February 28, 2024 | Recession Watch: Deficits And AI Versus The Real World

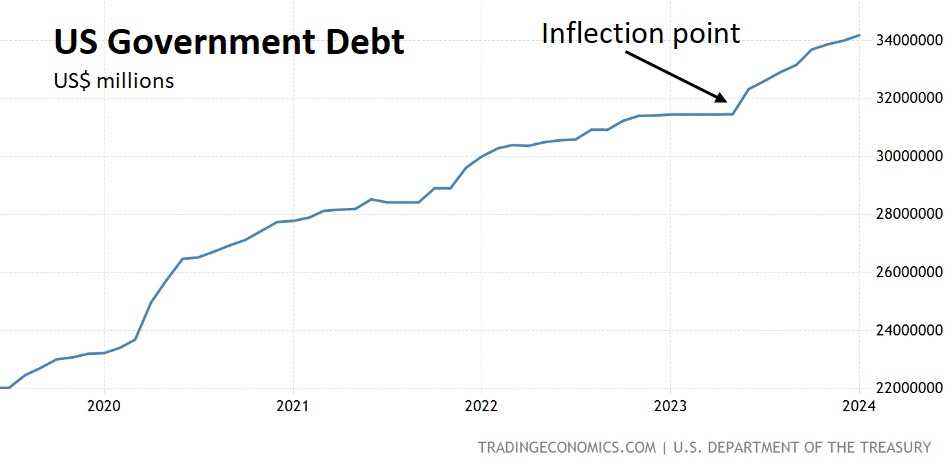

Two things are keeping the US economy afloat right now. First is massive deficit spending, as the US dumps about $2 trillion of borrowed money into the banking system each year:

Second, the AI “instant bubble,” is sending huge amounts of capital into a handful of tech stocks, thus levitating the entire market. See the “market structure” section below.

These two things do contribute to near-term growth. But arrayed on the other side of the argument is a long list of trends pointing in the other direction. Some of what follows has been covered in previous posts in this series, but they’ve gotten even more negative since then.

Tapped-Out Consumers

The excess savings built up during the pandemic have been spent:

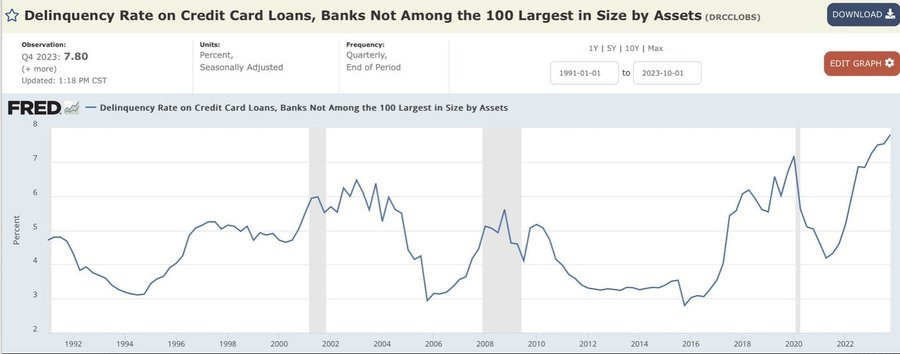

A growing number of people are putting day-to-day life on plastic, and then failing to make even the minimum payments:

Fragile Market Structure

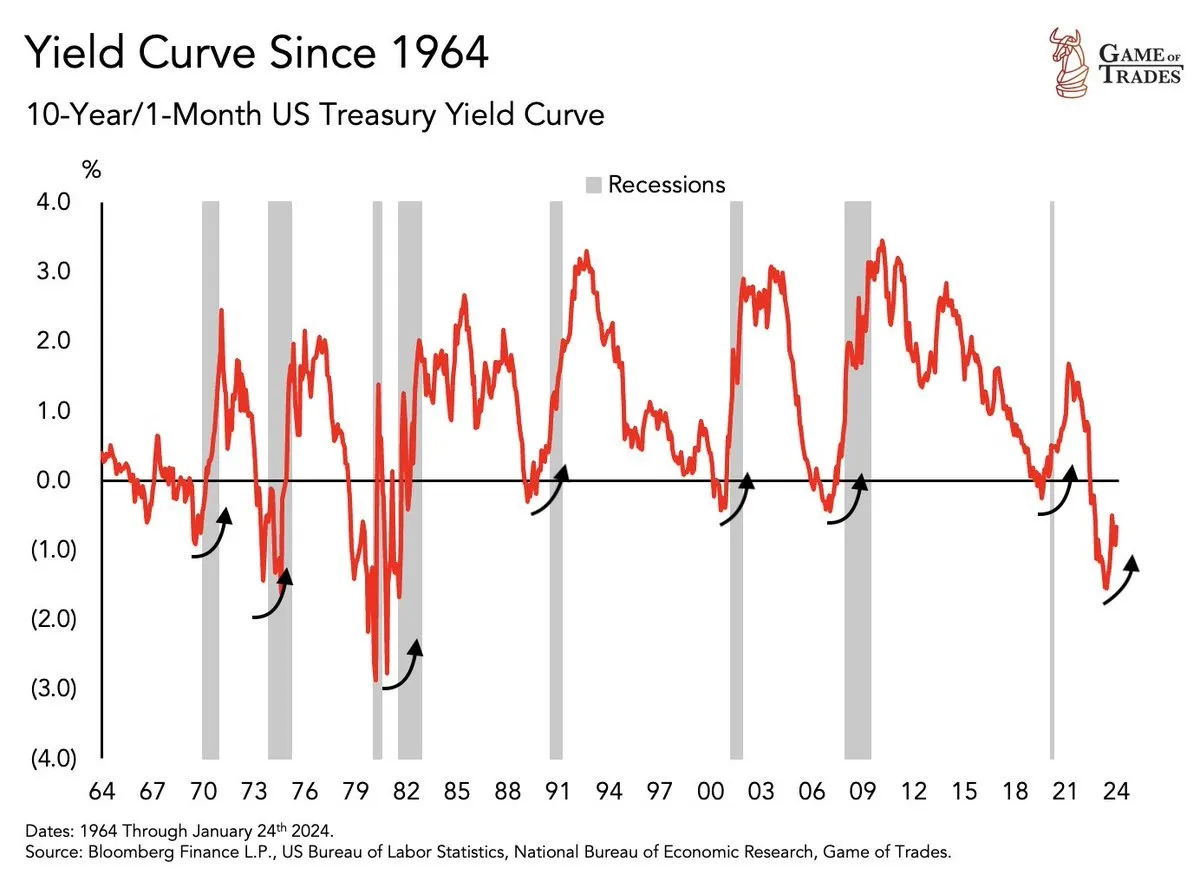

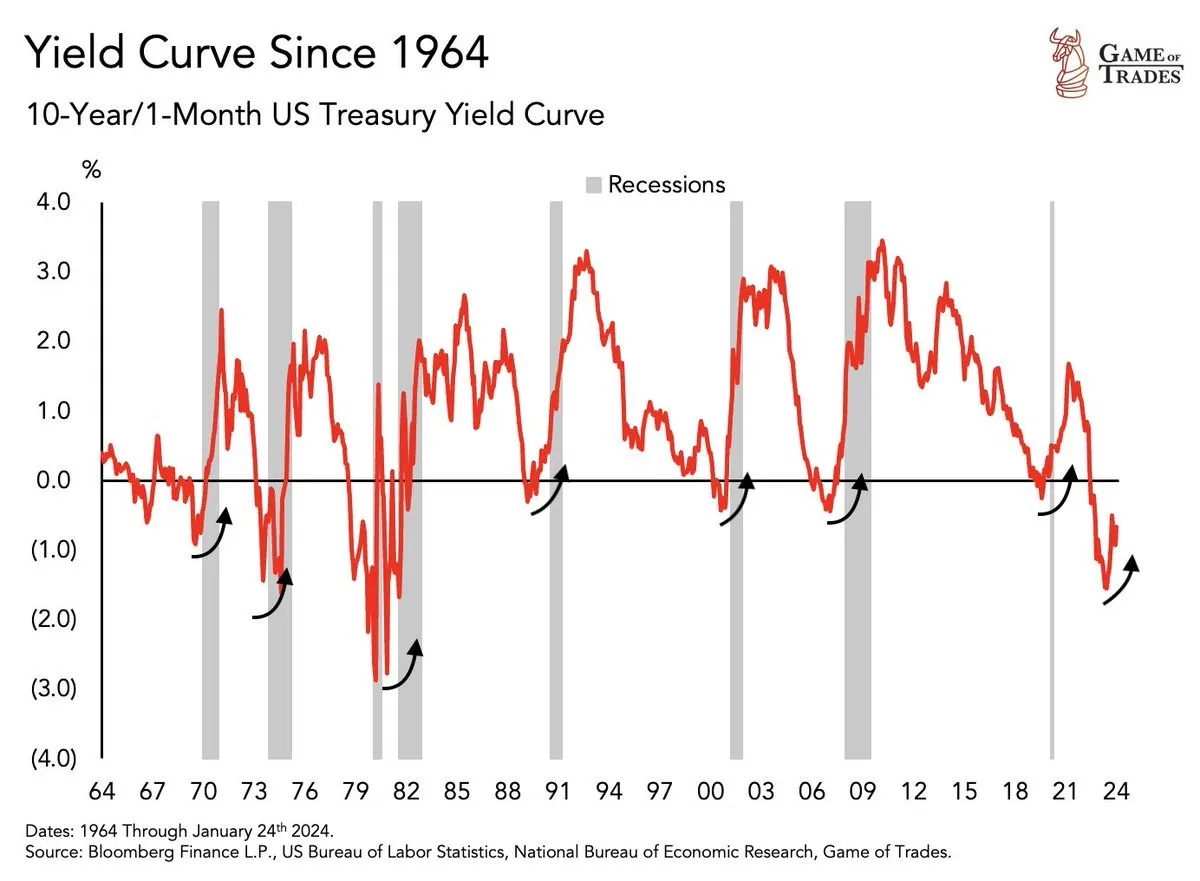

The yield curve is a great recession indicator — but with a lag. The real recession signal is not when the curve inverts, but when it starts to “un-invert”:

Today’s AI bubble is bigger than the 1990s tech bubble in terms of both capital flows and the resulting extreme valuation for the handful of stocks that are leading the charge. The