April 3, 2023 | Eyes On The Prize

Bear markets can be psychologically trying as interim rallies may obfuscate ongoing downtrends. Markets are liquidity junkies and repeatedly anticipate that central banks will pause and return to easing credit conditions (typically a few months after a pause). As with tightening, however, the bulk of easing effects are not felt until many months after they’re implemented.

Equities historically don’t bottom until after a recession is recognized and central banks near the end of easing efforts. Amid all the daily noise, the NASDAQ is about the same level today as late 2020—27 months ago; the S&P 500 is where it was 24 months ago, and Canada’s TSX is at the same level as June 2021, 22 months ago.

Undoubtedly, central banks want inflation to fall back to their 2% target. But that does not mean they wait until it gets there before they start easing. In October 2007, credit stress caused the Fed to start easing with the inflation rate at 3.5%. When inflation reached 2% in November 2008, the funds’ rate had been cut by 425 basis points. In January 2001, inflation was at 3.7% when the Fed started to ease. When inflation fell to 2% in November 2001, the Fed had already cut 450 basis points. As usual, the year after the Fed started tightening is when panic broke loose in the economy and stock market.

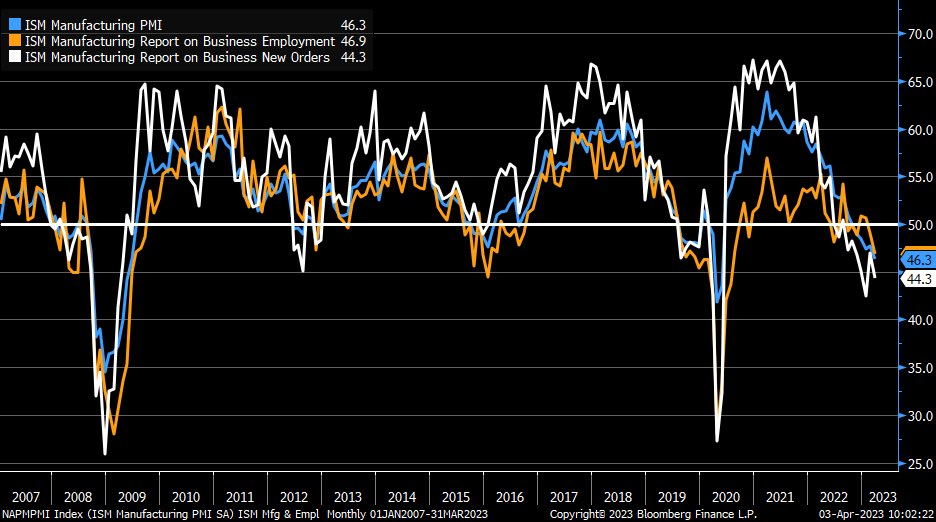

The past year’s violent liquidity contraction is now compounding through the economy. US ISM manufacturing, employment and new orders, shown below since 2007, are officially in contraction (all sub 50).

Confirming the economic downturn, Treasury prices bottomed last October (yields peaked) and have risen since, with the first quarter of 2023 having the strongest government bond gains since the first quarter of 2020. The bullish Treasury trend continues today, with the Canadian 10-year yield at 2.88% from 3.77 last October and the US 10-year at 3.43 from 4.33%. As central banks move to pause and eventually start easing credit conditions again, later this year or early next, government bonds are due to rise further (their yields to fall).

The prize of investment discipline is collecting attractive cash yields and gains on the safest credits as equities, commodities, corporate debt, and real estate deflate back to lucrative entry points–always well worth the wait.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park April 3rd, 2023

Posted In: Juggling Dynamite

Next: The US Begins to Arm Taiwan »

Just like the 2008/2009 lows the market will be well off its lows before the so called experts stop calling it a bear market. This bull market will not be over until everyone is up to their eyeballs in stocks. It’s easy to be bearish most are doing it.