May 13, 2023 | Trading Desk Notes For May 13, 2023

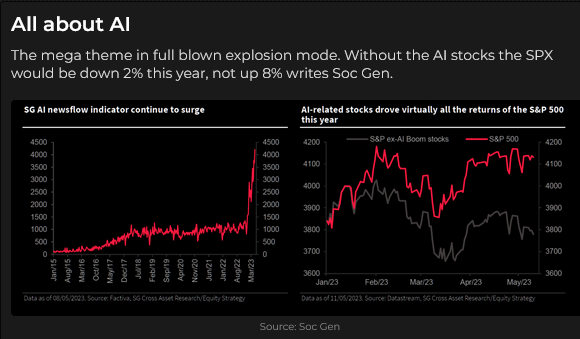

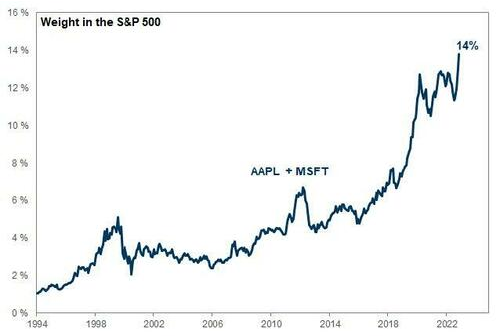

Megacap tech continues to provide nearly all the YTD gains for the broad stock indices

While small-cap stocks continue to underperform the broad indices and Megacap tech.

Bullish stock factors: the recession has been postponed, and strong labour markets mean buying power for consumers, which means pricing power for corporations. We are at or near peak interest rates; inflation has peaked and is trending lower. AI is the New Big Thing, and people are chasing it. Market sentiment is tilted bearish, so the bears will have to chase if stocks rally.

Bearish factors: The bullish factors are already priced in.

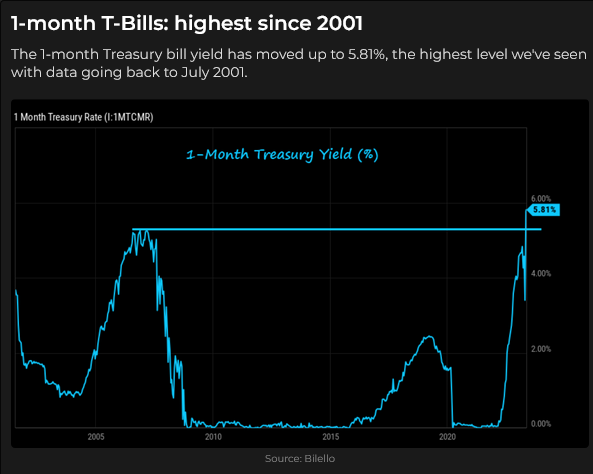

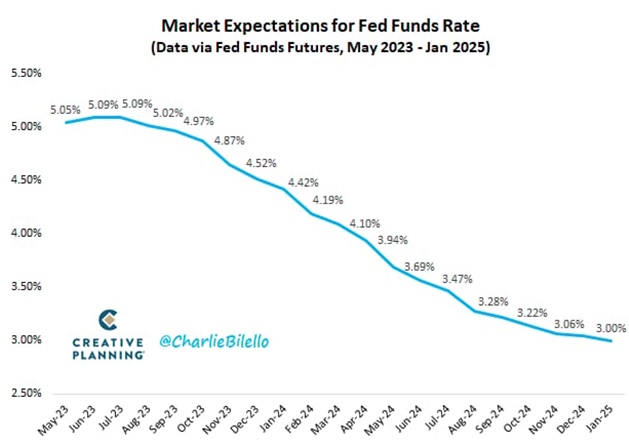

Interest rates

The market is pricing short-term interest rates to fall ~75 bps between June and December 2023, even as the heads of the ECB, the BoC and the Fed make it clear that they do NOT expect to cut rates in 2023.

Why are markets “fighting the Fed” over expected s/t interest rates? Perhaps they expect a recession to start with a vengeance in H2, unemployment to increase sharply, inflation to fall sharply, or “something breaks.”

My thought: The Fed won’t cut rates because they “want to,” but because they “have to” in reaction to an event precipitated by the “consequences” of raising rates too far, too fast after a decade+ of near-zero rates. That will not be bullish for stocks.

