June 11, 2022 | Trading Desk Notes For June 11, 2022

Markets expect Central Banks to become more aggressive – stocks tumble, while interest rates and the US Dollar surge higher

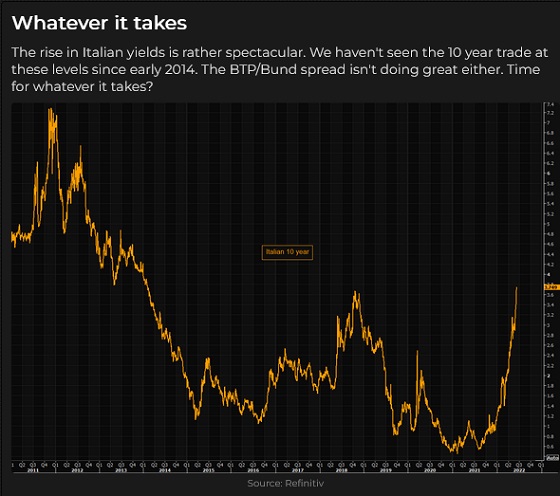

The ECB finally “grasped the nettle” on Thursday, but their announced intentions (to raise interest rates by 0.25% next month and to also stop buying bonds) were tepid relative to soaring inflation, so the Euro fell sharply Vs. the USD, interest rates jumped, and sovereign spreads widened dramatically.

On Friday, the CPI report was hotter than expected, and consumer sentiment plunged to a record low. Interest rates surged higher, credit quality spreads widened, and the US Dollar soared while stocks tumbled.

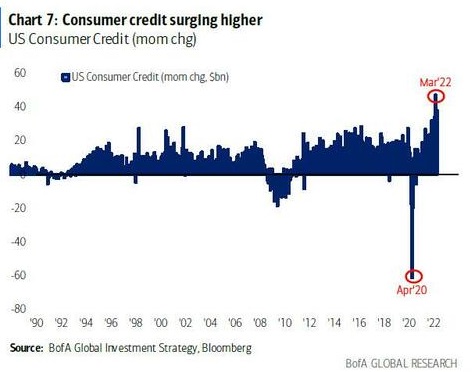

Consumer spending is ~70% of American GDP. Consumers are more worried about inflation than anything else. Previously, inflation was mostly confined to financial assets and real estate, but now inflation is hitting consumer necessities like food, fuel and electricity. Consumer spending has been holding up, but consumer debt is rising sharply.

I expect consumer spending to fall sharply as Central Banks raise interest rates. The economy will slow faster than CBs currently expect, corporations will struggle to maintain margins, and PE ratios will shrink.

A few weeks ago, some analysts were toying with the thought that “peak tightening” had come and gone and that the market had “over-priced” how aggressive the Fed would be. By the end of this week, sentiment had shifted to the idea that (to para-phrase BofA’s Michael Hartnett) “In short, the inflation shock isn’t over, and the rates shock is just starting (the growth shock is coming, and so is a recession.”)

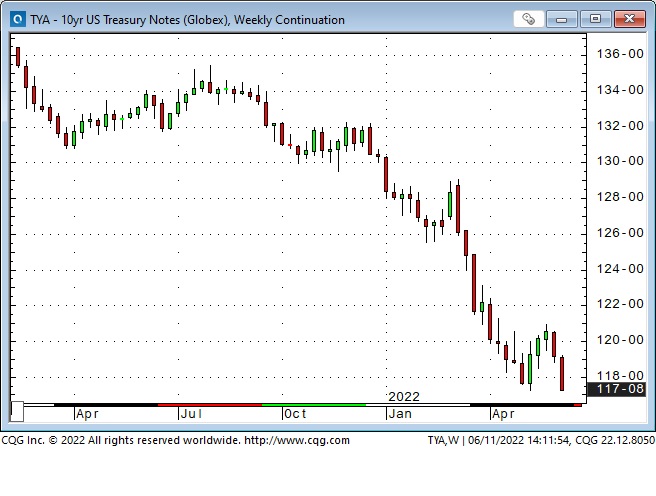

The US 10-Year bond futures are at a 12-year low (yields at a 12-year high of 3.17%).

The US 2-year note futures are at a 14-year low (yields at a 14-year high of 3.07%.)

