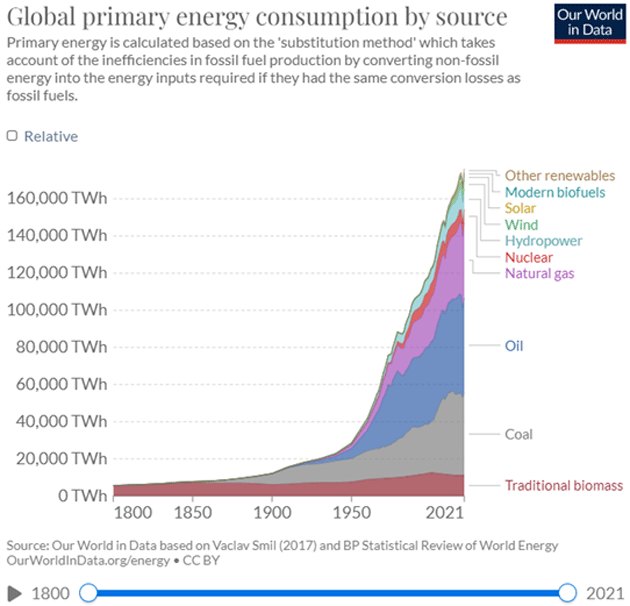

The Amazing Growth of Energy Consumption

While whole books have been written on the remarkable creativity of human beings in adapting their environment to improve their lives, with pumps and water mills and forges, our real story is going to begin a little before 1800 with James Watt and the invention of a practical steam engine. The use of energy literally exploded. Sixteen times since just 1900 and approximately 5 times since 1950.

The growth of energy use is what makes modern life possible. And while per capita energy use has basically gone flat in developed countries, most of the world is still underserved. Literally billions lack adequate access to power and all want it. The question is not whether we will use considerably more energy in the future, but where will it come from?

Source: Our World in Data

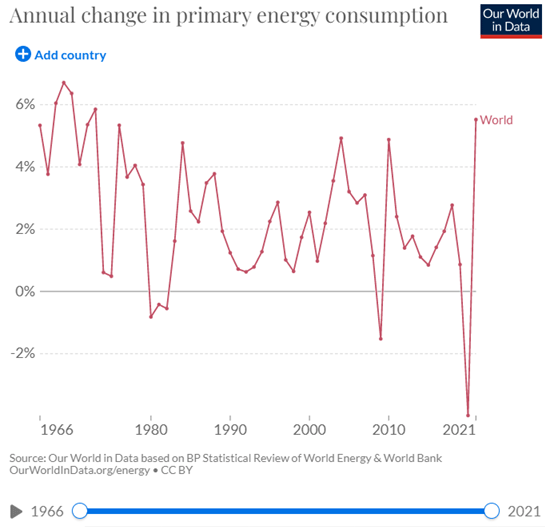

The chart below shows the annual increase in energy consumption for the last 56 years. Even with declining usage in recessions, energy growth has clearly been north of 3% for the world on average. In some countries, 10 to 15%!

