March 2, 2024 | Trading Desk Notes For March 2, 2024

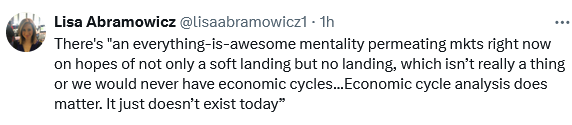

Key global stock indices surge to new highs; breadth at near record highs on “buy everything” sentiment

The S&P hit new All-Time Highs again this week, up 16 of the last 18 weeks for a gain of ~1,000 points (25%) from the October 2023 lows. During this rally, the S&P market cap has increased ~$8 trillion, or ~4X the Canadian GDP. The index has risen ~47% from the October 2022 lows and is up ~130% from the 2020 Covid lows.

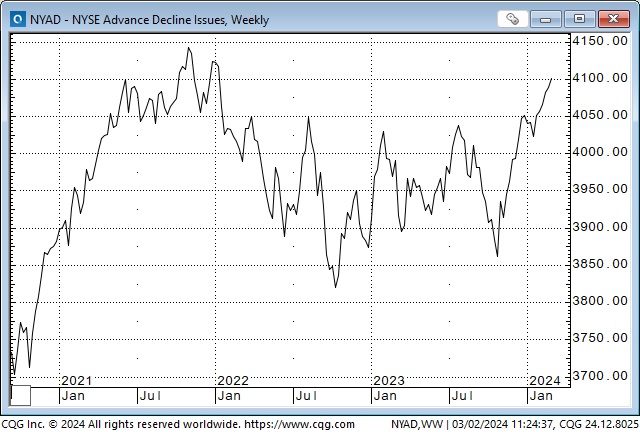

The NYSE A/D ratio hit a 40+ year high in 2021.

The DJIA has rallied ~7,000 points (22%) from the October 2023 lows; the NAZ is up ~ 29%. The broad stock market indices for Japan and Europe hit new All-Time Highs again this week, and the TSE reached a 22-month high. The Shanghai Index has rallied for three consecutive weeks after hitting 5-year lows in early February.

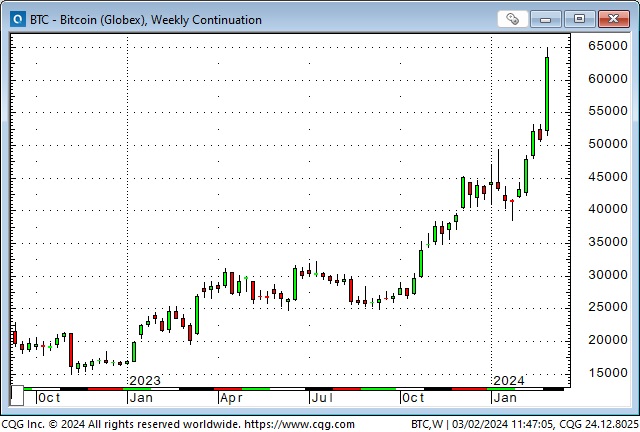

Cryptocurrencies also signal unrestrained bullish sentiment, with Bitcoin futures doubling from October 2023.

Stock index options volatility near multi-year lows signals a “complacency” with current market pricing and conditions.

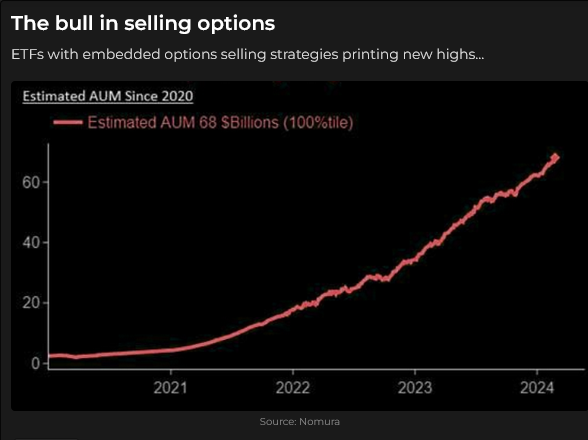

The “free money” siren song of selling options may indicate risk tolerance is rising.

