April 22, 2023 | Trading Desk Notes For April 22, 2023

Stock indices stuck in a narrow range

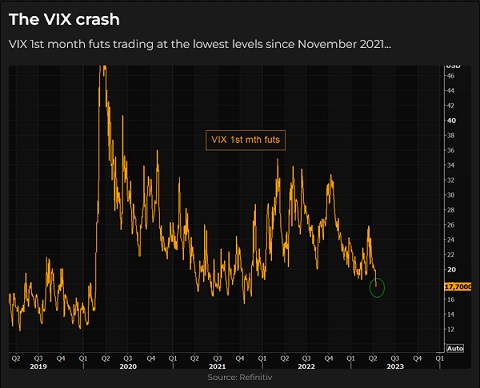

For most of April, the premiere American stock indices have been stuck in a narrow range as economic data and Fed speakers deliver mixed signals. Volatility metrics are at or below one-year lows, and some folks view 5%+ money market yields as a better investment than stocks.

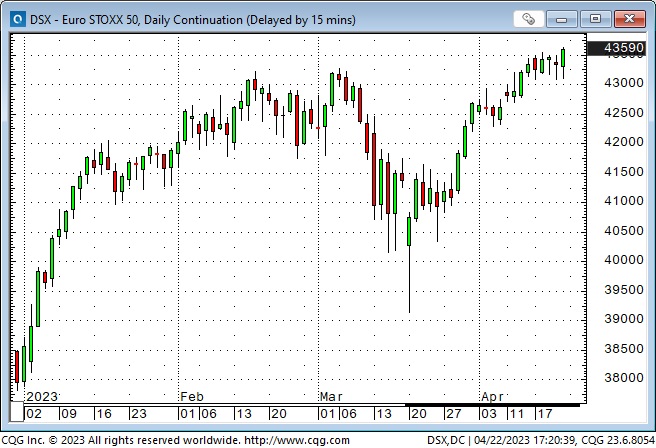

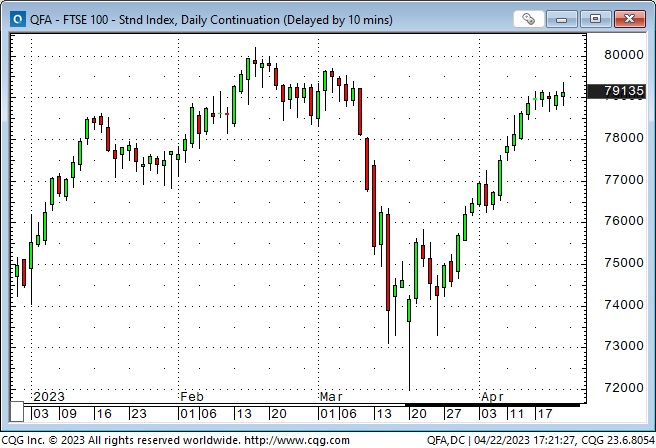

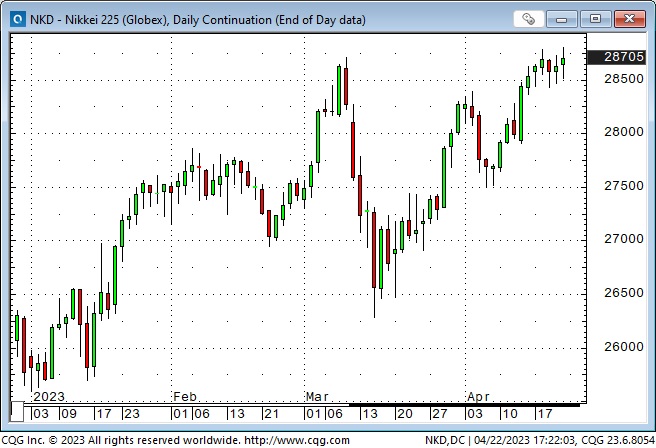

While American indices drift quietly sideways, European, Japanese and Canadian indices remain buoyant.

