April 10, 2024 | Debt Stress Pandemic

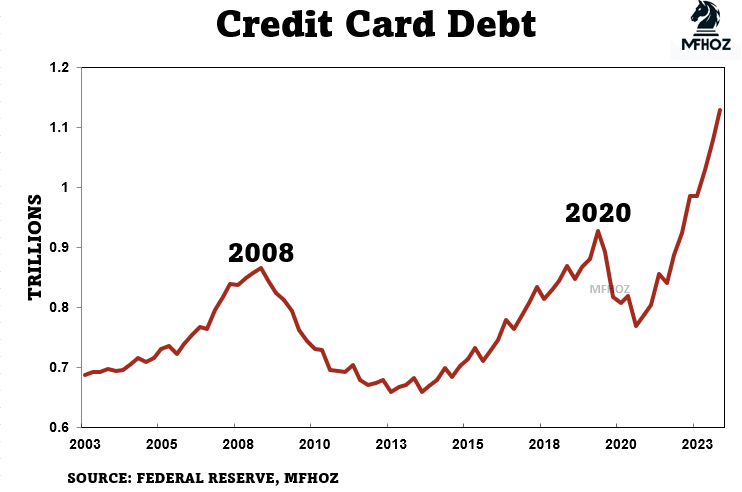

US credit card debt topped $1.34 trillion in February, significantly above the cycle tops of around $900 billion in 2008 and 2020 (as shown below since 2003, courtesy of MFHOZ). The interest rate on this debt is above 20%.

New car loans (5-year term) at 8.22% are above the 2007 rate peak (shown below courtesy of Liz Ann Sonders). Compounding the pain is that most who bought vehicles (and many homes) in the 2019 to 2023 pandemic price spike have seen their equity fall since.

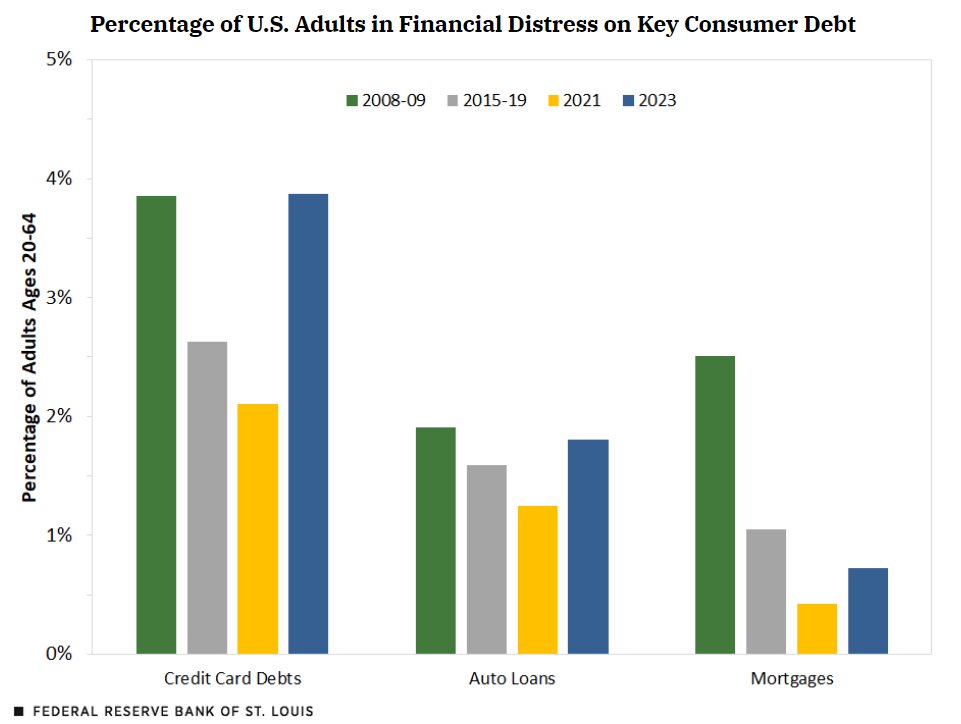

In 2023, borrowers with credit card and auto loan delinquencies (90 days plus late on payment, shown below courtesy of Mr.Awsumb) had already reached levels matching the 2008 recession. All debt-type delinquencies have continued to rise year to date.

