August 26, 2023 | Trading Desk Notes For August 26, 2023

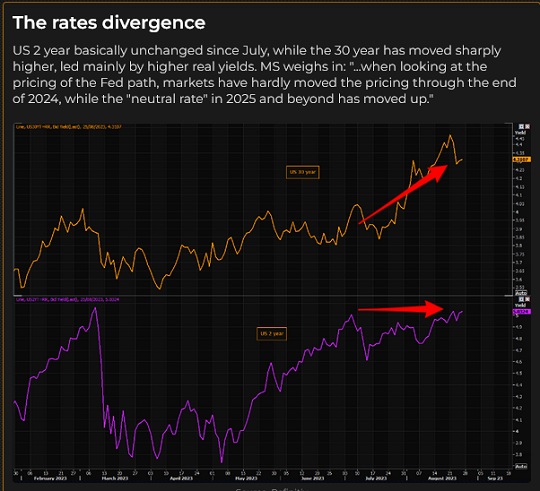

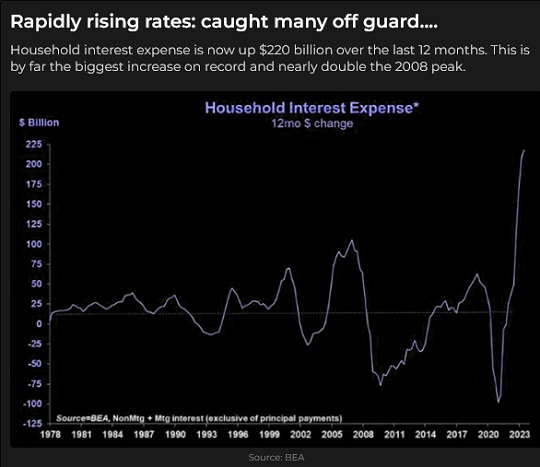

Short-term interest rates surged higher this week

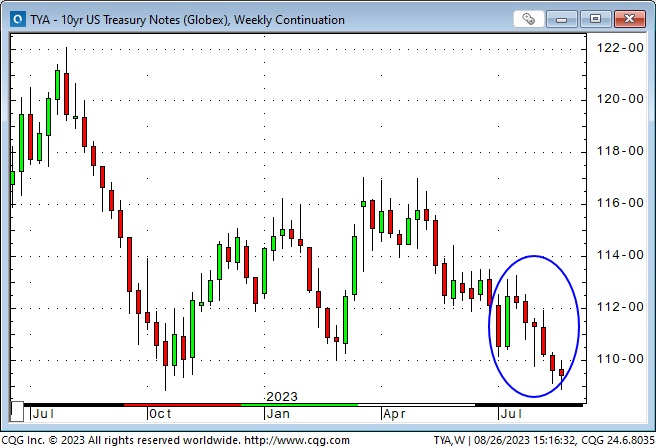

Two-year Treasury futures traded to a 23-year low, the 5-year hit a 16-year low, and the 10-year closed the week at a 16-year low, but the long and ultra-long bond futures closed a little higher on the week after hitting multi-year lows on Monday.

June 2024 SOFR futures have dropped nearly 70 bps since mid-July as the market continues to “reprice” the Fed staying “higher for longer.”

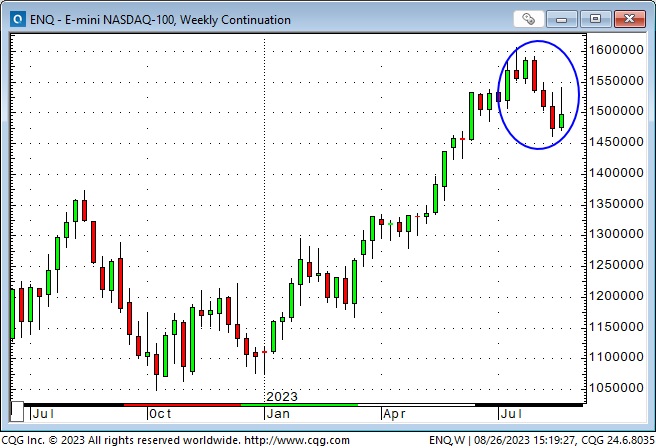

In last week’s Notes, I reported that mid-July was a Key Turn Date as interest rates and the US Dollar turned higher while stock indices turned lower. The 10-year bond futures and the US Dollar index have extended their trends to six consecutive weeks.

The leading stock indices were mixed this week, with the DJIA, DJT and R2000 closing lower, while the S&P and the NAZ did not make new lows and closed higher.

Markets are pricing a ~20% chance of a 25bps rate increase from the Fed in September and a ~50% chance of an increase in November.