The (May 12 to June 2) bear market rally is over

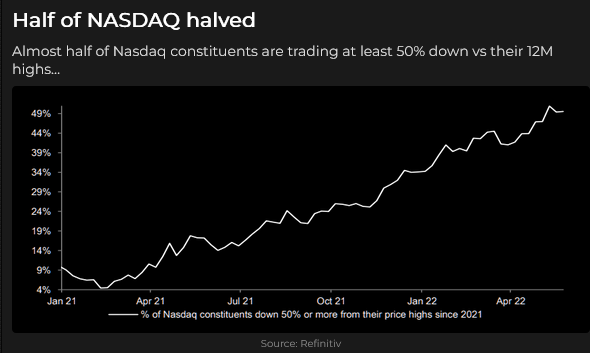

The S+P has closed lower in 9 of the last 10 weeks, with this week being the worst week YTD, yet volatility metrics remain below the highs made on May 12, when the S+P touched a 14-month low and was (briefly) down more than 20% YTD. Perhaps the market isn’t “worried enough” to have made a bottom.

The market cap of global stocks is down ~$23 Trillion from last November’s ATH of ~$100 Trillion. That’s equivalent to about one full year’s worth of US GDP.

The US Dollar rallied against virtually all other currencies this week

My FX mantra for the past 40 years has been that capital flows to the USA for safety and opportunity. When markets are “worried,” the USD is bid. The “opportunity” in the USD now is higher interest rates and security in an appreciating currency.

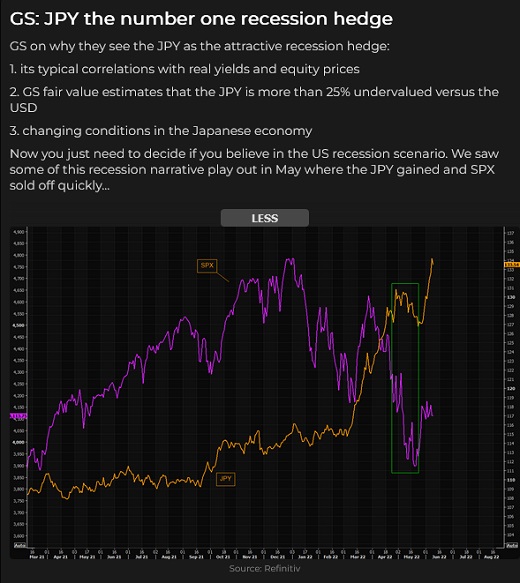

The Yen was down again this week (down 14% YTD), hitting a new 20-year low due to ultra-loose BOJ policies. However, a rare joint statement of “concern” from the BoJ, the MoF and the Financial Services Agency late this week may presage a “change in tone” at next week’s BOJ meeting.

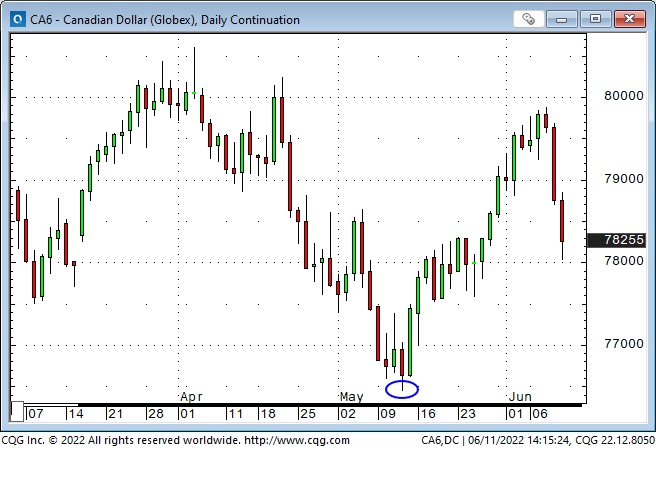

The Canadian Dollar hit a 20-month low on May 12 (as the S+P hit a 14-month low and the USD made a 20-year high) and then rallied to nearly 80 cents over the next four weeks as the USD weakened, commodities (especially crude) and stocks rallied, and market sentiment shifted to risk-on.

The CAD fell nearly two cents this week as the USD surged (the Euro plunged) and stock markets tumbled. The CAD weakness was sustained despite Canadian unemployment levels hitting a 46-year low of 5.1% and average wages growing ~4% YoY. (These reports will likely harden the BoC’s resolve to raise interest rates aggressively – keeping Canadian interest rates at a premium to American rates.) The CAD also fell despite fossil fuel prices remaining firm.

The solid historical correlation between the CAD and commodity prices may not be showing up in USDCAD (the tremendous strength of the USD has trumped the CAD/commodity correlation) but note that the CAD is at a 9-year high against the major European currencies and a 14-year high against the Yen.

