September 29, 2023 | Recession Watch: When Big Trends Collide

Let’s start with the US borrowers who can’t make their credit card payments:

Is there a subprime credit card crisis on the horizon?

(MarketWatch) – Subprime consumers are falling behind on their credit card bills. Borrowers with a VantageScore between 300 and 600 experienced an 8.9% delinquency rate — of 30 to 59 days — in July 2023, up from 7.49% a year earlier, VantageScore data reveals.

Meanwhile, credit-card delinquency rates at smaller banks hit a record high of 7.51% in the second quarter of 2023, up from 6.01% at the same time last year, according to the Federal Reserve Bank.

“We’ve seen a huge increase in credit-card delinquencies,” said Balbinder Singh Gill, assistant professor of finance at the Stevens Institute of Technology’s School of Business in Hoboken, N.J. “In the U.S., we only seem to fix things when there is a crisis. I’m very worried about delinquencies, especially as these are impacting households with low wages.”

With a 24% average APR on credit cards, falling behind could push those lower-income workers into bankruptcy, Gill said. “It’s a very dangerous situation currently, especially for low-wage workers.” What’s worse, consumers could end up paying late-payment fees of up to $35 per month if they default on their payments, and an APR of up to 30%, according to LendingTree.

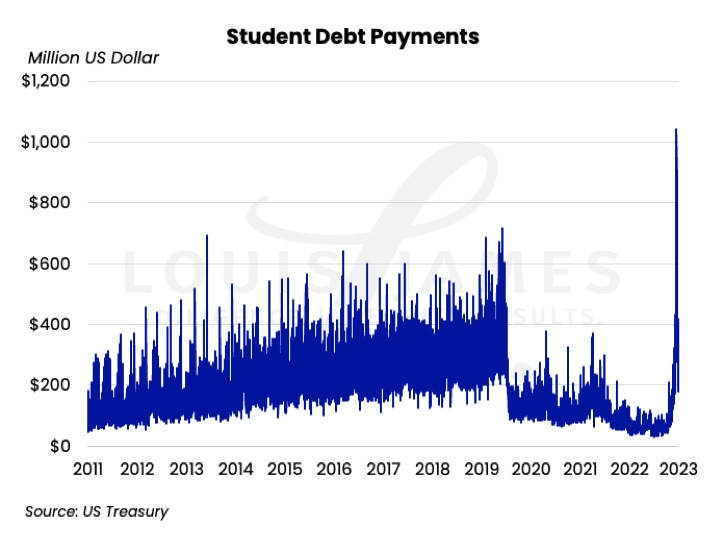

And now student loan payments are about resume, taking a billion-dollar annual bite out of the above credit card slaves:

