September 14, 2022 | Lower Prices Improve Affordability and Investment Prospects

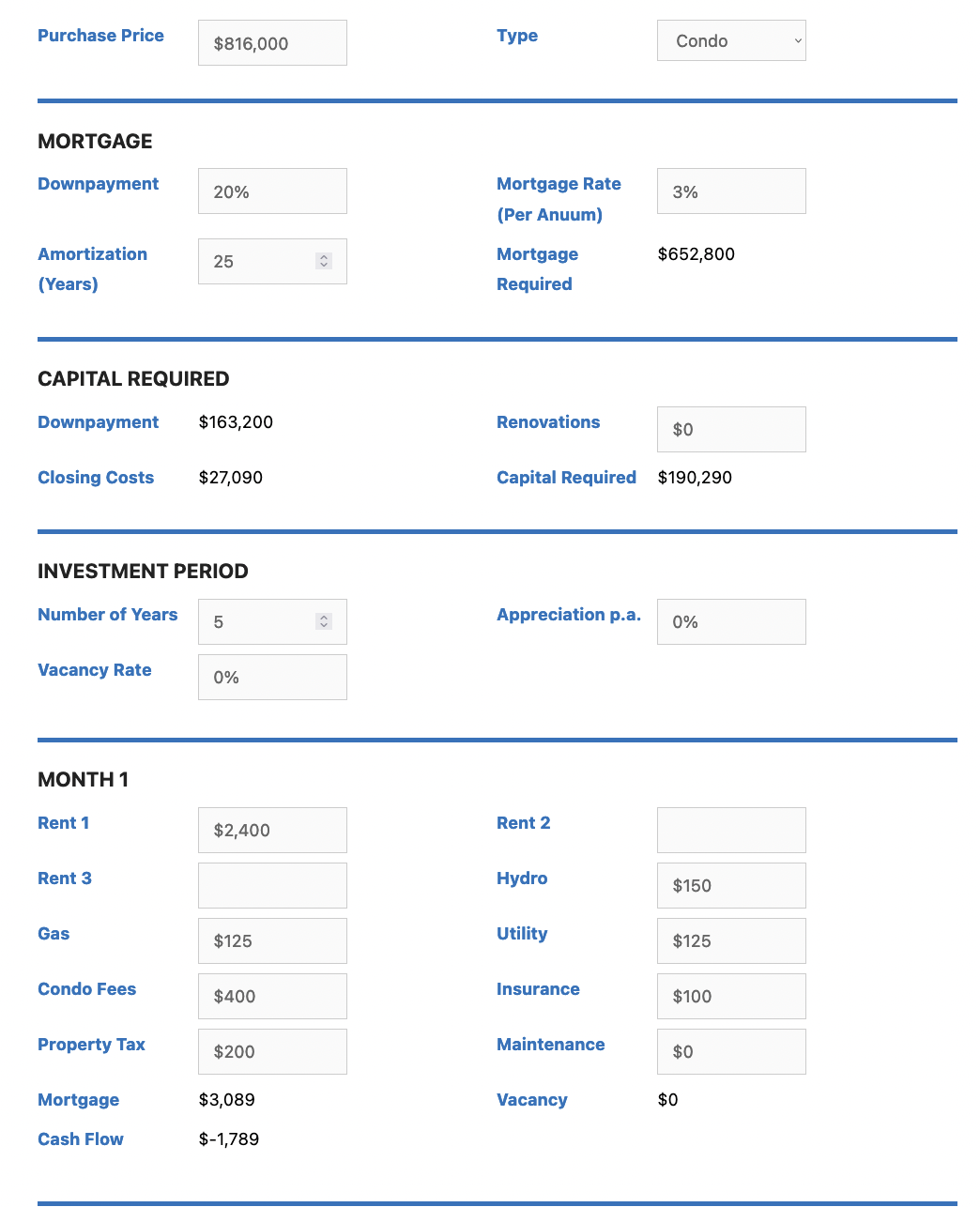

Well before the rate increases this year, many would-be investment properties had rents insufficient to cover expenses, and owners were subsidizing the negative carry in hopes that capital gains would more than repay their costs over time. This helpful calculator allows us to compare relative numbers.

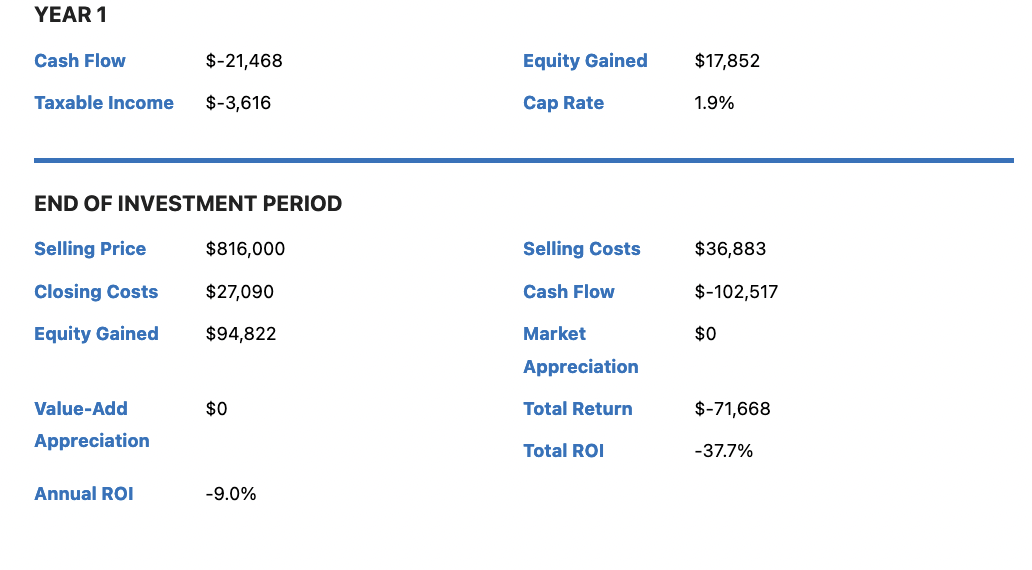

In February 2022, with the average Canadian national sale price of $816,000, a 20 percent downpayment, and a fixed mortgage rate of 3%, a typical rental condo in Toronto had a negative cash flow of about $1789 per month. But with a 3% annual appreciation rate over a five-year term, the total return could still be positive.

If property prices stagnate with zero capital appreciation, the negative monthly cash flow for the same investment amounts to a 37% loss over the five-year mortgage term (as shown below).

With a mortgage rate of 5%, the total loss on this negative-carry property balloons to 70% over a five-year holding period.

If the market price falls 20% (happening now?), the total loss on this average condo could be greater than 70% over a five-year holding period. Note: most property calculators do not allow one to input/model negative appreciation rates, even though negative returns have typically followed previous cycle tops.

The upside for those waiting to buy is that affordability can improve with falling prices, notwithstanding higher mortgage rates. For example, the average Canadian home price at $816,000 in February with a 3% mortgage rate required a higher 20% downpayment ($163k) and higher monthly mortgage payment ($3,089) than a $629,000 average home price in July (20% downpayment $125,000) and a mortgage rate of 5% ($2,927 per month). Further price declines could greatly improve affordability over the year to come.

Returns are also looking up for investors who wait to buy. However, doing so takes some cyclical insight, patience and cash at the ready.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park September 14th, 2022

Posted In: Juggling Dynamite