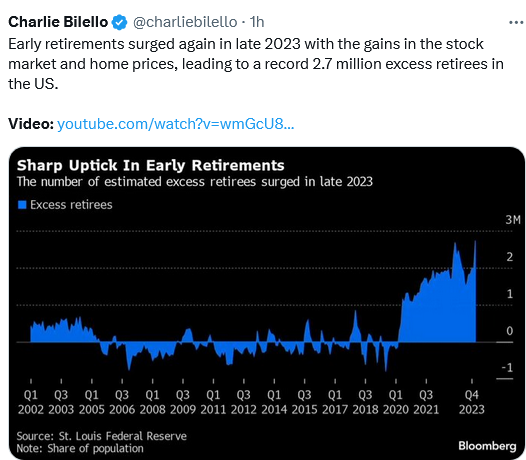

People are making so much money in the stock market and real estate that they no longer have to go to work!

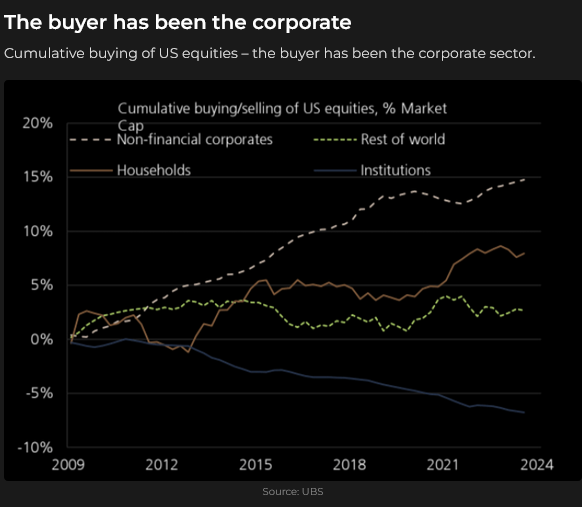

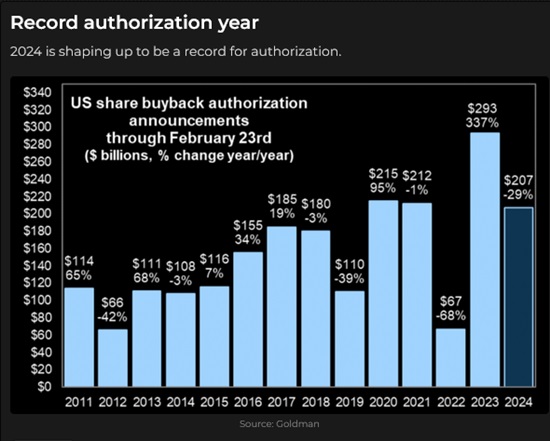

Corporate buybacks continue to be a significant support for higher share prices.