Inflation metrics in the USA and Canada depict a softening trend, but the core numbers are still well above central bank target rates.

Market sentiment/expectations appear to be balanced between a looming recession (and thus Fed cuts) and sustained inflation (with the Fed higher for longer). The wild card is a looming combination of a recession, rising unemployment AND sustained inflation (stagflation.)

The “balance” of expectations illustrated by the sideways price action of the premiere American stock indices is unlikely to last; one side will gain the “upper hand,” and prices will break out of the range.

Earnings season

75% of the companies that have reported quarterly results have beaten pre-report estimates. This coming week will see 42% (by cap weighting) of companies in the S&P 500 reporting.

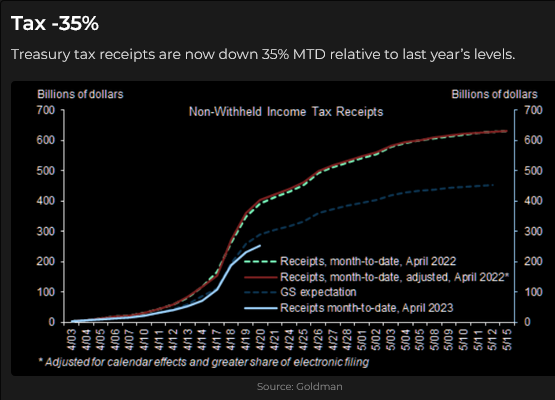

Tax receipts falling

Home prices falling

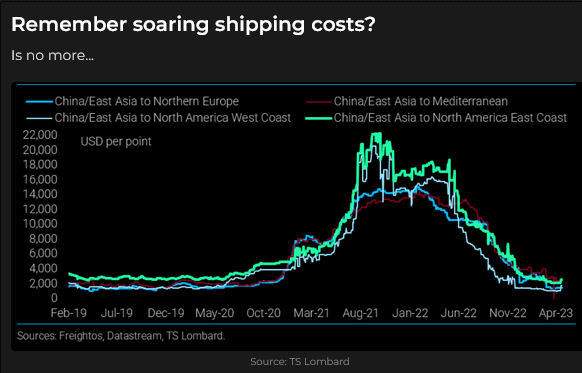

Freight rates falling

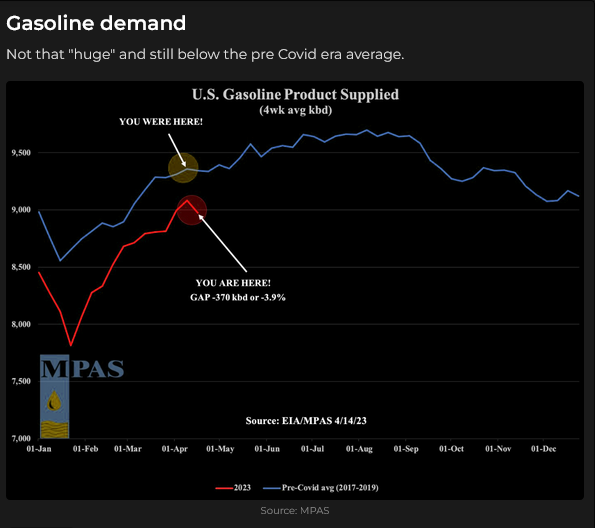

Gasoline prices falling

Inflationary behavior

People will try to “keep up,” “catch up,” or “get ahead” as they perceive the prices they pay for things (goods and services) are rising faster than their income. They will ask for a raise, quit to take a higher-paying job or go on strike. There are now significant strikes in Canada, the UK, France and Germany.

I remember there was always somebody on strike in the 1970s and I expect we will see more strikes in the future as workers react to the pain of negative real wage growth.

The Fed thought inflation would be “transitory” because the “supply chain bottlenecks” (remember the fleet of container ships waiting off-shore Los Angles) would dissipate (they did) and inflation would drop back towards their 2% target (it didn’t.)