Source: Our World in Data

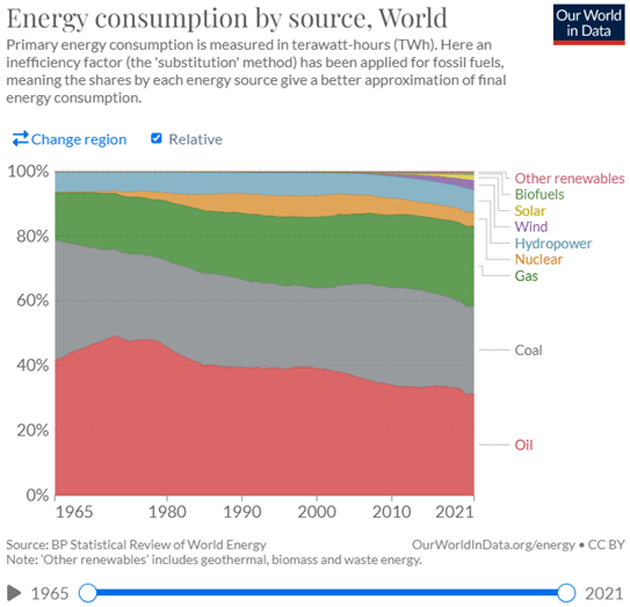

So where is the energy coming from? Primarily fossil fuels with a small but growing contribution from renewables. Note that natural gas is slowly replacing coal, generally a win for the environment. Yet coal is not going away as much of Asia and the developing world is still building coal-fired power plants.

How can you tell people in places with no power for simple cooking they need to wait or spend more than we do in the developed world? That argument falls flat when there is no power for hospitals or for simple cooking. Much of the world still uses wood to cook. Roughly 4 million people a year die from indoor pollution, primarily wood and coal fumes from cooking.

Source: Our World in Data

Now here’s where it gets a little tricky for your humble analyst. This is a very controversial topic. I am making the case that the price of energy is generally going to trend up over the next three to four years. But I also believe we should be looking for ways to reduce our carbon footprint. I think of myself as a realistic environmentalist. I don’t want to see the air I breathe nor anything in my black rum but pure, clear ice. But like 99%+ of you, I still want the convenience of modern electricity and power. For me, that means that even though I support increasing renewable energy as fast as reasonably possible, I also recognize that fossil fuels will realistically be a meaningful part of our lives for more than a few decades.

I believe by the late 2040s all new power production for electricity will be carbon free by necessity. And a few decades after that? Coal use will have declined substantially for power production. Oil and gas will be mostly industrial and legacy transportation.

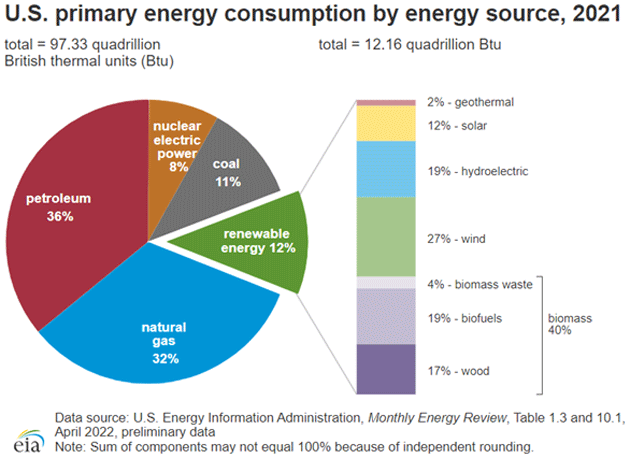

This next chart breaks out energy consumption by source. This is where the realist has to step in. We have spent well over $2.5 trillion dollars on solar and renewables. Here in the US, solar is less than 1.5% of total energy use. Wind is more than double that, but still the entire renewable stack is less than 12%, assuming you count wood as renewable.

Source: US Energy Information Administration

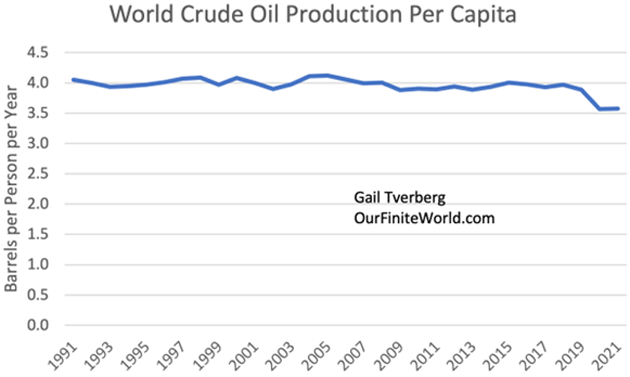

World crude oil production per capita has basically been flat for 30 years. But energy production is up dramatically. That is in part explained by humanity being more efficient, but a big part of the reason is that population in increasing. Energy consumption grows almost 1 for 1 with population.