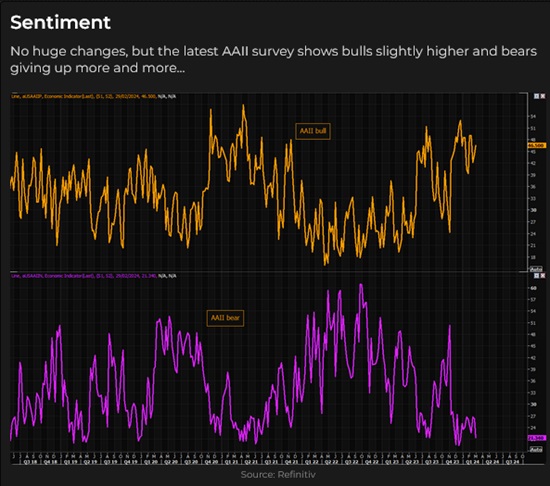

Sentiment

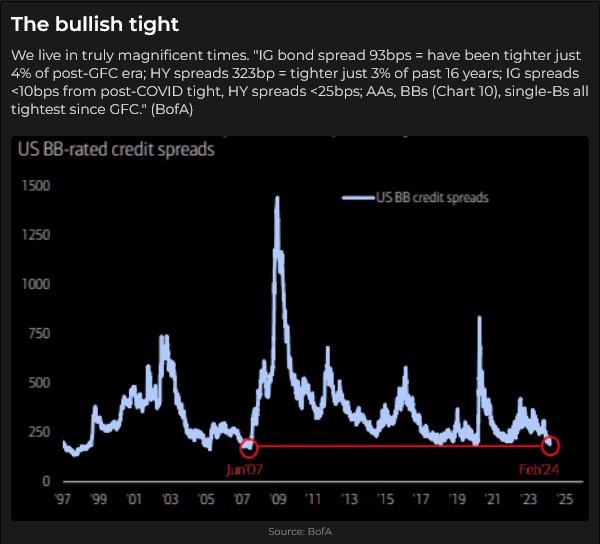

Current stock market sentiment reminds me of 2007 (not the 1999 Dot.com boom) when the S&P made new All-Time Highs, taking out the January 2000 highs after rallying ~100% in five years from the 2002 lows.

Currencies

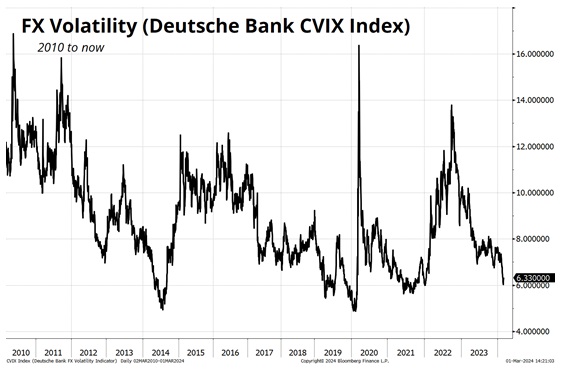

The recent currency market VOL has been near the lowest in the last ten years. (Chart thanks to Brent Donnelly.)

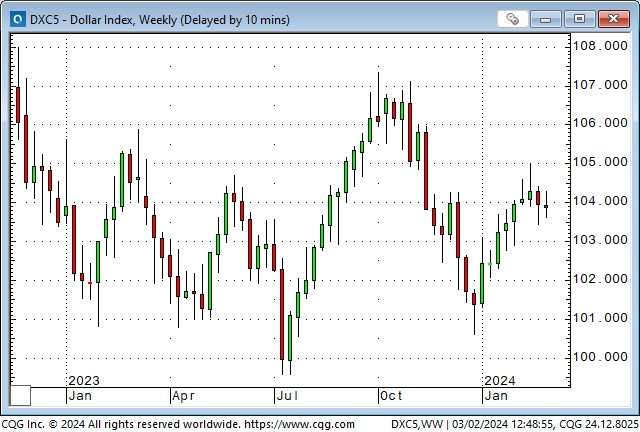

The US Dollar index rallied in January from the December lows but has gone sideways in February. Why is capital not flowing to the US (and pushing up the USD) with Europe struggling with low growth, Russia/Ukraine stress, and, compared to America, relatively few opportunities in the tech space? Is there a worry about soaring fiscal deficits? The deadlocked Congress? The prospect of Trump becoming President? The idea that the US stock market and economy are near “as good as it gets” and will weaken from here?

The Canadian Dollar has traded lower for nine consecutive weeks, falling from ~7600 to ~7350. The BoC meets Wednesday, March 6, with markets anticipating no change in policy – although they could be surprised with an interest rate cut.

The Japanese Yen has also traded lower for nine consecutive weeks, from ~7200 to ~6650 (~8%) to near 34-year lows. Open interest on the CME YEN futures rose to All-Time Highs (EX delivery period spikes) as large speculators have increased their net-short positioning to 6+year highs (up ~70% since Jan 1), likely assuming that Japanese authorities will not intervene (or change monetary policy) to support the Yen. Some analysts suggest that China may devalue the RMB to stimulate exports, which could pressure all Asian FX.

Interest rates

In mid-January, forward short-term interest rates were pricing 6-plus 25bps interest rate cuts from the Fed within the next twelve months. By early this week, with thoughts of a “recession” banished, the number of cuts had been reduced to ~3, with the first cut coming in June at the earliest. (Some commentators believe there will be no cuts this year and that the Fed’s next move will be to raise rates.)

