October 5, 2023 | Pull It!!!

“The illusion of freedom will continue as long as it’s profitable to continue the illusion. At the point where the illusion becomes too expensive to maintain, they will just take down the scenery, they will pull back the curtains, they will move the tables and chairs out of the way and you will see the brick wall at the back of the theater.”―

I know they try to keep us distracted with Taylor Swift’s latest escapades, today’s fake indictments of Trump, Biden’s dog biting another White House visitor, Dementia Joe falling down or shitting his pants while lying about his past, our imminent death from climate change and gas stoves, black lesbians from Maryland being appointed senator from California, allowing millions of third world savages to invade our homeland and then proposing Trumps wall, the annual government shutdown kabuki dance, and sending another $25 billion into Zelensky’s off-shore bank accounts for his noble freedom fighting efforts against Russia.

But I know and you know it is all bullshit, meant to divert our attention from the imminent destruction of our financial system at the behest of the Deep State cabal using Dementia Joe as their Trojan horse. They plan to implement their Great Reset agenda come hell or high water. They want to reduce the “surplus population” of the planet through whatever means necessary, whether it be their toxic vaccines, global warfare, climate lockdowns, destroying farmers, starving the peasants, making sure you own nothing, and creating a catastrophic financial collapse designed to impoverish the masses.

While the masses are mesmerized by modern day bread and circuses (NFL, MLB, Dancing With the Stars, The Bachelor, Taylor Swift’s boyfriend, latest explosive Apple iPhone version), the economic trajectory of the country and the globe is set to crash mode. To paraphrase James Carville, “It’s the debt, stupid”. Those pulling the strings are supremely confident they have done a spectacular job in dumbing down multiple generations through the government education indoctrination centers, they know the masses are incapable of understanding simple math or thinking critically. They’ve only been taught how to feel, obey and not question the approved narrative.

This week was filled with conspiratorial theories about the FEMA Emergency Alert test on Wednesday, that happened to coincide with Russia conducting a nuclear attack warning test on the same day. I didn’t believe the more far-fetched dire warnings about 5G activating the covid vaxx, but I do believe THEY like to foreshadow what they plan to do in the near future. They held Event 201, simulating a global pandemic in October 2019, three months before they launched the Covid Scamdemic exercise. The WEF has recently warned of a global Cyber-attack threat. They used this Emergency Management “test” as a psychological technique to prepare the masses for the next “emergency” they roll out in order to take away more of our rights, liberties, freedom and wealth. There are no coincidences. Everything they do has a purpose.

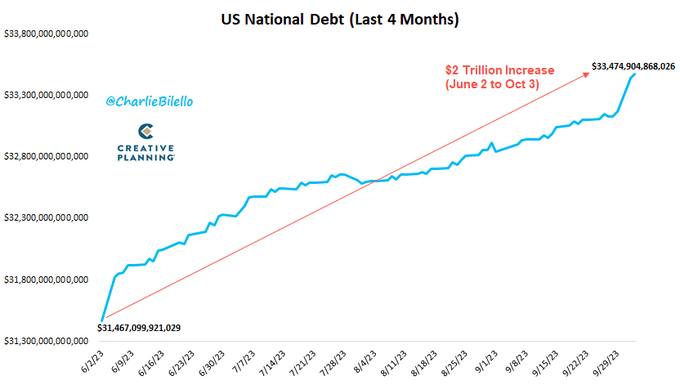

So that brings us to the reality portion of this rant. It’s all about the debt. Earlier this week the national debt increased by $275 billion in one day. The annual deficit in 2007, before the Wall Street/Fed created financial disaster, was $160 billion. The entire national debt after 200 years as a nation was $2.9 trillion. In the last four months they have added $2 trillion to the national debt. Does that seem sustainable? With interest rates at sixteen year highs, the interest on the national debt will exceed $1 trillion per year, on a path to $1.5 trillion. It was $400 billion prior to the 2008 financial crisis.

