April 16, 2023 | Inflationary Choices

Spotting trend changes is the key to economic forecasting. They don’t happen often. Most of the time, this year will be similar to last year. The pace varies but the overall trend continues… until it doesn’t.

Those who lived through the painful 1970s inflation developed a certain mindset. Similarly, the 2008‒2020 disinflation/low inflation period, accompanied by multiple waves of QE, set expectations some still hold today. They think the current inflation is an aberration which will end as soon as Fed officials find the right magic words.

Of course, pointing out that much of today’s inflation comes from sources outside the Fed’s control—shipping, energy, etc.—displeases those who think the Fed has magic words. In fact, the Fed’s tools are blunt instruments with side effects even if they work. In this case, a likely recession.

Inflation will be on our Strategic Investment Conference agenda next month, but perhaps not in the way you think. We’ll look at where inflation came from and where it’s going but most important, how you can turn it to your advantage.

“Trust the Fed” isn’t the answer, nor is “grin and bear it.” Join me at the SIC as we plan a new strategy and think the unthinkable.

Juggling Thoughts

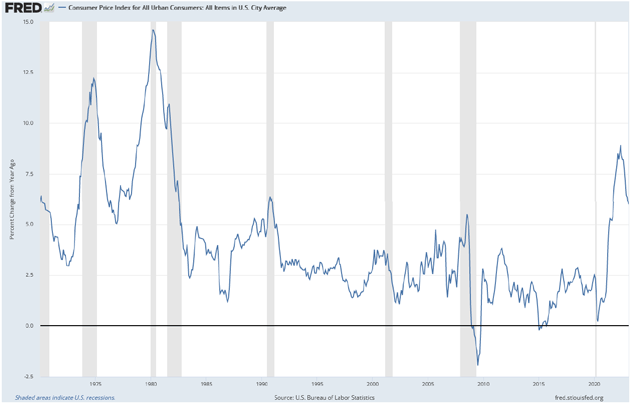

We got some important new data this week with the Consumer Price Index’s March update. The good news: Price inflation continued receding from last year’s heights. As of June 2022, headline CPI had risen 9.1% in the last year. Now, nine months later, the pace is down to 5.0%.

This is certainly better. But in February 2020—the last reading before COVID changed everything—CPI was running at a 2.3% annual rate and had been consistently below 3% for the previous eight years. Today’s 5% inflation seems low only compared to recent experience. And 5% inflation means that your money will lose 50% of its purchasing power in just 14 years. And even at 3% inflation, you lose 50% in 24 years. Most of my readers now in their 50s and 60s will live a lot longer than 24 years.

Will your lifestyle live as long as you do? Inflation certainly makes it difficult. All that being said…

We have to be careful with our language here. Is inflation better than it was? Yes. Is inflation too high? Yes again. Both can be right at the same time. Juggling those thoughts requires being simultaneously pleased and displeased, which is hard, so usually one attitude takes precedence. This varies based on all kinds of other beliefs.

There’s also a data reliability question. The official inflation data certainly has flaws, as I’ve written many times. It tries to summarize an impossibly complex situation in a few numbers. But it’s all we have.

In any case, the broader question is about setting a baseline expectation. In the 1970s, 5% inflation seemed low amid those long stretches of 10% or more where it felt like we were in a banana republic. In the 1980s, 5% became normal and, compared to what was then a recent memory, didn’t feel so bad. From the mid-1990s through 2008, the range shifted down a bit, then down even more in the 2010s. Now it’s moved up again.

Here are annual inflation rates by month since 1970:

Source: FRED

In each of these inflation regimes, the economy adjusted. Unable to change it, we learned to deal with it. Will the same happen this time? Probably… but how we deal with it matters and will look different.

The March data supports something that was already becoming clear: Inflation is more and more about housing prices. Food and energy remain expensive, but consumers have more control over that kind of spending. They can buy cheaper brands, drive less, adjust the thermostat, etc. Housing prices are mostly static unless/until you move, which is difficult and often costly in itself. And everyone needs some kind of home.

Housing inflation in turn propels other prices higher. Service workers who can’t afford to live near their jobs have to demand higher wages to cover their commuting costs and time. All those trucks carrying heavy construction materials damage the roads, which local governments may be unable to repair unless they raise taxes. But if they don’t repair the roads, it slows down other things.

All this feeds on itself and will, I think, keep inflation well above the Fed’s 2% target, which looks increasingly ridiculous as time passes. I’m (cautiously) optimistic we won’t see 9% annual inflation again. But 2%? The only way that happens is if they generate a severe recession… which may, in fact, be the plan (but I hope we avoid it!).

