March 28, 2024 | How Inflation Hurts Our Kids, In 5 Charts

In 1971 the US, along with most of the rest of the world, tried something new. They ditched their previously gold-backed money in favor of “fiat” currencies backed only by citizens’ trust in central banks and politicians.

The results were profound, as the dollar lost about 90% of its purchasing power. But the real damage was generational: Eroding currencies ended up enriching the architects of the plan and their kids (i.e., the baby boomers) while impoverishing subsequent generations. Here’s a guided tour, in five charts:

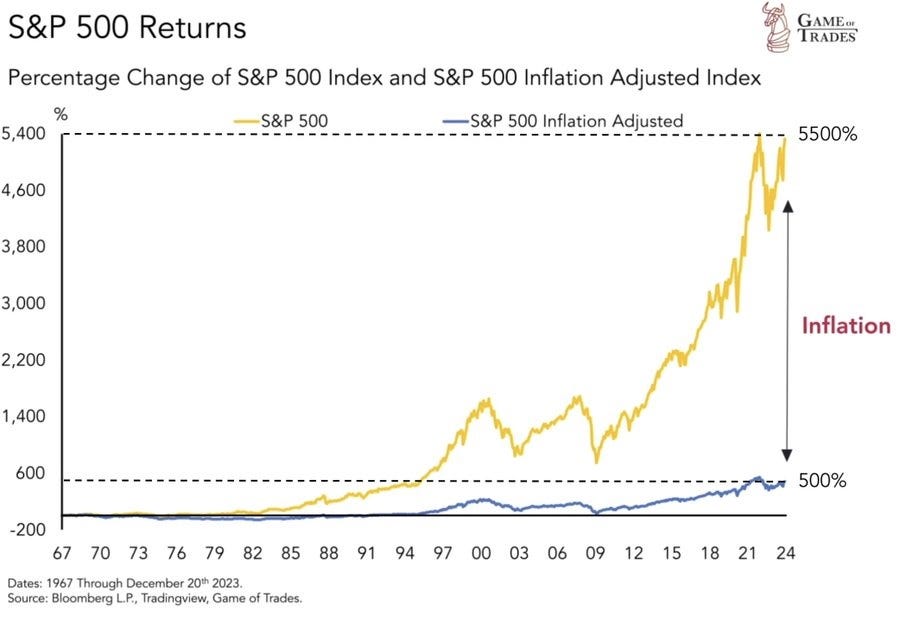

During the fiat experiment’s 53 or so years, equity prices have risen by about 500% adjusted for inflation and ten times as much in nominal terms. That’s what monetary inflation does to financial asset prices.

Now notice the timing. The blow-off part of the run came just as baby boomers (born between 1946 and 1961) were entering their big saving/investing years in the 1980s and 90s. They were able to spend 20 or so years buying stocks which then took off on a historic run.

In contrast, when the millennials (born 1981 to 1996) entered their saving and investing years in the 2000s, they were too late to the party to accumulate real financial wealth.

The result was, in effect, a wealth transfer between the people who owned rapidly inflating stocks at the beginning of the run and the vast majority of people who didn’t own stocks but had to pay for an ever-rising cost of living. Boomers (and to a lesser extent Gen X) got richer while their kids and grandkids stagnated.