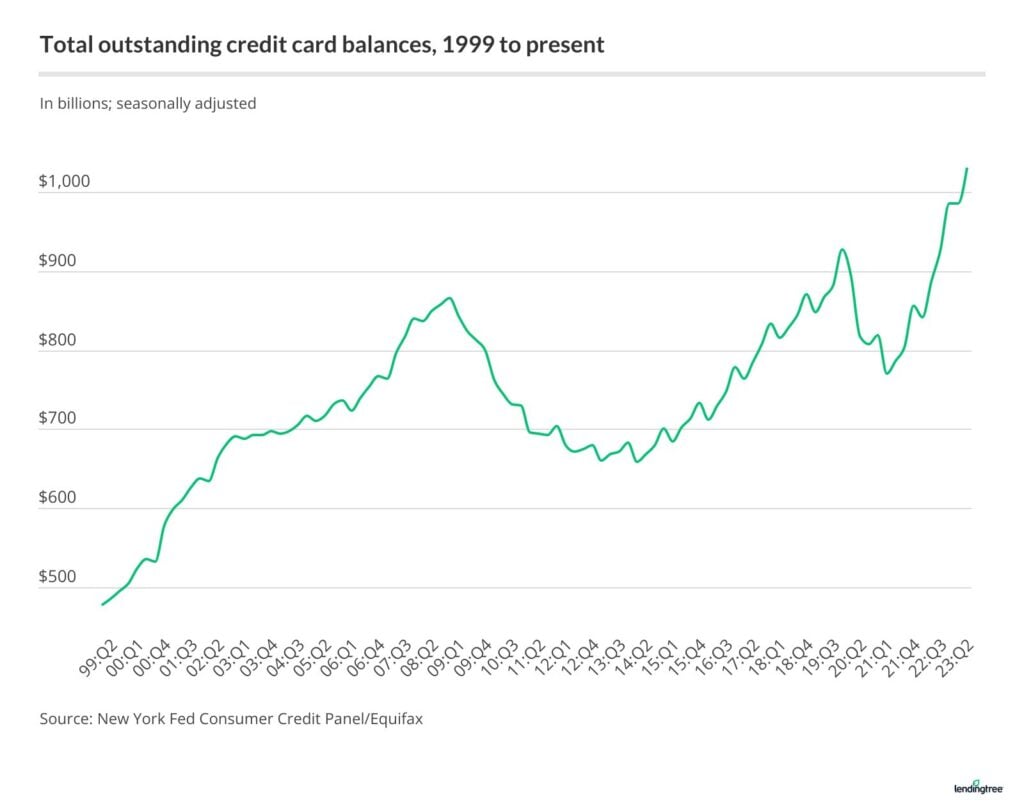

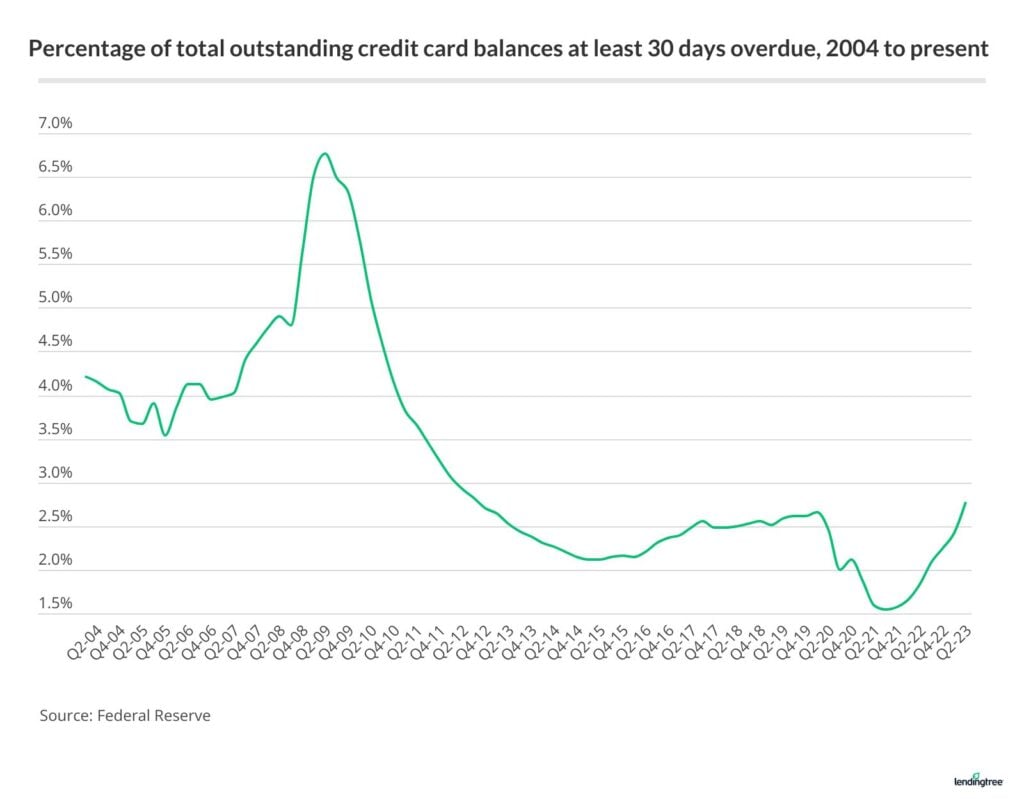

The pollyannas claim credit card default rates are still near all-time lows. But the trend is not their friend. Delinquency rates are now the highest in eleven years. They were artificially suppressed by the billions of covid handouts, rent moratoriums, and student debt payment suspensions, which are now fully spent. Delinquencies have risen seven consecutive quarters and are now poised to accelerate as the economy contracts and the average student loan payment of $500 starts this month.

It appears someone pulled the punch bowl away in the last month, as the change in credit card spending has crashed. This has been confirmed by multiple retailers reporting horrible sales results, in addition to the billions walking out their doors as reparations for the diverse downtrodden. Once delinquencies begin to accelerate, the Wall Street cabal will all react in an identical manner, cutting credit lines and denying new credit to those who have no intention of paying them back. That will further reduce credit card spending and worsen the economy, as 70% of GDP depends upon the masses spending money they don’t have on things they don’t need.

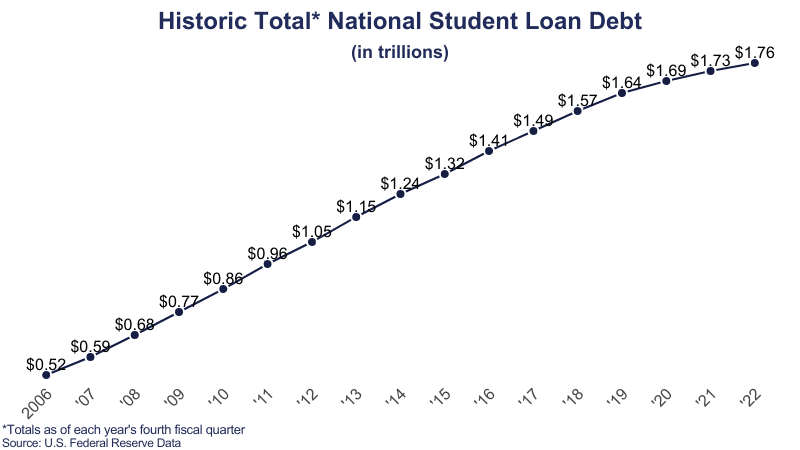

The student loan debacle, created by Obama and his minions, is about to blow up in the faces of millennials and Gen Z, now that Biden’s UN-Constitutional method of buying votes through bribing lesbian and african studies graduates, by not making them pay their legal obligations, has come to an end. The 43 million borrowers now have to start repaying the $1.76 trillion they borrowed for worthless degrees. This will mean $70 billion will not be spent on autos, gadgets, bling, vacations, sporting events, rent, and lattes. The recession that has been predicted forever is coming fast, and the markets know it.