Employment, real wage growth, inflation and profit margins

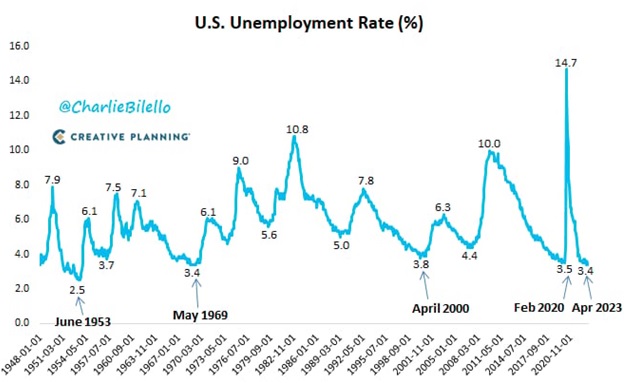

The US unemployment rate is 3.4%, the lowest in 54 years. Unemployment in the G10 countries is at ~50-year lows. Wage growth remains strong as workers try to “catch up” to rising prices, but real wages are not keeping up with rising costs. Initial claims rose to an 18-month high this week.

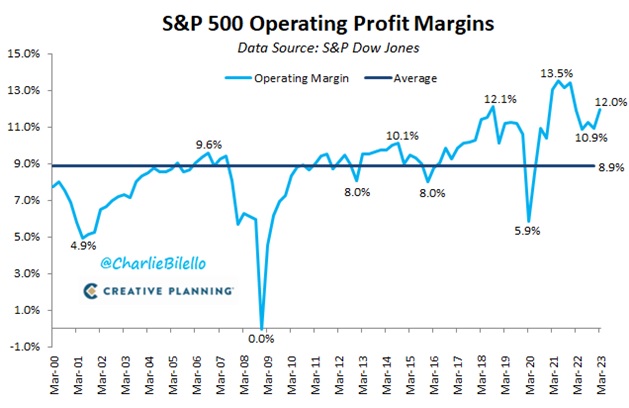

Corporations can sustain strong profit margins because the strong labour market (and credit cards) give consumers the power to pay higher prices. This could become a “wage/price spiral,” sustaining inflation well above central bank targets.

My thought: Inflation won’t drop to central bank targets until consumers stop paying higher prices for goods and services.

University of Michigan Consumer sentiment

5-year inflation expectations @ 3.2% are a 15-year high. Consumers expect to pay more for groceries but will cut back on discretionary spending.

Currencies

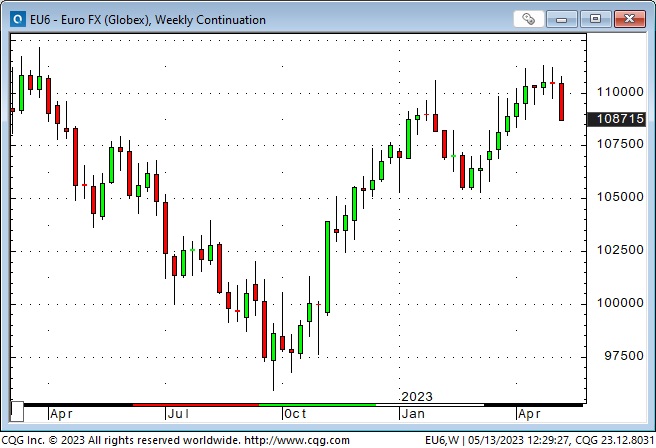

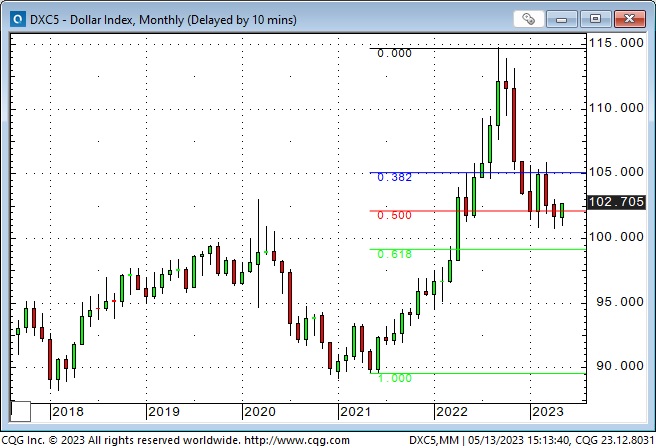

The US Dollar Index had its highest weekly close, and the Euro had its lowest weekly close in seven weeks.

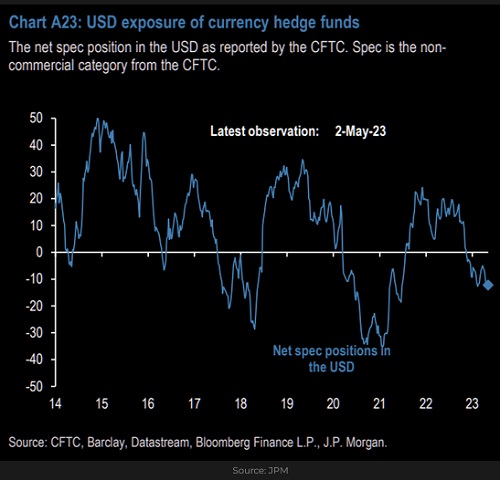

Speculative positioning in the currency futures markets has been net short of the USD since last fall, with almost all of that positioning created by long Euro positions.