Home sweet capital gain

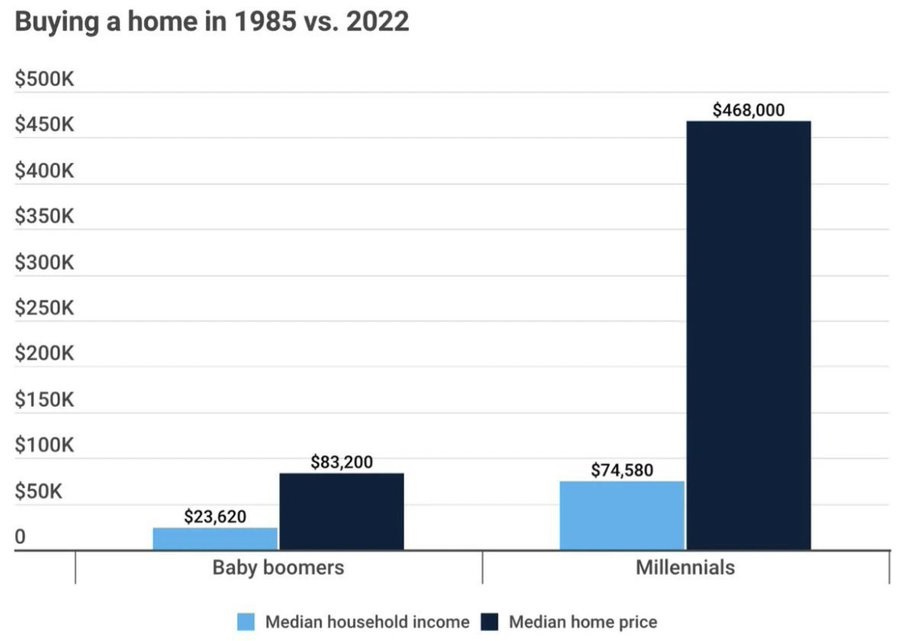

Same thing with real estate. Boomers entered the housing market early in the fiat currency experiment when prices were low, both in nominal terms and relative to wages. So their homes were swept up on the inflationary tide, rising much faster than incomes for the next four decades. Millions of boomers became “house-rich,” regardless of their subsequent career success.

Millennials, here again, came of age in an inhospitable real estate market where the typical house costs more than the typical family earns, effectively closing them out of both home ownership and real estate appreciation.

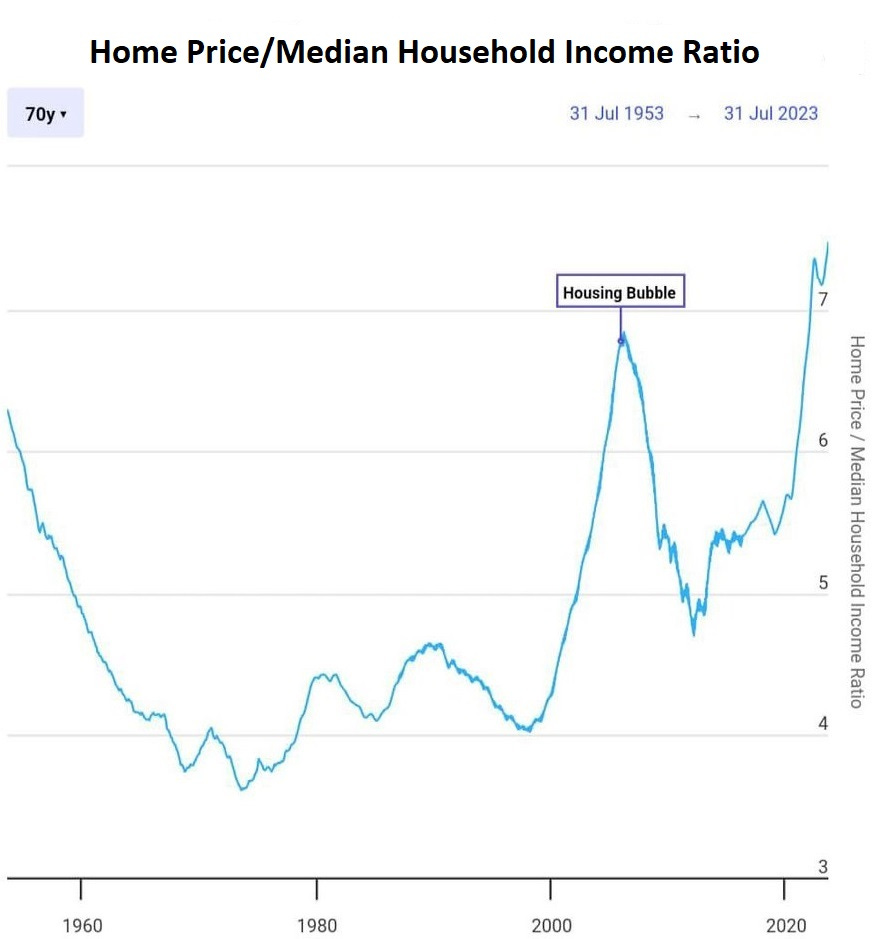

The next chart tells the same story in a slightly different way. 1980s boomers lived in a world where the average house cost 4 times the median household income, while today’s millennials are surrounded by houses that are, relative to incomes, almost twice as expensive. Which is to say mostly out of reach.