Source: Oilprice

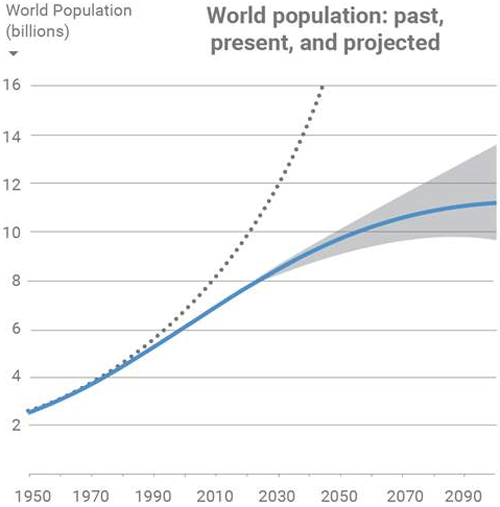

And while population growth has generally flatlined in the developed world, that is not the case for the developing world. Population is projected to grow 25% in the next 25‒30 years. That means AT LEAST as much increase in needed energy. Even if all that needed extra energy was renewable, that still doesn’t replace oil and gas. My back of the napkin analysis suggests solar and wind will need to grow almost 10 times just to keep up with increased demand. Other new technologies? We will need them.

Source: Anthropocene Magazine

Essentially, my bullish view on oil and gas boils down to supply and demand. Demand is going to rise. What about supply? As an aside, I have never bought into the “Peak Oil” nonsense. Peak cheap oil is another thing. Let’s look at supply…

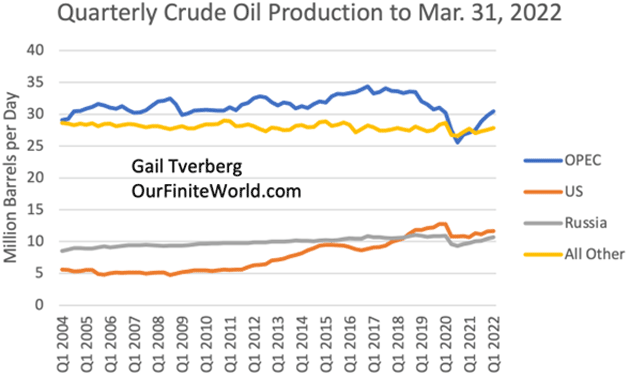

First, OPEC and the rest of the world production has been basically flat for 20 years. There have been two sources of significantly increased oil and gas production: the US and Russia. The US has more than doubled in the last 10 years. Russia is up a few million barrel a day—for now.

Source: Anthropocene Magazine

OK, I said I don’t believe in “Peak Oil,” but that is on a global basis. EVERY field, no matter where it is, has a “peak” for any given production methodology. Reviving an old field is sometimes possible with fracking or other enhanced drilling technology, but not always.

My friend Mark Mills points out that on average, production in working oil fields declines about 6% per year. In two years, that is almost the total production of Russia. The rest of the world has to run very fast just to stay in place when you have to replace a Russia every two years. No wonder global production ex-US is flat!

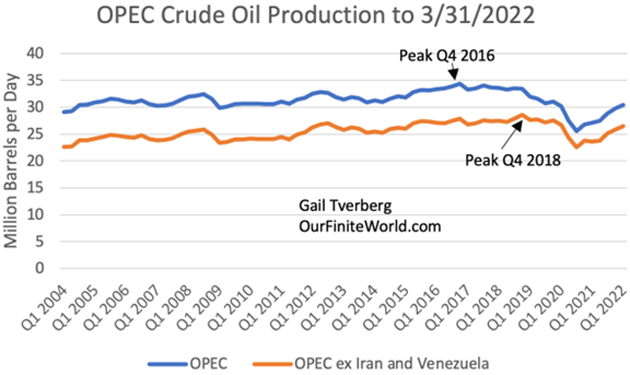

The chart below shows OPEC production is essentially flat and peaked 4‒6 years ago. Yes, if Iran and Venezuela ever escape sanctions, they could add a few million barrels a day but rising demand will consume all of it.