The “WIN” buttons were promoted, and worn by President Gerald Ford during his presidency – August 1974 to January 1977.

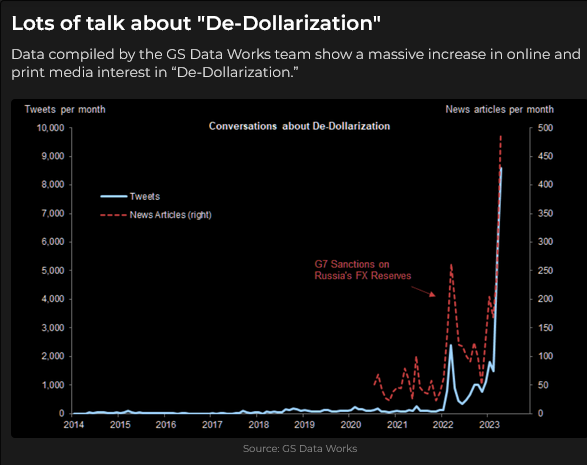

My old school analysis is that inflation has been caused by governments embracing deficit spending (like never before), which devalues the purchasing power of currencies, which is inflation. Voters will not elect a government which vows to balance the budget (and spells out exactly what they will do to achieve that goal), so we have transitioned into an era of “endless” deficits and inflation. People will “jostle for position” to try to “get ahead” of inflation, contributing to a wage/price spiral, and “devil take the hindmost” (people who don’t have the leverage/opportunity to earn more.)

“Deficit management” via inflation is more politically expedient than slashing government services or raising taxes.

Markets

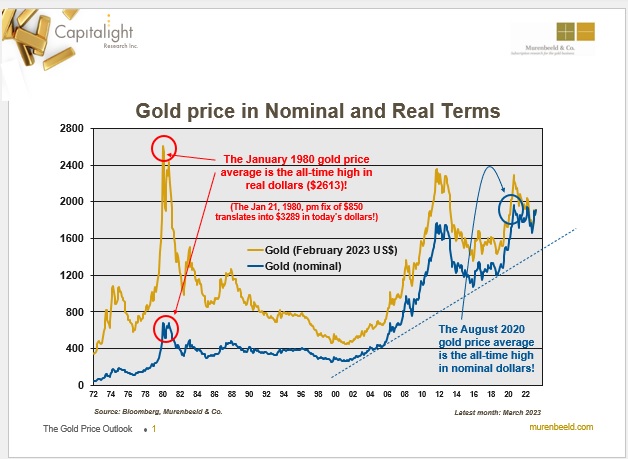

Gold ran too high too fast, and fell back ~$75 from last week’s highs.

Here’s a 50-year chart, from my friend Martin Murenbeeld, showing gold in nominal and real terms. It is a beautiful expression of the decline in the Dollar’s purchasing power!

I was working as a commodity broker at Conti when gold soared from ~$450 in November 1979 to ~$850 in January 1980 – only to fall back to ~$450 two month later. When you look at the rally in nominal terms (the blue line) it doesn’t look like such a “big deal” but when you see it expressed in real terms (the gold line) you can see why “GOLD” seared an unforgettable memory into the minds of today’s aging boomers! The All-Time High (in today’s dollars) was made on January 21, 1980 at ~$850. (Comex futures traded a high of $875 that day, and a low of $679 the next day – that’s not a typo, gold dropped ~$200 overnight and silver fell ~$13 when the Comex changed the rules to limit who could buy silver.)

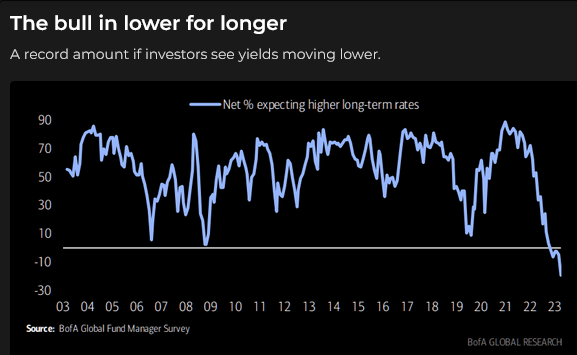

Bond prices fell in February, a casualty of pervasive “higher for longer” thinking, but then rallied hard from the “banking crisis” lows in mid-March (the Fed will have to ease to avoid a credit crisis.) Prices drifted lower in April as worries about a credit crisis faded, and as thoughts about a “looming recession” were pushed further into the future.

