March 23, 2022 | Rate Shock Pandemic Spreading

Yesterday, US Fed head Jerome Powell ramped up talk of inflation-fighting rate hikes and aggressively reducing the Fed’s balance sheet. Bond prices have tumbled, as debt service costs leap for the public and private sectors.

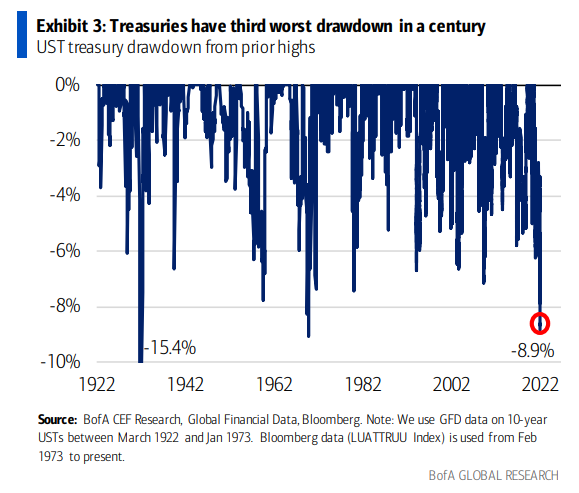

Over the past seven months, US ten-year Treasury prices (the flip side of yields) have seen their third-largest drawdown of the last century (as shown below). Touching 2.187% this morning, the US two-year Treasury yield (up from 1.80% last week and .149 last June) was just .16% below the ten-year–a fresh cycle low and the narrowest spread since the last recession began in 2020.

The US thirty-year bond at 2.59% (up from 1.20% in July 2020) is lower than the 20-year as the curve has inverted at 30-20, 3-10 and 5-10 terms.

Along for the rise in yields, the 30-year US mortgage rate is up to 4.72% from 2.75% in November 2021, just as the median listing price reached $392,000 in February (from $300,000 in March 2020) As shown below, the higher home prices and mortgage rates have combined for a 28% leap in homeownership costs–the fastest and largest since 1987.

In Canada, five-year Treasury yields have rocketed to 2.237% from .78% in August 2021, taking the five-year fixed mortgage rate above 3.5% at all major banks from 1.5% in early 2020. Over the same time, the median home price is up about 64%, from $530,000 to $870,000 nationally, making housing affordability positively grim.

While fixed mortgage rates move with the bond market’s expectation of Fed policy, variable-rate mortgages move with the rate hikes themselves. From around 1.65% today, Canadian variable-rate mortgages should rise to about 3% over the next 12 months if the Bank of Canada delivers on the five hikes currently telegraphed. This will be a significant increase for the 35% of Canadian mortgages presently variable.

Interest rates are also on the rise on business and personal loans, credit cards, lines of credit, bank overdraft and margin interest charged on brokerage accounts. All on top of the spike in food and gas prices.