green columns below show the PE ratios of the 10 biggest (by market cap) S&P 500 companies. This is what all those “The stock market has bad breadth!” articles are pointing out.

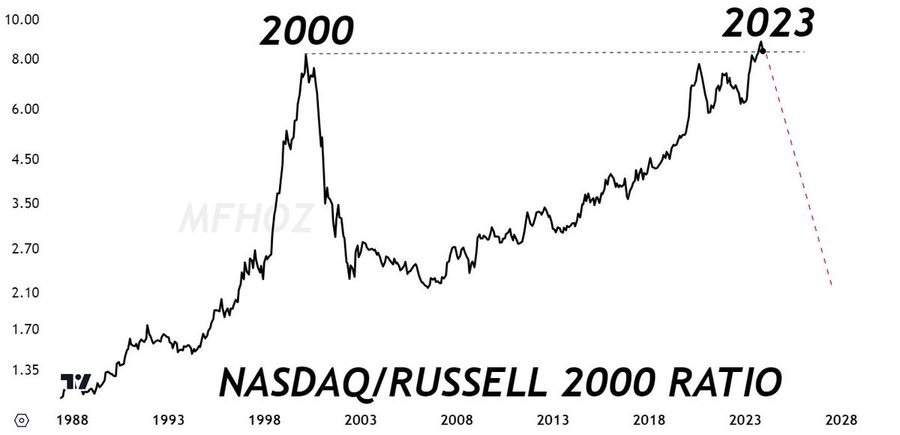

Another way of analyzing market breadth is by comparing the tech-dominated NASDAQ to the much broader Russell 2000 index. In retrospect, this ratio was screaming “crash” in early 2000. And it’s right back there today:

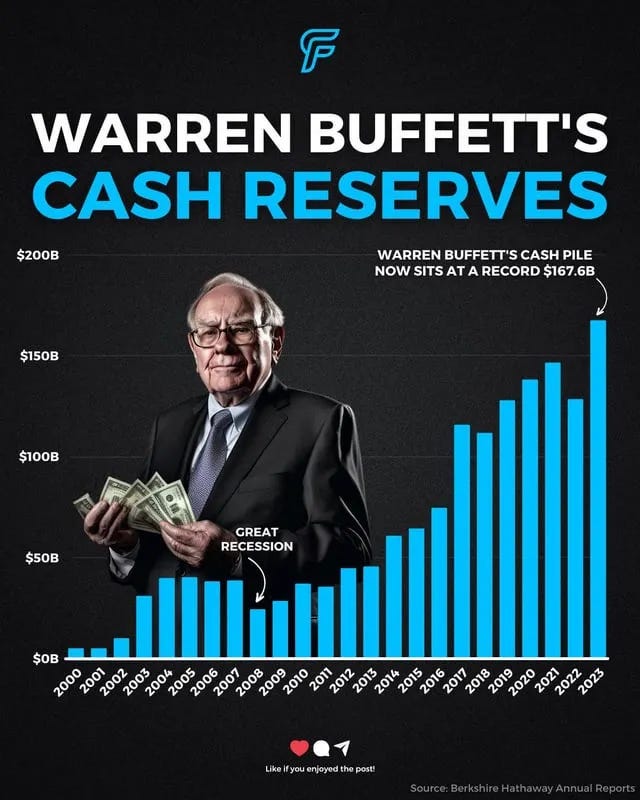

Warren Buffett tends to build up cash heading into market peaks, and today he has more than three times as much as before the last crash.

Overvalued Real Estate

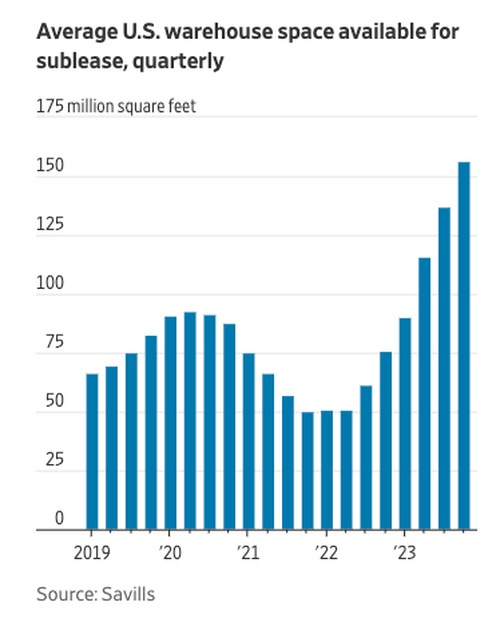

Highly leveraged buildings are among the first things to crash in recessions. Today’s likely suspects include the warehouse buildings, where the recent construction binge was apparently way overdone:

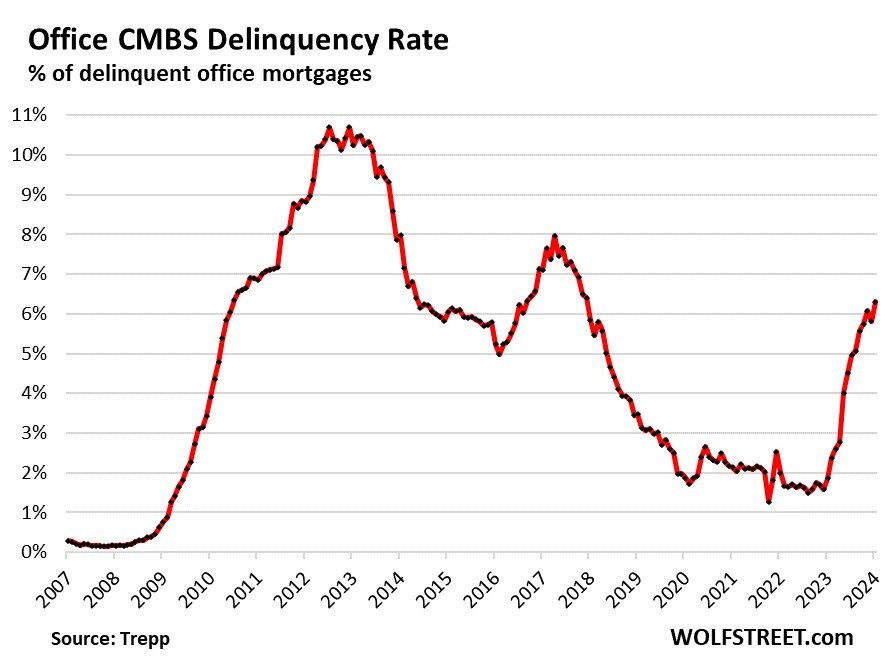

But office space is the epicenter of the coming CRE bust, as related debt starts to default:

And now that mortgage rates are back above 7%, only cash buyers are left to buy wildly overvalued houses. This won’t last. Here’s a video explaining what happens next:

Summing Up

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino February 28th, 2024

Posted In: John Rubino Substack