December 6, 2023 | Subprime Comes Home to Roost for Specialized Auto Dealers, Lenders & Investors: Car-Mart Was Next to Confess

Subprime is re-getting into trouble, after having somewhat gotten out of trouble during the free-money pandemic, when folks used some of the free money to catch up with past-dues.

In the auto industry, subprime is largely confined to older used vehicles. Less than 5% of new vehicle sales are financed with loans or leases to subprime-rated customers (more in a moment). The sweet-spot is 8-to-12-year-old vehicles, only a corner of the used vehicle business. But in that corner, several subprime-specialized dealer-chains – owned by PE firms – have already filed for bankruptcy this year, and we covered a couple of them here. Others are struggling.

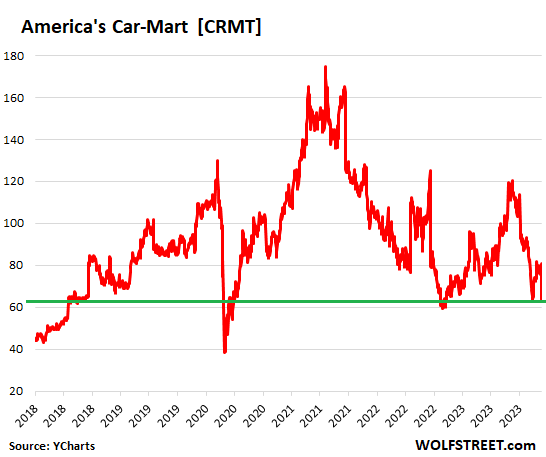

Yesterday, it was the turn of America’s Car-Mart – a publicly traded subprime-specialized used-vehicle dealer chain – to confess in its quarterly earnings, upon which its shares [CRMT] tanked by a combined 21% yesterday and today. They’re down by 61% from the free-money peak in August 2021. What felled the shares yesterday and today was the disclosure of a massive jump in charge-offs and loan losses (chart via YCharts):

Car-Mart has 154 stores in smaller cities in the South-Central US. It sold over 15,000 used vehicles in the quarter and generated $362 million in revenues, including $59 million from interest income from those high-interest rate loans that its subprime customers use to fund their purchases of the overpriced vehicles.

Subprime is the mother lode of profits – until it isn’t.

Car-Mart is a good example. But they all work on a similar principle. Subprime-rated customers are the motherlode of profits for subprime-specialized auto dealers because these customers have few other choices left; they tried other dealers and got turned down because their credit is bad, and so they find a dealer that will provide the loan, and the rest doesn’t matter.

These specialized dealers make huge amounts of profits on each sale in several ways, well, until they don’t:

- Selling the vehicle at a ridiculous price and profit margin

- Charging dizzying interest rates on the loans

- Selling insurance and warranties, usually provided by their own affiliates.

- Charging late fees

- Servicing the loan after it has been securitized and sold to investors.

Huge gross profits per unit sold. Car-Mart reported an average gross profit per vehicle sold of $6,835 – on vehicles with an average selling price of $19,035. So that’s a gross profit per unit of around 35%.

Dizzying interest rates. For the auto industry overall, data from Experian shows how high those interest rates were for “subprime” auto loans (FICO score of 501-600), and “deep-subprime” loans (300-500). The table compares Q3 2023 and Q3 2022. Note the increases in rates:

| Average Interest Rate by FICO Score, per Experian | ||

| Q3 2023 | Q3 2022 | |

| Deep subprime | 21.2% | 20.2% |

| Subprime | 18.4% | 16.8% |

| Near prime | 13.5% | 11.3% |

| Prime | 9.3% | 7.0% |

| Super prime | 7.4% | 5.0% |

Car-Mart provides these loans via its finance subsidiary, Colonial Auto Finance, and generated $59 million in interest income in the quarter, up from $48 million a year ago.

So let’s ballpark an average interest rate based on the sparse numbers Car-Mart provided: It carried $1.1 billion in finance receivables at the end of the quarter. So very very roughly, the quarterly interest income of $59 million ($236 million annualized) would amount to an average annualized rate of very very roughly 21%.

Average total collected per month per customer in principal, interest, and late fees rose to $533. So these customers are paying out of their nose on a monthly basis for an older used vehicle.

But only about 80% of the outstanding loans are “current,” roughly unchanged from a year ago, while 20% are in arrears.

What makes this business extra-risky is that dealers are selling hugely overpriced cars at huge interest rates to people who can least afford them. It’s like a self-fulfilling prophecy: Because the people have a history of defaulting on their debts, they represent a big risk to lenders, and many lenders won’t lend to them. Lenders that do lend to them make up for the risk by charging them extra, which inflates the monthly payments, which further increases the risks.