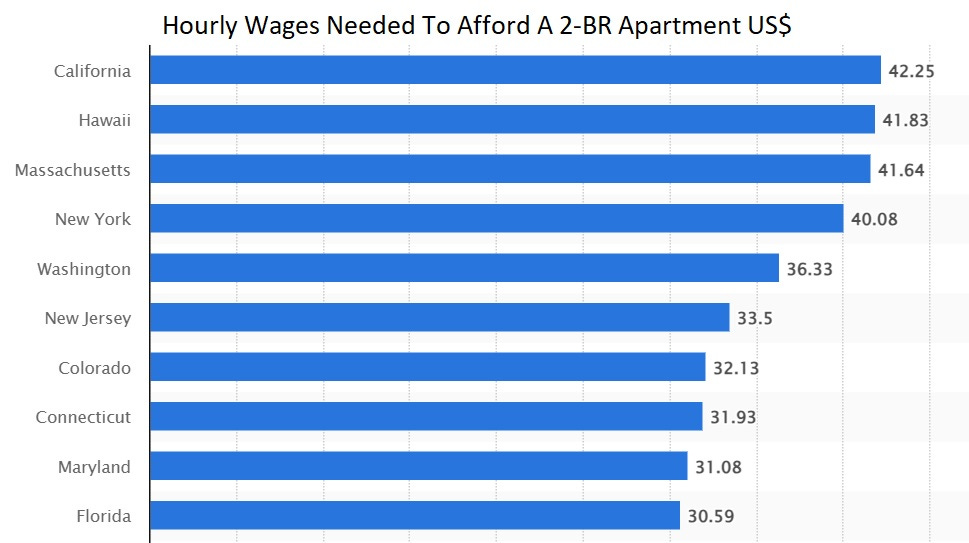

Same thing with rents

Rental apartments were cheap in the 1970s and 80s, but since then, inflation has sent them up much faster than incomes. In high-cost-of-living states, it takes an hourly wage of between $30 and $42 to afford a 2-BR apartment. $30/hour equals $60,000 per year. How many millennial or Gen-Z workers make that kind of money? Probably fewer than half.

To sum up, inflation didn’t affect the US population evenly. It enriched one group and impoverished others, tearing some very big holes in the fabric of society. When people talk about “unsound money” destroying a culture, this is part of what they mean.

Now it gets really intense

Two big trends will add a dramatic final chapter to the fiat experiment:

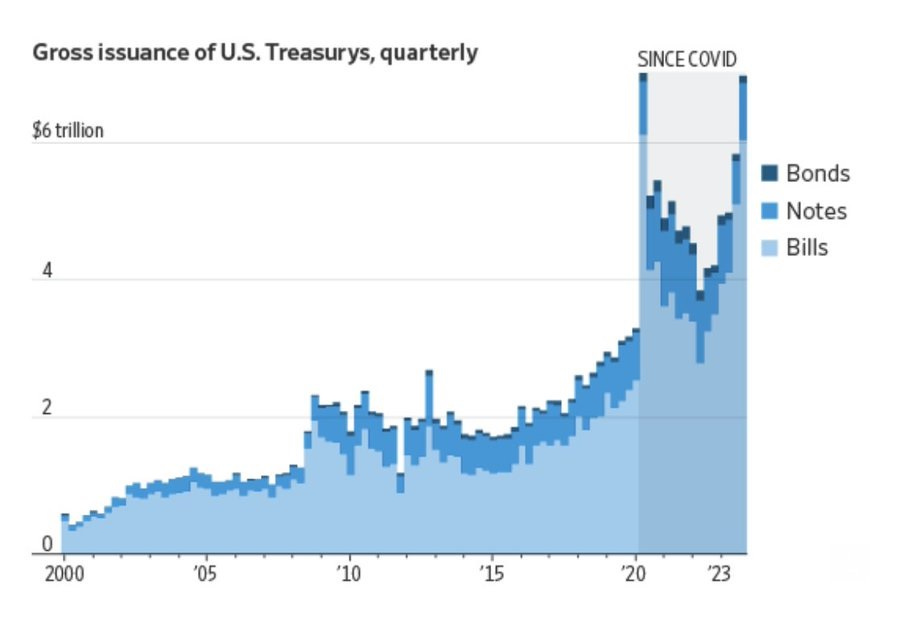

Big Trend #1: Governments around the world have basically given up on fiscal or monetary discipline, and have entered the blow-off stage of currency debasement. The US government’s borrowing — already dangerously aggressive pre-pandemic — has now gone almost literally off the chart. The current schedule calls for $10 trillion of new paper to be sold in 2024, raising the question of who will buy it. The answer: If China declines (as it will), the only remaining candidate is the US Fed and its printing press.

The upshot: If inflation was a dominant and divisive force in the previous few decades, we haven’t seen anything yet

Big Trend #2: The oldest boomers are now in their 70s. Many are helping their kids and grandkids with housing, tuition, and health care, while other boomers are dying and distributing their accumulated wealth to their descendants. Some might say better late than never. But others might say justice delayed is justice denied.

The problem for all concerned is that inflationary booms don’t end with a whimper in which some assets are shuffled around and everyone settles into a comfy new normal. If history is a reliable guide, millennials and Gen-Z might finally get their hands on that boomer wealth — just as it evaporates in an epic bust. That is unless Grandma and Grandpa were gold bugs.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino March 28th, 2024

Posted In: John Rubino Substack