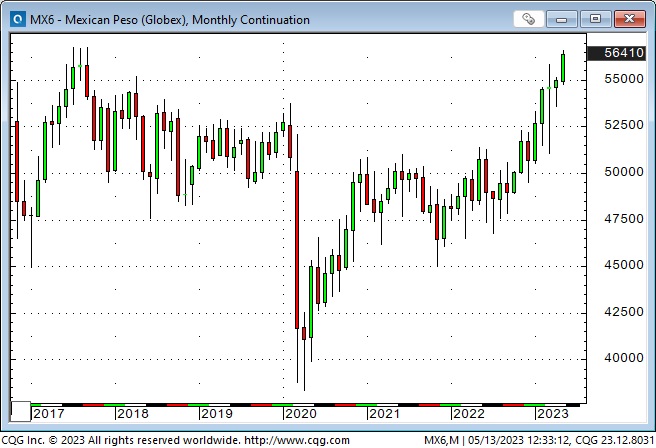

The Mexican Peso hit a 6-year high as short-term rates of ~11.5% in Mexico tower over US short-term rates.

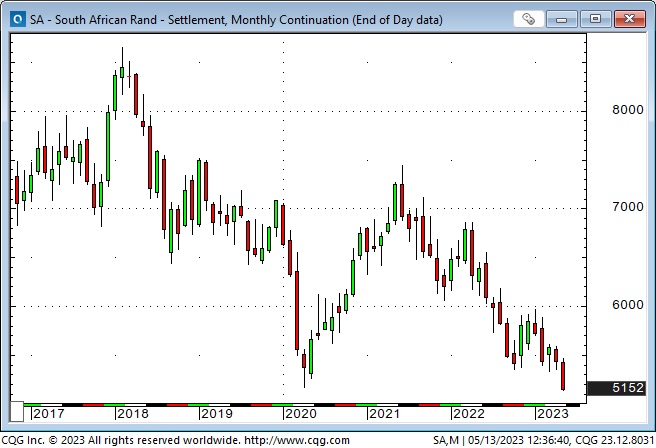

The South African Rand dropped to an All-Time Low this week after the US accused South Africa of supplying Russia with weapons. It is down ~40% from 2018 highs.

The Canadian Dollar has traded mostly between 72 and 75 cents for the last eight months. The CAD has (sometimes substantial) correlations with 1) the overall strength or weakness of the USD, 2) the commodity markets and 3) risk-on / risk-off sentiment, especially as manifested in the ups and downs of the S&P. Late last week, the CAD had a shart rally as the S&P jumped ~100 points in two days. This week the CAD tumbled as the USD was strong against virtually all other currencies.

Gold

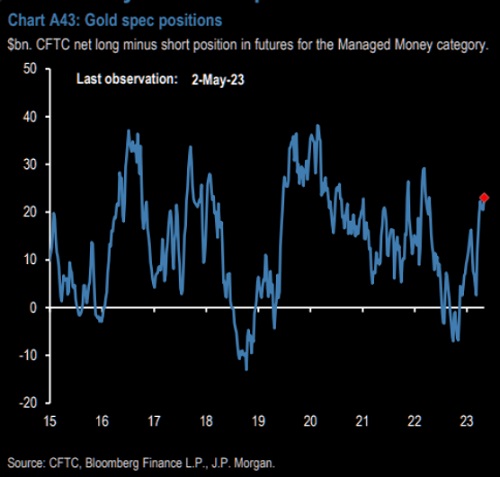

Comex gold futures briefly (two minutes) spiked to new All-Time Highs of ~$2085 in late Thursday afternoon trading last week (at the same time, Nymex WTI futures spiked to a 17-month low), then dropped ~$80 from those highs to Friday’s low. The market traded between $2005 and $2050 this week, as the USD strengthened while silver was much weaker than gold.

Gold open interest (circled in the gold chart above) has increased by ~50,000 contracts (~10%) since the end of April as speculative net long positioning has increased.

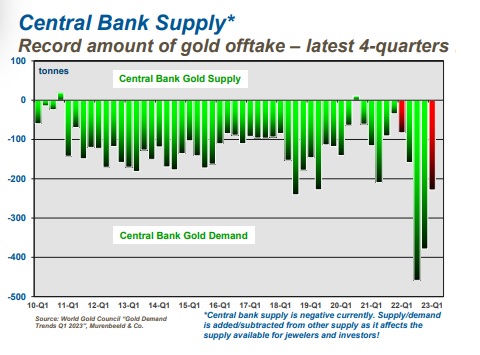

Reports of substantial central bank gold purchases have supported the ~$450 (25%) rally from the November lows.