Source: Oilprice

Global oil is roughly $90 as I write (flying over Gulf oil fields on my way to Houston). Why aren’t oil companies punching more holes in the ground? At $90 oil is wildly profitable, at least in the US. Natural gas prices are just insanely profitable at this moment, but will it last? That is the question oil company executives ask themselves every day.

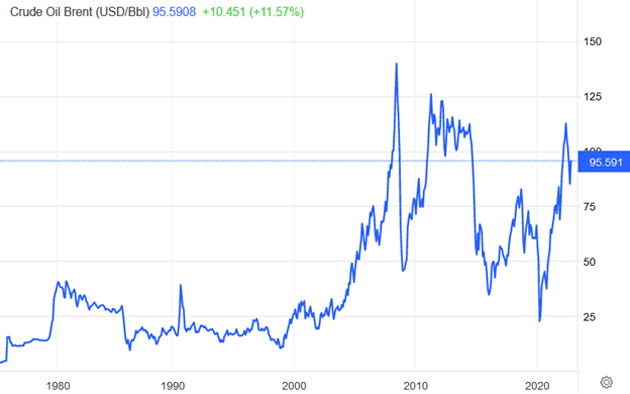

We used to say the cure for high prices is high prices, incentivizing oil companies to increase drilling and production. Now? Look at the Brent crude price below. Three massive bear markets in the last 16 years sparked shareholder revolts and made executives cautious over expanding drilling too fast.

Source: Trading Economics

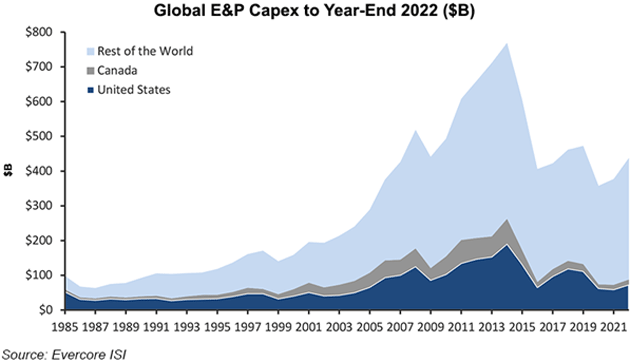

So now we see more drilling, but not on the previous scale. The US exploration and production (E&P) sector is increasing its capital spending in 2022 for the first time in four years, while Canada is set to remain near multi-decades lows, according to Evercore ISI. US capital expenditures (capex) in the oil patch are less than half the peak. Global capex has collapsed to about 60% of its peak. And remember, global production has essentially flatlined, so the current capex (outside of the US) is essentially replacing falling production. The major “swing” producers have been the US and Russia.

Drilling for oil is extraordinarily expensive. To meet demand, either supply or price must increase. And that does not appear yet, at least in the forecasts, to be happening. It doesn’t help that the Glasgow Financial Alliance for Net Zero, which is a global network of 500 bankers representing $150 trillion in assets, has come together to phase out financing of hydrocarbons. Other groups of similar size are forming. It is reducing the pool of capital debt oil companies have.

Source: naturalgasintel

And on that pesky Russian oil production problem… Right now, even with sanctions, China and India are buying Russian oil, albeit at significant discounts. Oil production has fallen in Russia, but not that much so far. But without Schlumberger and Halliburton, etc., how long can that hold up? Think Venezuela. With the largest (purportedly) oil fields in the world, their production has dropped precipitously. Why? They lost access to modern oil field technology. Same in Iran. Loss of Western technology and workers is going to have a major impact over time. An increase in Russian oil production under sanctions? Not in the cards.

