March 29, 2024 | Canada Declares an Emergency as Economic Productivity Growth Lags Far Behind

“Well, it’s time to break the glass,” said Carolyn Rogers from the Bank of Canada in a recent speech, referring to the emergency situation in the lack of improvement in productivity in Canada’s business sector.

The Bank of Canada cares about productivity because “productivity is a way to inoculate the economy against inflation.”

Productivity can be measured in many different ways, but the general idea is that productivity is a measure of the ratio of units of output to input, usually labour, which is measured by the number of hours worked.

There are several other ways to measure productivity which Rogers outlines briefly in her speech.

Rogers says, “Labour productivity measures how much an economy produces per hour of work.”

There’s a paper cited in the speech by Andrew Sharpe and Tim Sargent of the Study of Living Standards which digs deeper.

From Finances of the Nation: The Canadian Productivity Landscape – An overview” Andrew Sharpe and Tim Sargent Centre for the Study of Living Standards Canadian Tax Journal 2023.

The authors state, “Economists consider productivity to be the Holy Grail. Societies strive to increase the living standards of the population, defined as income per capita, and the only sustainable long-term way to do so is through increased output per hour worked.”

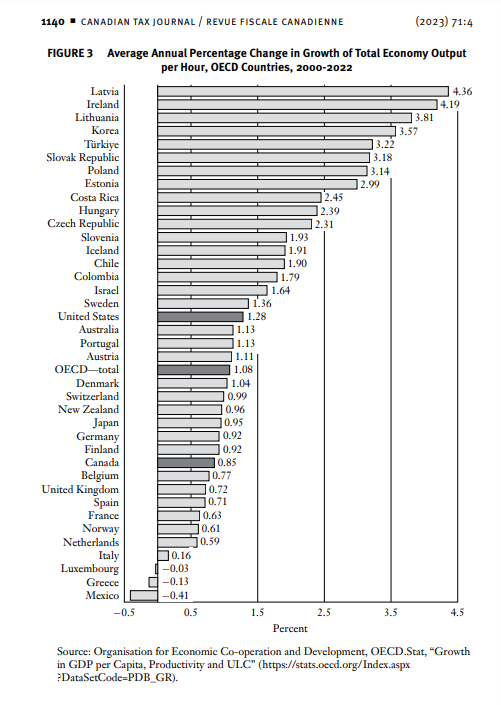

The paper shows that Canada is lagging far behind other OECD countries in “total economic output” productivity:

But we see that other countries like France, Spain and Italy are also falling behind when compared to the United States, for example.

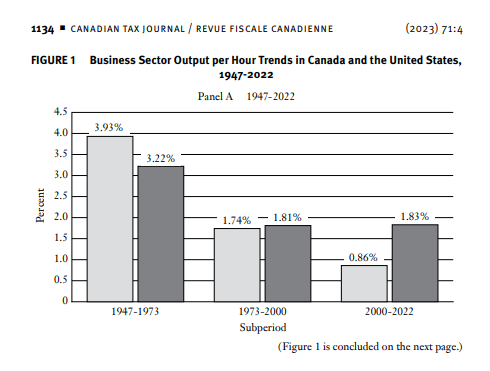

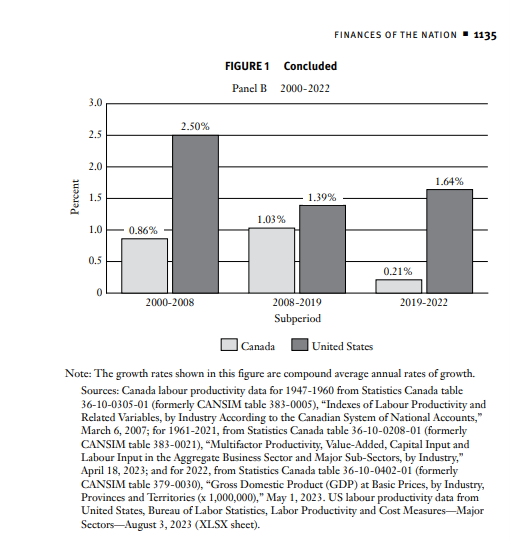

But these tables include government. A better way to look at productivity is through the business sector only:

The authors divided the post-2000 era into three sub-periods. The U.S. is ahead of Canada and pulling even further ahead in the most recent period 2019-2022.

A sector approach yields interesting results (not shown). The one that jumps out where Canada lags badly is known as ICT, which stands for “information and communications technologies.” The U.S. has Facebook (Meta), Twitter (X), the giant Google (now Alphabet) and hardware producer Apple as well as Amazon, the world’s largest online store. And now in artificial intelligence the chip maker Nvidia is leading the hardware race, while in electric cars Tesla is dominant, at least outside of China. There are no equivalents to these companies in Canada.

Can Canada respond?

One of the largest Canadian business sectors is banking and finance. There have been few productivity advancements in banking, as the incumbent oligopoly of a half-dozen large institutions is not pushed to make any major changes.

Another area that dominates in Canada versus the U.S. is residential real estate investment, a sector that makes up 8 percent of Canadian GDP compared to about 5 percent in the U.S. and other OECD countries. Productivity gains are difficult in renovations and house building given the nature of the work.

Canada desperately needs a new growth mandate. Bank of Canada Senior Deputy Governor Carolyn Rogers is correct to declare an emergency.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth March 29th, 2024

Posted In: Hilliard's Weekend Notebook

Utter nonsense. The number one creator of inflation is the Bank of Canada itself. It is their official policy!