October 1, 2022 | Trading Desk Notes For October 1, 2022

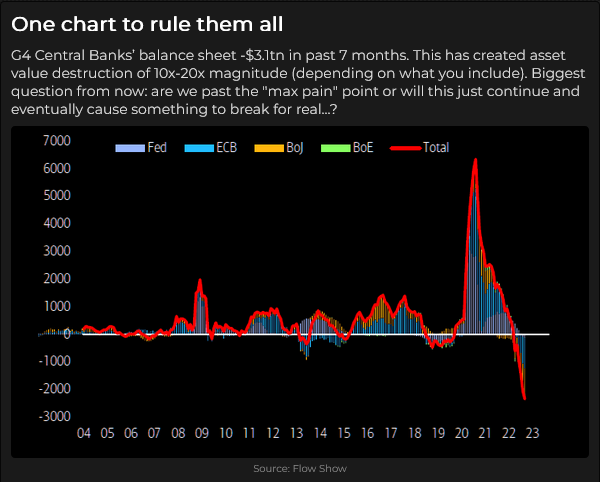

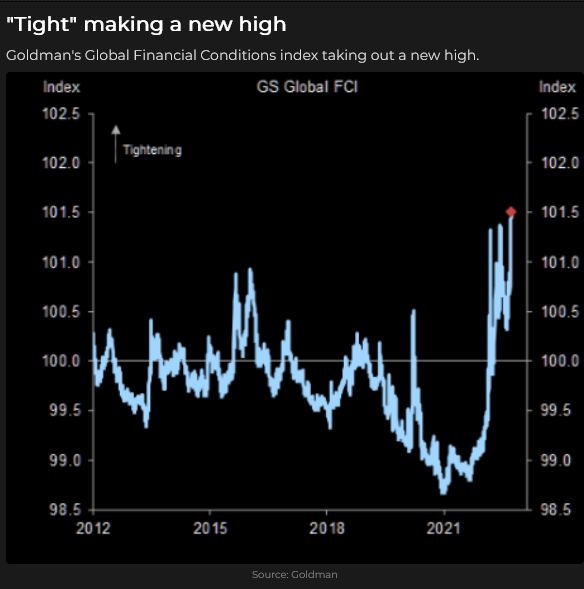

“The most important thing” for the financial markets the past few months, and especially for the last three weeks, has been the realization that the Fed is DETERMINED to get inflation down and “break the back” of future inflation expectations.