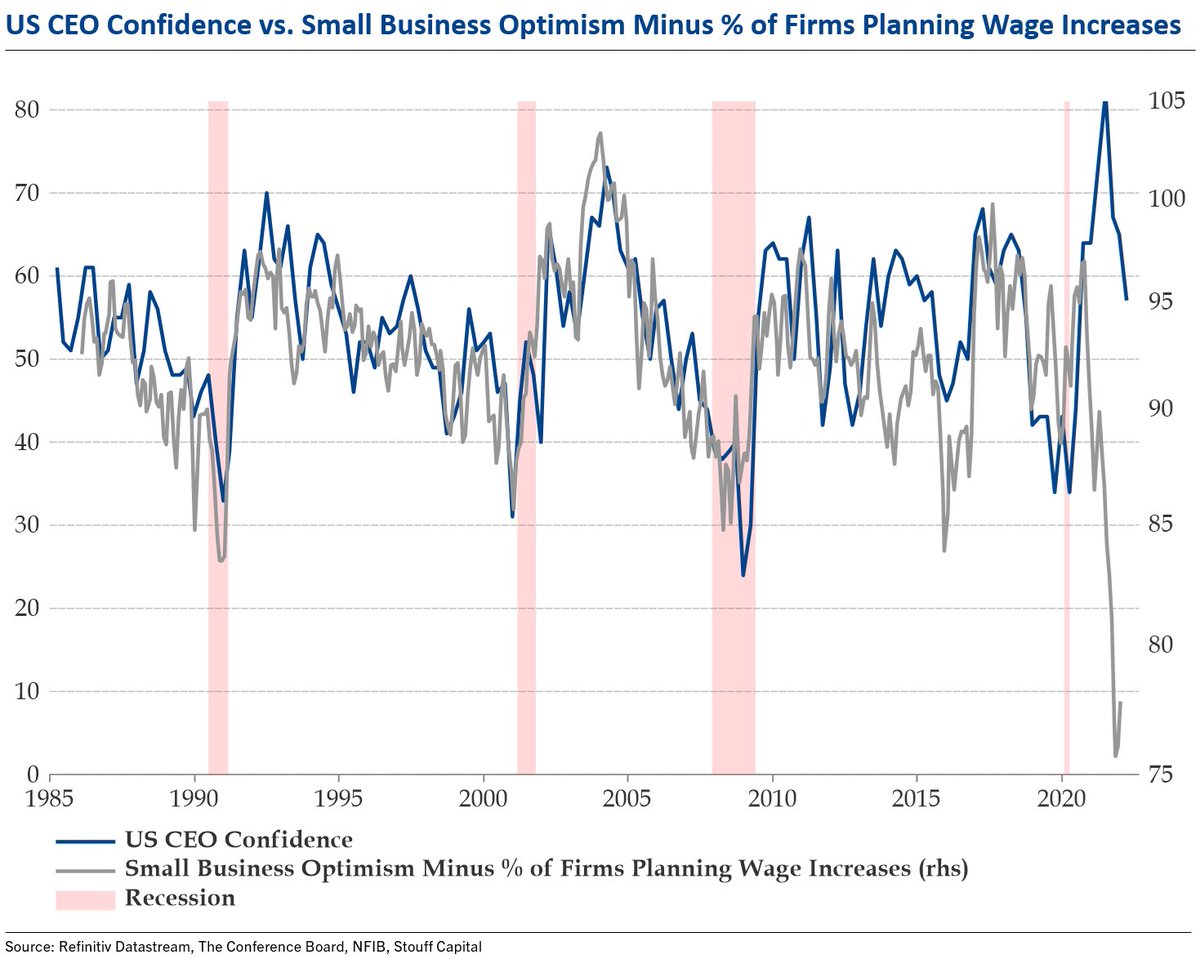

Financial stress is rising, and consumers and businesses are necessarily pulling in their spending and investment plans. Consumer confidence is slumping along with small business, and CEO confidence (below since 1985 courtesy of Julien Bittel) as free cash flow, revenue and profit margins shrink.

There is no doubt that politicians and central banks are unnerved by the recent rise in inflation and Russia’s war on Ukraine has intensified the shock and urge to “do something!”

In reality, in our highly levered world of households, businesses and financial markets, the tightening to date has already been massive and is undermining economic momentum.

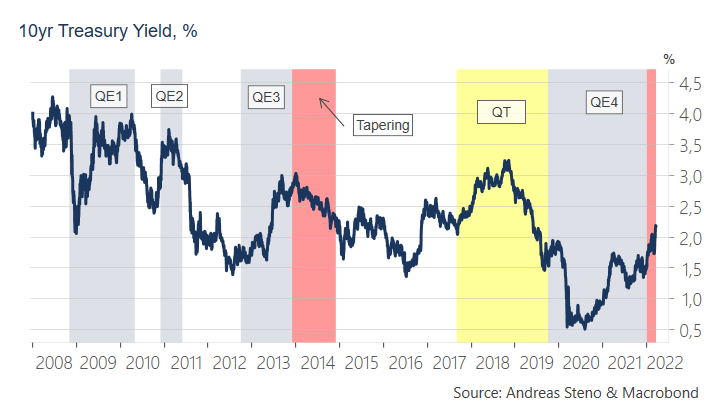

As shown below with the 10-year US Treasury yield since 2008, rates have repeatedly risen during loose monetary conditions, only to tumble again as conditions tighten and the economy and risk assets slump. We’re there again now.

Central banks can talk up further tightening plans, but the bond market has already done their work. As the economic downturn intensifies, growth and inflation expectations will tumble with yields as Treasury bonds rebound, and policymakers shift back to trying to revive borrowing, animal spirits and asset prices. That could take years for the many who will suffer financial setbacks between here and there.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park March 23rd, 2022

Posted In: Juggling Dynamite