Hammers and Nails

The Federal Open Market Committee is an excellent illustration of the old saying, “When all you have is a hammer then everything looks like a nail.” Their entire toolbox consists of different ways to manipulate the flow of credit. When they want growth, they encourage more debt. And when, like now, they’re worried about inflation they make borrowing and lending less attractive. And in both cases, they do it not just with interest rates but in less obvious ways.

Influencing the credit supply is, at best, an indirect way to achieve the Fed’s mandates. Moreover, their policy changes need a long time to work. Imagine driving a car that has a ten-second delay after you step on the brake pedal before the brakes actually do anything. There would be more than a few wrecks. But it’s kind of what the FOMC has to do.

That is increasingly a topic in my conversations. Numerous writers and analysts like me were calling on the Fed to raise rates in early 2021, frustrated with how long it took them to get with the program. Now rates may need to go higher than if they had started earlier. But we are where we are, finally seeing the results of what they started a year ago.

Here’s what is happening. Higher rates are enticing money out of banks which, as they lose deposits, are raising loan requirements, cutting credit lines, and otherwise making capital scarcer. This should (in theory) reduce the demand that has been driving inflation higher. Like I said, a very blunt tool.

It might work but maybe not as well as in the past. The private economy is less credit-dependent now, thanks in part to post-2008 changes and, more recently, to COVID benefits that boosted savings rates. On top of that, demographic trends are reducing labor supply and raising wages. This further insulates consumers from tighter credit.

The labor shortage is both helping boost inflation and reducing the Fed’s ability to control inflation. And there’s no easy short-term solution. We can’t conjure more productive workers out of thin air.

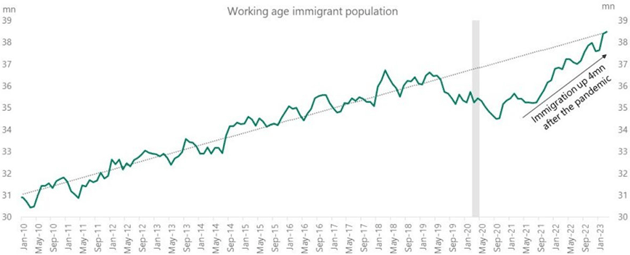

My friend David Bahnsen recently pointed out this has a lot to do with immigration (or lack thereof). For a long time, we camouflaged demographic changes by importing farm and service industry workers from abroad. That is no longer as easy. The working-age immigrant population began declining before COVID, and then health restrictions kept new workers from entering. It is just now returning to the previous trend.

Source: David Bahnsen

The other potentially disinflationary force is productivity. We can get by with fewer workers if each worker produces more. Technology like AI (which we’ll be discussing at SIC, by the way) will likely help, just as other technologies have in the past. But this probably won’t help much in the next year.

Recession Projection

Last Wednesday the Fed released minutes from the March FOMC meeting. That’s the one that occurred soon after the two large bank failures and associated fears. Many analysts thought the committee would skip hiking again due to bank failures. I disagreed, thinking the Fed’s new loan facilities were in place to prevent further such incidents. And they did indeed raise rates 25 points.

However, the just-released minutes revealed something we didn’t previously know.

At each FOMC meeting the Fed staff presents its economic outlook. As of January, their forecast was for real GDP to slow this year before picking up in 2024. That changed last month. Here’s the relevant part of the March FOMC minutes (my emphasis in bold).

“For some time, the forecast for the US economy prepared by the staff had featured subdued real GDP growth for this year and some softening in the labor market. Given their assessment of the potential economic effects of the recent banking sector developments, the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years.”

The Fed staff changed its outlook significantly and quickly when it saw banks come under stress, forecasting a recession—a mild one, but still a recession. That’s new and important. And rare.

But my friend Renè Aninao points to something even more important: FOMC members heard this recession forecast and unanimously raised rates again anyway. Plus, their individual “dot plot” contributions show they intended (at least as of March) to hike again in May.

The staff outlook is simply advisory, of course. The committee members aren’t required to accept it. Their other public statements suggest some aren’t fully aboard this forecast. But whatever they’re thinking, this is new evidence the FOMC is serious about squelching inflation—even at the cost of sparking recession.

Remember what I said above about lead time. The FOMC members know whatever they do now will take months to make any difference. Their own staff just said it expects recession to start “later this year.” Yet the people around that table didn’t blink. They stayed the course despite having several reasons to pause.

This reveals two things.

The FOMC members think inflation isn’t yet falling as much as they want.

- The FOMC members see controlling inflation as their first priority.

