Hyman Minsky was an American economist who focused on the business cycle and debt. Since mainstream economics ignores debt, banking and financial cycles, Minsky was on the sidelines of the economics profession.

Minsky talked extensively about the phenomenon in history of long periods of economic stability and growth followed by a period of serious financial instability when debts have become too large, and a banking crisis ensues.

The housing and debt situation in Canada today is an excellent example of his description of the final phase of the financial cycle, which he called the Ponzi Finance stage. This stage occurs when some borrowers cannot pay even the interest on their debt, and many will never be able to repay the principal amounts owed.

Recent reports by bank lenders indicate that as many as 20 percent of all mortgage borrowers are in negative amortization, which means their monthly payments are smaller than the interest they owe each month according to the amortization schedule of their mortgage contract.

Other borrowers are able to make payments that cover their interest but have slipped in the repaying of the principal, which means their original 25-year term for the mortgage contract is now 30 or 35 years or even longer.

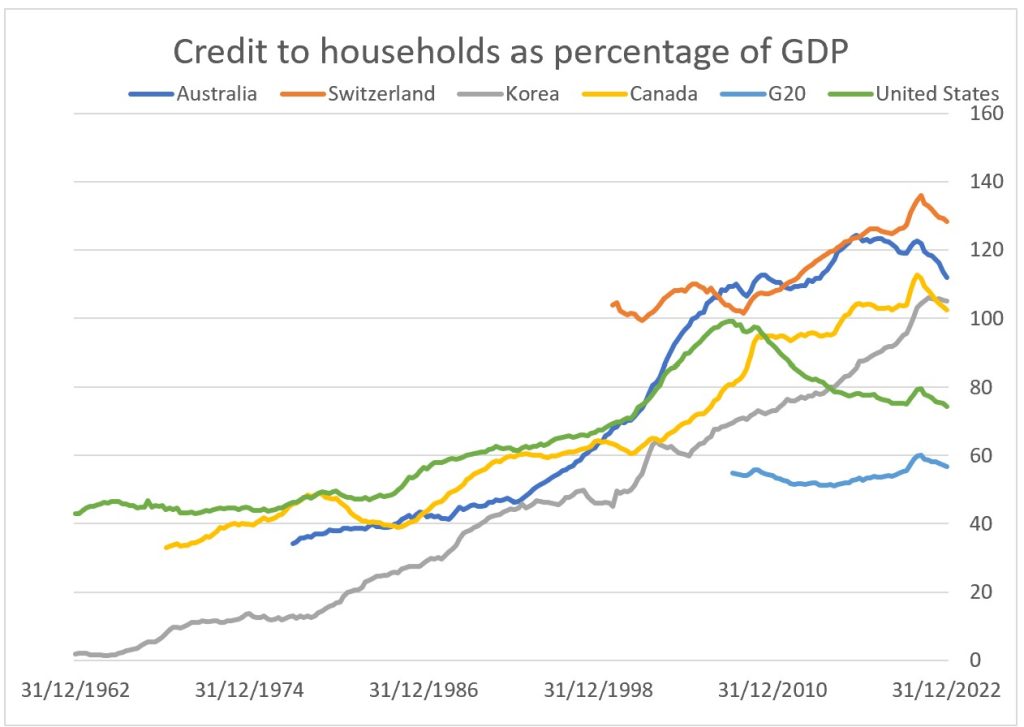

The Bank for International Settlements provides data showing Canada is one of only four countries where households debts are greater than 100 percent of GDP. Canada is at 102, Australia at 111, Korea at 105 and Switzerland is at 128. The U.S. is at 74 percent while the G20 average is even lower at 62 percent.

Source: BIS

Philip Colmar, of MRB Partners, in a recent op-ed piece in the Globe and Mail, makes a convincing argument that Canada’s massive housing and debt bubble is about to burst.

He attributes the development of the “massive housing bubble” to more than two decades of “cheap money and lax lending standards” and notes that “Excessive home prices are worrying, but mounting household debt burdens is where the outlook becomes ugly.”

He says, “Regardless, Canada will face a difficult decade ahead once the housing bubble begins to deflate. Policy makers will have their work cut out for them, as the day of reckoning is fast approaching.”

A Minsky Moment arrives when there’s a sudden shift to panic among lenders, investors and borrowers over debt.

When banks realize that customers cannot afford to pay even the interest on their loans, they apply much stricter lending standards.

The subsequent drop in the availability of credit leads to a decline in consumer demand for houses, autos, furniture and home renovations, and eventually to the forced sale of distressed assets.

As happened in the U.S. from 2006 to 2012, house prices will decline dramatically. Housing affordability is restored, but only after years of debt restructuring.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

Us debt to GDP is over 120% much worse than households

US debt to GBT is much worse than household debt