September 23, 2022 | The Fed Talks Tough as the Inflation Fighter

The Federal Reserve jumped its policy interest rate to 3 percent this week, from 2.25 percent.

The Fed reiterated its commitment to getting inflation back to the target level of 2 percent, from its current pace of around 8 percent. The Fed is talking tough.

Can the Fed walk the walk or is it just talk?

The policy rates of the Federal Reserve and the Bank of Canada are now about 3 percent. This is less than one-half of CPI inflation in the US and Canada. Canadian CPI was officially 7 percent in August while the US is about 8 percent.

Canada’s CPI this week showed food prices increasing by 11 percent year-over-year and most shoppers claimed that the “real” inflation rate for food is much, much higher.

In the US the Fed has two mandates. The goals are to keep inflation at 2 percent or lower and promote full employment and a strong economy. Even casual observers see that the Fed has failed often at avoiding recessions, with the 2009 global financial crisis (GFC) the most recent exhibit. Now the Fed is failing to meet its inflation goal also. And the Fed needs to recognize that bailing out speculators was never in their mandate.

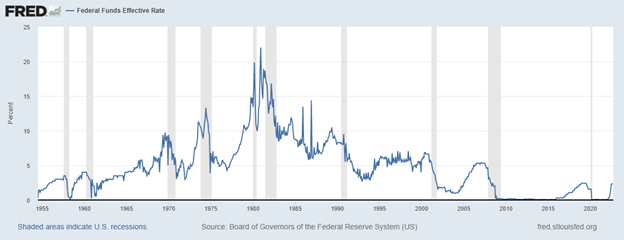

Post-GFC the Fed adopted the misguided policy of keeping interest rates at close to zero (officially 0.25 percent) for a very long time, from 2009 to about 2015. A similar policy of zero interest rates was maintained in Canada and England. In Germany government interest rates went to negative levels and stayed there for a long time.

In the context of a longer-term view and the benefit of hindsight those zero rates seem nonsensical now. And the recent angst over rates going up to (gasp) 3 percent is just as silly.

Every time the Fed tried to restore normality the markets panicked, and they moved rates back to zero. It was like telling an addict that there would be no more drugs. Markets were totally addicted to zero rates, and they put pressure on everyone to make sure that they got their fix.

And, until recently, the central bankers were agreeable to that approach as long as there was no evidence of a runaway surge in inflation.

The Fed was not watching financial markets closely enough. They ignored companies using debt to fund buybacks and dividends they could not afford. In Canada authorities refused to see the massive housing bubble that had taken shape right in front of them.

Now the current crop of central bankers — most are not the same people who were there during the 2009 to 2015 period —have to decide what is more important. To keep inflation under control — more accurately get inflation back under control — or appease financial markets when the next panic arrives.

There will always be another market panic. But central bankers should not be expected to abandon their inflation targets every time there is a frightening break in the stock and bond markets.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth September 23rd, 2022

Posted In: Hilliard's Weekend Notebook