January 11, 2024 | Prices Fall and Home Listings Rise as Canadians Struggle with Overhead

When Canadians sell a property for less than is owed in the mortgage, lenders are entitled to pursue any balance remaining plus interest, fees, and legal costs; this includes garnishing bank accounts and income.

For those in debt strife, it’s wise to speak with an Insolvency Trustee to consider if you may be a candidate for bankruptcy or a consumer proposal that negotiates outstanding sums down to a feasible repayment plan and often allows debtors to keep their home and other assets. See more here.

The latest MNP Consumer Debt Survey found Canadians’ current debt perception at an all-time low, with 63% of respondents saying they were worried about their ability to repay their loans.

“Spending on credit has served as a relief mechanism for many to keep up with increasing costs, especially for lower-income Canadians. We see from the data that the burden of repaying that debt is exacerbating the growing financial strain for many households, particularly amid higher interest rates,” says Grant Bazian, president of MNP LTD, the country’s largest insolvency firm. “Most things cost more and debt repayment costs more. That leaves more Canadians feeling pessimistic about paying off debts, making ends meet, and about their financial futures.”

Meanwhile, most Canadian mortgages face much higher interest rates on term renewals every month through 2024-2026. Adding to costs, the City of Toronto just announced plans for a 10.5% property tax increase, and other cash-strapped municipalities are likely to follow suit.

For-sale listings are rising daily in most areas, and the price drops for any selling are significant. This is not likely to turn around quickly. Fewer transactions and lower prices also mean less land transfer tax revenue for provinces.

🚨🇨🇦 $640,000 Loss.. Dear God.

🤯The is the biggest $ loss I’ve seen in Brampton from the top.

🏠 People who bought in 2022 who are selling now are seeing devastating losses. 📷

💰How many are selling because their payments have jumped? Why else would you sell so soon? 📷

— Jason G. (@jasongofficial) January 10, 2024

📢 $320k Down the Drain in Kitchener 💸

📍Kitchener, ON 🇨🇦

More bloodshed for homeowners who bought at the top of the market. 📉

Bought in February 2022 for $300k over asking, this Kitchener end unit townhome was just sold after a month on the market for a $320k loss. 💔

Not… pic.twitter.com/spyDD0cBgO

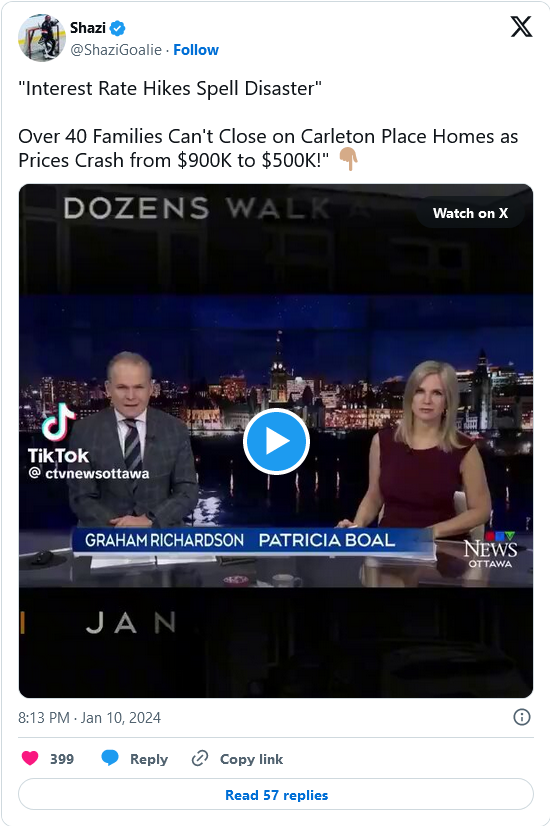

— Shazi (@ShaziGoalie) January 10, 2024

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park January 11th, 2024

Posted In: Juggling Dynamite

Next: Migrant Crisis Motive Revealed »