We think of the Middle East as this vast potential for oil production, but for the last 30 years, not so much. New production simply replaces old fields that are well past their prime without new technology. Which comes at a price.

We are not in danger of running out of oil, just “cheap” oil.

Peak Oil or Cheap Oil?

If you look at just proven reserves, the world runs out of oil and gas in about 50 years. Of course, we will find more, and figure out how to recover more oil and gas from “old” fields. We are not going to run out of oil and gas for a long time. But “new” oil is going to mean higher costs and thus prices. Over time, that will make renewables relatively cheaper but the operative words are “over time.”

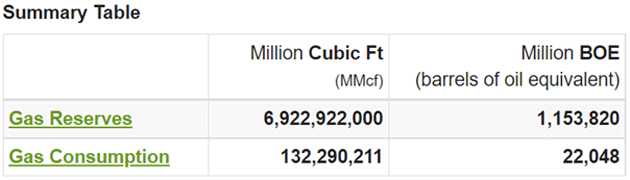

The world has proven gas reserves equivalent to 52.3 times its annual consumption. This means it has about 52 years of gas left (at current consumption levels and excluding unproven reserves). And that is at current consumption. Consumption is going to increase dramatically. This table is for natural gas. Proven oil reserves give us 47 years.

Source: Worldometers

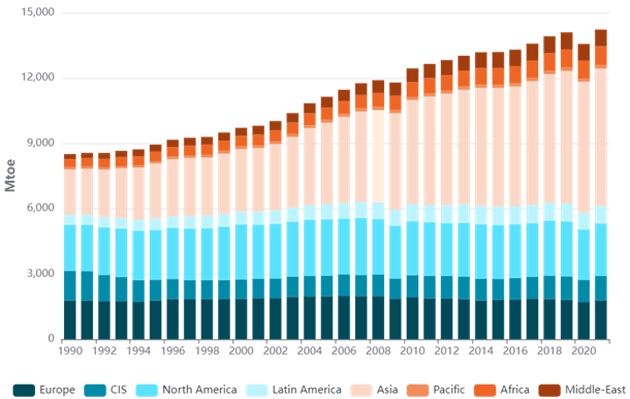

Where is that new consumption coming from? Primarily Asia but in the future increasingly Africa. Note that in the chart below, the US and Europe are basically flat over the last 30 years.

Source: enerdata

“But John, we are going to go to renewable energy for electricity and convert to electric autos. We won’t need that oil.” Eventually, yes, but eventually can be longer than you think.

The world today has over 1.45 billion cars and trucks. Unsurprisingly, North America comes out on top with 710 vehicles per 1,000 people or 0.71 vehicles per capita, followed by:

- Europe: 0.52

- South America: 0.22

- Middle East: 0.18

Asia/Pacific: 0.14

- Africa: 0.05

- Antarctica: 0.05

Does anyone who has traveled really think that Africa, Asia, the Middle East, and South America are satisfied with their current situation? Europe has literally 10 times the number of cars per capita as Africa. I have traveled extensively in Africa and they want to live a “modern” lifestyle. Their use of cars is going to go up as their income rises, as will their energy demand.

