October 27, 2023 | The Bank of Canada Needs To Worry About a Recession

The Bank of Canada kept its official interest rate at 5 percent on Wednesday, October 25, 2023. The Governor, Tiff Macklem, emphasized that the BOC is willing to hike rates higher if needed, as he is not happy with the rate of decline in the inflation measures.

But the BOC also issued a lower forecast for GDP for this year and next, which shows a risk of recession.

Should the BOC be more worried about growth in Canada, or inflation? What are the risks of recession in 2024?

The Bank of Canada continues to worry about an economy that is too strong, with upward pressure on wages and the rising cost of housing. But signs of incipient weakness in the economy in Canada continue to build, especially in the housing sector.

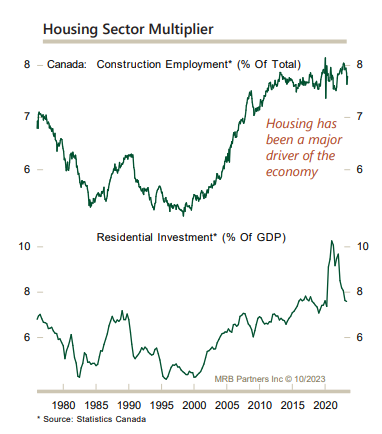

The residential real estate sector is one of the most important in Canada for providing investment and jobs. The Statistics Canada calculation for investment in residential real estate includes new construction, renovations and the cost of buying and selling such as realtor commissions.

Renovations are the largest component of that subcategory.

MRB Partners shows how much this heavyweight component of GDP for Canada has slipped already and how important the sector is for jobs and investment.

At a peak of 10 per cent of GDP, the sector was worth $220 billion annually in activity. The chart shows that investment peaked in 2021 and has declined substantially since then. A decline of 2 percent of GDP, from about 10 percent to just under 8 percent is about 44 billion dollars in annual investment, based on 2023 GDP numbers.

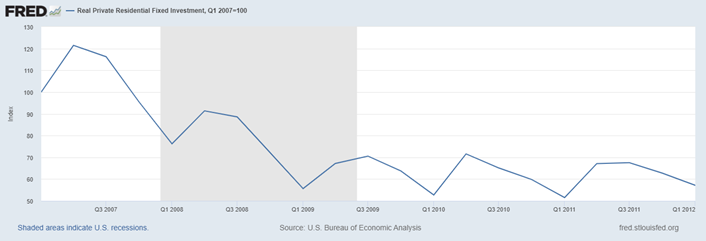

We can compare this decline to what happened in the US when they went through a correction in the housing market from 2006 to 2011. Investment in residential real estate peaked at about 6 percent of GDP and declined to 2% of GDP.

This drop in investment hit the US economy hard. Of course, there was a Global Financial Crisis happening at the same time so there were lots of other factors causing the US economy to falter. Many companies went bankrupt, while others were rescued by the government.

The decline in the US residential housing market during that period looks like this:

The index peaked in the middle of 2007 at 121.5 and bottomed at 51.5 in 2011.

If a similar decline in Canada happened with residential real estate, investment would drop to less than 5 percent of GDP, for a loss of about 127 billion annually. It took many years in the US for the amount of investment to recover to its 2006 level, and it would be similar in Canada.

Given the size of the residential real estate sector a recession is almost guaranteed, if investment levels drop from 10 percent to 5 percent.

The BOC should be thinking about what happens when the residential real estate bubble bursts. Their normal reaction would be to cut interest rates, but that might not work this time.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth October 27th, 2023

Posted In: Hilliard's Weekend Notebook