Gold rallies ~$50 on Friday despite surging interest rates and a strong USD

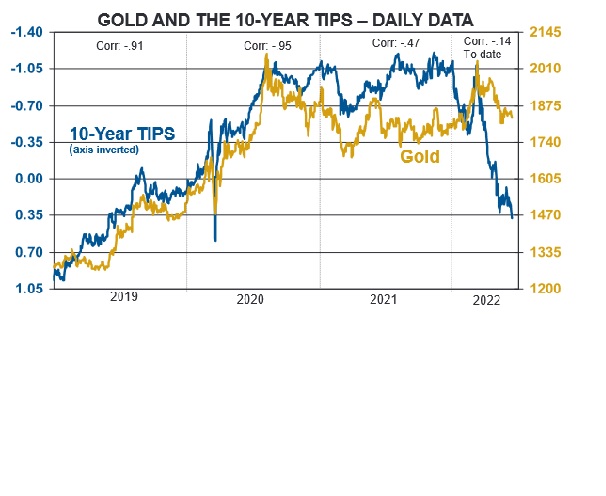

Gold hit a new All-Time High of ~$2075 following the Russian invasion of Ukraine (and the subsequent sanctions) but dropped as much as $300 by early May as the USD strengthened and as interest rates (especially real rates) rose.

On Friday morning, gold dropped to a 3-week low on the CPI report but then rallied ~$50 to a one-month high even as the USD soared. It is unusual to see both gold and the USD enjoy a big rally on the same day – it is often a sign that markets are “worried.”

Gold open interest climbed about 28% from early February to the March spike and has now returned to early February levels. (Speculators bought the market on the way up and sold it on the way down.) Given that gold has “held up” reasonably well despite the strong USD and the return of real yields to positive territory, the purging of speculative interests may set the stage for another leg higher.