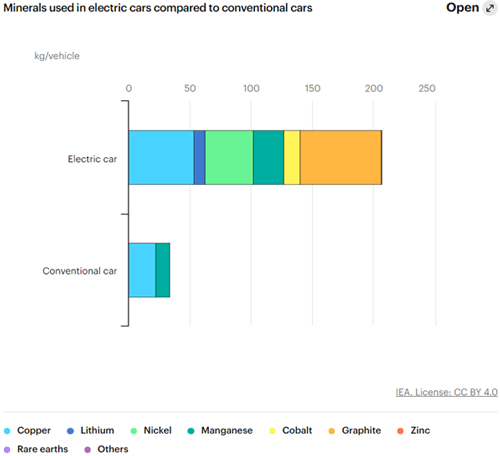

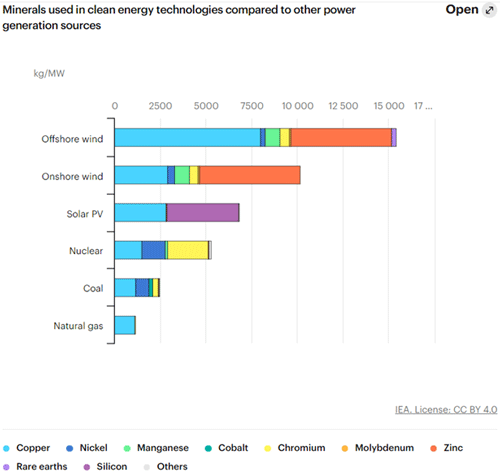

If even half of those cars become electric, plus the solar and wind and other renewables infrastructure, we simply don’t have the metals currently needed. I agree that we need to move toward less carbon. But how? We’re going to need more oil and gas, at least in the short term (10‒20 years). Where do we find it? From ISI:

“Onshore operators in the United States are up against a wall, faced with ‘declining well productivity and increasingly challenging geological conditions limiting production growth,’ Richardson said. In addition, the US privates are playing “an outsized role.” Private E&Ps today have about 60% of the US land rig count under their control, but they only account for 13‒15% of Evercore’s 2021/2022 domestic capex estimates.”

Energy Reduces Poverty

Since 1990, 1.1 billion people have escaped extreme poverty, with more than 140 million entering the burgeoning middle class every year. History suggests that as people find more money in their pockets, they spend much of it—directly or indirectly—on energy.

And that brings us to why I am bullish on oil and gas. Over time, I think we will be forced to rethink our aversion to nuclear energy. Fourth-generation nuclear production can cheaply and safely produce the power needed to both sustain our lifestyles and help the rest of the world escape poverty.

By installing nuclear power France went from 3% to 70% clean electricity in the 20 years to 1997. No country adding solar and wind power has come anywhere near that transition rate, even with today’s strong motivation. And they did it with old and expensive technology.

Some say that will take too long. Nuclear slow? Not intrinsically. Our nuclear-phobic regulations make it slow. And using smaller and less expensive nuclear tech, which can be scaled and made modular, it can happen faster than you think. And it will happen because there is no alternative, at least until we figure out fusion.

Why do I say that? Because we are behind the renewables curve. The world must cut emissions 43% by 2030 to meet Paris goals. Instead, they’re set to rise 10.6%.

Source: International Energy Agency

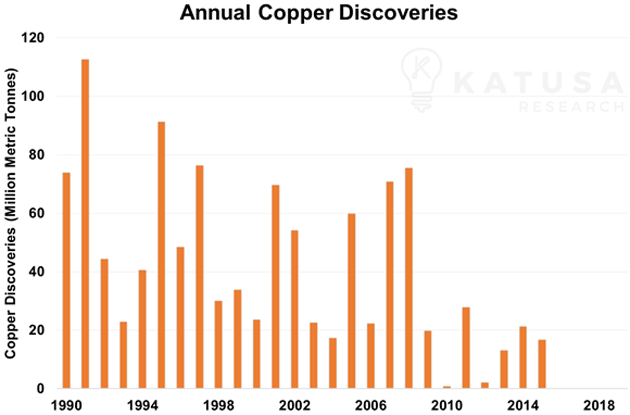

Where do those metals come from? Increasingly from hard-to-find new sources. Not that they can’t be found, but they are increasingly in difficult environments and countries. And one of those difficult environments is the US (and Europe). We have significant potential copper, lithium, and rare earth sources but try and get approval to mine them. Maine just turned down a major lithium mine, totally on private land and in a remote location, because they did not want an open pit mine which is the only way to make the mine economical. Evidently we want to be green, but only with metals from other countries. It’s OK for them to develop mines, but not in my backyard.