The short-term interest rate forward market is pricing in a 25 bps increase in Fed Funds at the May 3 FOMC meeting, followed by ~50bps of cuts from the Fed by December 2023.

The US Dollar Index rallied from last week’s lows on Monday, but then went sideways for the rest of the week.

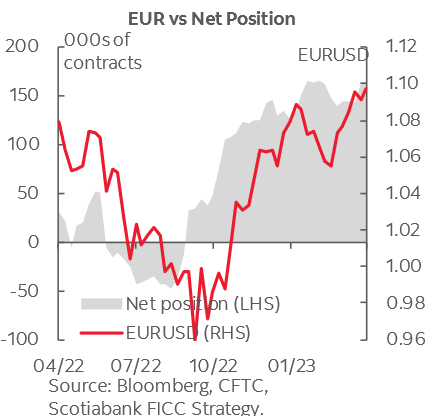

The Euro reached a 1-year high last week (up ~15% from the 20-year lows hit in September) but fell back a bit this week. I’ve recently called the Euro the Anti-Dollar because it seems to be the “chosen” vehicle for traders who want to bet against the USD. The April 11 Commitments Of Traders report for the currency futures market shows that net speculative positioning in all currencies other than the Euro is either close to flat or net short. Net speculative positioning in the Euro is hugely net long.

The Canadian Dollar hit a 2-month high last Friday, but fell as much as 1.5 cents from that high this week. US interest rates remain above Canadian rates and that spread is likely to widen as the Fed raises rates while the BoC pauses. The strike of ~150,000 government workers may have also negatively impacted the CAD.

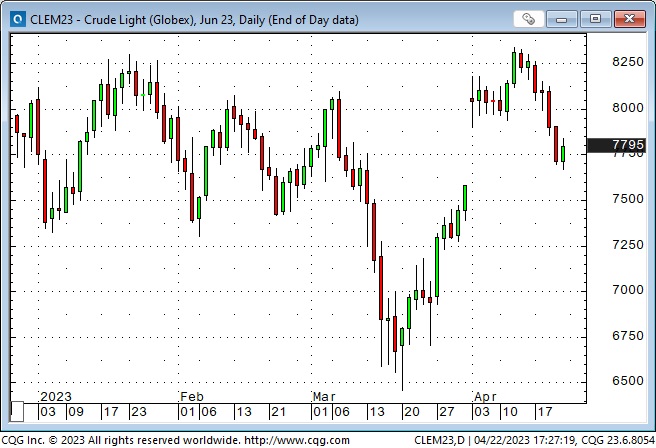

WTI crude oil prices on the Nymex jumped higher following the surprise OPEC+production cut, but fell back this week by as much as ~$7 from last week’s highs..

Thoughts on trading

“People think they make (trading) decisions based upon their analysis, but they make (trading) decisions based upon how they feel about their analysis.” Denise Shull, (If you have access to RealVision see this video.)

I discovered Denise Shull on RTV a few years ago and was very impressed with the way she thought about traders’ emotions, especially fear. (The trading coach Wendy Rhoades, in the TV series “Billions” was modeled after Denise.)

I watched (and recommend to my readers) several free market videos posted this week by Hedgeye, including one with Gio Valiante, a performance psychologist, who has worked with a number of professional athletes and top level traders. I had previously seen Gio with Denise on RTV.

I recommend Denise and Gio because I believe people, not news, move prices. More precisely, peoples’ emotional reaction to news moves prices.