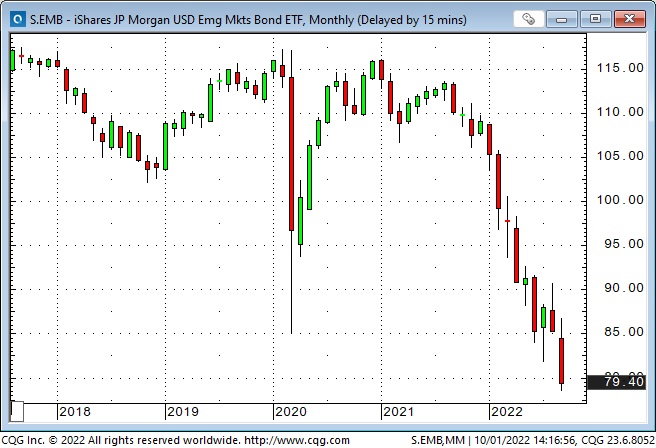

Credit markets

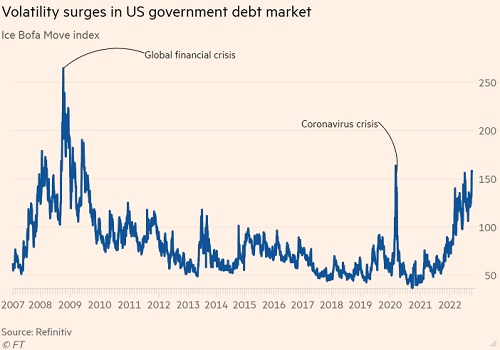

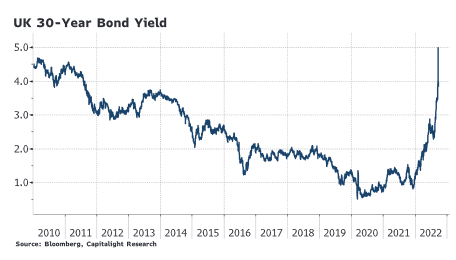

US bond yields YTD have had the steepest rise ever – with 2/3 of the move coming in the last two months. The 10-year yield touched 4% this week for the first time in 14 years. Credit spreads are widening, and real yields are soaring. Bond yields in the UK rose to a 24-year high (5%), prompting the BoE to intervene (buying bonds) to prevent a market collapse. The emerging market bond ETF has fallen to GFC lows.

This chart of UK bond yields looks similar to the price of UK Natgas earlier this year.

Currency markets

The US Dollar index soared to a new 20-year high early this week (up 18% YTD – the best year ever.) Currency volatility has surged higher, and the central banks of Japan and Korea intervened last week to keep their currencies from going into free fall.

The British Pound dropped to a 37-year low against the USD on Monday but bounced back from Tuesday to Friday.

The Canadian Dollar has fallen ~ 5 cents in the last three weeks – hitting a 28-month low.

The Chinese RMB fell to a 14-year low against the USD. (In this chart, higher prices mean it takes more RMB to buy one USD.)

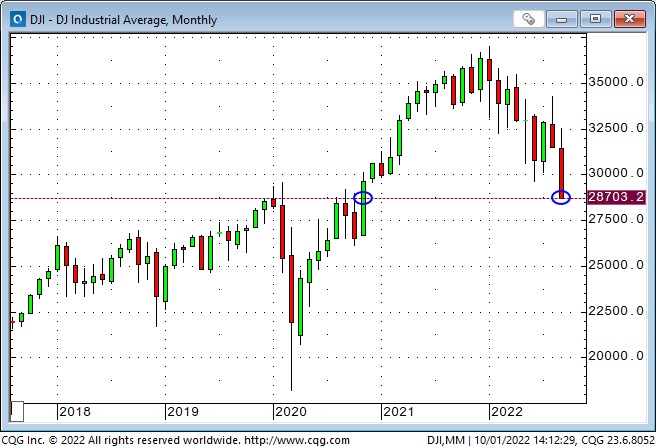

Stock markets

The DJIA is down >8,000 points (~22%) from January All-Time highs to levels last seen in November 2020, when Biden was elected, and Pfizer announced the covid vaccine.

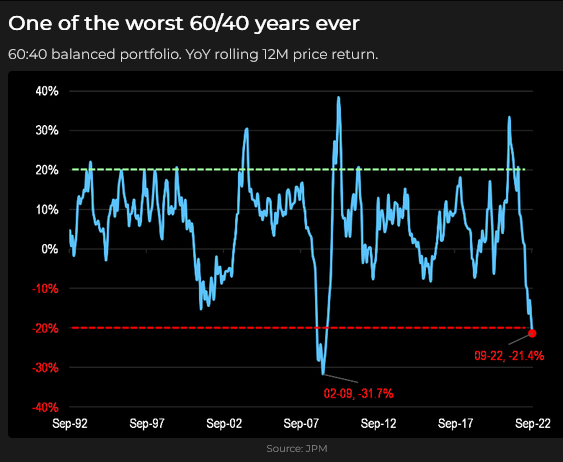

The 60/40 stock/bond classic portfolio

Commodity markets

The (energy heavy) Goldman Sachs commodity index has fallen ~30% from the 14-year highs reached immediately after the Russian invasion of Ukraine. This is the lowest index level since early January of this year.