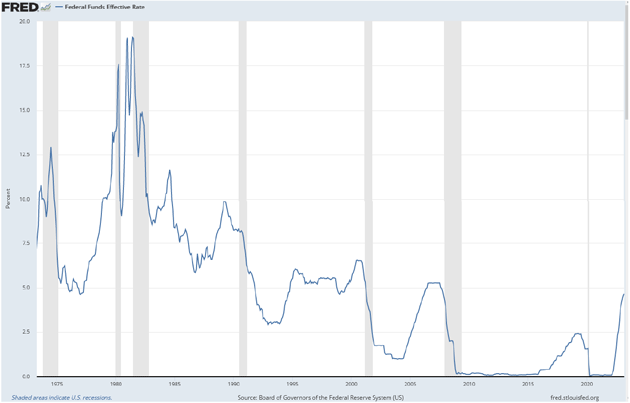

If we take them at their word, it means rates will stay where they are and maybe go a little higher by year end. That will be pretty unusual if it happens. Look at this 50-year chart of the Fed funds rate. The gray vertical bars are recessions. Notice anything?

Source: FRED

The normal pattern is for the Fed to start cutting rates shortly before the recession. That is what we have been accustomed to for the last 50 years. The FOMC sees downturns coming and tries to preempt or at least soften them. For the committee to now say …

- We know recession is coming but

- We’re holding rates right here at this cycle’s peak

…is quite unusual. I think it speaks to their concern about the economy if inflation continues at these levels, and their determination not to repeat the 1970s experience.

Many investors don’t believe this. The futures curve continues to show a market that expects rate cuts as soon as this summer. People think the FOMC will lose its nerve, that Jerome Powell and his team will surrender to Wall Street and political pressure and switch to boosting growth.

That’s not entirely crazy. We saw Jerome Powell lose his nerve before in 2018. (Remember he was reducing the balance sheet and raising rates then reversed course to appease the market.) But maybe he learned from that experience.

Note also, what the FOMC will do is a different question from what it should do. If inflation is coming down to the target on its own, further tightening will be a giant mistake—one that could produce a not-so-mild recession.

This is a tough call. I’d like to say I’m confident in the Fed officials who will make it. But even if we give them every benefit of the doubt, they’re limited by mistakes their predecessors made.

Some Guesses

Let me summarize what I’ve been writing for the last few years and offer you a few guesses as to what the future might look like.

I began writing early in this cycle that the Fed would eventually hike to 5% or more Fed funds while waiting for unemployment to get to 5%. We are now at the 5% Fed funds but nowhere close to 5% unemployment. Wage growth is finally starting to (more or less) keep up with inflation. But wages and the inflationary mindset will still be with us.

I see more and more comments from leading analysts and good friends who were happy the Fed finally started raising rates but are now in the camp that it’s gone far enough. They may very well be right. But back in the real world, Federal Reserve Governor Christopher Waller came out this Friday morning saying (from Peter Boockvar):

“Governor Waller just now is basically saying he wants to hike again where in his speech he said ‘Because financial conditions have not significantly tightened, the labor market continues to be strong and quite tight, and inflation is far above target, so monetary policy needs to be tightened further. How much further will depend on incoming data on inflation, the real economy, and the extent of tightening credit conditions.’”

To illustrate what I said about some analysts who previously agreed with raising rates now believe that we should pause, let me use the next paragraph from Peter Boockvar’s note this morning [comments in brackets are mine]:

“My 2 cents, each reason Waller gave for wanting to hike again is rear view mirror analysis. There is no way that what happened on March 9th [SVB and other banks collapsing] filters through an economy immediately. It takes time but we have seen loan data since then and they have fallen so the wheels are in motion. You read what I wrote on Fastenal for March. [Where they clearly talk about a slowing economy. Since they are involved in almost every part of the US economy, their calls mean something.] Waller though doesn’t seem to be in the mood for patience and while I respect the fight against inflation, I reiterate that a pause doesn’t mean the fight is over as they can always hike at the meeting thereafter.”

The FOMC will raise rates at the next meeting (just for fun, they meet during the SIC). They then will see two CPI reports (covering April and May) before their June meeting, plus continued analysis of tightening credit, two additional jobs reports, etc.

Depending on how they look at the data, they could find reason for another rate hike or to actually pause. The labor market will still be tight. We have no idea what level of unemployment will make the FOMC feel uncomfortable. We’ll find out.

I would not be surprised if the May hike is their last for a while. But I do think the markets will be surprised when they pause and then we see a recession with relatively mild unemployment. I don’t think the Fed will cut until they see a “two handle” on inflation. Given the lagging nature of home prices and rent, that very well could happen.

Bottom line: I think the Fed is going to keep rates higher for longer than the vast majority of the market appears to currently believe.