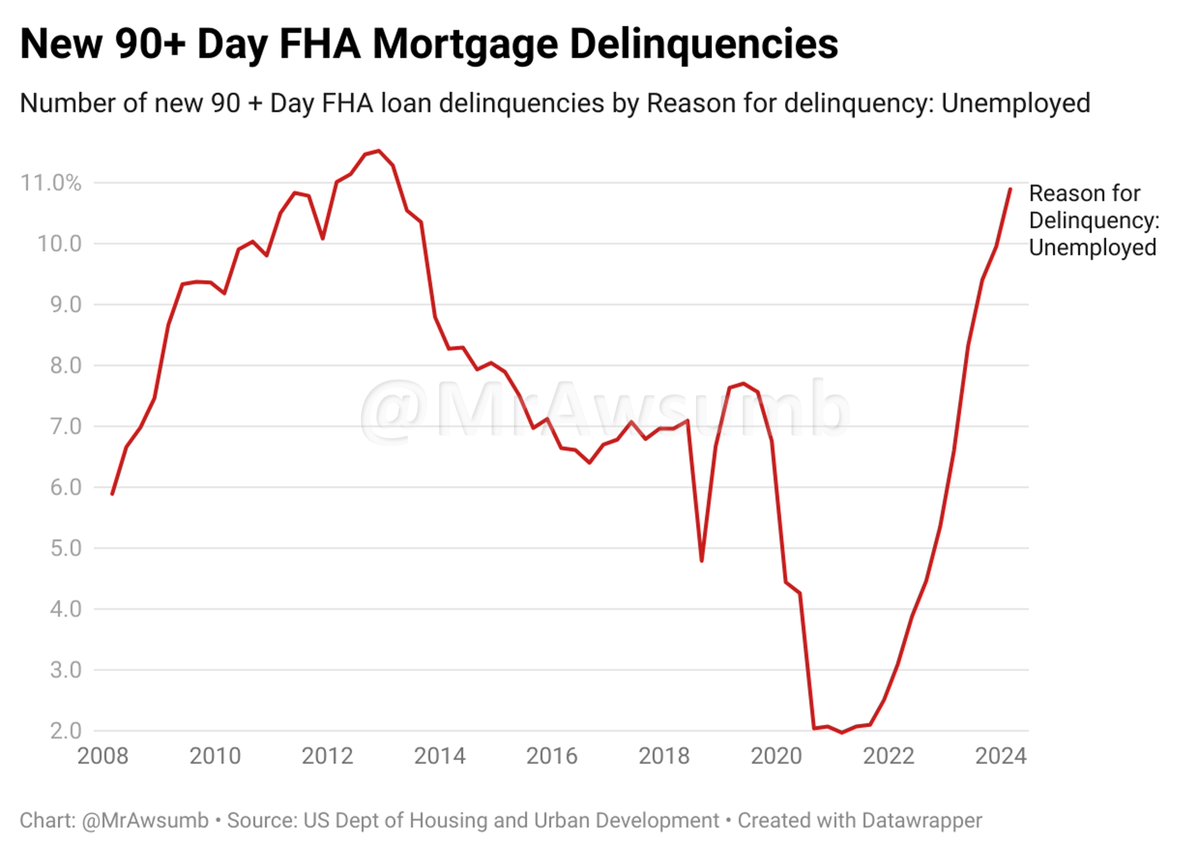

While the US ‘U3’ unemployment rate remains near all-time lows of 3.8%, individuals saying they defaulted on mortgage payments due to unemployment have already spiked above 2008 levels (source link here).

We note that the broader ‘U6’ measure of US unemployment at 7.3% in the latest measure is now 80 basis points above its cycle low and higher than the pre-COVID level of 6.9%.

Canadian unemployment at 6.1% in March was +130 basis points above the July 2022 low of 4.8% and higher than the pre-COVID level of 5.7%. Historically, when the Canadian unemployment rate rose 80 basis points from the cycle low, a recession was underway. And lest anyone forget, it’s typical for unemployment to accelerate during central bank easing cycles and well into the subsequent economic recovery.