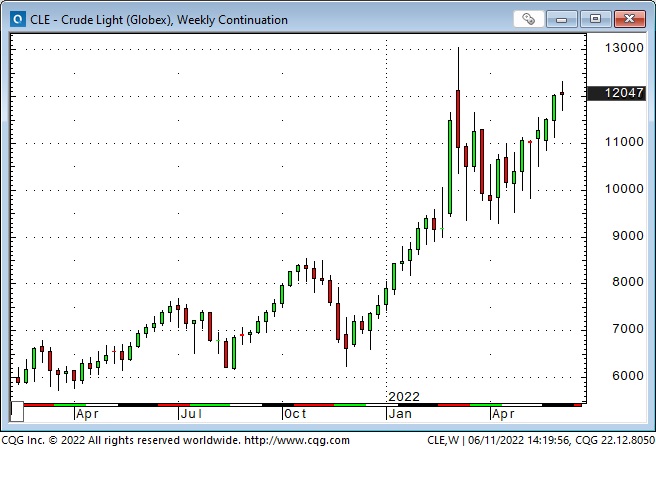

Fossil fuel markets remain strong

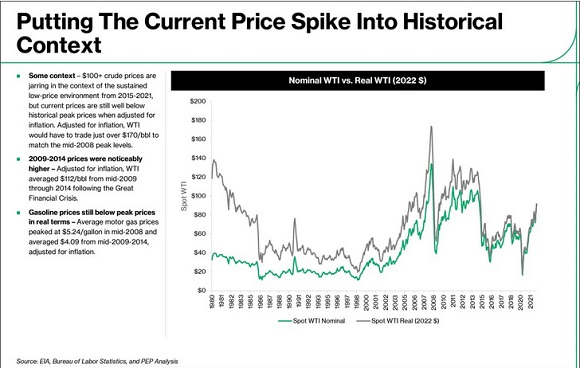

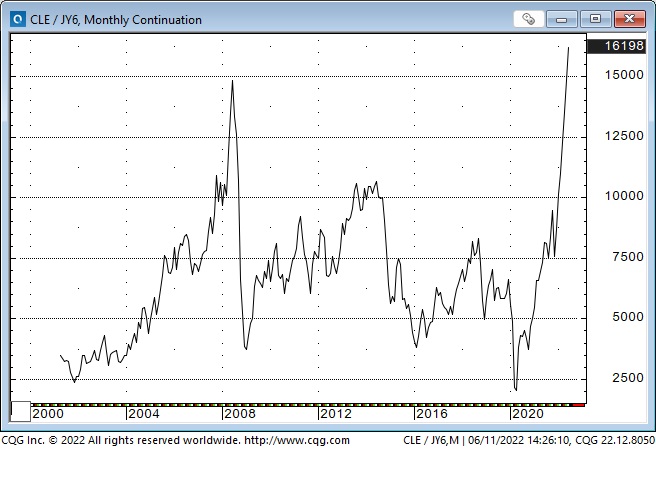

WTI crude oil traded above $130 in early March (when gold was hitting ATH) for the first time since 2008. Prices dropped ~$35 following that spike but have been trending higher for the past two months, with this week’s close (on a continuous basis) the highest since 2008. Gasoline and Heating Oil futures (lacking refining capacity) have been stronger than WTI futures and have recently traded at ATH.

While gasoline, diesel and crude oil prices have been the focus of media attention, North American natural gas prices have more than tripled from their average over the past five years. (The US is exporting LNG to Europe.)

With the Yen at 20-year lows, the Yen price of WTI crude has soared to an ATH.

My short-term trading

I returned from a 5-day road trip on Monday afternoon, and it took me a few days to understand what to do in the markets. I shorted the S+P futures Thursday morning and covered the position shortly after the CPI report Friday morning. I’m flat going into the weekend, and my P+L is up >0.50% on the week.

On my radar

The possibility of Central Banks “tightening into a recession” sets the stage for “something” (or maybe several things) to break. I will look for opportunities in markets that have made strong one-way moves to reverse. That doesn’t mean simply taking a counter-trend position, but if I see a trend break and a subsequent attempt to return to trend fail, I’ll get interested.

Thoughts on trading

One of the best reasons I keep writing this blog is that it connects me with other traders I would not otherwise have met. When swapping emails with another trader, I usually keep the “message” short and to the point. Here are a couple of edited quotes (from me) to another trader this week:

My road trip caused a disconnect between me and the markets, which may be a good thing. My trading time horizon the past few months had become very short-term – day-trading – and historically, my strong suit has been a swing-trading time frame; a few days to a few weeks.

The short-term volatility in markets (particularly equity futures) “forced” me into a shorter-term time horizon.

So I’m back at my desk with a “clean sheet” in front of me. As a person with “multiple personalities,” I’ll be interested to see who shows up!

Interesting that you mention Cathie Wood. I saw a story about her maintaining that deflation is a bigger worry than inflation – that’s an interesting thought (especially if she’s right!)

The essence of what you’re doing (looking at market correlations, seeing a breakdown in CAD/WTI, and CAD/commodities – seeing the near-universal energy market bullishness) is classic Bruce Kovner: What I am really looking for is a consensus that the market is not confirming. I like to know that there are a lot of people that are going to be wrong.

Risk Management Quotes from the Notebook

At that moment, I was confronted with the realization that I had blown a great deal of what I thought I knew about discipline. To this day, when something happens to disturb my emotional equilibrium and my sense of what the world is like, I close out all positions related to that event. Bruce Kovner, The Market Wizards, 1989

My comment: The Market Wizards is a must-read for traders, and the interview with Bruce Kovner is one of the best in the book. As I keep repeating, I make money from managing risk, not from having a great crystal ball. I know that things I can’t possibly anticipate can happen, so I need to do whatever I can to avoid taking a devastating trading loss.

Time and time again, when I read interviews with accomplished traders who are asked for advice for new traders, they say, keep your size small. That way, if you’re wrong, you don’t get killed. Having a BIG position inevitably means you’ve got your ego tied up in the trade, and if it goes against you, you will either fight it or freeze – which is precisely the worst thing you can do.

The Barney report

When I returned from my 5-day road trip, Barney was thrilled to see me – and I was delighted to see him. We had previously never been apart for more than a day.

We live on a golf course, and Barney loves to find golf balls. I take him out in the evening when no players are on the course, and he finds balls I can’t see. He gets a treat every time he finds a ball.

My wife and I have been giving away golf balls on our back fence for the past five years. We will have given away over 11,000 balls by the end of this season – and these days, Barney is finding more balls than my wife and I put together!

A request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you want to see something new in the TD Notes.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >20 years. The June 11 podcast is available at: https://mikesmoneytalks.ca.

You can listen to my June 4th interview with Mike, where I talk about some of my risk management rules, here.

You can listen to my 30-minute June 11 “This Week In Money” interview with Jim Goddard. Marc Faber and Ross Clark are also on this week’s podcast.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair June 11th, 2022

Posted In: Victor Adair Blog