In this case, the dealer-lender charges them extra for the vehicle and finances it at very high rates, which caused the payment on these old cars to be very high, which increases the likelihood of a default. And you know what’s coming.

The risks came home to roost.

In its quarterly report, Car-Mart announced that it had a pre-tax loss of $35.6 million. By comparison, a year ago, it had a pre-tax profit of $4.1 million.

The reason was a massive increase in the allowance for credit losses. Credit losses are always big, which is in the nature of the subprime business. And the above discussed big-fat profits more than make up for them, normally.

But for the quarter, provisions for credit losses jumped by 52% from a year ago, to $135 million (from $89 million a year ago).

Net charge-offs jumped to 7.2% of average finance receivables in the quarter, up from 5.8% a year ago.

But wait… a return to pre-pandemic normal. That 7.2% of net charge-offs was in line with the pre-pandemic rate. Over the five years before the pandemic, net charge-offs had averaged 7.0%, the company said, “signaling a return to pre-pandemic net charge-off percentages.”

But wait again... more than just a return to pre-pandemic normal. The company said:

“Both the frequency and severity of losses played a factor in the increase, with frequency driving approximately two-thirds of the increase primarily due to the external environment.

“Severity was driven by longer contract terms and lower recovery values.

“We have experienced increases in both frequency and severity on some 2021/2022 [loan] pools as well.”

Tightening a little late. Car-Mart is doing what everyone else in the subprime business is doing: tightening their underwriting, including “higher down payments” (down payments averaged just 4.9% in the quarter) and shorter terms (the average term was 44.1 months).

Subprime hinges on auto-loan securitizations.

For subprime-specialized dealers, it all hinges on being able to securitize those loans and sell these Asset Backed Securities to investors, and slough off some of the risks. Dealers sell the vehicle, and make a ton of money on the sale, as Car-Mart has shown, and they provide the loan at a very high interest rate, as Car-Mart has also shown. And they gather those loans into big loan pools, and once or twice a year they securitize those loan pools and sell the resulting ABS to investors.

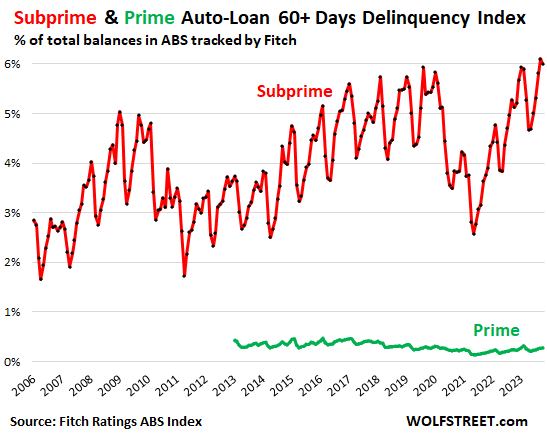

The 60-day delinquency rates of the subprime loans in the ABS that Fitch rates rose to an all-time high in September of 6.1%, having squeaked past the pre-pandemic high in August 2019. In October, it dipped a hair to 6.0%. A dip in October is seasonally typical.

But note that prime-rated loans are in pristine conditions (green line).

During the era of interest rate repression, yield-hungry investors loved those subprime auto-loan-backed ABS, but now, they don’t. And the fabric is coming apart.

As ABS investors have started to take losses and get skittish, a bunch of subprime-auto-loan backed ABS deals got scuttled recently, and dealers got stuck with those loans. Other deals had to be renegotiated before they could be sold.

When these deals cannot be sold, the dealers get stuck with the loans and can run out of money. As mentioned a minute ago, several subprime dealer-chains have filed for bankruptcy this year.

So credit is tightening in subprime. But just how big is it?

4.3% of new vehicles sales: In Q3, 21% of all customers paid cash, according to Experian which uses the credit data it collects from lenders and from registrations (liens). Of the remaining 79% of customers that financed with a lease or a loan, 5.4% were rated subprime, which translates into 4.3% of all new vehicle sales.

7.7% of used vehicle sales. In Q3, 63% of customers paid cash for their used vehicle. Of the remaining 37% who financed, 20.7% were customers with subprime credit ratings, which works out to be 7.7% of total used vehicle sales.

So subprime is a high-risk-high-profit business on the specialized fringes of auto sales. But the players in that small portion of auto sales are taking big hits. The risks they had taken were too big, and during the 0%-era they’d gotten too greedy, and now they bear the consequences of loading their customers up with ridiculously overpriced vehicles financed with usurious rates, all of which was very profitable until the risks came home to roost.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Wolf Richter December 6th, 2023

Posted In: Wolf Street

Next: Stock Markets in 2024 »