The daily turnover in the global foreign exchange market is estimated at ~$7 Trillion per day. Over the past few decades I have noted that trends in the currency markets seem to go WAY further than makes any sense and then they “turn on a dime” and go the other way. I think the fact that they “turn on a dime” reinforces the notion that the trend had gone WAY too far.

FX traders used to understand the term, “leads and lags,”although you don’t hear that expression much anymore. It referred to how people would “time” their trades in accordance with how they “felt” about the market. For instance, if a Canadian company received USD from selling lumber to an American firm the company CFO would know that the CAD was trending lower against the USD and he would delay converting the funds in the hopes that the trend would continue and his company would receive more CAD as a result of waiting – he “lagged” the conversion decision.

Alternatively, if the CFO saw that the CAD was trending higher against the USD he might book a conversion rate with his bank in anticipation of receiving the USD funds at a later date – fearing that if he waited until he actually received the money that he would receive fewer CAD when he did the conversion – he “lead” the conversion decision.

Multiply the impact of these “timing” decisions by the millions of import/export deals being done on both sides of the Canada/US border and you get a sense of how a “trend in motion, stays in motion” due to peoples’ emotional reaction when they see a trend.

My short term trading

I started this week with a short CAD position established Friday of last week. I stayed with the trade, moving my stop lower to lock in profits in case CAD rallies. I had unrealized gains on the trade of more than one cent at Friday’s close.

I’ve been shorting the S&P the past couple of weeks, in anticipation of the market rolling over and falling at least 100+ points. I’ve had some small wins, small losses and a few break even trades, but the net result has been small losses. I shorted the S&P again this week: one small loss, one breakeven and I’ve gone into the weekend short with a tiny unrealized gain.

I have a (short-term) bearish bias on both the CAD and the S&P and I’ve tried to get short close to the point where I would stop myself out – I’ve been selling what looked like relative highs – so that I’m risking very little relative to what I think I could make on the trade.

I’ve had a short-term bearish bias on gold, but have not tried to get short. I see it as the “same trade” as being short CAD or S&P and I want to limit my concentration risk.

On my radar

I have a bias that the USD may rally. I’m already short CAD but I’m really “waiting and watching” the Euro – the Antidollar – with a relatively huge net long position. I watching for the Euro to have a “failure to rally” which might be an opportunity to get short.

I’m also waiting and watching the British Pound, which may have a more bearish “background” than the Euro. Again, I’m watching for a “failure to rally.”

Because I have a bullish USD bias I’m watching for an opportunity to short gold, while also being aware of concentration risk.

With the S&P my bias is that 4,200 is resistance. If the market rallies through that level, I’m wrong to be bearish, but if it breaks lower that reinforces the 4,200 level resistance. But it’s hard to sell the S&P lower give the recent “buy the dip rallies.”

The Barney report

It has been a cold wet spring but Barney knows that when I strap him into the passenger seat of my car that we are headed for the forest trails and he will have nearly two hours of off-leash running time. I try to get him to the forest trails 3 to 4 times a week – he loves to run and I love to watch him run – its a win/win!

The Archive

Readers can access weekly Trading Desk Notes going back five years by clicking the Good Old Stuff-Archive button on the right side of this page.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. You can listen to us talk about markets on April 22 on the Moneytalks podcast. Our session starts around the 1.04 minute mark.

I recorded a 30 interview with Jim Goddard on April 8 for This Week In Money. I talk about my Big Picture view of what impacts all the markets (changing Fed policies) and drill down to several specific markets. You can listen here.

Oceanside Special Olympics Charity Golf Tournament at Pheasant Glen golf course June 10, 2023

This event is the only annual fund-raiser for the 50 special needs kids in the Oceanside area of Vancouver Island. If you’d like to play in this event (my team in the photo) or donate money to a worthy cause, click this link.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys, and talk with him.

Headsupguys has had over five million hits on its website, and over a half million men have taken the self-check. Most men who click on the website do so after midnight their local time. Headsupguys save lives.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair April 22nd, 2023

Posted In: Victor Adair Blog

Next: The Contagion of War »