Gold shares continue to underperform bullion.

Commodities

Comex copper has trended down ~15% from 7-month highs in January, despite continuing stories about how copper prices will skyrocket due to electrification demand. Copper hit ATH ~$5 in March 2022.

The energy-heavy Goldman Sachs commodity index closed at a 16-month low this week, down ~36% from the highs made following the Russian invasion of Ukraine. Do we have a demand problem?

Nymex WTI crude oil tumbled to a multi-month low last week but bounced back as much as ~$10 by mid-week. Those gains could not be sustained, and WTI closed this week below the previous week’s close.

Nymex natgas prices remain under pressure – down ~80% from last year’s highs.

China “re-opening”

The “re-opening” of China after months of severe lockdowns was anticipated to create enormous demand for goods and services. So far, the re-opening has been a bit of a dud, which may account for some of the weaknesses in various commodity markets. China is the biggest export market for Germany.

My short-term trading

I started this week with no positions but got short the Euro on Tuesday. For the past couple of weeks, I’ve been watching for opportunities to short the Euro – which I have called the “Antidollar,” but I’ve been patient – waiting for signs of a breakdown rather than acting on “anticipation” of a breakdown. I remain short into the weekend.

I shorted gold on Wednesday but was stopped overnight for a loss of $16 per ounce. I reshorted gold on Thursday and remained short into the weekend.

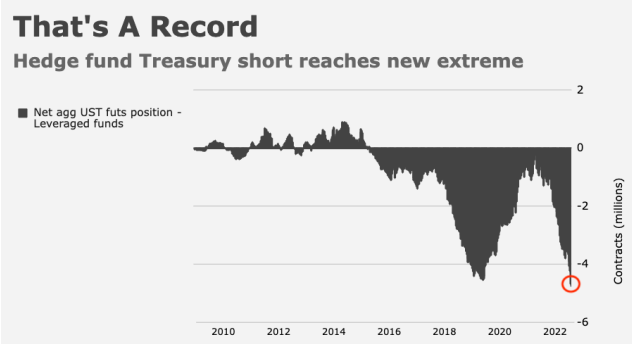

My short Euro and short gold positions are both bullish USD trades. Speculators in gold and the Euro are heavily net long, and if those markets reverse course, they may become sellers.

I shorted the S&P on Thursday but was stopped for a slight loss.

On my radar

The US Dollar Index rallied from `90 to ~115 from mid-2021 to September 2022 and subsequently fell back to ~101, a ~50% correction of the previous rally. I’ve been looking for the correction to end and for the USD to rally.

The Barney report

Spring is quickly turning into summer here, and the temperatures are rising. In his fur coat, Barney seems sluggish in the heat and likes to find a shady spot to lie down. We will fill the wading pool in the backyard (although he wasn’t much interested in it last year) and start taking him to swim in the ocean. We are lucky to have huge sandbanks extending into the sea, so in the summer, the shallow water gets nice and warm – and Barney loves to swim!

The Archive

Readers can access weekly Trading Desk Notes going back five years by clicking the Good Old Stuff-Archive button on the right side of this page.

Listen to Victor talk about markets

I hosted Mike Campbell’s extremely popular Moneytalks show this week while Mike was on vacation. I interviewed our regular commentators, Michael Levy and Ozzy Jurock, and I had a terrific 40-minute interview with our feature guest Dr. Martin Murenbeeld (starting at the 31-minute mark), about the gold market. We had a shocking stat about how much taxes people pay, and we dug up one of Mike’s best “Goofy awards” to wrap up the show. You can listen to the podcast here.

I’ll host the show again next week, featuring Greg Weldon, a brilliant market analyst (we’ve been friends for 20+ years), and Alan Oslie, a Vancouver Island realtor who will talk about why so many people are moving to Vancouver Island.

I recorded a 30-minute interview with Jim Goddard for This Week In Money on May 6. I talked about my Macro views and thoughts on several markets I trade. I also had some “practical” advice for traders who are “new to the game!” You can listen here. My interview starts at the 42.15-minute mark, following Ross Clark and Martin Armstrong.

Oceanside Special Olympics Charity Golf Tournament at Pheasant Glen golf course June 10, 2023

This event is the annual fund-raiser for the 50 special needs kids in the Oceanside area of Vancouver Island. If you’d like to play in this event (my team in the photo) or donate money to a worthy cause, click this link

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys, and talk with him.

Headsupguys has had over five million hits on its website, and over a half million men have taken the self-check. Most men who click on the website do so after midnight their local time. Headsupguys save lives.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair May 13th, 2023

Posted In: Victor Adair Blog

Next: Plan for Paralysis »