March 11, 2022 | Cost of Crude Oil Could Start a Recession

A doubling in the price of crude oil in a short period of time (a year or less) has been a reliable predictor of recession. In fact, every time in the post-WWII period when oil has doubled, there has been a recession.

Will there be a recession after the current jump in oil prices?

The surge in the price of oil is unlikely to end soon, unless there is a global recession. Russia’s advance into Ukraine will inspire retaliation from the West. Since Russia is one of the top 3 oil suppliers to the world (about 11% of total), shunning Russian oil could cause shortages in some regions.

Of course, Iran is about to resume oil exports as the Biden administration is close to an agreement to lift 2018 sanctions. Iran could supply up to 2.5 million barrels a day, an increase of 1.5 million.

Global demand for oil is 100 million barrels per day, up from the COVID-induced collapse in demand in 2020 when demand was only 83 million barrels.

If there are shortages of oil the US has abundant shale oil in Texas and elsewhere, but producers have indicated that they will be slow to expand production if it means taking on too much financial risk. But, if the price is right, they will drill, and the oil will flow.

The US, Russia and Saudi Arabia supply about 30-35 million barrels. OPEC in total produces about 34 million.

Removing Russia’s 5 million barrels of exports from global supply might cause prices to soar even higher. But the US banning imports of Russian crude does not mean that Russian production ceases — it will just flow elsewhere and be sold at a discount, perhaps to China. And the US takes only 700,000 barrels of Russian oil.

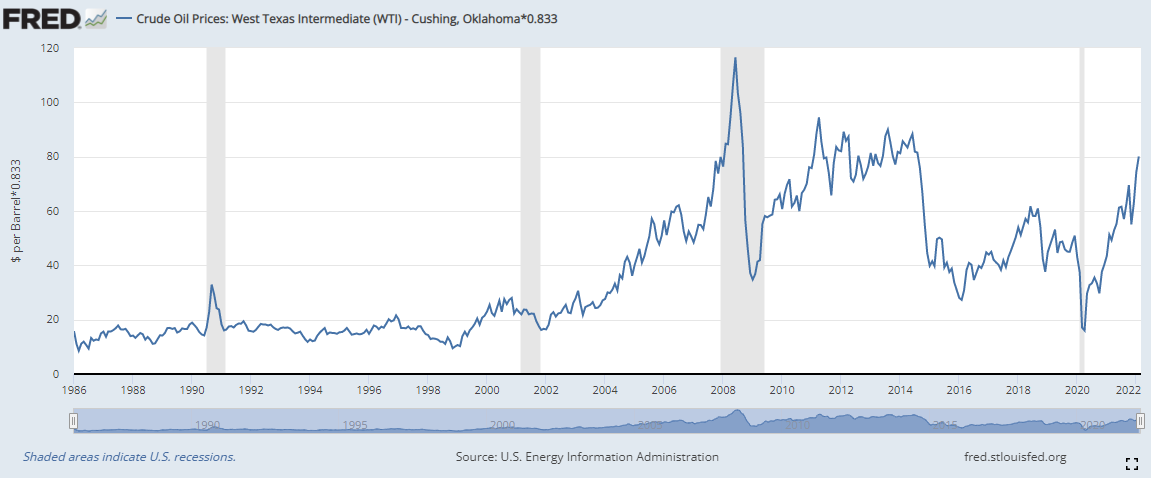

Credit Suisse charts published on February 14, 2022, show oil at $80 while it is now $120 – deflated using today’s prices. That same methodology is used here in a chart from FRED/St. Louis Fed:

The higher price of oil precedes/triggers recessions because consumers must buy gasoline while their household income is fixed in the short term, so they must cut back spending in other areas. Vacations, home renovations, new car and furniture purchases are delayed when the price of oil stays high. In the US, consumer spending is more than 65 percent of GDP so even a small reduction at the consumer level can cause recession.

According to Credit Suisse when the cost of oil hit 4 percent of GDP in 1990, a recession was triggered. Oil at $125 now would equal 4 percent GDP in some parts of the world.

At $120 oil costs are close to the trigger point for a recession, but crude at $140 to $150 per barrel would almost certainly do it. And rising interest rates and tightening central bank policy at the same time are unusual headwinds.

Investors are eagerly buying shares of oil producers, but it is important to remember what happened in March and April 2020. A sharp recession brought on sudden demand destruction and oil prices plummeted.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth March 11th, 2022

Posted In: Hilliard's Weekend Notebook