This table is a few years old, but it’s not really that out of date. This is the number of new copper mines being discovered. Notice the downtrend. It is getting harder to find new deposits of copper/nickel/cobalt/rare earths, etc., of any real size. There is no doubt they are there. But it seems we have found most of the easy sources.

Source: Marin Katusa

My friend Mark Mills is a scholar at the Manhattan Institute. One of the things he focuses on is the difficulty of producing the materials for electric vehicles. I recommend this article if you’re interested in the problems of finding enough metals for our net-zero ambitions.

*************

Let’s quickly summarize:

#1. Energy demand is going to increase, not only from new population, but from those who are already here and desire to improve their lives.

#2. Energy supply is increasingly under pressure. When demand increases and supply is under pressure that is typically resolved by either more production or higher prices. We will likely have both.

#3. There are many, especially in government and institutions, who think we can easily transition to a zero-carbon, renewable energy future. They seem to think we can do this by 2030 or by the latest by 2035. Given the current plans to transition to solar and wind, this is simply not possible. If we make a commitment to 4th-generation nuclear, we can be there within 15 to 20 years. Maybe sooner depending on how committed we are.

#4. Oil and gas companies are reluctant to ramp up production and are being starved of capital. As noted above, 60% of current wells being drilled are by private groups, not traditional public energy companies.

#5. Sometime in November, the 1,000,000 barrels a day from the Strategic Petroleum Reserve will no longer be put into the system.

#6. China will eventually get its act together and demand for oil and gas and commodities of all type will increase once again. Demand will also rise after we get through this coming recession.

Finally, and what really pushed me personally over the edge, is the entire ESG movement which is pushing to significantly decrease funding for oil and gas production, limiting what they will lend or invest in oil and gas. In what can only be characterized as ironic, “defunding” oil and gas will only make the prices of oil and gas go higher, penalizing the consumer.

Of course, they think that by making the price of oil and gas higher it will make the comparisons with renewables like solar and wind better. That is true, and all things being equal, we would substitute renewable energy for oil and gas based on price.

But that’s not how the real world will work. There is only so much energy that solar and wind can produce in the near term (5‒10 years). The rest will have to be made up by traditional power sources, some of which are renewable like geothermal and hydro, some of which are carbon free like nuclear, but given the natural limits on production it still means oil and gas will remain a significant contributing factor to our energy usage.

Until there is a significant sea change in the political climate not just in the US but at least in Europe, until there is less of a hostile business climate and the ESG movement becomes less effective at blocking capital flowing to oil and gas companies, the pressure on the price of oil and gas is going to be up. To be sure, if we have a recession, the price of oil will go down but history demonstrates it will rebound as demand rebounds after the recession is over.

I need to close now, but I will be doing a series of white papers on various aspects of energy at much deeper dives.

Houston, Dallas, Denver, and Tampa

Shane and I are in Houston today for my 50th Class Reunion at Rice University. Where did the time go? I will fly to Dallas on November 16th, Denver on the 17th for the Annual CFA dinner with Vitaly Katsenelson, back to Dallas for a few days before going to Tulsa for Thanksgiving dinner. I might do Tampa for a client meeting in a few weeks. I will let you know.

I remember being a young student at Rice during homecoming and looking at all of the “old” alumni. I am sure on an intellectual level I knew that I was going to eventually be them. But it did not hit me at the visceral level that it does today. I am not certain how it would have changed my views or what I did, but it would have made me realize how short a time we actually have and to value each moment.

You have a great week! Don’t forget to follow me on Twitter!

Your getting ready to be with “old friends” analyst,

John Mauldin

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Mauldin October 30th, 2022

Posted In: Thoughts from the Front Line