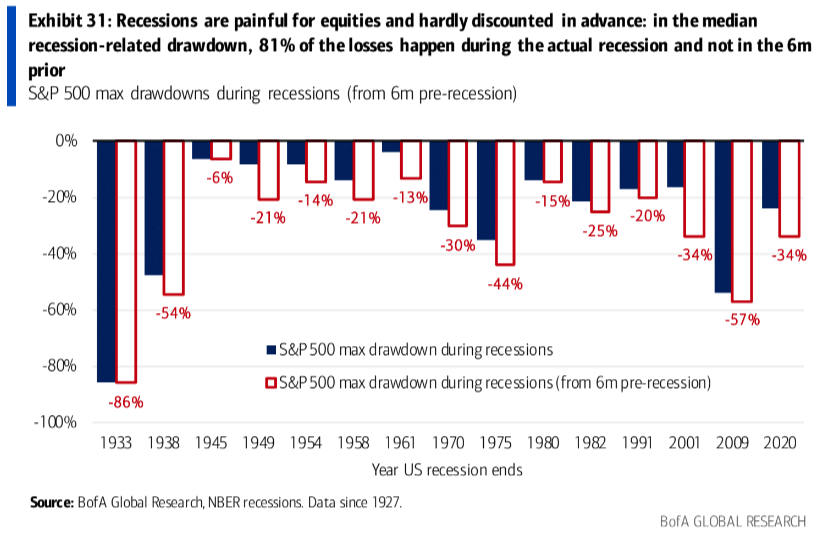

Reminder: while equity bear markets typically start from full employment and an expanding economy, the bulk of cycle losses (81%) happen once recessions begin (blue bars below since 1933), when the unemployment rate is jumping, and central banks are slashing monetary conditions once more.

Canada’s TSX has gone nowhere since June 2021, but propped up by a nearly 20% weight in (late cycle) oil and gas, it’s so far just 9% from its April 2022 peak. Past recessions have seen the cyclically-sensitive TSX drop more than 40% as fossil fuel demand finally implodes. Financials (30% of the TSX) lead the market cycle and the Canadian finance sector (XFN) is off 16% since March 2022. The US financials ETF (IYF) is -9% since it peaked in November 2021 and the US regional bank index (KRX) remains -29% since January 2022.

Canada’s TSX has gone nowhere since June 2021, but propped up by a nearly 20% weight in (late cycle) oil and gas, it’s so far just 9% from its April 2022 peak. Past recessions have seen the cyclically-sensitive TSX drop more than 40% as fossil fuel demand finally implodes. Financials (30% of the TSX) lead the market cycle and the Canadian finance sector (XFN) is off 16% since March 2022. The US financials ETF (IYF) is -9% since it peaked in November 2021 and the US regional bank index (KRX) remains -29% since January 2022.

If central banks start cutting in 2024, the equity market should bottom months later. We aren’t there yet. Rising loan loss provisions crimp bank earnings and are part of what triggers the next leg down. The discussion below illuminates.

Bay Street Veterans discuss what Canadian banks being hit by higher-than-forecast provisions for loan losses signal regarding the economy. David Rosenberg, Founder and President of Rosenberg Research says Canada’s household debt is concerning. Meanwhile, Ed Devlin, Founder of Devlin Capital, Senior Fellow at C.D. Howe Institute and Former Head of Canadian Portfolio Management at PIMCO says there is a lot of distortion happening because of immigration, including housing prices not coming down as fast as expected amid rate hikes. Here is a direct video link.