With mortgage rates at 7.9% and home prices at all-time highs the housing market is Wiley Coyote suspended in motion, just before he plummets to the bottom of the canyon. There will not be a soft landing. The flippers will falter first. Once unemployment starts to accelerate, the newer buyers, who bid 25% above asking price last year, will be taught a lesson they’ll never forget. Once the housing crash starts, it will go on for several years, just as it did from 2006 through 2012. An unsustainable trend will not be sustained.

With average interest rates of 7% for new cars and 11% for used cars, average loans over 72 months, and an average new auto price of $48,000, the auto industry is about to implode, just as their union workers are looking for a 40% pay increase. I see bankruptcies and massive layoffs in their future.

Essentially the country is a room full of unstable powder kegs and we have a plethora of mediocre, low IQ, diversity hires running around the room celebrating whatever LGBTQ+++++ day it is by lighting matches. The actions of those purportedly in charge of the country are designed to create chaos, havoc, violence, despair and financial collapse. They have set events in motion and there is absolutely nothing that can be done or will be done to stop it. You should be angry, because no matter what preparations you’ve made, you will still bear the brunt of the coming storm. We know the culprits and we know what their fate should be, but will enough irate citizens do it? We shall see. For now we await the Larry Silverstein of our time to yell “PULL IT!!!”

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Jim Quinn October 5th, 2023

Posted In: The Burning Platform

Next: Shortage, Indeed »