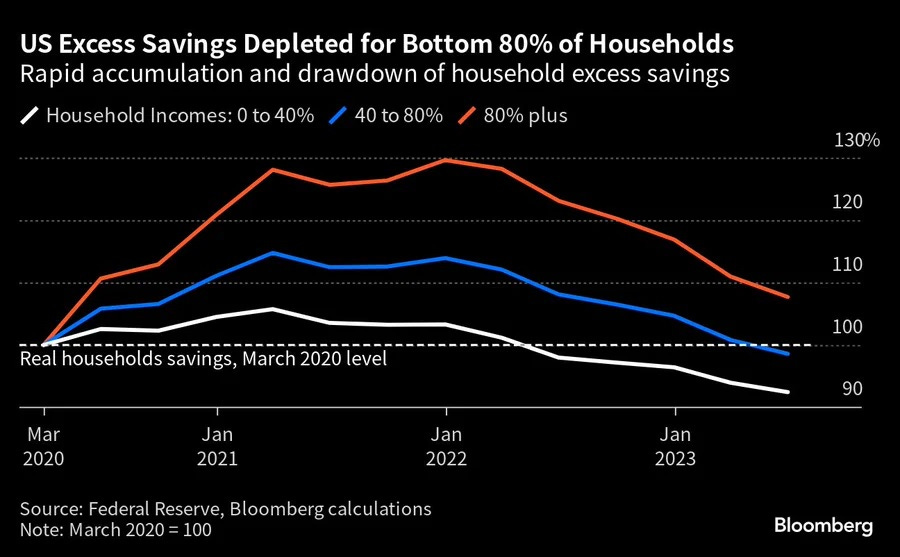

This is happening just as Americans are running through the “excess savings” they accumulated during the pandemic lockdowns. As the following chart illustrates, low-income households spent their excess savings in 2022 (hence the recent spike in subprime credit card debt), while middle-income households burned through theirs in mid-2023. Even high-income households are rapidly heading for zero. The combination of evaporating savings and higher credit card and student debt payments virtually guarantees recession-level consumer spending in 2024.

Meanwhile, the world’s second and third-largest economies are in even worse shape than the US: Germany hitched its future to cheap Russian natural gas and then stood by impotently while the US blew up its main pipelines. Now the former manufacturing juggernaut is “de-industrializing”:

‘Ugly figures’ as German manufacturing slumps in July

(Reuters) – The downturn in Germany’s manufacturing sector deepened at the start of the third quarter as goods producers recorded sharper declines in new orders, factory gate prices, and output in July, a survey showed on Tuesday.

The HCOB final Purchasing Managers’ Index (PMI) for manufacturing, which accounts for about a fifth of Germany’s economy, fell to 38.8 in July from 40.6 in June.

July’s reading, the sixth consecutive monthly decline and the lowest since May 2020, confirmed a flash estimate and was well below the 50 level that separates growth from contraction.

“These are ugly figures,” said Cyrus de la Rubia, chief economist at Hamburg Commercial Bank AG, particularly new orders, which saw one of the most pronounced falls in roughly three decades, and employment, which dropped into contraction territory for the first time since 2021.

China is committing a very different kind of suicide by betting its future on housing, of all things, only to find itself with perhaps the greatest real estate glut in human history. Now comes the mass bankruptcy and civil unrest:

Evergrande debt setback rattles China property stocks

(Reuters) – Another obstacle to embattled developer China Evergrande Group’s long-pending debt restructuring plan rekindled fears for China’s crisis-hit property sector on Monday, sparking a stock sell-off.

Evergrande (3333.HK), the world’s most indebted developer and poster child of China’s property sector crisis, has been seeking creditor approval for an offshore debt restructuring after it defaulted in 2021.

Under the plan unveiled in March, Evergrande proposed options to offshore creditors, including swapping their debt holdings into new notes with maturities of 10 to 12 years.

But in an unexpected twist, Evergrande said on Sunday it was unable to issue new debt due to an ongoing investigation into its main domestic subsidiary, Hengda Real Estate Group Co Ltd.

Evergrande’s shares dropped 21.8% on Monday to their lowest close since Sept 5 and in their biggest one-day percentage drop since Aug. 28. “Hopes of any meaningful recovery for the Evergrande debt holder are vanishing,” said Fern Wang, KT Capital Group senior researcher, who publishes on Smartkarma.

Here’s a brutal video from economic analyst Peter Zeihan. He has by far the most pessimistic take on the China real estate bust, so this is not the mainstream consensus. But if Zeihan is even partly right, the shock waves will be global.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino September 29th, 2023

Posted In: John Rubino Substack

Trudeau in Canada created this day off with a Truth and Reconciliation Day for Canadians atrocities to the Native Community.

GET THE HELL OFF MY LAND day for the peasants that don’t know any better.

Major depression and micro anxiety aggression disorders will be prevalent this day as White people seem to be in disagreement.

Playing this game with Trudeau has been quite profitable for this made up bullshit day of contemplation…for your past sins that you had no say or control over…and must compensate with your payments in taxes.

Still no dead babies or bodies discovered or exhumed and no police investigation either…hmmmm.