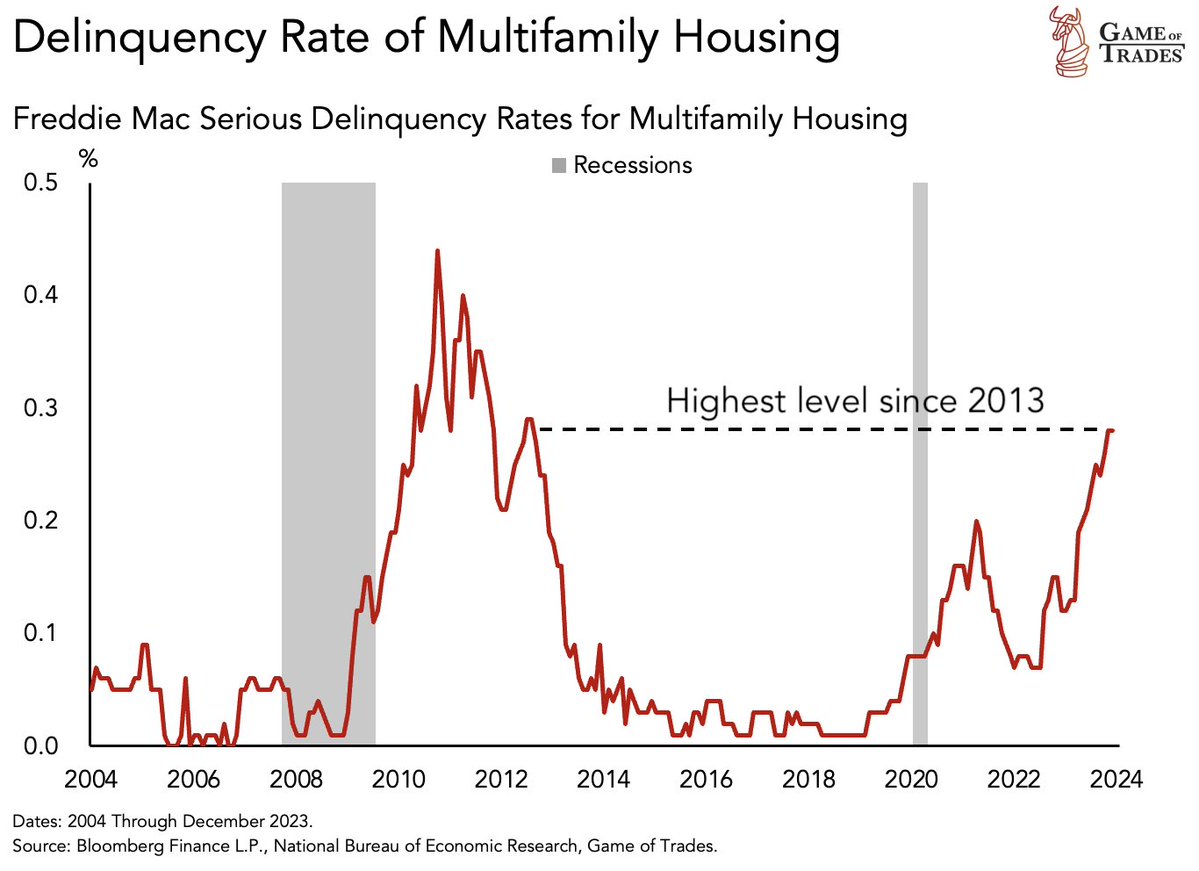

It’s not just individuals falling behind on their payments; loan delinquencies on multifamily properties are today the highest since 2013 and the 2008 recession before that (below courtesy of Game of Trades).