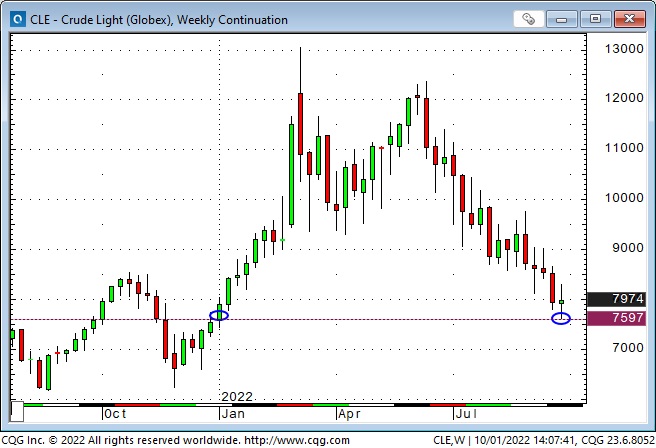

Front-month WTI futures traded below $77 this week for the first time since early January.

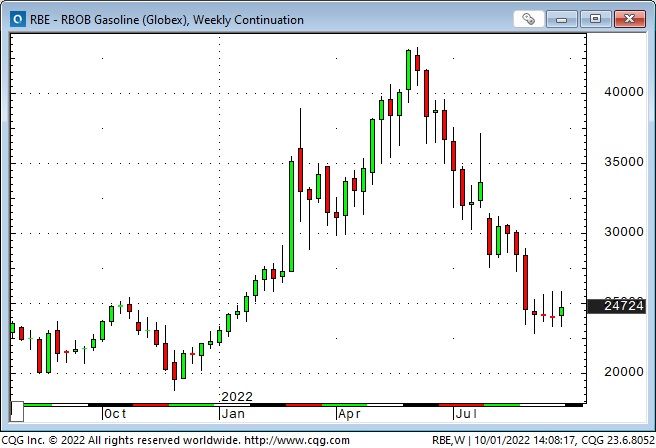

Front-month Gasoline futures ended September ~43% below the All-Time Highs made in early June.

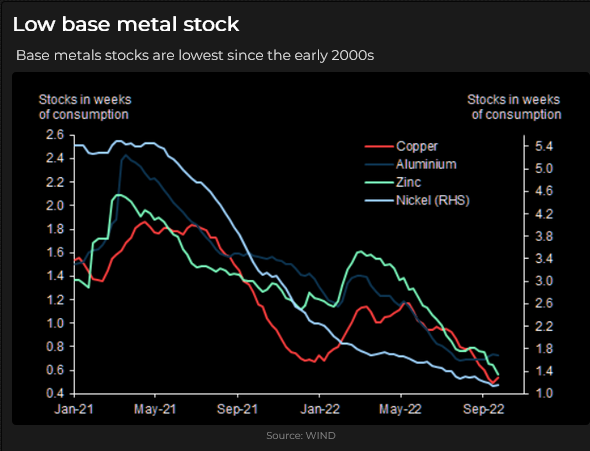

Base metal supplies are low.

Gold

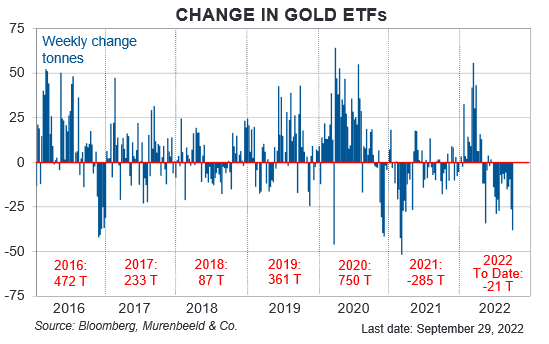

This week, gold touched a 30-month low – down ~$470 (~22%) from ATH made following the Russian invasion. Gold rallied ~$60 off this week’s lows following the BoE intervention, and as the USD fell against the GBP and the EUR. The gold rally came despite surging real yields and may foreshadow a possible giant rally if the Fed ever reverses policy as the BoE did this week.

The chart (courtesy of Murenbeeld & Co.) shows that buying of gold ETFs surged around the Russian invasion, but all of that and more has been sold in the past few months (as the USD and real interest rates have surged.)