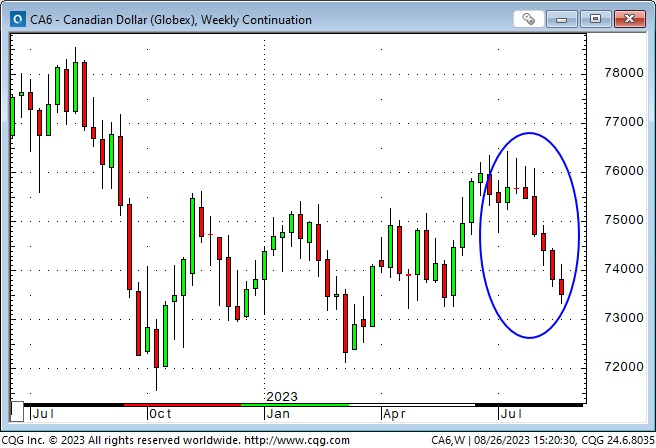

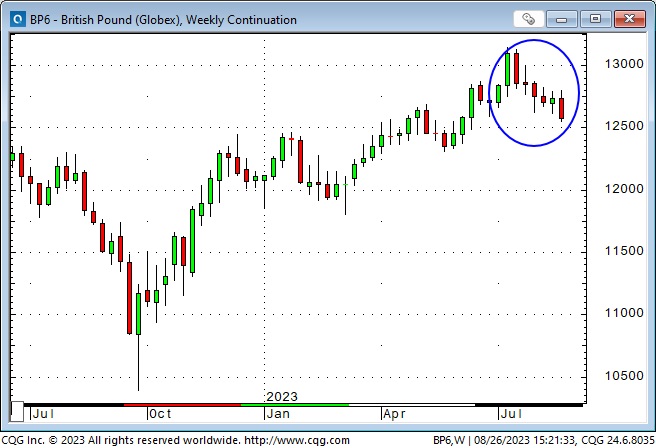

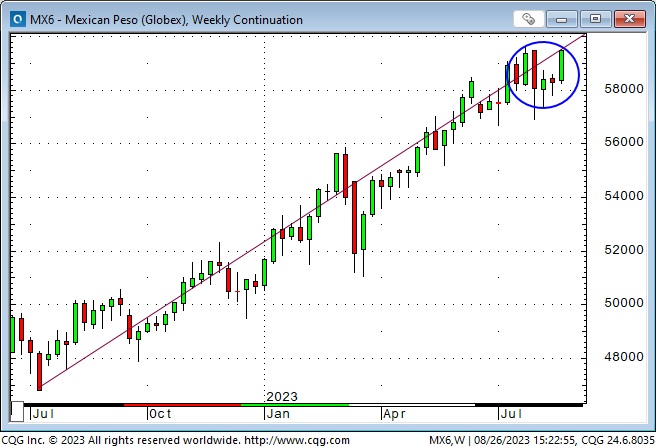

All of the leading currencies, except the Mexican Peso, have fallen against the USD since mid-July

The Canadian Dollar, the Euro, the Swiss Franc, the Aussie Dollar, the New Zealand Dollar and the Swedish Krona have dropped for six consecutive weeks.

The British Pound, the Yen, the RMB and the Norwegian Krone have closed lower for five of the last six weeks.

The Mexican Peso is marginally above its mid-July levels, closing this week at an 8-year high against the USD (continuing its run as the world’s strongest currency!)

Gold

Gold prices fell ~$115 (6%) from mid-July highs to this week’s lows as higher interest rates (real and nominal) and a stronger USD created a toxic environment for gold.

Silver fell ~$3 (12%) from mid-July highs to last week’s lows but has rallied back ~$2.

My short-term trading

Since the “defining moment” of the $100 Billion increase in MSFT market cap (in less than one hour!) on July 18, my P+L has benefitted from shorting stock indices and buying the USD.

My P+L suffered minor losses this week as I tried (unsuccessfully) to pick a bottom in the Yen and a turn lower in the S&P.

I bought the 10-year T-Note and the CAD on Friday near the close and held those trades into the weekend – looking for a bounce after six consecutive weeks lower.

Thoughts on trading

I thought the six-week surge in interest rates and the USD was overdone, and I considered how best to “play” that idea. What would be my time frame, what markets offered the best risk/reward profile, and how would I manage my risks?

My time frame will initially be a few days, but if the trades go my way, I may extend that. In other words, I’m looking for a bounce, not a secular change in trend.

I chose to buy the CAD rather than any other currency because the S&P closed higher on the week (despite the dramatic chop around the NDVA report), and the CAD has a stronger correlation to the S&P than other currencies. If the S&P trades higher next week, that “helps” the CAD, and if the USD is weaker against most currencies (the USDX corrects lower after a 6-week bull run), the CAD should benefit.

I’ll control my risk on the trade with a GTC stop above this week’s lows. (The trade either starts to work immediately, or I’m gone with a very small loss.)