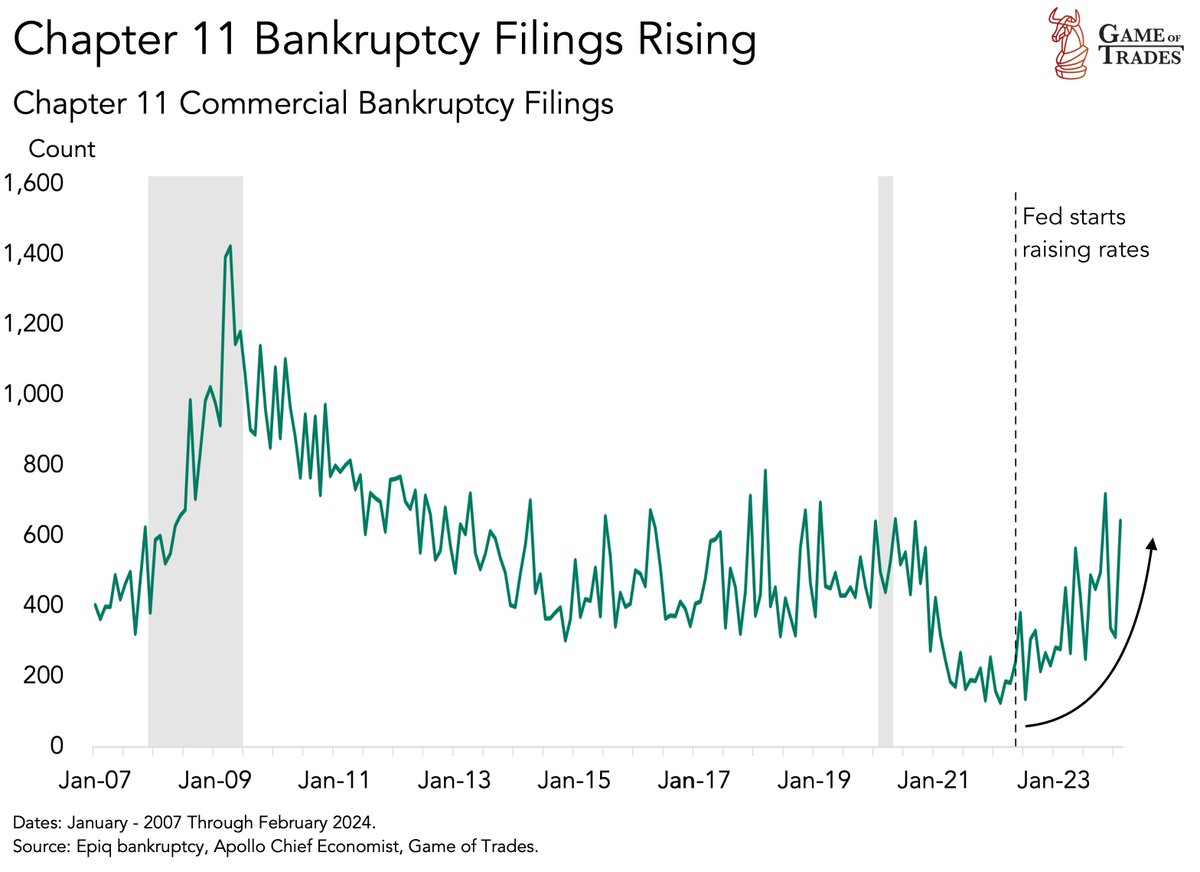

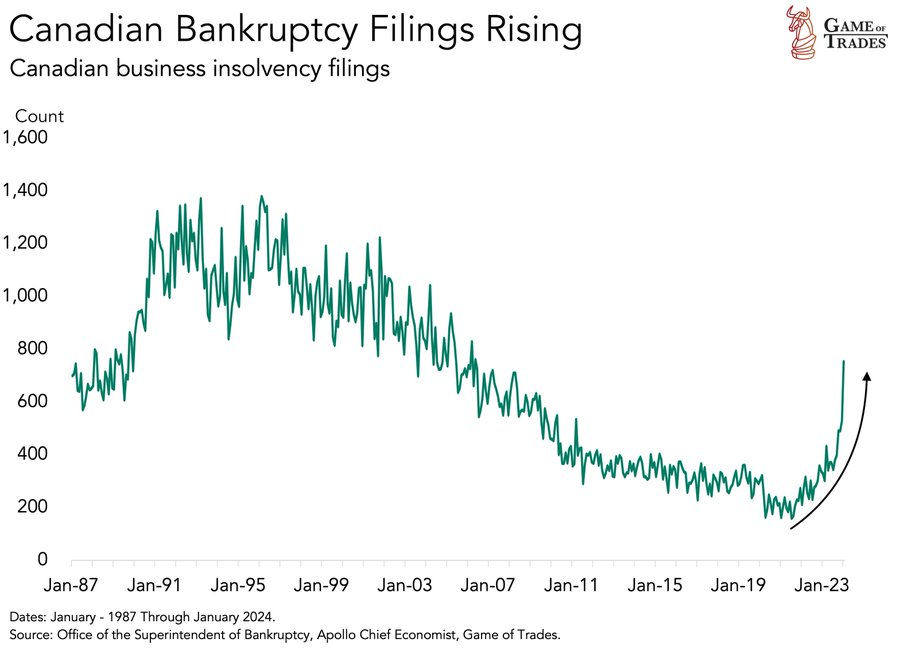

Corporate bankruptcy filings have been leaping since the Fed started hiking base rates in March 2022, both in America and Canada (shown below).

Again, it’s worth noting that central bank easing cycles have never been a quick fix to debt stress pandemics. Just as tightening efforts move at a 12 to 24-month lag, defaults and bankrupty filings tend to accelerate as central banks embark on easing efforts and unemployment continues to rise.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park April 10th, 2024

Posted In: Juggling Dynamite