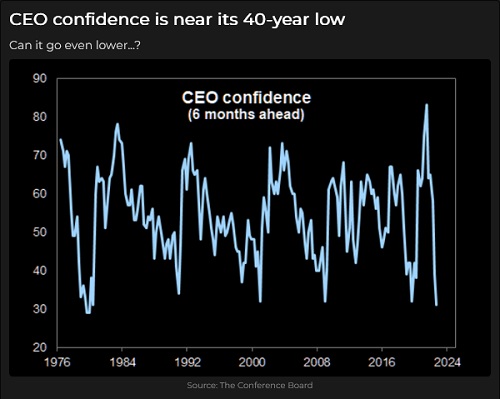

Markets are struggling to adapt to aggressive Fed policy

Jeremy Siegel and Jeff Gundlach have both recently been critical of the Fed’s aggressive policies – with Gundlach announcing that he is buying Treasuries at these prices in the expectation that the Fed will drive the economy into a recession. Market “fears” seem to be shifting from inflation to recession.

My short-term trading

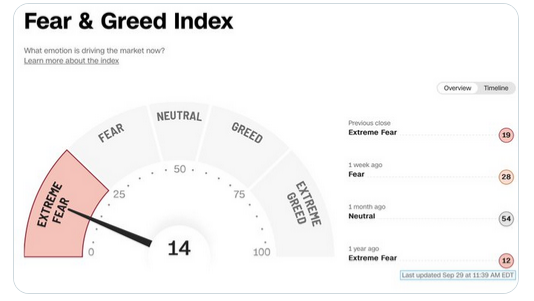

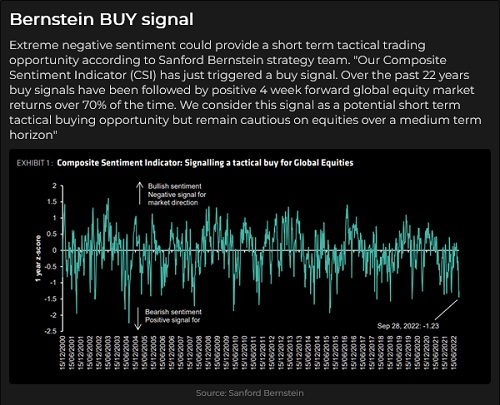

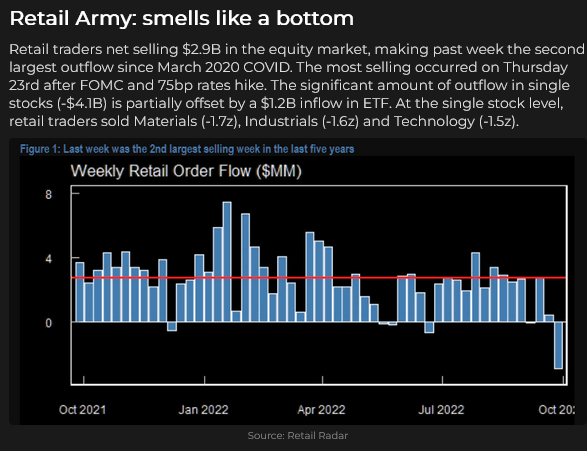

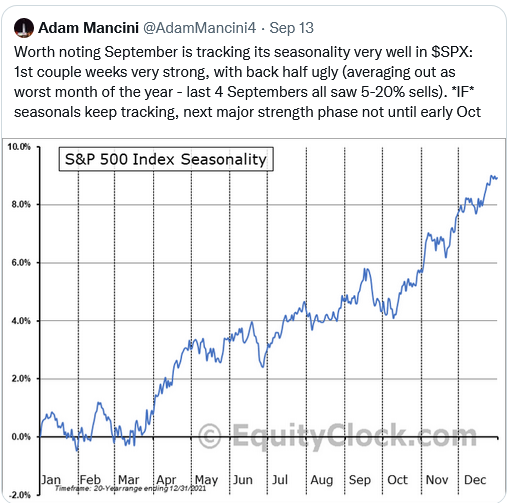

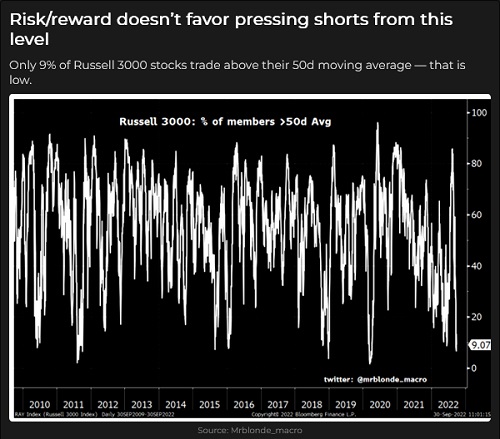

Stock and bond market sentiment has become increasingly negative (for a good reason!), but I’ve been expecting a short-term bounce to be followed by lower prices.

I’ve taken long positions in TNotes, stock index futures, the Canadian Dollar and gold. I’ve made some money (particularly on the Wednesday bounce), but I have small net realized losses at the end of the week.

It may look like I’m trying to catch a falling knife on a daily or weekly chart, but I watch for “higher low” patterns on intraday charts and buy small positions with tight stops – looking for a sharp short-covering rally.

So far, I’ve been early – which means, in my business, that I’ve been wrong!

At the end of the week, I’m long gold with small unrealized gains, and I’m (still) long OTM TNote calls which have lost about half their premium and time value.

In a nutshell, my current short-term strategy is making several bets where I think I’m risking 50 cents to make $5. I expect many of these trades to result in small losses.

I think it is far too late to “short” the market here, looking to catch (for instance) a 5,000-point break in the DJIA – without being prepared for the DJIA to rally back 5,000 points. I also have no interest in buying the market here (because it’s “oversold” and cheaper than it used to be) and gritting my teeth if/when it falls another 5,000 points.

There is a lot of “stress” in the market right now, which could lead to “forced selling,” which might, in turn, create a “falling dominos” scenario which would cause a “pivot” from the Fed (like we saw from the BoE this week.) I think the market is vulnerable to “event risk,” particularly a “credit event” where rising interest rates push “someone” over the edge with possible contagion ramifications.