As this week progressed and economic data came in a little softer than expected, forward short rates took a small step toward “more cuts sooner.”

10-year Treasury prices hit a 16-year low in October (with yields at 5%) and then rallied to a 5-month high in December as markets embraced the idea that inflation would continue falling and the Fed would be easing policy.

Since late December, however, bond prices have trended lower, with the market likely “concerned” about government deficits and Congressional deadlock. Late this week, bond prices rallied on softer economic data. The US employment reports are due next week, the CPI data the following week, and the FOMC meeting is on March 19-20.

Credit spreads have been very tight lately (corporates can (and are – in size!!) borrow at a narrow yield premium over governments.) If markets start to price in a “recession,” these spreads will likely widen as investors worry about the ability of corporates to service debt.

Gold

Front-month Comex gold futures closed at an All-Time Daily and Weekly High on Friday at $2,092. (Comex prices “very briefly” traded above Friday’s close in December, but a daily and especially a weekly higher close trumps those brief spikes.)

Gold futures rallied ~$50 on Friday to produce the record-high close, with the rally seemingly tied to the sharp tumble in treasury yields as markets pivoted to the prospect of easier Fed policy.

Gold had been “ignored” recently, with markets focused on high-flying stocks and crypto. Gold options volatility and open interest were both around 4-year lows.

Gold prices are at All-Time Highs against virtually all currencies (except the Swiss Franc – and that’s a narrow miss), and, as my good friend and world-renowned gold analyst Dr. Martin Murenbeeld likes to remind me, that is a classic sign of a robust bull market!

Gold may be hitting All-Time Highs against virtually all currencies, but the share prices of gold mining companies are not keeping up with gold, with Newmont, the world’s leading gold producer, trading around 2018 and 2019 lows when gold was ~$1200 – $1300. Readers who have an interest in gold may want to research Newmont.

Energy

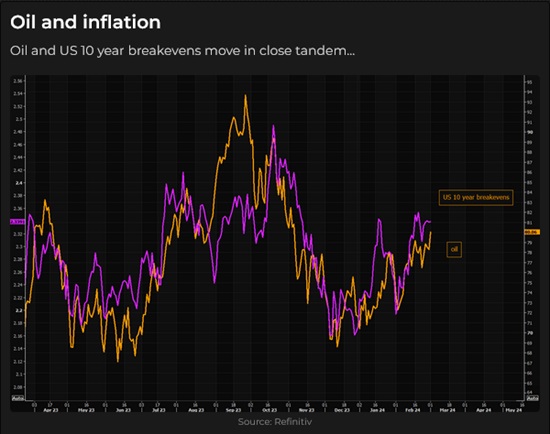

Front-month WTI crude oil futures traded above $80 on Friday for the first time in nearly four months.

Grains

Front-month CBOT corn futures fell to a 40-month low on Monday but rallied to close ~12 cents higher w/w on Friday.

Corn, wheat and soybeans rallied to near record-high prices on Russia’s invasion of Ukraine in 2022 but have tumbled since then as high prices (once again) proved to be the best remedy for high prices. Large speculators currently hold the largest net short corn position in five years.

This was the Economist magazine cover in May 2022, just before grain prices began a 2-year plunge.

My short-term trading

I started this week short the S&P, a position I established on Friday last week. I was ~45 points ahead on the trade before the PCE data report early Thursday morning and held the trade into the report as I was looking for a possible 100+ point move. The market rallied on the PCE report, and I was stopped during the overnight session for a slight loss.

On Wednesday, February 28, I bought OTM calls on corn and the Yen and bought September SOFR futures. I held all three positions over the weekend.

Corn and the Yen have historically massive net-short speculative positions and could have a sharp (short-covering) rally on bullish news. Buying OTM calls rather than futures is simply a risk-management move.

I bought the September SOFR futures, thinking the market had “gone too far,” pricing out Fed cuts on the notion that a “recession” will not develop.

I had considered making these trades for a week or more but waited for price action to give me a “sign” that the time was right.

On my radar

The BoC is on Wednesday, the ECB is on Thursday, and the FOMC is on March 19/20.