I bought the 10-year because it had surged higher Wednesday after touching multi-year lows Tuesday and then settled back Thursday and Friday but did not take out Tuesday or Wednesday lows. I also thought that the long and the ultra-long bond futures, which closed higher on the week, might “pull” the 10-year higher.

I’ll control my risk on the trade with a GTC stop above Friday’s lows. Like the CAD trade, this trade either starts to work immediately, or I’m gone with a very small loss.

These trades are just two more in the long list of trades I make every year. I have no idea whether they will make or lose money, but I like their asymmetrical risk/reward profile. If I get stopped on these trades, I may look for an opportunity to re-enter the trades – in other words, I may maintain my idea that these markets are due for a bounce, but I may not get correctly positioned on my first attempt.

The Yen

Japan is the only major developed market that has not raised interest rates even as inflation has increased. The BoJ tweaked its Yield Curve Control, allowing bond yields to rise “modestly,” but the Yen is now just above last October’s 33-year lows when the authorities aggressively intervened to support the Yen.

The Yen has fallen ~45% against the USD (and >50% against the Euro) since Abe introduced the Three Arrows program in 2012 to “revitalize” the Japanese economy.

The Nikkei Index has risen ~4X since 2012 and has probably benefited from the falling Yen. (Foreign buying of Japanese stocks has not caused the Yen to rally.)

Japanese authorities may be more concerned about the value of the Yen relative to other Asian currencies (competitive advantage) than its value against the USD or Euro.

The most potent boost for the Yen would likely come from Japanese people and institutions repatriating capital from overseas investments, for instance, if they sold US bonds and bought domestic bonds.

I bought the Yen last week but was quickly stopped for a slight loss. I will maintain my idea that the Yen is due for (at least) a bounce, knowing I may not get correctly positioned on my first attempt.

An interesting idea from David Rosenberg

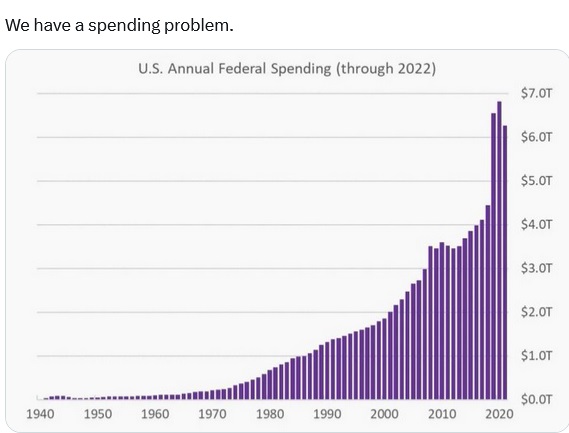

I’m going to paraphrase an idea that David Rosenberg published this week: Massive fiscal stimulus (including generous UE payments) from Trump and Biden caused Americans to believe that the government would “be there” for them in any future “troubles” so they drew down their savings (and went into debt) to “maintain a lifestyle.” This strong consumption helped support the economy despite the most aggressive tightening from the Fed since 1981.

David’s idea is similar to something I recently wrote (paraphrasing): Governments have discovered that voters like fiscal stimulus and don’t care about deficits and the costs of servicing debt. With elections coming in 2024, expect fiscal stimulus to continue. What people/voters do care about is inflation and the rising cost of living, and they will do what they can to earn more money. Expect more strikes.

If you think the world is changing faster than you can keep up, you’re right!

I spend hours daily reading, listening to podcasts and watching videos from analysts and market commentators. At times, the conflicting opinions (or conflicting “facts”) leave me confused – not knowing what (or who) to believe. But I persist because sometimes I get a great idea that I can transform into a good trade.

I have my favourites, of course (especially people who write well and have a skeptical sense of humour), and one is the Heisenberg Report. The basic service is ~$7 a month. Here’s a link to a terrific August 25 essay.

The Barney report

Barney loves to go for long off-leash walks, but he also has to spend lots of time “laying around” waiting for Papa to quit playing on his computers. He has several preferred spots around the house to “lay around,” but sometimes he decides it is “playtime,” he will keep poking me with his nose until I turn away from my screens and engage with him.

Listen to Victor talk about markets

On August 25, I talked with Mike Campbell on his top-rated Moneytalks podcast about how markets were repricing US interest rates to stay higher for longer – which supported the USD and pressured stocks and gold. Frank Giustra was also on the show – warning that the purchasing power of your currency will keep falling. You can listen to the show here.

On August 25, I also did a 30-minute interview with Jim Goddard on This Week In Money. I discussed the Key Turn Date in July that led to bond yields and the USD rising for six consecutive weeks. We also discussed the developing troubles in China, the Nivida quarterly report, Jackson Hole, the Tucker Carlson/ Donald Trump interview and the trades I’ve been making. You can listen here.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys and talk with him.

Active listening requires practice, but it can reduce feelings of pressure and judgment to support someone’s mental health.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair August 26th, 2023

Posted In: Victor Adair Blog