Life risk management

Last week I noted that I had two good friends who took their own lives when markets moved hard against them. With the way markets are these days, I “know” that some people are under a lot of personal stress – maybe some people you know.

HEADSUPGUYS has saved 100s of lives. Don’t be afraid to share a link to their website with people you know.

Headsupguys.org is a project at the University of British Columbia with:

- Nearly 5,000,000 website visits (over 60,000/month – and growing) from around the world (Canada, US, UK, Ireland, Australia, New Zealand, Philippines, India, Pakistan, South Africa)

- 20 million people reached through ongoing social media promotions and campaigns

- More than 500,000 self-checks were completed by men aged 18+

- Over 32,000 followers on social media (Facebook, Twitter, Instagram)

- Over 120 media features (including CBC, Global TV, Huffington Post Canada, Huffington Post US, Huffington Post UK, The Mighty, Movember Radio, and The Telegraph)

- Over 80 sites linking to us as a formal resource (Movember (Canada and US), Canadian Mental Health Association, and The Anxiety and Depression Association of America )

The Barney report

Barney is living the good life. He’s well fed, well-loved, and well looked after. I weighed him this week, and despite all the food he’s been eating, he seems to be levelling off around 60 pounds. Maybe all the exercise he gets is keeping him from gaining weight.

He loves to run when we go out for a long off-leash walk, but he also loves to take it easy practically anywhere in the house.

Victor in Calgary October 20 – 22 to attend Josef Schachters’s Annual Energy Conference

The conference will run all day Saturday, October 22, at Mount Royal University in Calgary. Josef and his team have organized a fantastic conference, and if you have any interest in the energy markets, I highly recommend that you make plans to attend. Get all the info you need

A request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you’d like to see something new in the TD Notes.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. The October 1 podcast, with Luke Groman as Mike’s special guest, is at: https://mikesmoneytalks.ca.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair October 1st, 2022

Posted In: Victor Adair Blog