Update on the Oil Fund and a New Paper

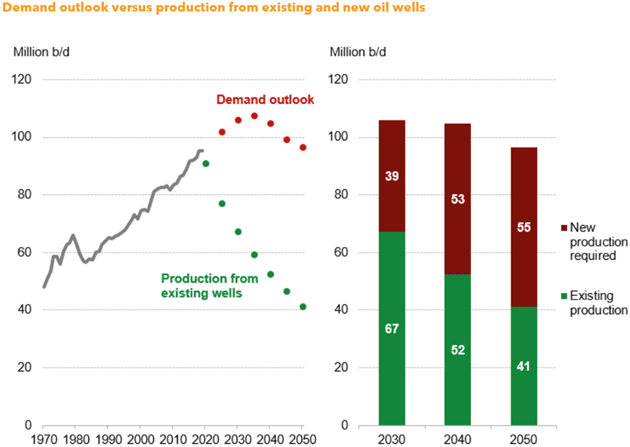

I have become increasingly convinced that the ESG movement, by trying to restrict investments in oil and gas ventures, is going to have the perverse effect of reducing supply even as global demand increases, thus making the price of energy rise. It is simply not rational for the developed world to expect developing countries to ignore the needs of their citizens to have access to power and clean water which requires energy, and specifically oil and gas (and to some extent coal).

History clearly shows that the increased use of energy (of all types) is what drives the economics, health, and prosperity of humanity. The data on supply and demand for oil and gas is compelling. Once again, this year will be an all-time high in demand for oil and gas, a trend that has only been interrupted during recessions over the last century before quickly recovering to new all-time demand highs. I am bullish over the medium- and long-term prospects for oil and gas prices. The chart below shows that we are going to need to drill a lot of wells just to stay in place, let alone meet increased demand.

Source: Bloomberg

The question is: What is the best way to take advantage of this misguided policy?

One potentially significant upside in oil and gas investing is not just the actual price of oil and gas (which is important!), but the increase in the value of proven and probable reserves in the field. Think of it as buying an older apartment complex in a good neighborhood, doing a complete renovation, increasing the rent and then selling the complex at the new, higher value. Essentially, what my partners at King Operating do is buy the rights to drill in an older but proven field in a “great neighborhood.” Typically, the older fields were all vertical wells, but you can improve the value of that old field by doing horizontal drilling and fracking. (Oil and gas is a risky business and past performance is not indicative of future results.) It’s more complex than that, but that is the essence.

My partners at King Operating have helped pioneer this investment model (wells plus the field) for retail investors. I have written the first of what will be a series of research papers on energy, that also outline the strategy. I have also just finished a paper called “Why I Am Working with King Operating” where I discuss the opportunities, risks, and rewards associated with oil and gas investing. Why King as opposed to others? I offer my reasons in what I think is one of the more important papers I’ve written in a while. Note: You will have to have an offering document available for you to get this last paper. If you haven’t already gotten it, we will also send you my first paper on the future of energy.

On a final note, we are in the process of completing three wells in the current program in Borden County, Texas, in the Permian basin. We knew there was one zone and suspected there would be more than one but have been delighted to find six potential pay zones with hydrocarbons. Get my latest paper to find out what that means. You can click on the link at the end of these disclosures.

Important disclosures: Note that John Mauldin’s association with King Operating is completely separate, legally and financially, from his involvement with Mauldin Economics. The opportunity presented above by John Mauldin in TFTF is not endorsed by Mauldin Economics, ME Research LLC, or any of its other partners nor do any of them have any financial or other interest in the described venture.

John Mauldin will be receiving significant financial benefits from investments made in this venture by investors. More specifically, as chief economist of King Operating, John is entitled to receive consulting fees as well as a significant interest in the fund’s general partner.

This opportunity is offered by King Operating and it is limited to accredited investors. Prospective investors should carefully review the offering memorandum and risks disclosure before proceeding.

Click here to download my report The Future of Energy on King Operating’s website and find out more.

Dallas, Austin, Colorado Springs, and Tulsa

I fly to Dallas to meet with my partners at King on Tuesday (and see my daughters Tiffani and Melissa), then on to Austin on Thursday to have dinner with Joe Lonsdale and friends at The Cicero Institute Awards dinner on Saturday. Then I’ll fly to Colorado Springs to see Chad, Danielle, and my new grandson Odin, then to Tulsa to see three of my kids (Henry, Abigail, and Amanda), spouses and grandkids. The back to Dorado Beach.

Last night, I got to have dinner with my great friend David Bahnsen and some of our local friends. I live for long dinners and conversations like that.

We have just finalized the details of Stephen Wolfram’s participation in the SIC. Stephen is the founder of Mathematica which is the base for much of the software on your desk (geeks will get it!). He is an over-the-top genius and has multiple books on artificial intelligence. This is huge. I also woke up this morning to a long text from a well-known friend whom I have been trying to get to agree to speak with a few colleagues of his. It now looks possible. Things are really coming together and this is an SIC you do not want to miss.

Your watching inflation with both eyes analyst,

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Mauldin April 16th, 2023

Posted In: Thoughts from the Front Line