The US (and Canadian) employment reports next week and the CPI/PPI data the following week could jolt markets.

I think the equity markets are in an “irrational exuberance” mode, and I will continue to look for price-action setups to get short. I’ll trade small size and use tight stops.

I missed buying gold (I could have had a buy stop above the market, but I didn’t.)

I’m watching Nat Gas for a buy, with prices around 30-year lows and large spec net-short positions.

A few weeks ago, I suggested that TSLA would be booted out of the MAG7 for share price performance unbecoming a member. I think I must add AAPL and GOOG to that list, which reduces the MAG7 to the MAG4: NVDA, MSFT, AMZN and META.

AAPL had ~20% of sales in China, which doesn’t look like it will continue, and some folks wonder if Mr. Buffett is a seller.

GOOG seems to have a disaster with Gemini, which fits my idea that GO WOKE / GO BROKE may develop into a powerful trend. (Here’s hoping!)

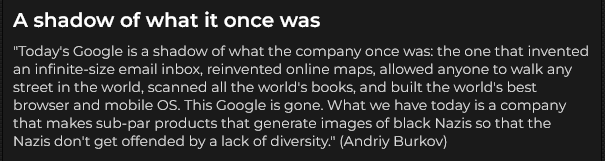

I’ve recently posted charts from Charlie Bilello showing that prices for used Tesla cars have fallen ~50% from year-ago highs. I’ve seen that various EV makers are cutting back production (AAPL has cancelled going into production), and share prices of various EV companies have fallen sharply (TSLA shares are down ~30% from July 2023 highs.) Was all the hype over EVs just a fad (like Toyota said it was?)

Brian Mulroney

Brian Mulroney died this week. He was the Canadian Prime Minister from 1984 to 1993. There was a time in the mid-1980s when he, Ronald Regan and Margaret Thatcher were all leaders together. Now they are gone.

The Barney report

I weighed Barney last week; he was 70 pounds, a new All-Time High. He’s mostly muscle and bone; he gets so much exercise that he has no fat. He gets a good three walks a day, and I usually get him out at midday for at least an hour of off-leash running in the forest. He loves being in the forest!

Listen to Victor talk markets with Mike Campbell

I did an interview with Mike this morning on his Moneytalks show. We discussed the “giddy” mood of the stock and crypto market, insider selling, Warren Buffett being happy with T-bills at 5.5%, Gold and gold shares and especially Newmont at $30. Mike’s special guest this week is mining legend Frank Guistra. You can listen to the show here. My spot with Mike starts around the 59-minute 40-second mark.

The Archive

READERS CAN ACCESS WEEKLY TRADING DESK NOTES GOING BACK SEVEN YEARS BY CLICKING THE GOOD OLD STUFF-ARCHIVE BUTTON ON THE RIGHT SIDE OF THIS PAGE.

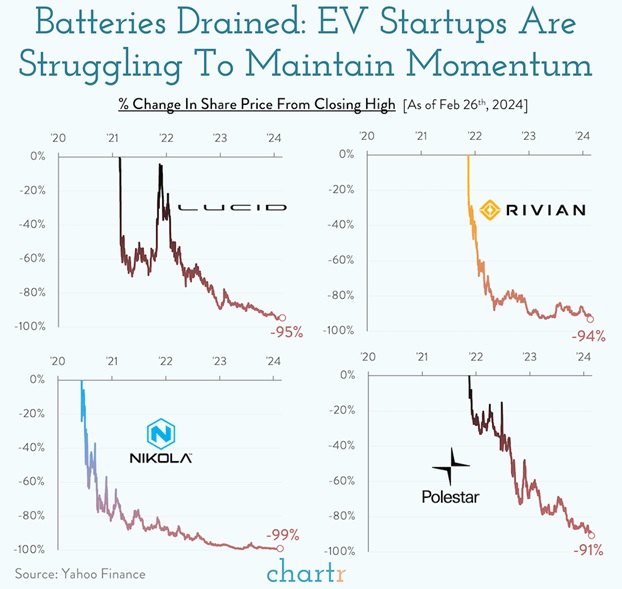

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair March 2nd, 2024

Posted In: Victor Adair Blog